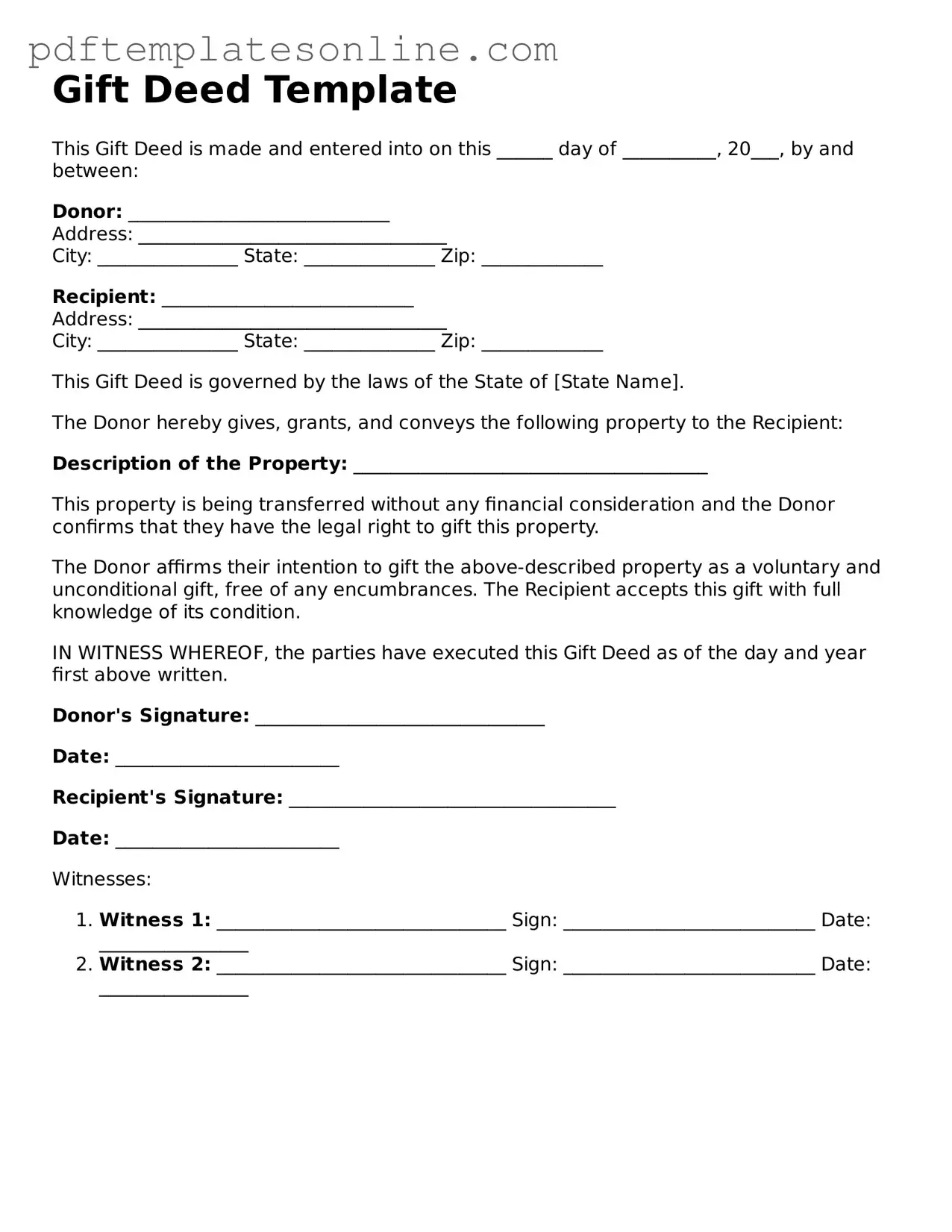

Fillable Gift Deed Document

Key takeaways

When considering a Gift Deed, it’s essential to understand the implications and requirements involved. Here are some key takeaways to guide you through the process:

- Understand the Purpose: A Gift Deed is a legal document that transfers ownership of property or assets from one person to another without any exchange of money.

- Identify the Donor and Recipient: Clearly state the names and addresses of both the person giving the gift (donor) and the person receiving it (recipient).

- Describe the Gift: Provide a detailed description of the property or asset being gifted. This clarity helps prevent future disputes.

- Consider Tax Implications: Be aware that gifting may have tax consequences. Consult a tax professional to understand potential gift taxes.

- Signatures Are Crucial: Ensure that both the donor and recipient sign the Gift Deed. In some cases, witnesses may also be required.

- Notarization: Having the document notarized can add an extra layer of authenticity and may be required in certain jurisdictions.

- Record the Deed: After signing, consider recording the Gift Deed with the appropriate government office. This step helps establish public record of the transfer.

By keeping these points in mind, you can navigate the process of creating and utilizing a Gift Deed with greater confidence and clarity.

Gift Deed Forms for Particular States

Common mistakes

Filling out a Gift Deed form can be a straightforward process, but many people encounter pitfalls that can lead to complications. One common mistake is failing to provide complete information about the donor and the recipient. Both parties must be clearly identified, including full names and addresses. Omitting any details can create confusion and may even invalidate the deed.

Another frequent error involves not accurately describing the property being gifted. It is essential to include a precise description of the property, whether it is real estate, personal belongings, or financial assets. Vague descriptions can lead to disputes later on. Clarity in this section helps ensure that everyone understands exactly what is being transferred.

People often overlook the importance of signatures. A Gift Deed requires the signatures of both the donor and the recipient. Neglecting to sign the document, or having it signed by someone who is not authorized, can render the deed ineffective. Additionally, some jurisdictions may require witnesses or notarization, which should not be ignored.

Finally, many individuals fail to consider the tax implications of gifting property. While a Gift Deed may not incur immediate taxes, it is wise to consult with a tax professional to understand any potential liabilities. Ignoring this aspect can lead to unexpected financial burdens down the line. Taking the time to address these common mistakes can make the process smoother and more secure for both parties involved.

Misconceptions

When it comes to the Gift Deed form, many people hold onto misconceptions that can lead to confusion or even legal issues. Understanding these myths is crucial for anyone considering making a gift of property or assets. Here are five common misconceptions:

- A Gift Deed is the same as a Will. Many believe that a Gift Deed functions like a will, but this is not the case. A Gift Deed transfers ownership of property immediately, whereas a will only distributes assets after death.

- You don’t need witnesses for a Gift Deed. Some think that a Gift Deed can be valid without any witnesses. In reality, most states require at least one or two witnesses to ensure the deed is legally binding.

- A Gift Deed cannot be revoked. It is a common belief that once a Gift Deed is executed, it cannot be undone. However, under certain circumstances, a donor can revoke a Gift Deed, especially if it was made under duress or fraud.

- Gift Deeds are only for real estate. Many people assume that Gift Deeds are exclusively for real estate transactions. In fact, they can also be used for transferring personal property, such as vehicles, artwork, or other valuable items.

- Gift Deeds are tax-free. While gifts may not incur income tax, there are still tax implications to consider. In some cases, large gifts may be subject to gift tax, and it’s important to understand the limits and regulations surrounding this.

By dispelling these myths, individuals can make informed decisions when it comes to gifting property or assets. Always consult with a knowledgeable professional to navigate the specifics of your situation.

Dos and Don'ts

When filling out a Gift Deed form, it’s crucial to follow certain guidelines to ensure everything is completed correctly. Here’s a list of what you should and shouldn’t do:

- Do: Provide accurate information about the donor and the recipient.

- Do: Clearly describe the gift, including its value and any specific conditions.

- Do: Sign the form in front of a notary public to ensure it is legally binding.

- Do: Keep a copy of the completed Gift Deed for your records.

- Don't: Leave any sections of the form blank; all fields should be filled out.

- Don't: Use vague language when describing the gift; be specific.

- Don't: Forget to check local laws regarding gift taxes or requirements.

- Don't: Rush through the process; take your time to review everything carefully.

Browse Common Types of Gift Deed Templates

Deed in Lieu Meaning - Negotiating the specifics of a Deed in Lieu can sometimes lead to more favorable outcomes for distressed homeowners.

When engaging in the buying or selling of a mobile home, it's essential to recognize the significance of the California Mobile Home Bill of Sale form. This document plays a pivotal role in establishing clear ownership transfer between the seller and the buyer while ensuring compliance with state regulations. For reliable access to this form and other necessary documents, you can visit California PDF Forms.

Detailed Guide for Writing Gift Deed

Completing a Gift Deed form is an important step in transferring ownership of property or assets from one person to another without any exchange of money. Once the form is filled out, it will need to be signed and notarized to ensure its validity. Below are the steps to help you fill out the form accurately.

- Obtain the Gift Deed Form: You can usually find this form at your local courthouse, online legal resources, or from a legal professional.

- Identify the Donor: Clearly write the full name and address of the person giving the gift. This is the donor.

- Identify the Recipient: Provide the full name and address of the person receiving the gift. This is the recipient.

- Describe the Gift: Detail the property or asset being gifted. Include specifics such as address, legal description, or any identifying information.

- State the Intent: Include a statement that indicates the donor's intention to give the gift voluntarily and without any compensation.

- Sign the Form: The donor must sign the form. If applicable, the recipient may also need to sign.

- Notarization: Take the signed form to a notary public to have it notarized. This step is crucial for legal recognition.

- File the Form: Depending on your state, you may need to file the completed and notarized form with the local property records office.

Following these steps will help ensure that the Gift Deed is filled out correctly and is legally binding. It is always advisable to consult with a legal professional if you have any questions or concerns during this process.