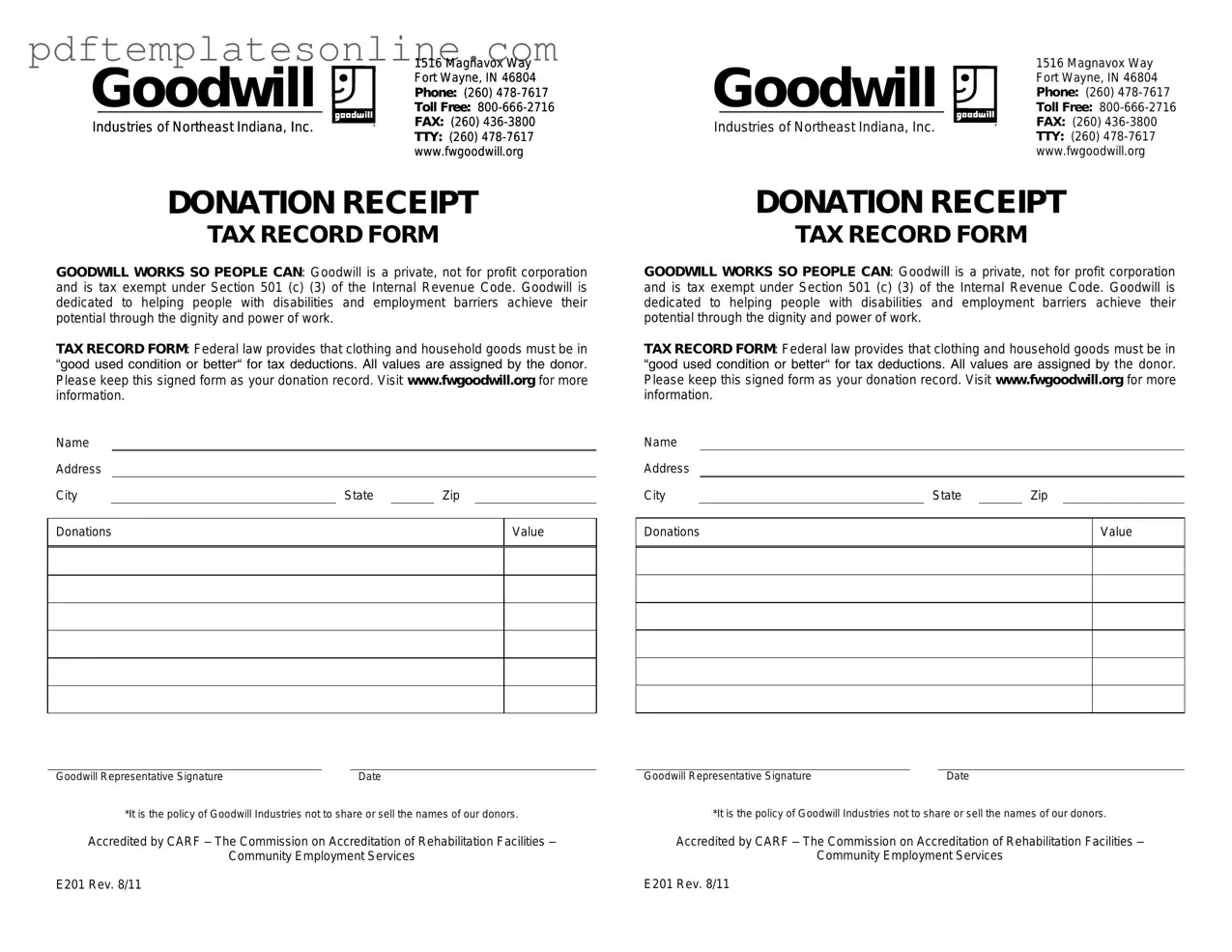

Blank Goodwill donation receipt Form

Key takeaways

Filling out and using the Goodwill donation receipt form is an important step in ensuring your charitable contributions are properly documented. Here are some key takeaways to consider:

- Accurate Information is Essential: Make sure to fill in your name, address, and the date of the donation. This information is crucial for record-keeping and tax purposes.

- Itemize Your Donations: Clearly list the items you are donating. This helps both you and Goodwill track what has been given and can assist in determining the value of your contributions.

- Value Your Donations: While Goodwill does not assign a value to your items, it is your responsibility to estimate their fair market value. This can impact your tax deductions.

- Keep a Copy for Your Records: Retain a copy of the receipt for your records. This documentation is important for tax filing and can serve as proof of your charitable contributions.

Common mistakes

When donating items to Goodwill, it's essential to fill out the donation receipt form accurately. Many people make mistakes that can complicate their tax deductions or lead to misunderstandings later. One common error is failing to list all donated items. Each item should be documented clearly, as this can affect the value of your deduction.

Another frequent mistake is not estimating the fair market value of the items. Donors often underestimate the worth of their belongings, which can result in a smaller tax deduction than deserved. It’s crucial to research and determine a reasonable value based on similar items in thrift stores or online marketplaces.

People also tend to forget to sign and date the receipt. A signature and date are vital for validating the donation. Without these, the receipt may not hold up if questioned by tax authorities. Always remember to complete this step before leaving the donation center.

In addition, some donors neglect to keep a copy of the receipt for their records. It’s important to retain a copy for tax filing purposes. Without it, proving the donation could become challenging if the IRS requests documentation.

Another mistake involves not checking for specific guidelines from Goodwill regarding the types of items accepted. Donors may inadvertently list items that Goodwill cannot accept, which can lead to confusion and complications. Always verify the donation guidelines to ensure compliance.

Lastly, some people fill out the form in a hurry, leading to illegible handwriting. If the receipt cannot be read, it may cause issues later on. Take the time to write clearly, ensuring that all information is easy to understand.

Misconceptions

Many individuals and families choose to donate items to Goodwill, often seeking to support a worthy cause while also receiving a tax benefit. However, several misconceptions about the Goodwill donation receipt form can lead to confusion. Here are eight common misunderstandings:

- The receipt guarantees a specific tax deduction amount. Many people believe that the receipt will automatically ensure a certain deduction on their taxes. In reality, the IRS allows you to deduct the fair market value of the donated items, which can vary widely.

- Only items in perfect condition can be donated. While it's true that items should be usable and not severely damaged, Goodwill accepts a wide range of items, including those that may show signs of wear.

- The receipt must list every item donated. Some think that they need to provide a detailed list of every item on the receipt. However, a general description of the items is typically sufficient for tax purposes.

- Goodwill will appraise the value of donated items. Many assume that Goodwill will determine the value of their donations. In fact, donors are responsible for estimating the fair market value of their items.

- The receipt is only useful for tax purposes. While the primary purpose of the receipt is for tax deductions, it can also serve as proof of charitable giving, which may be important for personal records or financial planning.

- Donations must be made during business hours to receive a receipt. Some believe that they can only receive a receipt if they donate in person during store hours. However, many donation centers have drop-off locations where receipts are available even when the store is closed.

- All donations are tax-deductible. It is a common misconception that every donation made to Goodwill is tax-deductible. While most donations qualify, it’s essential to consult IRS guidelines to understand any limitations.

- Goodwill provides a standard value for all items. People often think that Goodwill has a set value for each type of item donated. In truth, the value is subjective and varies based on condition, demand, and market trends.

Understanding these misconceptions can help donors navigate the donation process more effectively and ensure they receive the benefits they expect. Always consider consulting with a tax professional for personalized advice related to charitable donations.

Dos and Don'ts

When filling out the Goodwill donation receipt form, it is important to follow certain guidelines to ensure accuracy and clarity. Here are five things you should and shouldn't do:

- Do provide a clear description of the items you are donating.

- Do include your name and contact information for record-keeping.

- Do estimate the fair market value of your donated items.

- Don't forget to sign and date the receipt.

- Don't leave any sections blank; complete all required fields.

Other PDF Forms

High School Transcript - Transcripts may include a section for disciplinary actions, if applicable.

This vital comprehensive Tractor Bill of Sale document ensures that all necessary information regarding the sale is properly recorded, protecting both parties during the transaction and facilitating future ownership transfer and registration processes.

Da Form 2977 - Documenting lessons learned creates a repository of best practices for future missions.

Detailed Guide for Writing Goodwill donation receipt

After gathering the necessary information, you will be ready to fill out the Goodwill donation receipt form. This form is essential for documenting your charitable contributions. Ensure you have all required details on hand before you start.

- Locate the Goodwill donation receipt form. This may be available online or at your local Goodwill location.

- Enter the date of the donation in the designated field.

- Provide your name and address. Ensure all information is accurate and complete.

- List the items you are donating. Include a brief description of each item.

- Estimate the fair market value of each item. Be realistic and honest in your assessment.

- Sign and date the form at the bottom to confirm the donation.

- Keep a copy of the completed form for your records.