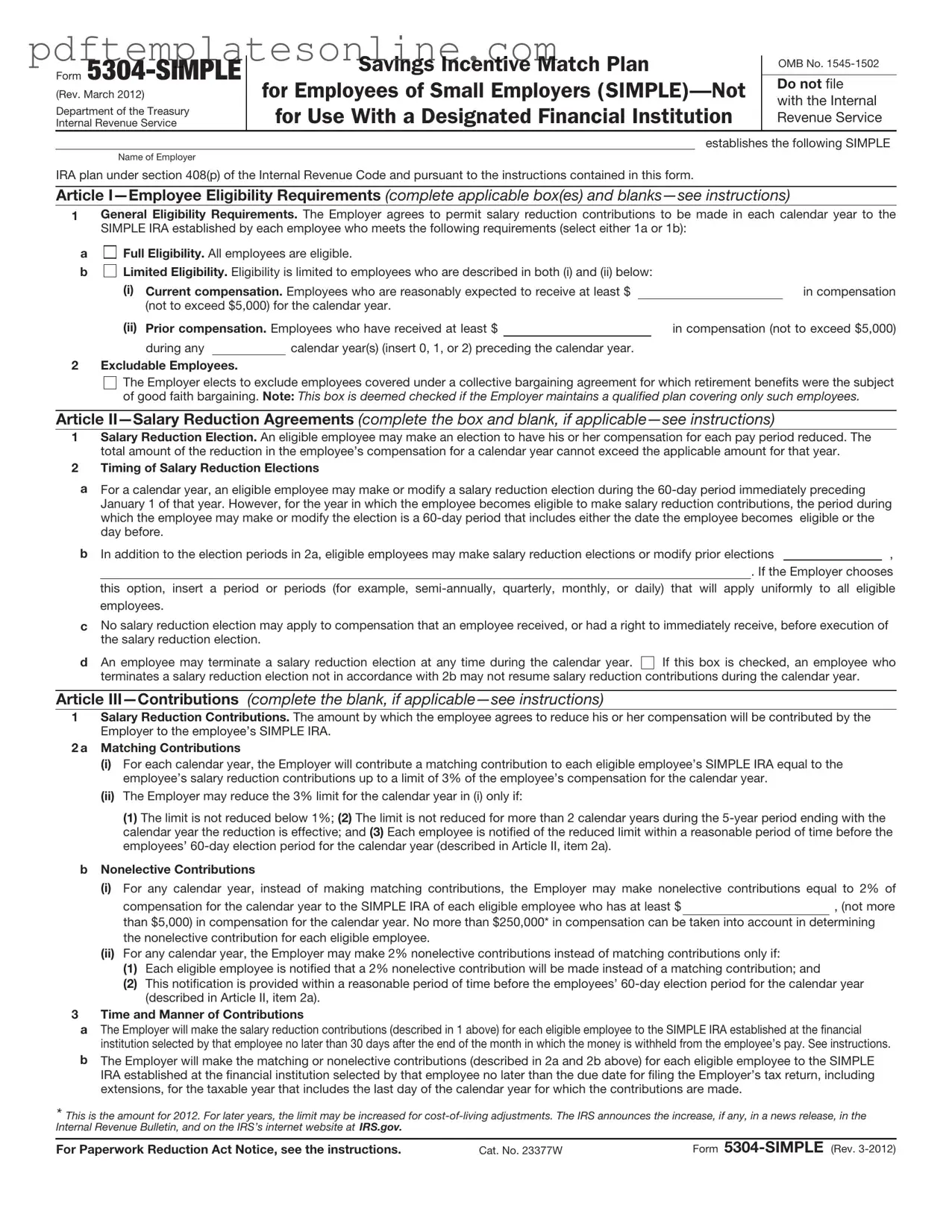

Blank IRS 5304-SIMPLE Form

Key takeaways

Here are key takeaways regarding the IRS 5304-SIMPLE form:

- The IRS 5304-SIMPLE form is used to establish a SIMPLE IRA plan for eligible employees.

- Employers must provide this form to employees by October 1st of the plan year.

- Employees can choose to participate in the SIMPLE IRA plan by completing the form.

- The form outlines the contribution limits for both employers and employees.

- Employers must match employee contributions up to a certain percentage.

- Employees can withdraw funds from their SIMPLE IRA, but penalties may apply if taken before age 59½.

- It is essential to keep a copy of the completed form for your records.

- Changes to the plan can be made annually, but they must be communicated to employees.

- Both employers and employees should understand the tax implications of contributions and withdrawals.

- Using the form correctly can help ensure compliance with IRS regulations.

Common mistakes

When filling out the IRS 5304-SIMPLE form, many individuals make common mistakes that can lead to complications down the line. One frequent error is not providing accurate information about the employer. The form requires specific details about the employer's name and address. If these details are incorrect or incomplete, it can cause delays in processing and may affect the employee's retirement plan.

Another mistake often seen is failing to understand the eligibility requirements for participating in a SIMPLE IRA. Some individuals may not realize that only certain employees are eligible to participate. This misunderstanding can lead to incorrect filings and potential penalties. It is important to review the eligibility criteria carefully before completing the form.

People also sometimes overlook the contribution limits set by the IRS. Each year, the contribution limits can change, and not adhering to these limits can result in excess contributions. This can lead to tax penalties and complications when filing tax returns. Keeping up-to-date with the current limits is essential for compliance.

Finally, individuals may forget to sign and date the form before submitting it. A missing signature can render the form invalid, causing delays in the establishment of the SIMPLE IRA. Taking the time to double-check that all necessary signatures are present can help ensure a smoother process.

Misconceptions

The IRS 5304-SIMPLE form is an important document for small businesses that want to establish a SIMPLE IRA plan for their employees. However, there are several misconceptions surrounding this form that can lead to confusion. Here are four common misunderstandings:

- Only large companies can use the IRS 5304-SIMPLE form. Many people believe that only large businesses are eligible to set up a SIMPLE IRA plan. In reality, this form is specifically designed for small businesses with 100 or fewer employees.

- Employees must contribute to the SIMPLE IRA to participate. Some assume that employee contributions are mandatory for participation. However, employees can choose whether or not to contribute to their SIMPLE IRA, and employers are required to make contributions regardless of employee participation.

- The IRS 5304-SIMPLE form is only for new plans. There is a misconception that this form is only applicable for new SIMPLE IRA plans. In fact, it can also be used to amend existing plans, providing flexibility for businesses that may need to make changes.

- Filing the IRS 5304-SIMPLE form is overly complicated. Many believe that the process of filing this form is complicated and time-consuming. In truth, the form is straightforward and user-friendly, designed to simplify the establishment of retirement plans for small businesses.

Understanding these misconceptions can help business owners make informed decisions about retirement planning and ensure they are utilizing the IRS 5304-SIMPLE form correctly.

Dos and Don'ts

When filling out the IRS 5304-SIMPLE form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do read the instructions carefully before starting the form.

- Do provide accurate information about your business and employees.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank, as this may delay processing.

- Don't submit the form without reviewing it for errors.

Other PDF Forms

Peco Energy Company - Mail or fax the completed application to the appropriate PECO office.

When engaging in real estate transactions, it's essential to utilize the appropriate agreements to facilitate the process effectively. A California Real Estate Purchase Agreement is vital for ensuring that both buyers and sellers are clear about their responsibilities and expectations. For those seeking convenience and accessibility in accessing these forms, online resources like California PDF Forms can be invaluable, providing easily editable templates to streamline the process.

Advance Payment Request Form - Use this form when you need temporary financial support from your employer.

I 864 - Updates to forms, including the I-864, occur periodically, so checking USCIS for the latest version is important.

Detailed Guide for Writing IRS 5304-SIMPLE

Completing the IRS 5304-SIMPLE form is essential for employers who wish to establish a SIMPLE IRA plan. The next steps will guide you through the process of filling out the form accurately to ensure compliance with IRS requirements.

- Begin by downloading the IRS 5304-SIMPLE form from the official IRS website.

- Enter the name of your business in the designated space at the top of the form.

- Provide the Employer Identification Number (EIN) associated with your business.

- Fill in the address of your business, including the city, state, and ZIP code.

- Indicate the tax year for which the form is being completed.

- Complete the section regarding the number of employees eligible to participate in the SIMPLE IRA plan.

- Specify the contribution amounts for both employer and employee contributions.

- Review the plan features and check the boxes that apply to your specific plan options.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the IRS by the required deadline.