Blank IRS 2553 Form

Key takeaways

The IRS Form 2553 is essential for small businesses electing to be taxed as an S Corporation. Here are some key takeaways regarding its completion and use:

- Eligibility Requirements: Ensure that your business meets all eligibility criteria before filing. This includes having no more than 100 shareholders and only one class of stock.

- Filing Deadline: Submit Form 2553 within 75 days of your desired effective date. Late submissions may lead to complications in your S Corporation status.

- Shareholder Consent: All shareholders must consent to the S Corporation election. This requires their signatures on the form, highlighting the importance of communication among stakeholders.

- Impact on Taxes: Understand the tax implications of electing S Corporation status. This choice can affect how income is reported and taxed at both the corporate and individual levels.

Common mistakes

When filling out the IRS Form 2553, many individuals and businesses make common mistakes that can lead to delays or even rejection of their S Corporation election. One frequent error is not meeting the deadline. The form must be submitted within a specific time frame, typically within two months and 15 days of the beginning of the tax year. Failing to adhere to this timeline can result in the election being denied for that tax year.

Another common mistake is incorrect information regarding the corporation's name and address. It's essential to ensure that the name matches exactly with what is registered with the state. Any discrepancies can cause confusion and may delay processing. Additionally, providing an outdated or incorrect address can lead to missed correspondence from the IRS.

Many filers also overlook the requirement for all shareholders to sign the form. Each shareholder must consent to the S Corporation election. If even one signature is missing, the IRS may reject the form. This step is crucial and should not be skipped.

Incorrectly reporting the number of shareholders is another mistake that can lead to issues. The IRS has specific rules regarding the maximum number of shareholders allowed for an S Corporation. If a business exceeds this limit, it may lose its S Corporation status. Therefore, it's vital to double-check the count and ensure compliance with IRS regulations.

Finally, failing to provide the correct tax year can also be problematic. The form asks for the corporation's desired tax year, and it should align with the business's operational calendar. If the tax year does not match, it can complicate tax filings and create additional administrative hurdles.

Misconceptions

The IRS Form 2553 is an important document for small businesses that wish to elect S corporation status. However, there are several misconceptions surrounding this form that can lead to confusion. Here is a list of seven common misconceptions about the IRS Form 2553:

- Only corporations can file Form 2553. This is not true. While Form 2553 is primarily used by corporations, certain limited liability companies (LLCs) can also file this form to elect S corporation status.

- Form 2553 must be filed every year. This is a common misunderstanding. Once a business successfully elects S corporation status by filing Form 2553, it does not need to file the form again each year. However, it must continue to meet the requirements for S corporation status.

- Filing Form 2553 guarantees S corporation status. This is misleading. Even after filing, the IRS must approve the election. If the business does not meet the eligibility requirements, the election may be denied.

- There is no deadline for filing Form 2553. This misconception can lead to missed opportunities. There are specific deadlines for filing the form, typically within 75 days of the start of the tax year in which the election is to take effect.

- All shareholders must agree to the S corporation election. While it is important for shareholders to be aware, it is not necessary for all shareholders to formally consent to the election. However, all shareholders must be eligible to hold shares in an S corporation.

- Filing Form 2553 is a complicated process. Many people believe that the process is overly complex. In reality, the form is relatively straightforward and can often be completed with a basic understanding of the business structure.

- Once filed, the business cannot change its tax status. This is incorrect. A business can choose to revoke its S corporation status by filing a statement with the IRS. However, there are rules and limitations on how often this can be done.

Understanding these misconceptions can help business owners make informed decisions about their tax status and ensure compliance with IRS regulations. It is always advisable to consult with a tax professional for personalized guidance.

Dos and Don'ts

Filling out the IRS Form 2553, which is used to elect S Corporation status, is a crucial step for many businesses. To ensure that the process goes smoothly and to avoid common pitfalls, here are some important dos and don’ts to keep in mind.

- Do ensure that your business is eligible to make the S Corporation election.

- Do fill out the form completely and accurately.

- Do file the form on time, typically within 75 days of the start of your tax year.

- Do include all required information, such as the names and addresses of shareholders.

- Do consult a tax professional if you have any questions or uncertainties.

- Don't forget to sign and date the form before submission.

- Don't submit the form without checking for errors or missing information.

- Don't assume that the IRS will automatically grant your election; confirmation is necessary.

- Don't overlook the importance of timely filing; late submissions can lead to complications.

- Don't neglect to inform shareholders about the S Corporation election and its implications.

Other PDF Forms

Chick-fil-a Jobs - Work where every day brings new challenges and rewards.

Housing Choice Voucher Program - Misrepresentation of information may lead to denial or termination of assistance.

Detailed Guide for Writing IRS 2553

Filling out the IRS Form 2553 is an important step for businesses looking to elect S corporation status. This process can seem daunting, but by following a clear set of steps, you can complete the form accurately and efficiently. Make sure you have all necessary information at hand before you begin.

- Gather your business information, including the legal name, address, and Employer Identification Number (EIN).

- Determine the tax year for your S corporation election. You can choose a calendar year or a fiscal year.

- Complete Part I of the form, which includes basic information about your corporation and the election being made.

- In Part II, provide information about the shareholders, including names, addresses, and the number of shares owned by each shareholder.

- Fill out Part III if your corporation has more than one shareholder. This section requires additional details about the shareholders' consent to the S corporation election.

- Review the form for accuracy. Make sure all names, addresses, and numbers are correct.

- Sign and date the form. Ensure that an authorized officer of the corporation signs the form.

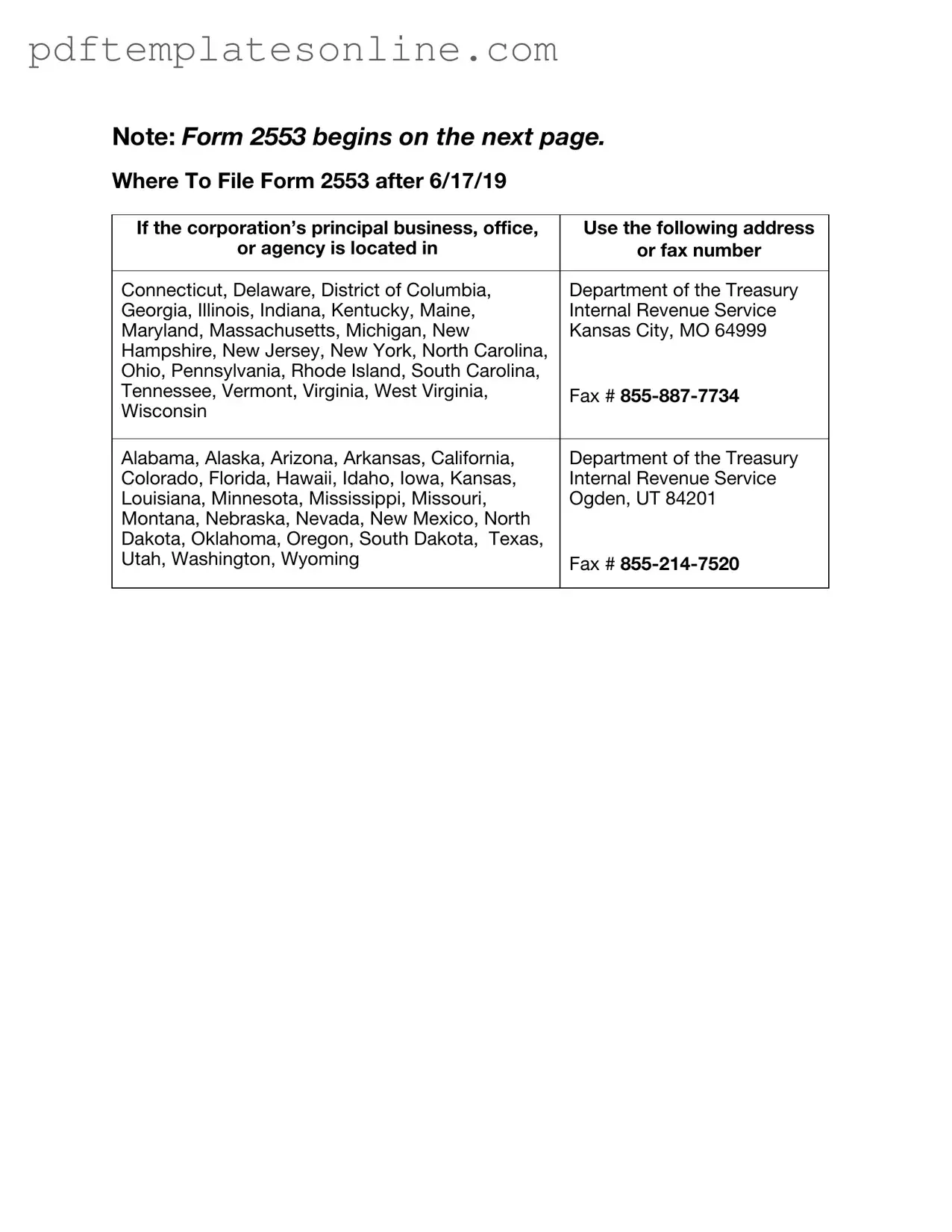

- Submit the completed Form 2553 to the IRS. You can mail it to the address specified in the form's instructions.

After submitting your Form 2553, the IRS will process your election. You should receive confirmation from the IRS regarding your S corporation status. Keep a copy of the submitted form for your records.