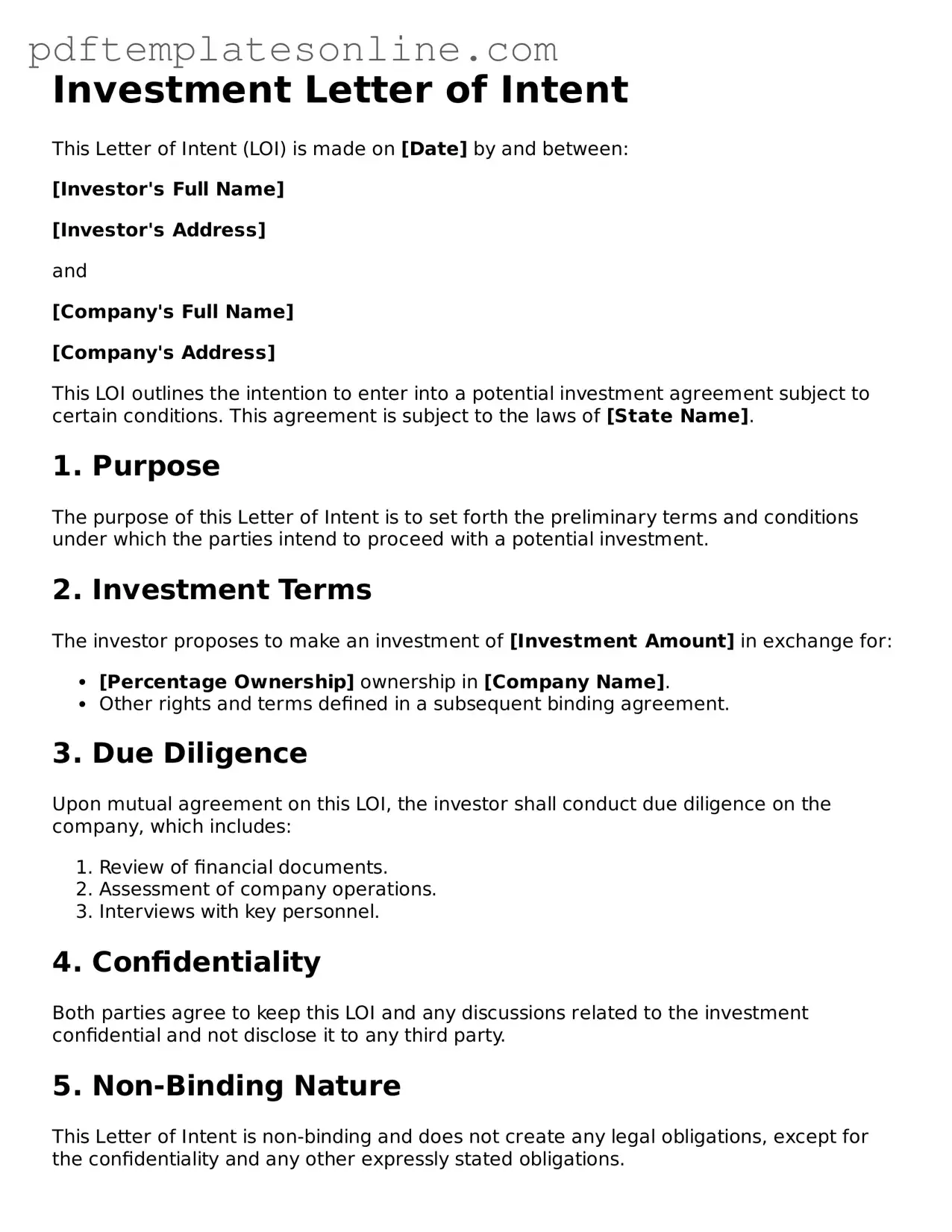

Fillable Investment Letter of Intent Document

Key takeaways

When filling out and using the Investment Letter of Intent form, keep these key takeaways in mind:

- Clarity is Crucial: Ensure that all information is clear and accurate. Ambiguities can lead to misunderstandings later.

- Specify the Investment Amount: Clearly state the amount you intend to invest. This helps both parties understand the commitment involved.

- Outline Terms and Conditions: Include any specific terms or conditions related to the investment. This sets expectations from the outset.

- Consult Legal Counsel: Before finalizing the letter, consider having a lawyer review it. This can help protect your interests.

- Keep a Copy: After submitting the form, retain a copy for your records. This can be useful for future reference.

- Follow Up: After sending the letter, follow up to confirm receipt and discuss next steps. Communication is key to a successful investment process.

Common mistakes

Filling out an Investment Letter of Intent form can be a straightforward process, but many people still make common mistakes that can lead to delays or complications. One significant error is providing incomplete information. It’s crucial to fill out every section of the form accurately. Leaving out details, even seemingly minor ones, can raise questions and cause processing delays. Always double-check that all required fields are filled in before submitting.

Another frequent mistake is misunderstanding the terms and conditions outlined in the form. Individuals often skim through the fine print or overlook important clauses. This oversight can result in misunderstandings about obligations or expectations. Taking the time to read and comprehend these terms ensures that you are fully aware of what you are agreeing to, which can save you from potential disputes later on.

Additionally, people sometimes fail to provide the necessary supporting documentation. The Investment Letter of Intent may require attachments like financial statements or proof of identity. Not including these documents can lead to the rejection of the application. Always check the submission guidelines to ensure you have all the required materials ready to go.

Lastly, many applicants neglect to proofread their submissions. Simple typos or errors can undermine the professionalism of your application. Mistakes in names, dates, or figures can create confusion. Taking a moment to review your form for accuracy can make a significant difference. A polished submission reflects well on you and can help facilitate a smoother process.

Misconceptions

Many people have misunderstandings about the Investment Letter of Intent (LOI) form. Here are nine common misconceptions along with clarifications to help you understand this important document.

- It is a legally binding contract. Many believe that an LOI is a binding agreement. In reality, it often serves as a preliminary outline of terms and intentions, not a legally enforceable contract.

- It guarantees funding. Some think that signing an LOI ensures that funding will be provided. However, it merely indicates interest and intent, not a commitment of funds.

- It is only for large investments. A common misconception is that LOIs are only necessary for substantial investments. In fact, they can be useful for any size of investment to clarify intentions.

- It is a standard form with no need for customization. Many assume that an LOI is a one-size-fits-all document. Each investment situation is unique, and LOIs should be tailored to fit specific circumstances.

- It cannot be modified once signed. Some individuals think that once an LOI is signed, it cannot be changed. In truth, parties can negotiate and amend the terms as needed.

- It is only relevant for investors. There is a belief that only investors need to be concerned with the LOI. In reality, it is important for both parties involved, including the recipient of the investment.

- It is not necessary if a formal contract will follow. Some think that if a formal contract is coming, an LOI is unnecessary. However, an LOI can help clarify intentions and streamline the process leading to the contract.

- It requires legal counsel to draft. While having legal counsel can be beneficial, many believe that it is mandatory. Individuals can draft an LOI themselves, but they should ensure it covers all essential points.

- It is only used in private investments. Some people think LOIs are exclusive to private investments. However, they can also be used in public offerings and other investment scenarios.

Understanding these misconceptions can help you navigate the investment landscape more effectively. An Investment Letter of Intent is a valuable tool, but clarity about its purpose and limitations is essential.

Dos and Don'ts

When filling out the Investment Letter of Intent form, it is important to follow certain guidelines to ensure accuracy and clarity. Below is a list of dos and don’ts to keep in mind.

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do use clear and concise language.

- Do double-check for any spelling or grammatical errors.

- Don't leave any required fields blank.

- Don't use jargon or overly complex terms.

- Don't rush through the form; take your time to ensure accuracy.

- Don't submit the form without reviewing it thoroughly.

Browse Common Types of Investment Letter of Intent Templates

Demand Letter of Intent to Sue - The form aims to facilitate negotiations before a lawsuit is filed.

Intention to Marry Within 90 Days of Entry - The letter can contain thoughtful messages that reinforce the couple's bond.

Letter of Hire - This document helps to set clear expectations for both parties during the hiring process.

Detailed Guide for Writing Investment Letter of Intent

Filling out the Investment Letter of Intent form is an important step in expressing your commitment to a potential investment opportunity. Once completed, this form will help facilitate the next stages of your investment process, allowing you to move forward with confidence.

- Begin by entering your full name in the designated field. Ensure that you spell it correctly, as this will be used in all official documents.

- Provide your current address, including street, city, state, and zip code. Double-check for accuracy to avoid any delays.

- Fill in your contact information, including your phone number and email address. This information is essential for communication purposes.

- Specify the amount you intend to invest. Be clear and precise in stating the figure to avoid misunderstandings.

- Indicate the type of investment you are interested in. This could include options such as stocks, bonds, or real estate.

- Review the terms and conditions provided in the form. Make sure you understand what you are agreeing to before proceeding.

- Sign and date the form at the bottom. Your signature signifies your commitment to the investment opportunity.

- Finally, submit the completed form according to the instructions provided. This may involve mailing it or submitting it electronically.