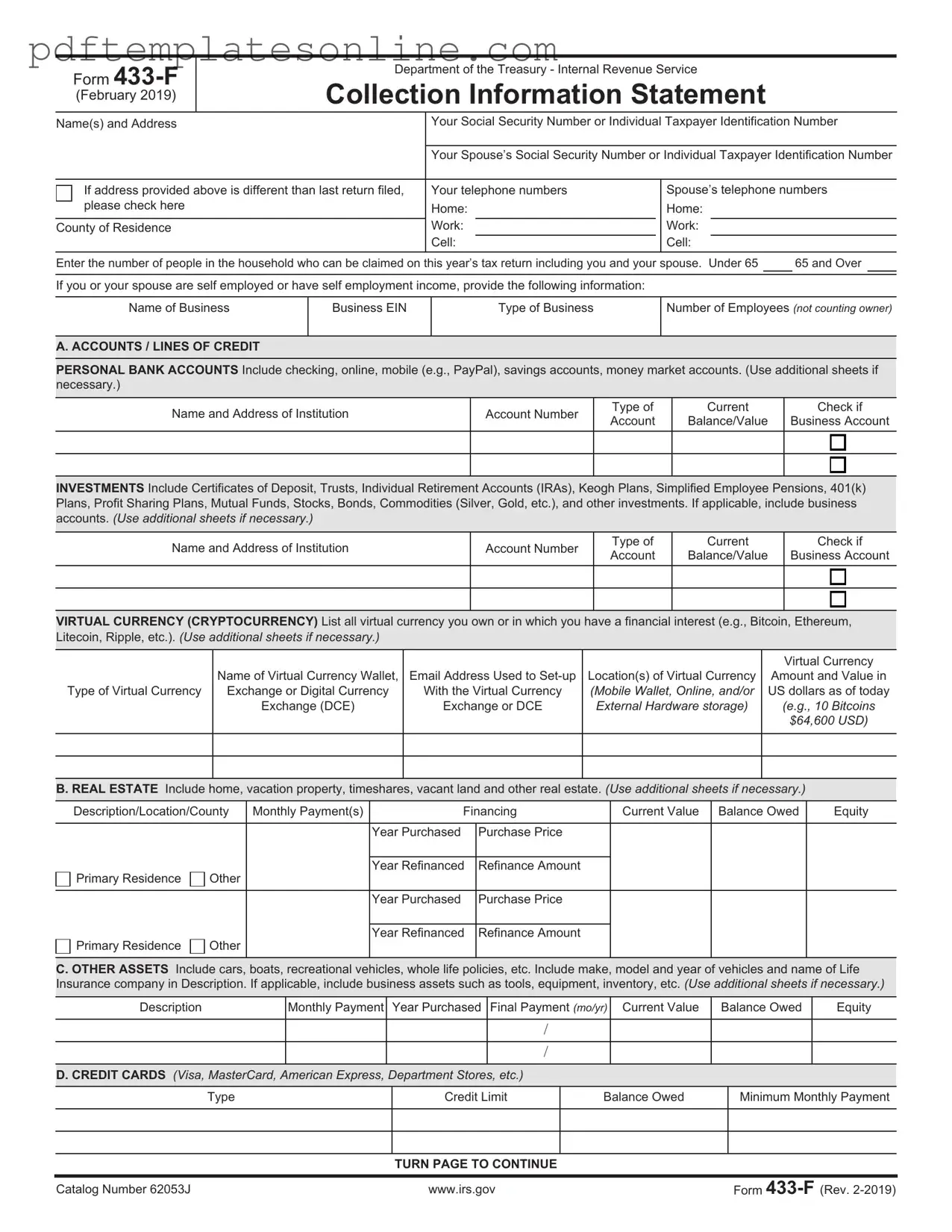

Blank IRS 433-F Form

Key takeaways

When dealing with the IRS 433-F form, understanding its purpose and how to fill it out can significantly ease your tax-related concerns. Here are some key takeaways to consider:

- The IRS 433-F form is primarily used to provide the IRS with a comprehensive overview of your financial situation.

- Accurate and complete information is crucial. Ensure that all income, expenses, assets, and liabilities are clearly documented.

- This form is often required when requesting a payment plan or an offer in compromise, making it essential for negotiating with the IRS.

- Review your entries carefully. Errors or omissions can lead to delays or unfavorable outcomes in your dealings with the IRS.

- Keep copies of the completed form and any supporting documents for your records. This can be helpful for future reference.

- Consider seeking assistance if you're unsure about how to fill out the form. Professional guidance can help avoid common pitfalls.

Common mistakes

Filling out the IRS 433-F form can be a daunting task, and many people make common mistakes that can lead to complications. One frequent error is not providing accurate personal information. Ensure that your name, address, and Social Security number are correct. Even a small typo can cause delays in processing your form.

Another common mistake is failing to report all income sources. It’s essential to include all forms of income, such as wages, self-employment earnings, and rental income. Omitting any income can lead to discrepancies and may raise red flags with the IRS.

Many individuals also underestimate their expenses. When listing monthly expenses, it’s important to be thorough and realistic. Some people forget to include necessary costs, such as medical expenses or childcare, which can affect the overall assessment of their financial situation.

Inaccurate asset reporting is another area where mistakes often occur. When detailing assets, be sure to include all bank accounts, real estate, and vehicles. Failing to disclose assets or undervaluing them can lead to complications during the review process.

People sometimes neglect to sign and date the form. A missing signature can result in the form being considered incomplete. Always double-check that you have signed and dated the document before submission.

Providing incomplete or vague descriptions of your financial situation can hinder the process. Be clear and specific about your circumstances. This helps the IRS understand your situation better and can expedite the review.

Another mistake is not keeping copies of the submitted form. Always retain a copy for your records. This can be crucial if any questions arise later about your submission.

Some individuals also fail to follow up after submitting the form. It’s important to monitor the status of your submission. If you don’t hear back within a reasonable timeframe, consider contacting the IRS for an update.

Lastly, many people do not seek assistance when needed. If you’re unsure about any part of the form, consulting with a tax professional can provide clarity and help avoid costly mistakes.

Misconceptions

The IRS Form 433-F is often misunderstood. Here are eight common misconceptions about this form, along with clarifications.

-

It is only for individuals who owe taxes.

Many believe that the form is solely for those who have outstanding tax debts. In reality, it can be used by anyone who needs to provide financial information to the IRS, including those applying for a payment plan or an offer in compromise.

-

Filing the form guarantees a payment plan.

Submitting Form 433-F does not automatically mean that the IRS will approve a payment plan. The IRS reviews each case individually and considers various factors before making a decision.

-

Only self-employed individuals need to file it.

This form is applicable to both self-employed individuals and employees. Anyone facing tax issues or seeking to negotiate with the IRS may need to complete it.

-

It is a lengthy and complicated form.

While it does require detailed financial information, many find it straightforward. With careful attention to the instructions, completing the form can be manageable.

-

Once submitted, the form cannot be changed.

Taxpayers can amend the information if their financial situation changes after submitting the form. It is important to keep the IRS updated with accurate information.

-

It is only necessary for large debts.

The form is useful for both large and small debts. Any taxpayer needing to negotiate or communicate financial status with the IRS should consider using it.

-

It is only required for certain tax years.

The form can be requested for any tax year in which the taxpayer is seeking assistance or negotiating payment options, regardless of the amount owed.

-

All information on the form is public.

Form 433-F is confidential. The information provided is used solely for the IRS's internal purposes and is not made public.

Dos and Don'ts

When filling out the IRS 433-F form, it's important to approach the process carefully. Here are seven tips to help you navigate this form effectively.

- Do provide accurate information about your income and expenses.

- Don't leave any sections blank; incomplete forms can delay processing.

- Do include documentation to support your claims, such as pay stubs or bank statements.

- Don't exaggerate your expenses; honesty is crucial.

- Do double-check your calculations to avoid mistakes.

- Don't forget to sign and date the form before submission.

- Do keep a copy of the completed form for your records.

By following these guidelines, you can ensure a smoother experience when dealing with the IRS 433-F form.

Other PDF Forms

Uscis Form I-134 - In instances where the sponsor's income is insufficient, they may include assets to demonstrate financial viability on the I-134 form.

The EDD DE 2501 form is a document used in California to apply for state disability insurance benefits. It provides essential information about the applicant's medical condition and work history. Understanding how to complete this form accurately is crucial for securing the financial support you may need during a period of temporary disability. For more information about the form, you can visit https://mypdfform.com/blank-edd-de-2501.

Fedex Direct Signature Required - Failure to sign will prevent the delivery from being completed.

Detailed Guide for Writing IRS 433-F

Filling out the IRS 433-F form is an important step in addressing your tax situation. This form helps the IRS understand your financial status, allowing for better communication regarding your tax obligations. Follow these steps to complete the form accurately.

- Start by downloading the IRS 433-F form from the official IRS website.

- Fill in your personal information at the top of the form, including your name, address, and Social Security number.

- Provide details about your employment or self-employment. Include your employer’s name and address, or indicate if you are self-employed.

- List your monthly income. Include all sources, such as wages, unemployment benefits, and any other income you receive.

- Detail your monthly expenses. Include necessary costs like housing, utilities, food, transportation, and any other regular payments.

- Document your assets. This includes bank accounts, real estate, vehicles, and any other valuable items you own.

- Sign and date the form at the bottom. Ensure that all information is accurate before submitting.

- Submit the completed form to the appropriate IRS address, as indicated in the instructions provided with the form.

Once you have submitted the form, the IRS will review your information. They may contact you for additional details or clarification. Be prepared to respond promptly to any inquiries to keep the process moving smoothly.