Blank Intent To Lien Florida Form

Key takeaways

When dealing with the Intent to Lien Florida form, it’s essential to approach the process with care and understanding. Here are some key takeaways to keep in mind:

- Understanding the Purpose: The Intent to Lien form serves as a formal notification to property owners that a lien may be filed against their property due to non-payment for services rendered or materials supplied.

- Timely Notification: Florida law requires that this notice be sent at least 45 days before filing a lien. This timeline is crucial for ensuring that property owners are adequately informed and have the opportunity to respond.

- Clear Communication: The form should clearly state the amount owed and the services provided. This clarity helps prevent misunderstandings and encourages prompt payment.

- Consequences of Non-Payment: If payment is not received within 30 days of sending the notice, the property may be subject to a lien, which can lead to foreclosure and additional costs for the property owner.

- Certificate of Service: It’s important to document how and when the notice was delivered. This record is essential for legal purposes and ensures that all parties are aware of the communication.

By following these guidelines, individuals can navigate the process of using the Intent to Lien form more effectively, fostering better communication and resolution of payment issues.

Common mistakes

Filling out the Intent To Lien Florida form requires attention to detail. One common mistake is leaving the date blank. This is critical, as the date establishes the timeline for the lien process. Without a proper date, the notice may be deemed invalid, leading to complications in enforcing the lien.

Another frequent error is failing to include the full legal names of the property owners. Incomplete or incorrect names can result in delays or even the rejection of the lien. Ensure that the names match the official property records to avoid confusion and ensure proper notification.

Providing an inaccurate mailing address is also a significant mistake. The address must be complete and correct to ensure that the notice reaches the intended recipients. An incorrect address can lead to non-delivery and potentially invalidate the lien process.

Omitting the general contractor's information, when applicable, is another oversight. If a general contractor is involved, their full legal name and mailing address should be included. This transparency helps clarify all parties involved in the project and can prevent disputes down the line.

Many individuals forget to specify the amount owed for the work performed. This figure should be clearly stated in the notice. Not including this information can create confusion and may weaken the claim, as the property owner may not understand the basis for the lien.

Another mistake is not adhering to the required timelines. The notice must be sent at least 45 days before recording the lien. Failing to follow this timeline can jeopardize the entire process, leaving the claimant without legal recourse.

Additionally, neglecting to include a certificate of service is a common error. This document serves as proof that the notice was properly delivered to the property owner. Without it, there may be challenges in proving that the notice was received, which can affect the validity of the lien.

Lastly, individuals often forget to sign the notice. A signature is essential for the document to be considered valid. Without it, the notice may be rejected, and the intended lien may not be enforceable. Taking the time to review the form carefully can prevent these mistakes and ensure a smoother process.

Misconceptions

Here are six common misconceptions about the Intent to Lien Florida form:

- It is the same as a lien. Many people think that submitting an Intent to Lien form automatically creates a lien. In reality, it serves as a notice of intent, allowing property owners a chance to address payment issues before a lien is formally recorded.

- It can be filed anytime. Some believe that the Intent to Lien can be filed at any point during a project. However, Florida law requires that it be sent at least 45 days before recording a Claim of Lien.

- Only contractors can file this notice. This is not true. Any party that has provided labor, services, or materials for a property improvement can file an Intent to Lien, including subcontractors and suppliers.

- Sending the notice guarantees payment. While the notice is an important step in the process, it does not guarantee that payment will be made. It simply informs the property owner of the outstanding payment issue.

- Failure to respond means a lien will be filed. Although the notice warns that a lien may be recorded if payment is not made, it does not mean a lien will automatically be filed. The filer may still choose to resolve the matter without further action.

- It is not necessary to keep a copy. Some individuals think they don’t need to retain a copy of the Intent to Lien. In fact, it is crucial to keep a copy for your records, as it serves as proof of notification.

Dos and Don'ts

Do's when filling out the Intent To Lien Florida form:

- Clearly state the property owner's full legal name and mailing address.

- Provide an accurate description of the property, including both the street address and legal description.

- Include the amount owed for the work performed to avoid confusion.

- Ensure the notice is sent at least 45 days before recording the lien.

Don'ts when filling out the Intent To Lien Florida form:

- Do not leave any sections blank; incomplete forms can lead to delays or rejections.

- Avoid using vague language; be specific about the services or materials provided.

- Do not forget to include your contact information for follow-up.

- Never send the notice without confirming it was delivered to the correct address.

Other PDF Forms

Wh-58 - Each form should be carefully reviewed by the employee prior to signing.

In addition to the standard requirements of a promissory note, borrowers in California can benefit from using resources such as California PDF Forms, which provide customizable templates to ensure all essential elements are included, thus enhancing the document's clarity and legal standing.

How Do You Know You Had a Miscarriage - The document provides confirmation for miscarriages that are not due to any intentional pregnancy termination.

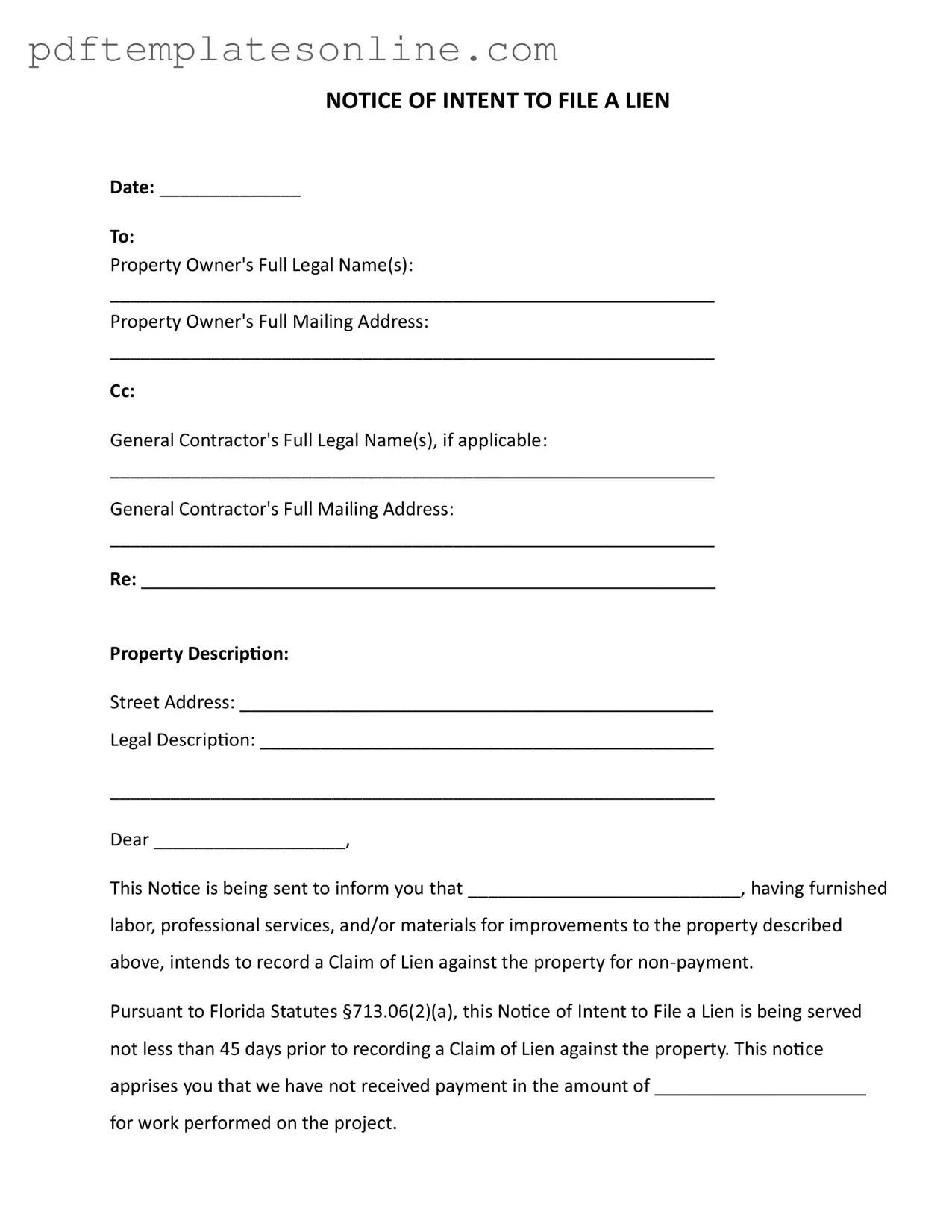

Detailed Guide for Writing Intent To Lien Florida

Filling out the Intent to Lien form is a critical step in the process of securing payment for services rendered. This form serves as a formal notice to the property owner about the intent to file a lien due to non-payment. It is essential to complete it accurately to ensure that your rights are protected. Follow these steps carefully to fill out the form correctly.

- Date: Write the current date at the top of the form.

- Property Owner's Name: Enter the full legal name(s) of the property owner(s) in the designated space.

- Property Owner's Mailing Address: Fill in the complete mailing address of the property owner.

- General Contractor's Name (if applicable): If there is a general contractor involved, include their full legal name(s) here.

- General Contractor's Mailing Address: Provide the complete mailing address for the general contractor, if applicable.

- Property Description: Specify the street address of the property in the appropriate section.

- Legal Description: Enter the legal description of the property, ensuring it is accurate and complete.

- Dear [Property Owner's Name]: Address the property owner formally, using their name.

- Notice of Intent: Fill in the name of the individual or company that has provided labor, services, or materials.

- Payment Amount: Clearly state the amount owed for the work performed on the project.

- Your Name: Sign the form with your name where indicated.

- Your Title: Include your job title beneath your name.

- Your Contact Information: Provide your phone number and email address for further communication.

- Certificate of Service: Fill in the date and name of the individual who received the notice, along with their address.

- Delivery Method: Check the appropriate box to indicate how the notice was delivered.

- Name and Signature: Sign and print your name at the bottom of the certificate of service.

Once you have completed the form, review it for accuracy and clarity. Ensure that all necessary fields are filled in correctly. After that, you can send the notice to the property owner and keep a copy for your records. Taking these steps helps maintain a clear line of communication and can facilitate a resolution to the payment issue.