Blank Gift Letter Form

Key takeaways

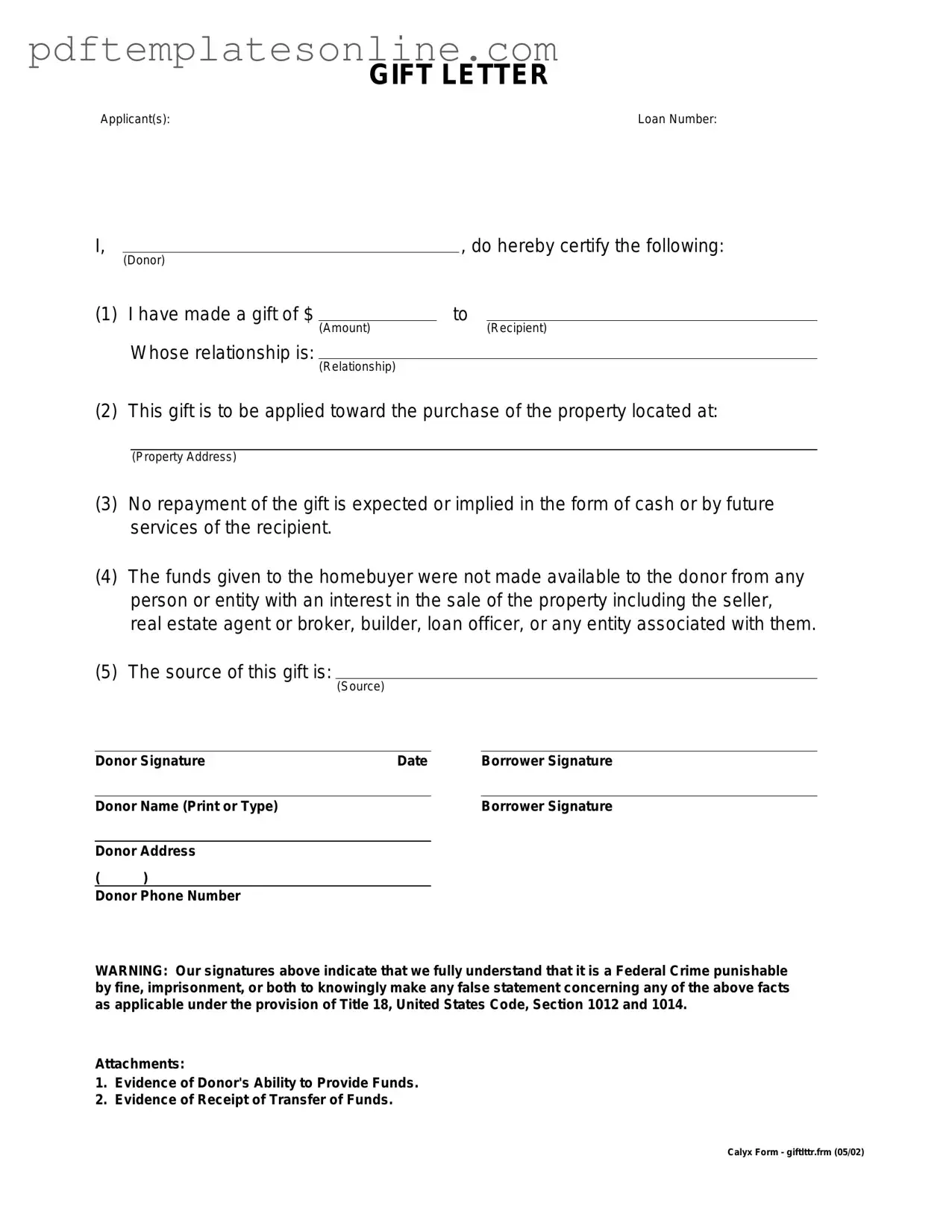

Filling out a Gift Letter form is a crucial step in the process of documenting financial gifts, particularly when it comes to securing a mortgage or loan. Understanding the essentials of this form can help ensure that everything is completed correctly and efficiently.

- Purpose of the Gift Letter: The Gift Letter serves to verify that a financial contribution is indeed a gift and not a loan, which can affect a borrower’s debt-to-income ratio.

- Donor Information: The form must include detailed information about the donor, such as their name, address, and relationship to the recipient.

- Recipient Details: Clearly state the recipient's name and how the gift will be used, typically for a down payment on a home.

- Gift Amount: Specify the exact amount of the gift, as this is important for both the lender and the recipient.

- Signature Requirement: The donor must sign the letter to confirm that the funds are a gift, which adds credibility to the document.

- Date of the Gift: Including the date when the gift was given or will be given is essential for record-keeping purposes.

- Documentation: Attach any necessary documentation that proves the transfer of funds, such as bank statements or transaction records.

- Impact on Loan Approval: Lenders often require a Gift Letter to ensure that the recipient is not incurring additional debt, which could impact their loan approval.

- Clarity and Honesty: Be transparent about the nature of the gift. Misrepresenting the funds can lead to serious repercussions in the loan process.

- Consultation: It may be beneficial to consult with a financial advisor or mortgage professional to ensure that the Gift Letter meets all necessary requirements.

By adhering to these guidelines, both the donor and recipient can navigate the process smoothly, facilitating a successful transaction while maintaining compliance with lender requirements.

Common mistakes

When it comes to filling out a Gift Letter form, many individuals make common mistakes that can lead to delays or complications in the process. Understanding these pitfalls can help ensure that the letter meets the necessary requirements and facilitates a smooth transaction.

One frequent error is failing to include the correct names of both the giver and the recipient. It’s essential to ensure that the names match exactly as they appear on official documents. Any discrepancies can raise questions about the legitimacy of the gift.

Another mistake often made is omitting the relationship between the donor and the recipient. Lenders typically want to understand the connection between the two parties to assess whether the gift is genuine or if it may come with expectations of repayment.

Inaccurate dollar amounts can also cause issues. If the amount of the gift is not clearly stated or if it differs from what is documented elsewhere, it can lead to confusion. Always double-check that the figures are accurate and clearly written.

Many people forget to date the Gift Letter. A missing date can create uncertainty about when the gift was given, which is critical for financial records and tax implications. Always include the date to provide a clear timeline.

Another common oversight is not signing the letter. Without a signature, the document lacks authenticity. Both the giver and recipient should sign to confirm their agreement and understanding of the gift.

Some individuals neglect to include a statement indicating that the gift does not need to be repaid. This assurance is vital for lenders, as it clarifies that the funds are a true gift and not a loan, which could complicate the financial assessment.

Lastly, failing to provide sufficient context or details about the gift can hinder the process. Including a brief explanation of the purpose of the gift or any relevant circumstances can enhance clarity and support the legitimacy of the transaction.

Misconceptions

Many people have misunderstandings about the Gift Letter form. Here are some common misconceptions that can lead to confusion:

- Gift Letters are only for large sums of money. Some believe that a Gift Letter is only necessary for significant financial gifts. However, any amount given as a gift may require documentation, especially if it is used for a mortgage down payment.

- Only family members can give gifts. While gifts from family members are common, friends and other individuals can also provide financial assistance. The key is to document the gift properly.

- Gift Letters are not required if the donor is present. Even if the donor is available to explain the gift, a written Gift Letter is still necessary. This documentation helps clarify the intent and nature of the gift.

- Gift Letters can be verbal. Some think that a verbal agreement suffices. In reality, a written Gift Letter is essential for lenders to verify the legitimacy of the funds.

- Gift Letters must be notarized. While notarization can add credibility, it is not a requirement for a Gift Letter. A simple written statement from the donor is typically sufficient.

- Gift Letters are only needed for first-time homebuyers. This is not true. Anyone receiving a gift for a down payment may need a Gift Letter, regardless of their home-buying history.

- Gift Letters can be generic. A common belief is that a simple template will do. However, each Gift Letter should be personalized to include specific details about the donor, the recipient, and the amount of the gift.

Understanding these misconceptions can help individuals navigate the process of providing or receiving financial gifts more effectively.

Dos and Don'ts

When filling out a Gift Letter form, it's important to ensure accuracy and clarity. Here are some dos and don'ts to keep in mind:

- Do provide accurate information about the donor and recipient.

- Do clearly state the amount of the gift.

- Do include the date of the gift.

- Do ensure that the letter is signed by the donor.

- Don't use vague language or terms that could be misinterpreted.

- Don't omit any required details, such as the relationship between the donor and recipient.

- Don't forget to keep a copy of the completed letter for your records.

- Don't rush through the process; take your time to review the information.

Other PDF Forms

Do Lien Waivers Need to Be Notarized - This waiver is typically used at the end of a project, signaling that all work has been completed satisfactorily.

Da2823 - It reinforces the Army's commitment to lawful behavior among its members.

The California Transfer-on-Death Deed form allows homeowners to pass on their property to a beneficiary without the complexities of going through probate court. This legal document offers a straightforward way for property owners to ensure their real estate transitions smoothly after they pass away. It's a valuable tool, designed to simplify the process of transferring property ownership in California, and you can find more information and resources at California PDF Forms.

How to Check College Credits - Include a full address for accurate mailing of your transcript.

Detailed Guide for Writing Gift Letter

Once you have the Gift Letter form in hand, it’s important to fill it out accurately to ensure a smooth process. This form is essential for documenting a gift you may be receiving, particularly in the context of a mortgage application. Follow these steps carefully to complete the form correctly.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Provide your full name in the designated field. Make sure it matches the name on your identification documents.

- Next, fill in the address where you currently reside. This should also match your identification.

- In the section for the donor's information, write the full name of the person giving the gift.

- Fill in the donor's address. Ensure this is accurate, as it may be verified later.

- Indicate the amount of the gift in the appropriate field. Be precise with the figures.

- Next, sign the form where indicated. Your signature confirms your understanding and agreement.

- If required, the donor should also sign the form in the designated area.

- Finally, review the completed form for any errors or omissions before submitting it.

After filling out the Gift Letter form, ensure that all necessary parties have signed it. Once completed, you can submit it along with any other required documentation to the relevant institution. This step is crucial in facilitating your transaction smoothly.