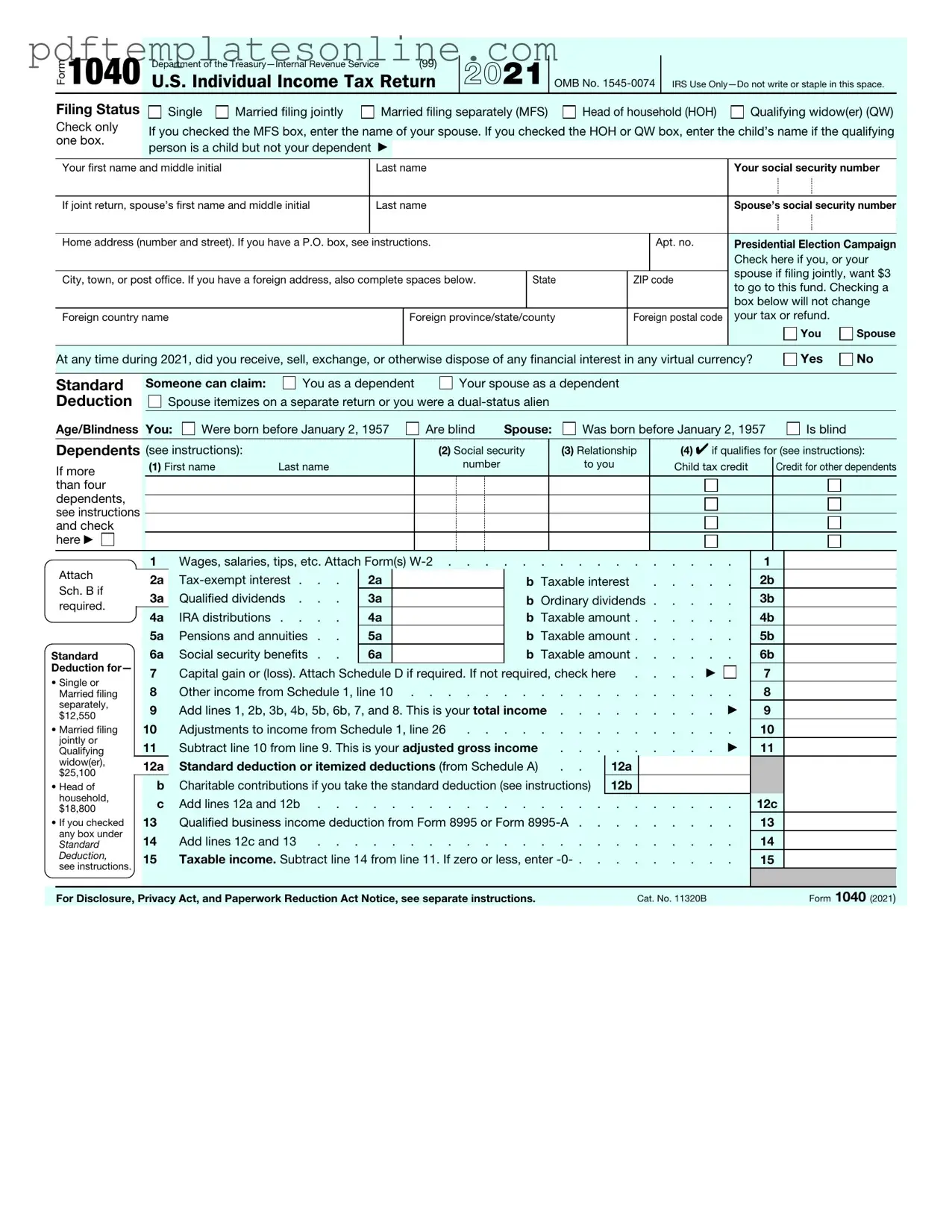

Blank IRS 1040 Form

Key takeaways

Filling out and using the IRS 1040 form is an important step in the annual tax process for individuals. Understanding its components can help ensure accurate reporting and compliance with tax regulations. Here are five key takeaways:

- Personal Information: Begin by providing accurate personal details, including your name, address, and Social Security number. This information is essential for proper identification and processing of your tax return.

- Filing Status: Choose the appropriate filing status, such as single, married filing jointly, or head of household. Your status affects your tax rate and eligibility for certain deductions.

- Income Reporting: Report all sources of income, including wages, dividends, and interest. Accurate income reporting is crucial for determining your tax liability.

- Deductions and Credits: Identify and claim eligible deductions and credits. These can significantly reduce your taxable income and overall tax bill, so it is important to research what applies to your situation.

- Review and Submit: Before submitting your form, review all entries for accuracy. Mistakes can lead to delays or audits. Ensure that you file by the deadline to avoid penalties.

By following these key points, individuals can navigate the IRS 1040 form more effectively and fulfill their tax obligations with confidence.

Common mistakes

Filling out the IRS 1040 form can be a daunting task, and many individuals make common mistakes that can lead to delays or complications. One prevalent error is incorrect personal information. This includes misspellings of names, wrong Social Security numbers, or incorrect addresses. Such inaccuracies can cause processing issues and may even result in a rejected return.

Another frequent mistake involves omitting income. Some people forget to report all sources of income, such as freelance work, side jobs, or interest from bank accounts. Even small amounts can add up, and failing to report them can lead to penalties or audits.

Many filers also struggle with deduction errors. Whether it’s failing to claim eligible deductions or incorrectly calculating them, this can significantly impact the amount of tax owed or the refund expected. It’s essential to understand what deductions apply and to keep accurate records.

Additionally, math errors are surprisingly common. Simple addition or subtraction mistakes can lead to incorrect calculations of tax owed or refund amounts. Double-checking all figures can help avoid this issue.

Another mistake is not signing and dating the form. A return that is not signed is considered invalid. This may seem minor, but it can delay processing and lead to unnecessary complications.

Some individuals also forget to include necessary attachments. This includes W-2 forms, 1099 forms, and any other supporting documentation. Failing to include these documents can result in processing delays or additional requests for information from the IRS.

Lastly, many people neglect to file on time. Missing the deadline can result in penalties and interest on any taxes owed. It’s crucial to be aware of filing deadlines and to plan ahead to ensure timely submission.

Misconceptions

Understanding the IRS 1040 form can be tricky, and many people hold misconceptions about it. Here’s a list of ten common misunderstandings, along with clarifications to help you navigate your tax filing process more smoothly.

- Everyone has to file a 1040 form. Many individuals believe that all taxpayers must file a 1040 form. In reality, it depends on your income, filing status, and age. Some people may not be required to file at all.

- The 1040 form is the only tax form. While the 1040 is the most common form, there are other forms like the 1040-SR for seniors and the 1040-NR for non-residents. Each serves different purposes based on individual circumstances.

- You can only file your taxes online. Some think that e-filing is the only option available. You can still file your taxes using a paper form if you prefer that method, though it may take longer to process.

- Filing a 1040 guarantees a refund. Many assume that filing a 1040 will automatically result in a tax refund. However, whether you receive a refund depends on your total income, deductions, and tax credits.

- All income is taxable. Some people believe that every dollar earned is subject to taxation. In truth, certain types of income may be exempt or only partially taxable, such as gifts or some scholarships.

- Tax deductions are the same as tax credits. There’s a common mix-up between deductions and credits. Deductions reduce your taxable income, while credits directly reduce your tax bill. Understanding the difference can significantly affect your tax outcome.

- You can’t amend a 1040 form. It’s a misconception that once you file a 1040, you cannot make changes. If you realize you made a mistake, you can file an amended return using Form 1040-X.

- Filing late means you’ll automatically face penalties. While it’s true that late filing can lead to penalties, the IRS may offer relief options in certain situations. It’s essential to communicate with them if you’re facing difficulties.

- You can only claim standard deductions. Many people think they must take the standard deduction. In fact, you can choose to itemize your deductions if it benefits you more, depending on your expenses.

- Once you file, you can’t track your return. Some believe that after submitting their 1040, they lose visibility into the process. The IRS provides tools to track the status of your return, giving you peace of mind.

By dispelling these misconceptions, you can approach your tax filing with greater confidence and clarity. Always consider seeking guidance if you have specific questions or concerns about your tax situation.

Dos and Don'ts

When filling out the IRS 1040 form, it's essential to approach the task with care. Here are some key do's and don'ts to keep in mind:

- Do gather all necessary documents before starting, such as W-2s, 1099s, and any other income statements.

- Do double-check your Social Security number and other personal information for accuracy.

- Do use the correct filing status based on your personal circumstances, such as single, married, or head of household.

- Do report all sources of income, including freelance work or side jobs.

- Don't forget to sign and date the form before submission.

- Don't leave any blank spaces; if a question does not apply, write "N/A" or "0" as appropriate.

- Don't ignore deadlines; ensure you file your return on time to avoid penalties.

Other PDF Forms

Panel Schedule - Supports compliance with insurance and safety regulations.

What Is Employment Verification Letter - The document aids in assessing eligibility for various social services.

Wage and Tax Statement - The W-2 form varies depending on the state and local tax requirements.

Detailed Guide for Writing IRS 1040

Completing the IRS 1040 form is a crucial step in filing your annual tax return. Follow these steps carefully to ensure accuracy and compliance with tax regulations.

- Gather your documents, including W-2s, 1099s, and any other income statements.

- Begin with your personal information. Fill in your name, address, and Social Security number at the top of the form.

- Indicate your filing status by checking the appropriate box. Options include single, married filing jointly, married filing separately, head of household, and qualifying widow(er).

- Report your income. Use the lines provided to enter wages, salaries, tips, and other income sources.

- Calculate your adjusted gross income (AGI). Subtract any adjustments to income, such as contributions to retirement accounts, from your total income.

- Claim your deductions. Choose between the standard deduction and itemized deductions. Enter the appropriate amount on the designated line.

- Determine your taxable income by subtracting your deductions from your AGI.

- Calculate your tax liability using the tax tables provided in the instructions or by applying the appropriate tax rate.

- Account for any tax credits you qualify for, such as the Child Tax Credit or Earned Income Credit. Subtract these credits from your tax liability.

- Report any taxes withheld or estimated tax payments made throughout the year. This will help determine if you owe additional taxes or if you will receive a refund.

- Sign and date the form. If filing jointly, ensure both spouses sign.

- Submit your completed form to the IRS, either electronically or by mail, depending on your preference.

Once you have filled out the form, review it for accuracy. Make sure all calculations are correct and that you have included all necessary documentation. Filing your taxes on time will help you avoid penalties and interest.