Blank Hospital Bill Form

Key takeaways

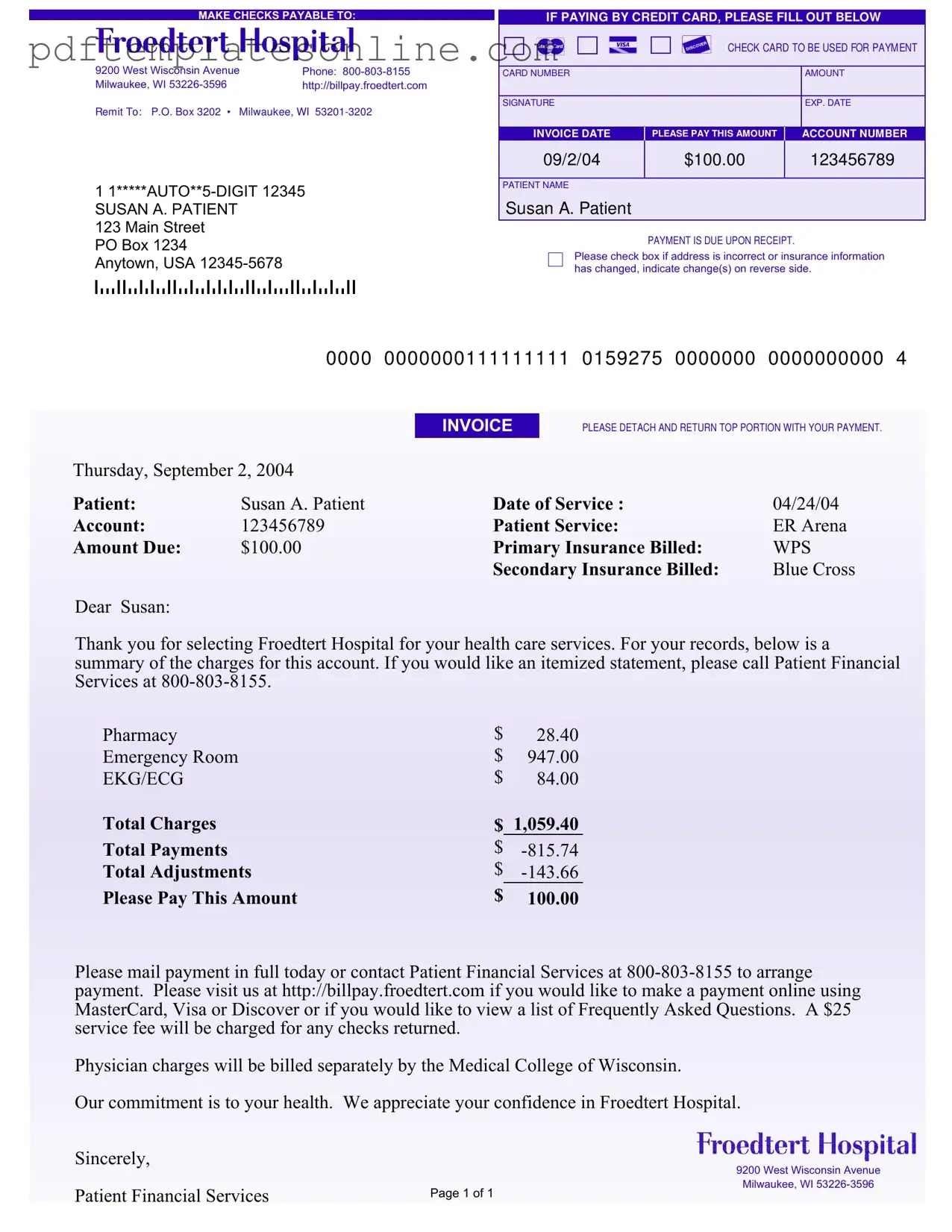

- Understand the Payment Process: Payment is due upon receipt of the hospital bill. Ensure you send your payment promptly to avoid any late fees.

- Fill Out the Form Completely: Provide accurate information, including your name, address, and insurance details. Incomplete forms can lead to processing delays.

- Use the Correct Payment Method: If paying by credit card, fill out the designated section carefully. Ensure that the card details, including the expiration date, are accurate.

- Review Charges: Check the summary of charges listed on the bill. If you have questions about specific charges, contact Patient Financial Services.

- Update Your Information: If there have been changes to your address or insurance information, indicate these changes on the reverse side of the bill.

- Consider Online Payment Options: For convenience, visit the provided website to pay online. This option allows for payment using major credit cards.

- Keep a Record: Retain a copy of the bill and any correspondence for your records. This will be helpful for future reference or disputes.

Common mistakes

When filling out the Hospital Bill form, individuals often make mistakes that can delay payment or create confusion. One common error is neglecting to provide accurate personal information. This includes the patient's name, address, and contact details. If any of this information is incorrect, it may lead to issues with billing and insurance claims.

Another frequent mistake is failing to check the insurance information thoroughly. Patients should ensure that the primary and secondary insurance details are complete and correct. Missing or incorrect policyholder IDs and group plan numbers can result in claims being denied or delayed, leaving patients responsible for the entire bill.

Additionally, many people overlook the payment method section. It is crucial to fill out the credit card information completely, including the card number, expiration date, and signature. Incomplete or inaccurate payment details can lead to payment processing issues, causing further delays in settling the bill.

Finally, individuals often forget to sign the form. A signature is necessary to authorize payment and confirm the information provided. Without a signature, the hospital may not process the payment, which can lead to additional fees or complications. Paying attention to these details can help ensure a smoother billing experience.

Misconceptions

Understanding hospital bills can be challenging, and several misconceptions often arise. Here are ten common misunderstandings about the Hospital Bill form:

- All charges are final and non-negotiable. Many people believe that the amount listed on the bill is set in stone. In reality, you can often negotiate charges, especially if you are facing financial hardship.

- Your insurance will cover all costs. Some assume that insurance will pay for everything. However, policies often have deductibles, co-pays, and exclusions that may leave you with out-of-pocket expenses.

- The bill is always accurate. It's a common belief that hospital bills are free from errors. In fact, mistakes can happen, and it is wise to review your bill carefully for any discrepancies.

- Payment is only necessary if you receive a bill. Many think they can ignore bills until they receive a reminder. However, it’s important to address any financial obligations promptly to avoid late fees or collections.

- All services are itemized on the bill. Some expect a detailed breakdown of every service. While some bills provide this, others may only summarize charges, requiring you to request an itemized statement for clarity.

- Emergency room visits always result in high bills. People often believe that any visit to the ER will lead to exorbitant charges. While costs can be high, they vary based on the services rendered and your insurance coverage.

- Payment plans are not available. There is a misconception that hospitals require full payment upfront. Many facilities offer payment plans to help patients manage their bills over time.

- All hospitals use the same billing practices. Some think that all hospitals operate under identical billing procedures. In reality, billing practices can differ significantly from one facility to another.

- Insurance will handle all communication. Many individuals assume their insurance company will manage everything related to billing. However, patients often need to advocate for themselves and follow up on claims.

- Once you pay, the matter is closed. Some believe that paying a bill ends the process. However, it’s essential to keep records and confirm that the payment has been applied correctly to avoid future issues.

By understanding these misconceptions, patients can navigate their hospital bills more effectively and ensure they are making informed decisions about their healthcare expenses.

Dos and Don'ts

When filling out the Hospital Bill form, it’s essential to ensure accuracy and completeness. Here are five things you should and shouldn’t do:

- Do double-check your personal information for accuracy.

- Do provide your insurance details clearly, including policyholder information.

- Do ensure that the payment amount matches the amount due on the invoice.

- Do sign the form if you are paying by credit card.

- Do contact Patient Financial Services if you have any questions.

- Don't leave any sections blank; incomplete forms can delay processing.

- Don't use a check that does not have sufficient funds; this may incur fees.

- Don't forget to update any changes in your address or insurance information.

- Don't submit the form without reviewing it for errors.

- Don't ignore the instructions regarding online payment options.

Other PDF Forms

Baseball Tryout Form - Players must demonstrate their skills in a structured tryout environment.

For those navigating the complexities of estate management, a crucial document to consider is the accurate completion of an Affidavit of Death for property transfer purposes. Understanding its significance can ensure compliance and facilitate smoother transitions. You can find more details in the understanding Affidavit of Death form essentials.

5707 Imm - Section A of the form includes information about the applicant, spouse, and parents.

Detailed Guide for Writing Hospital Bill

Completing the Hospital Bill form is a straightforward process that ensures your payment is processed efficiently. Follow these steps carefully to provide all the necessary information. Once the form is filled out, you can send it along with your payment to the designated address. Make sure to double-check your entries to avoid any delays.

- Gather your information: Collect your personal details, including your name, address, and insurance information.

- Fill out your personal information: In the designated fields, enter your name (Last, First, Middle Initial), address, city, state, zip code, telephone number, and marital status.

- Provide employer details: Enter your employer's name, telephone number, and address, including city, state, and zip code.

- Input insurance information: Fill in the details for your primary and secondary insurance companies, including their names, addresses, and your policyholder ID and group plan numbers.

- Enter payment details: If paying by credit card, check the appropriate box and provide your card number, expiration date, and the amount you are paying.

- Review your entries: Carefully go through all the information you have entered to ensure accuracy.

- Detach the top portion: Cut along the designated line to separate the payment portion from the rest of the form.

- Mail your payment: Send the detached top portion along with your payment to the address specified in the form.