Blank Independent Contractor Pay Stub Form

Key takeaways

When filling out and using the Independent Contractor Pay Stub form, there are several important points to keep in mind. Understanding these key takeaways can help ensure that the process is smooth and compliant with regulations.

- Accurate Information: Always provide accurate details about the contractor, including their name, address, and Social Security number or Tax Identification Number.

- Payment Details: Clearly state the payment amount, the date of payment, and the payment method used. This information is crucial for both record-keeping and tax purposes.

- Hours Worked: If applicable, include the total number of hours worked during the pay period. This helps in verifying the payment against the work performed.

- Contractor’s Rate: Specify the agreed-upon rate for the contractor's services. This could be an hourly rate, a flat fee, or a commission-based amount.

- Deductions: If there are any deductions, such as for taxes or other withholdings, clearly list these on the pay stub. Transparency in deductions is essential.

- Record Keeping: Maintain a copy of the pay stub for your records and provide a copy to the contractor. This ensures both parties have documentation of the transaction.

- Legal Compliance: Ensure that the pay stub complies with any applicable state or federal laws regarding independent contractor payments.

- Review Before Submission: Always review the completed pay stub for any errors before issuing it. Mistakes can lead to confusion and potential disputes.

Common mistakes

Filling out the Independent Contractor Pay Stub form can be a straightforward process, but several common mistakes can lead to complications. One frequent error is failing to include accurate personal information. Many individuals overlook the importance of providing correct names, addresses, and Social Security numbers. This oversight can cause delays in payments and may even lead to tax issues down the line.

Another common mistake is miscalculating earnings. Independent contractors often work on various projects with different pay rates. It’s easy to mix up the amounts earned for each job. This can result in underreporting or overreporting income on the pay stub. Ensuring that all earnings are correctly calculated is crucial for both accurate record-keeping and tax compliance.

Additionally, some individuals neglect to account for deductions. Independent contractors may have various expenses that can be deducted from their earnings, such as materials or travel costs. Failing to document these deductions accurately can lead to a higher tax burden than necessary. Keeping detailed records of all expenses is essential for maximizing take-home pay.

Lastly, not retaining a copy of the completed pay stub can be a significant oversight. Many contractors submit their pay stubs without keeping a record for themselves. This can create problems when trying to track payments or resolve discrepancies later. Maintaining a copy of each pay stub ensures that there is always a reference point for future inquiries or audits.

Misconceptions

The Independent Contractor Pay Stub form is often misunderstood. Here are nine common misconceptions about this important document:

- Independent contractors do not need a pay stub. Many believe that since independent contractors are not employees, they do not require pay stubs. However, providing a pay stub can help contractors track their earnings and expenses.

- Pay stubs are only for full-time employees. This is incorrect. Independent contractors can also receive pay stubs to document their income, just like employees.

- Pay stubs are optional for independent contractors. While not legally required, pay stubs can be beneficial for tax purposes and financial record-keeping. They provide a clear summary of earnings.

- All pay stubs look the same. Pay stubs can vary significantly in format and content. Each contractor may receive a stub that reflects their specific payment terms and conditions.

- Independent contractors cannot dispute errors on pay stubs. Contractors have the right to question discrepancies. They should communicate with the payer to resolve any issues regarding their earnings.

- Pay stubs do not include deductions. Some believe that pay stubs for independent contractors only show gross earnings. In reality, they can also include deductions for taxes or other expenses, depending on the agreement.

- Pay stubs are not necessary for tax filing. While not mandatory, having pay stubs can simplify the tax filing process. They provide a record of income that can be helpful during tax season.

- Independent contractors are always paid by the hour. Payment structures can vary. Contractors may receive a flat fee, commission, or hourly wage, and the pay stub should reflect the agreed-upon terms.

- Independent contractors cannot use pay stubs for loan applications. This is a misconception. Pay stubs can serve as proof of income, which is often required when applying for loans or mortgages.

Understanding these misconceptions can help independent contractors navigate their financial documentation more effectively.

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are ten things to keep in mind:

- Do provide accurate personal information, including your name and address.

- Don't leave any sections blank unless instructed to do so.

- Do list the correct payment period to reflect when the work was performed.

- Don't forget to include your tax identification number.

- Do specify the total amount paid for the services rendered.

- Don't misrepresent the nature of the work completed.

- Do keep a copy of the completed pay stub for your records.

- Don't submit the form without reviewing it for errors.

- Do sign and date the pay stub to validate it.

- Don't ignore any specific instructions provided with the form.

Other PDF Forms

Cdl Pre Trip Cheat Sheet - It serves as a preventive measure to decrease the likelihood of road incidents.

Using the California Transfer-on-Death Deed form can greatly simplify estate planning for homeowners, as it provides a hassle-free method for passing property to a beneficiary. This form, which can be found through resources such as California PDF Forms, helps to avoid probate and ensures that your real estate is transferred smoothly after you are gone.

Gift Letter for Mortgage Template - Useful for establishing financial support early in the process.

Dd Form 2656 March 2022 - The DD 2656 can alleviate potential conflicts among family members over retirement benefits.

Detailed Guide for Writing Independent Contractor Pay Stub

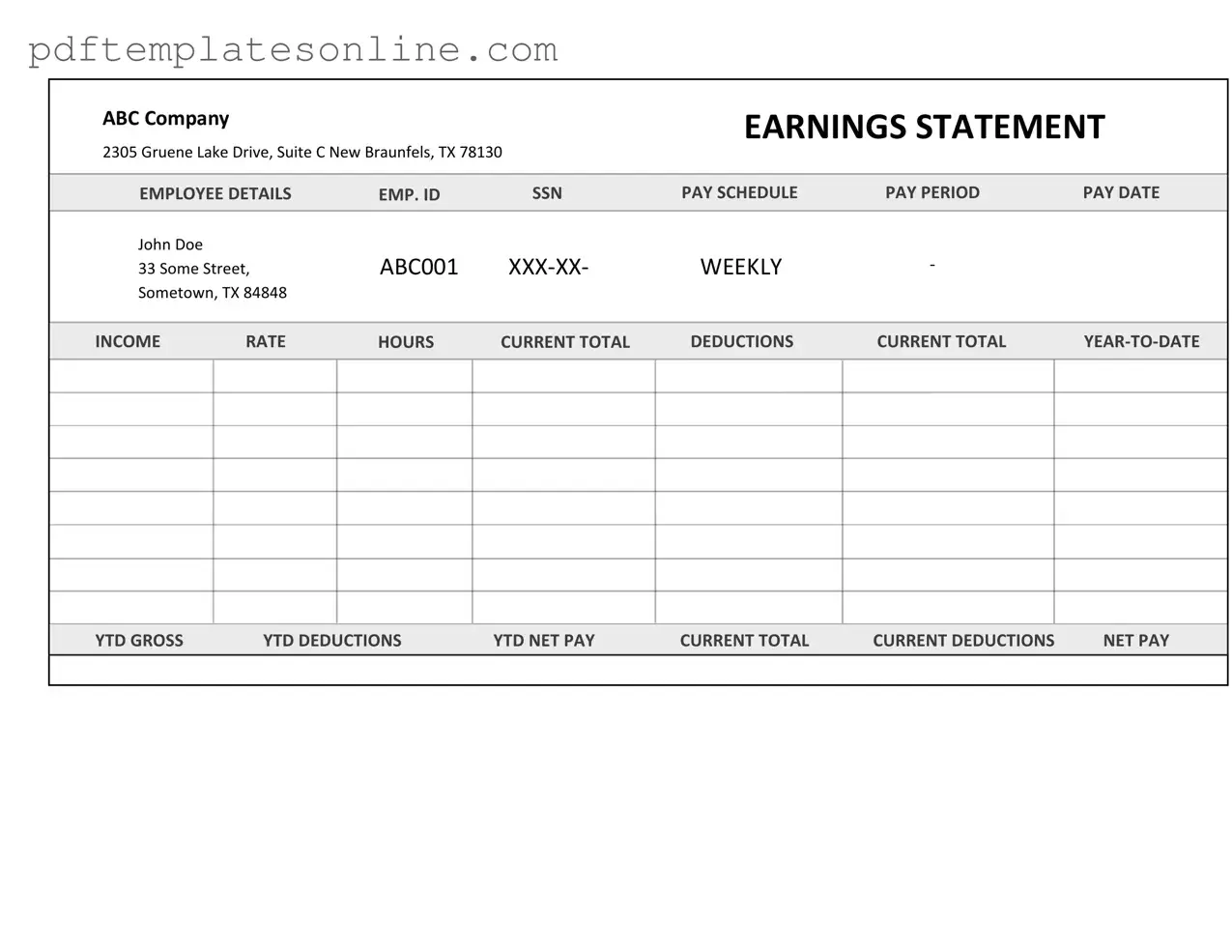

Filling out the Independent Contractor Pay Stub form is a straightforward process that requires accurate information about the contractor's earnings and deductions. Follow these steps to ensure that the form is completed correctly and efficiently.

- Obtain the Form: Start by downloading or printing the Independent Contractor Pay Stub form from a reliable source.

- Enter Contractor Information: Fill in the contractor's name, address, and contact information at the top of the form.

- Include Pay Period: Specify the start and end dates of the pay period for which the stub is being issued.

- List Hours Worked: Record the total number of hours worked during the pay period. If applicable, include any overtime hours.

- Input Rate of Pay: Enter the contractor's hourly rate or project rate. Ensure this aligns with the agreed terms.

- Calculate Gross Pay: Multiply the total hours worked by the rate of pay to determine the gross pay for the period.

- Detail Deductions: Itemize any deductions, such as taxes or benefits, that need to be subtracted from the gross pay.

- Calculate Net Pay: Subtract the total deductions from the gross pay to arrive at the net pay amount.

- Review Information: Double-check all entries for accuracy. Ensure that all calculations are correct and that no information is missing.

- Sign and Date: Finally, sign and date the pay stub to validate it. This step confirms that the information is accurate and complete.