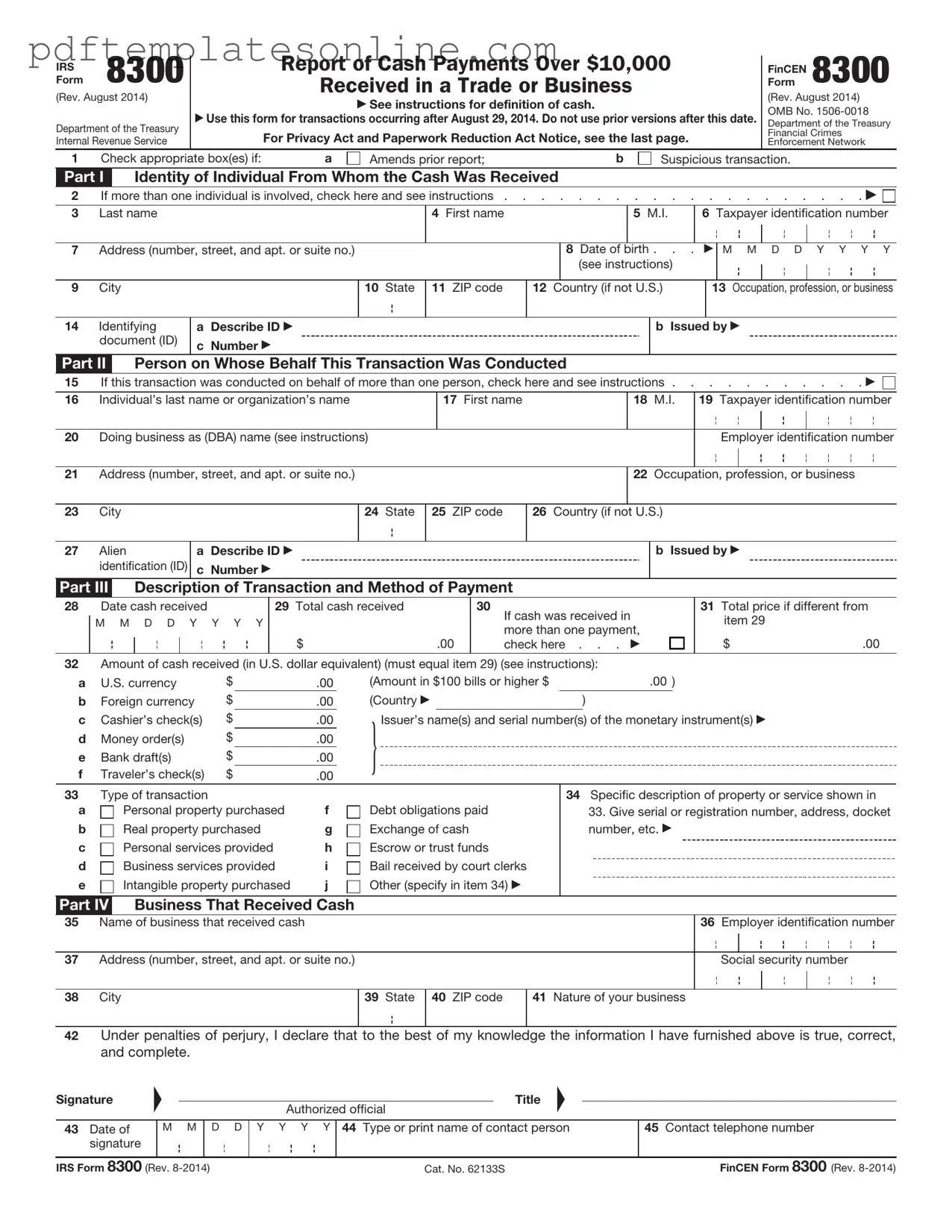

Blank IRS 8300 Form

Key takeaways

Filling out and using the IRS 8300 form is important for reporting cash transactions. Here are some key takeaways to consider:

- Threshold for Reporting: You must file Form 8300 if you receive more than $10,000 in cash in a single transaction or related transactions.

- Timely Filing: The form must be submitted within 15 days of receiving the cash to ensure compliance with IRS regulations.

- Accurate Information: Provide complete and accurate information about the transaction and the individuals involved to avoid potential penalties.

- Record Keeping: Maintain a copy of the form and any supporting documentation for at least five years in case of an audit.

Common mistakes

When completing the IRS Form 8300, individuals often make several common mistakes that can lead to delays or complications in processing. One frequent error is failing to report all required information. The form requires detailed information about the transaction, including the identity of the payer, the amount received, and the date of the transaction. Omitting any of this information can result in a form being returned or rejected.

Another mistake involves incorrect identification of the payer. The form mandates that the name, address, and taxpayer identification number (TIN) of the individual or entity making the cash payment be accurately recorded. If any of these details are incorrect or incomplete, it may cause issues with the IRS and can lead to penalties.

People also often misinterpret the definition of cash for the purposes of this form. Cash includes not only physical currency but also other forms of payment such as checks, money orders, and electronic transfers. Failing to recognize this can lead to underreporting and potential non-compliance with IRS regulations.

Additionally, individuals sometimes neglect to file the form within the required timeframe. The IRS mandates that Form 8300 must be filed within 15 days of receiving cash payments over $10,000. Late submissions can incur fines and may trigger further scrutiny from the IRS.

Another common issue is not keeping adequate records. The IRS recommends maintaining copies of the completed Form 8300 and any related documentation for at least five years. Without proper records, it may be difficult to substantiate the information reported on the form if the IRS requests further clarification.

Lastly, individuals might overlook the importance of training staff involved in cash transactions. Proper training ensures that all employees understand the requirements for completing Form 8300 accurately. This can help prevent errors and ensure compliance with IRS regulations.

Misconceptions

The IRS Form 8300 is an important document that businesses must file when they receive more than $10,000 in cash in a single transaction. However, there are several misconceptions surrounding this form. Here are seven common misunderstandings:

- Only large businesses need to file Form 8300. Many people believe that only big corporations are required to report cash transactions. In reality, any business, regardless of size, must file this form if they receive cash payments exceeding $10,000.

- Form 8300 is only for cash transactions. While the form is specifically for cash payments, it also applies to other forms of payment that can be considered cash equivalents, such as money orders or traveler's checks.

- Filing Form 8300 is optional. Some assume that reporting cash transactions is a choice. However, it is mandatory to file Form 8300 when the cash threshold is met, and failing to do so can result in penalties.

- Only the IRS sees the information on Form 8300. This form is not just for the IRS. It is also shared with other government agencies, including the Financial Crimes Enforcement Network (FinCEN), to help combat money laundering and other financial crimes.

- Form 8300 is only relevant for businesses in certain industries. Many think that only specific sectors, like casinos or car dealerships, need to worry about this form. However, any business that receives cash payments over $10,000 must comply, regardless of the industry.

- There are no consequences for not filing. Some people believe that not filing Form 8300 will go unnoticed. In fact, failing to file can lead to significant fines and legal issues, making compliance crucial.

- Form 8300 is complicated to fill out. While it may seem daunting at first, Form 8300 is relatively straightforward. Most businesses can complete it without legal assistance, especially with clear instructions provided by the IRS.

Understanding these misconceptions can help businesses ensure they remain compliant and avoid unnecessary penalties. Properly filing Form 8300 is an essential part of responsible financial management.

Dos and Don'ts

When filling out the IRS Form 8300, it’s essential to follow specific guidelines to ensure compliance and avoid potential issues. Here’s a list of things to do and things to avoid:

- Do: Provide accurate information.

- Do: Ensure that all required fields are filled out completely.

- Do: Submit the form within the required timeframe, typically within 15 days of receiving cash payments over $10,000.

- Do: Keep a copy of the form for your records.

- Do: Consult the IRS guidelines if you have questions about specific entries.

- Do: Use the correct form version to avoid processing delays.

- Don't: Leave any fields blank unless instructed.

- Don't: Provide false or misleading information.

- Don't: Ignore the reporting requirements for cash transactions.

- Don't: Submit the form late, as this can result in penalties.

- Don't: Forget to sign and date the form before submission.

- Don't: Rely on verbal communication; always document your cash transactions properly.

Other PDF Forms

Act 221 Disclosure - The insurance details for the association are documented for the buyer's awareness.

Understanding the intricacies of a California Non-compete Agreement form is essential for employers and employees alike, especially given the unique legal landscape in California where such agreements are often unenforceable. For further insights and resources on this topic, you can explore California PDF Forms, which provide valuable templates and guidance relevant to non-compete agreements.

California Child Labor Laws - This form may require additional documentation depending on the minor's age.

Detailed Guide for Writing IRS 8300

Completing the IRS Form 8300 requires careful attention to detail. This form is essential for reporting cash transactions exceeding $10,000. To ensure accuracy, gather all necessary information before you begin filling it out. Follow these steps to complete the form correctly.

- Obtain a copy of IRS Form 8300. You can find it on the IRS website or through your tax professional.

- At the top of the form, fill in your business name, address, and Employer Identification Number (EIN) or Social Security Number (SSN).

- Provide the date of the transaction in the designated space.

- Enter the name and address of the person or entity from whom you received the cash.

- Include the amount of cash received. Make sure this amount exceeds $10,000.

- Indicate the type of transaction. This could include a sale of goods, services, or other types of payments.

- Fill in the details about the individual who received the cash, including their name and address.

- If applicable, provide any additional information requested in the form, such as the purpose of the transaction.

- Review the completed form for accuracy and completeness.

- Sign and date the form at the bottom to certify that the information is correct.

- Submit the form to the IRS as instructed, either electronically or by mail, within the required timeframe.

Once the form is submitted, keep a copy for your records. This will be useful for any future inquiries or audits. Ensure that you stay informed about any updates or changes to the reporting requirements to maintain compliance.