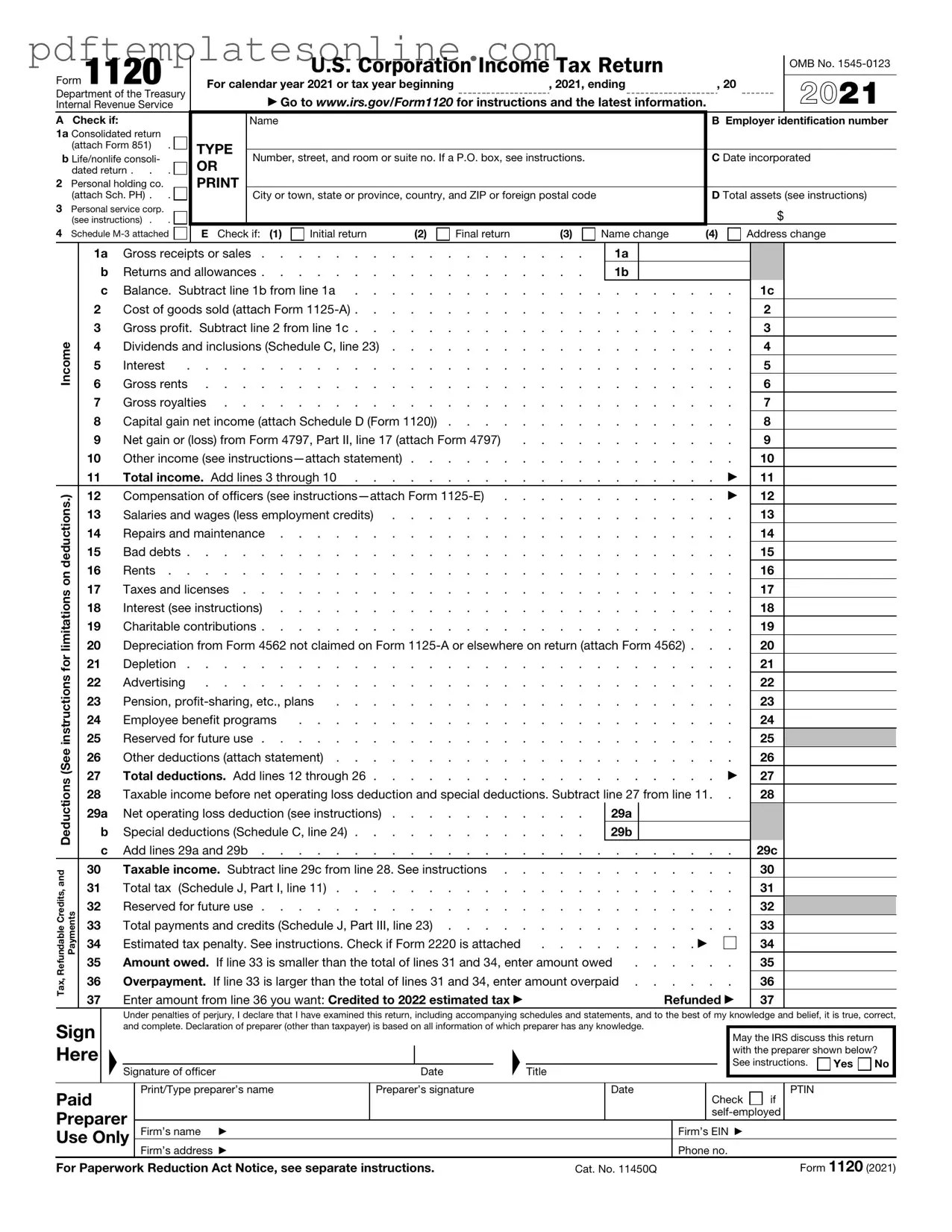

Blank IRS 1120 Form

Key takeaways

When completing the IRS Form 1120, it is essential to keep several key points in mind to ensure accuracy and compliance. Here are the takeaways:

- Understand that Form 1120 is primarily for C corporations to report income, gains, losses, deductions, and credits.

- Gather all necessary financial documents, including profit and loss statements and balance sheets, before starting the form.

- Ensure that you provide accurate information regarding the corporation’s name, address, and Employer Identification Number (EIN).

- Be aware of the various sections of the form, including income, deductions, and tax computation.

- Use the correct tax rates applicable for the year in question, as they may change annually.

- Double-check all calculations and ensure that the numbers reconcile with your financial statements.

- Consider filing electronically, as it can expedite processing and reduce errors.

- Be mindful of deadlines to avoid penalties; typically, Form 1120 is due on the 15th day of the fourth month after the end of the corporation's tax year.

Common mistakes

Completing the IRS 1120 form can be a complex process for many business owners. One common mistake is failing to accurately report income. It is essential to include all sources of revenue, as any discrepancies can lead to penalties or audits. Businesses should ensure that they have thoroughly reviewed their financial records before submitting the form.

Another frequent error involves the misclassification of expenses. It is important to categorize expenses correctly to maximize deductions. Mislabeling can result in missed opportunities for tax savings or even trigger an audit. Careful attention to detail in this area can significantly impact a business's tax liability.

Many individuals also overlook the importance of signatures. The IRS requires that the form be signed by an authorized person, typically an officer of the corporation. A missing signature can delay processing and create unnecessary complications. It is advisable to double-check that all required signatures are present before submitting.

Additionally, some business owners fail to keep track of deadlines. The IRS has specific due dates for filing the 1120 form, and missing these deadlines can result in late fees and penalties. It is beneficial to mark important dates on a calendar and set reminders to ensure timely submission.

Lastly, inadequate record-keeping can lead to significant issues. The IRS may request supporting documentation for the figures reported on the form. Without proper records, a business may struggle to substantiate its claims. Maintaining organized financial records throughout the year is crucial for a smooth filing process.

Misconceptions

The IRS Form 1120 is a critical document for corporations in the United States, but misconceptions about it can lead to confusion and missteps. Here are nine common misunderstandings regarding this form, along with clarifications to help demystify its purpose and requirements.

- Only large corporations need to file Form 1120. Many people believe that only large corporations are required to file this form. In reality, any corporation that earns income must file, regardless of its size.

- Form 1120 is the same as personal income tax forms. Some individuals mistakenly think that Form 1120 operates similarly to personal tax forms. However, it is specifically designed for corporations and has distinct requirements and calculations.

- Filing Form 1120 guarantees a tax refund. There is a misconception that filing this form automatically leads to a tax refund. While corporations may receive refunds, it depends on various factors, including their overall tax liability.

- All income must be reported on Form 1120. Some may assume that only certain types of income are reportable. In fact, all income earned by the corporation, including sales and investments, must be reported.

- Form 1120 can be filed at any time during the year. Many people think that they can submit Form 1120 whenever they choose. However, it must be filed on or before the 15th day of the fourth month after the end of the corporation's tax year.

- Corporations can skip filing if they don’t owe taxes. A common myth is that corporations can avoid filing if they do not owe taxes. This is incorrect; all corporations must file Form 1120, regardless of their tax liability.

- Tax preparation software is unnecessary for Form 1120. Some believe that they can easily complete Form 1120 without assistance. While it is possible, tax preparation software can help ensure accuracy and compliance with current tax laws.

- Only C corporations file Form 1120. There is a belief that only C corporations are required to use this form. However, certain other entities, like S corporations, may also need to file variations of this form under specific circumstances.

- Once filed, Form 1120 cannot be amended. Lastly, some individuals think that once they submit Form 1120, it cannot be changed. In fact, corporations can amend their tax returns if they discover errors or need to make adjustments.

Understanding these misconceptions can empower corporations to navigate their tax responsibilities more effectively. By clarifying these points, we can foster a better understanding of the importance of compliance and the implications of the IRS Form 1120.

Dos and Don'ts

When filling out the IRS 1120 form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do double-check all entries for accuracy before submitting.

- Do use the most recent version of the form to ensure you have the latest requirements.

- Do provide all necessary financial information, including income, deductions, and credits.

- Do sign and date the form before sending it to the IRS.

- Don't leave any sections blank; if a question does not apply, write "N/A."

- Don't forget to keep a copy of the completed form for your records.

Other PDF Forms

Ca Divorce Forms - The form typically prompts the applicant to provide contact information for both spouses.

In addition to providing clarity on the loan terms, borrowers and lenders can also benefit from utilizing resources such as California PDF Forms to ensure that their agreements are comprehensive and legally sound.

Va Form 10 2850c - Providing complete and accurate information on the VA 10-2850c enhances the application’s chances of success.

Detailed Guide for Writing IRS 1120

Filling out the IRS Form 1120 is an important step for corporations to report their income, gains, losses, deductions, and credits. Completing this form accurately is essential for compliance with tax obligations. Here’s how to proceed:

- Gather necessary documents, including financial statements, records of income, and expense receipts.

- Download the IRS Form 1120 from the official IRS website or obtain a physical copy from a tax professional.

- Begin by entering your corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Fill in the date of incorporation and the total assets of the corporation at the end of the tax year.

- Report your corporation's income in the appropriate sections. This includes gross receipts, dividends, interest, and any other income sources.

- List all deductions in the designated area. This can include business expenses such as salaries, rent, and utilities.

- Calculate the taxable income by subtracting total deductions from total income.

- Complete the tax calculation section to determine the amount of tax owed based on the taxable income.

- If applicable, fill out any additional schedules required for specific deductions or credits.

- Review the form for accuracy and completeness. Ensure all calculations are correct.

- Sign and date the form. If someone else prepared it, they must also sign it.

- File the completed form with the IRS by the due date, either electronically or by mail.

After submitting the IRS Form 1120, keep a copy for your records. It's crucial to stay organized and maintain documentation in case of any future inquiries or audits from the IRS.