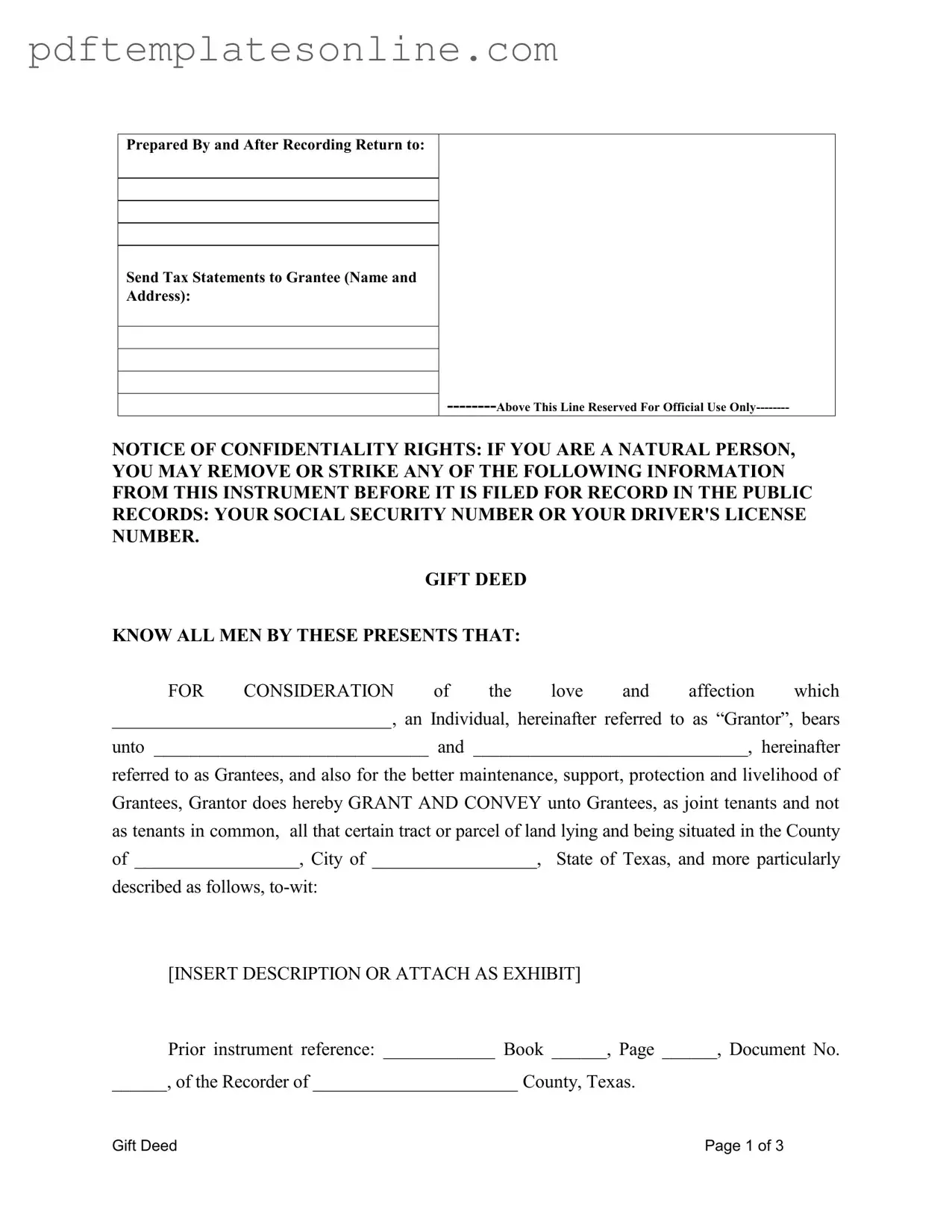

Blank Gift Deed Texas Form

Key takeaways

When filling out and using the Gift Deed Texas form, it is essential to understand several key points to ensure the process goes smoothly. Here are some important takeaways:

- Identify the Parties Clearly: Make sure to accurately identify the Grantor (the person giving the gift) and the Grantees (the recipients). This includes providing full names and any necessary titles.

- Property Description: Provide a clear and precise description of the property being transferred. This may involve attaching an exhibit if the description is lengthy.

- Joint Tenancy: Understand the implications of conveying the property as joint tenants with right of survivorship. This means that if one Grantee passes away, the other automatically inherits the entire property.

- Consider Tax Implications: Be aware of potential tax consequences associated with gifting property. It may be wise to consult a tax professional to understand any obligations.

- Confidentiality Rights: Remember that you can remove personal information, such as Social Security numbers or driver's license numbers, from the document before filing it publicly.

- Notarization Requirement: The Gift Deed must be acknowledged before a notary public. Ensure that this step is completed to validate the document legally.

Common mistakes

When filling out the Gift Deed Texas form, many individuals inadvertently make mistakes that can complicate the process or even invalidate the deed. One common error is failing to provide a complete and accurate description of the property being gifted. This description is crucial because it identifies the specific parcel of land being transferred. Omitting details or providing vague information can lead to confusion and disputes in the future. Always ensure that the property description is clear and precise, possibly attaching an exhibit if necessary.

Another frequent mistake involves the identification of the Grantor and Grantees. People often forget to include all necessary names or fail to specify the correct relationship between the parties involved. It’s essential to clearly state who the Grantor is and who the Grantees are. If multiple Grantees are involved, their names should be listed accurately to avoid any ambiguity. This ensures that everyone understands who is receiving the property and helps prevent any legal challenges down the line.

Additionally, many individuals overlook the importance of the acknowledgment section, which requires a notary public. Without a proper notarization, the Gift Deed may not be legally binding. Some people assume that their signature alone is sufficient, but this is not the case. The notary serves as a witness to the signing, confirming the identities of the parties involved and ensuring that the deed is executed voluntarily. Neglecting this step can lead to significant issues when attempting to record the deed.

Finally, failing to address the homestead status of the property can lead to complications. The form requires the Grantor to specify whether the property is part of their homestead. This distinction is important because it can affect the legal implications of the transfer. If the property is a homestead, both spouses must typically sign the deed. Ignoring this requirement could result in the deed being challenged or deemed invalid. Always check the homestead status and ensure compliance with Texas laws regarding property transfers.

Misconceptions

Here are ten common misconceptions about the Gift Deed Texas form, along with clarifications for each.

- Gift deeds are only for family members. Many believe that gift deeds can only be used to transfer property between family members. In reality, anyone can give a gift deed to another person, regardless of their relationship.

- A gift deed has no legal standing. Some people think that a gift deed is not a legally binding document. This is incorrect; when properly executed and recorded, it holds legal weight.

- Gift deeds require payment or consideration. It is a misconception that a gift deed must involve payment. By definition, a gift deed transfers property without any monetary exchange.

- All gift deeds must be notarized. While notarization is common and often recommended, it is not always legally required for a gift deed to be valid in Texas.

- Gift deeds can be revoked at any time. Some believe that a gift deed can be easily revoked. However, once the deed is executed and delivered, it is generally irrevocable unless specific conditions allow for revocation.

- Gift deeds are the same as wills. A gift deed transfers property during the grantor's lifetime, while a will only takes effect upon the grantor's death. This distinction is crucial.

- There are no tax implications for gift deeds. Many think that transferring property through a gift deed has no tax consequences. However, there may be gift tax implications depending on the property's value and the grantor's total gifts in a year.

- Only real estate can be transferred through a gift deed. While gift deeds are commonly used for real estate, they can also be used to transfer other types of property, such as vehicles or personal belongings.

- Gift deeds automatically include survivorship rights. Not all gift deeds include survivorship rights unless explicitly stated. It's important to specify this if it is desired.

- Gift deeds are only useful for large properties. Some believe that gift deeds are only practical for transferring large estates. In truth, they can be used for properties of any size, making them versatile tools for property transfer.

Dos and Don'ts

When filling out the Gift Deed Texas form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are four things you should and shouldn't do:

- Do provide complete and accurate information for all parties involved, including names and addresses.

- Do clearly describe the property being gifted, including any relevant details or attachments.

- Don't forget to include any necessary signatures, especially from both spouses if the property is part of a homestead.

- Don't overlook the confidentiality notice; consider removing sensitive information like Social Security numbers before filing.

Other PDF Forms

Types of Medicine - It serves a critical role in the continuity of care for residents.

Transfer of Deed Document - The form may vary slightly based on local government regulations or requirements.

Completing the EDD DE 2501 form correctly is vital for Californians seeking state disability insurance benefits, as it requires accurate details about one's medical status and employment background. For those looking for a resource to help with this process, you can find more information at https://mypdfform.com/blank-edd-de-2501.

Cdph Tb Risk Assessment - It captures important information about the healthcare professional and patient involved.

Detailed Guide for Writing Gift Deed Texas

Filling out a Gift Deed form in Texas is a straightforward process. This document is essential for transferring property ownership as a gift. Once completed, the form must be filed with the appropriate county office to ensure the transfer is legally recognized. Below are the steps to help you fill out the Gift Deed Texas form accurately.

- Prepare the document: Obtain the Gift Deed Texas form, which can typically be found online or at your local county clerk's office.

- Fill in the Grantor's information: In the designated space, write the name of the person giving the gift (the Grantor).

- Enter the Grantees' names: List the names of the individuals receiving the gift (the Grantees). If there are multiple Grantees, ensure all names are included.

- Specify the property: Describe the property being transferred. This can include the address and any specific details that clarify the property’s boundaries. If necessary, attach a separate exhibit with the full description.

- Reference prior instruments: If applicable, provide details of any previous deeds related to the property, including book, page, and document numbers.

- Indicate the county and city: Fill in the county and city where the property is located.

- Sign and date the form: The Grantor must sign and date the document, indicating their intention to transfer the property.

- Notarization: Have the document notarized. This step is crucial for validating the deed. The notary will fill in their information and confirm the identity of the Grantor.

- Complete Grantee information: Include the mailing address of the Grantee(s) at the end of the form.

Once you have filled out the Gift Deed Texas form, the next step is to file it with the county clerk's office where the property is located. This will officially record the transfer and protect the rights of the new owner. Ensure you keep a copy for your records.