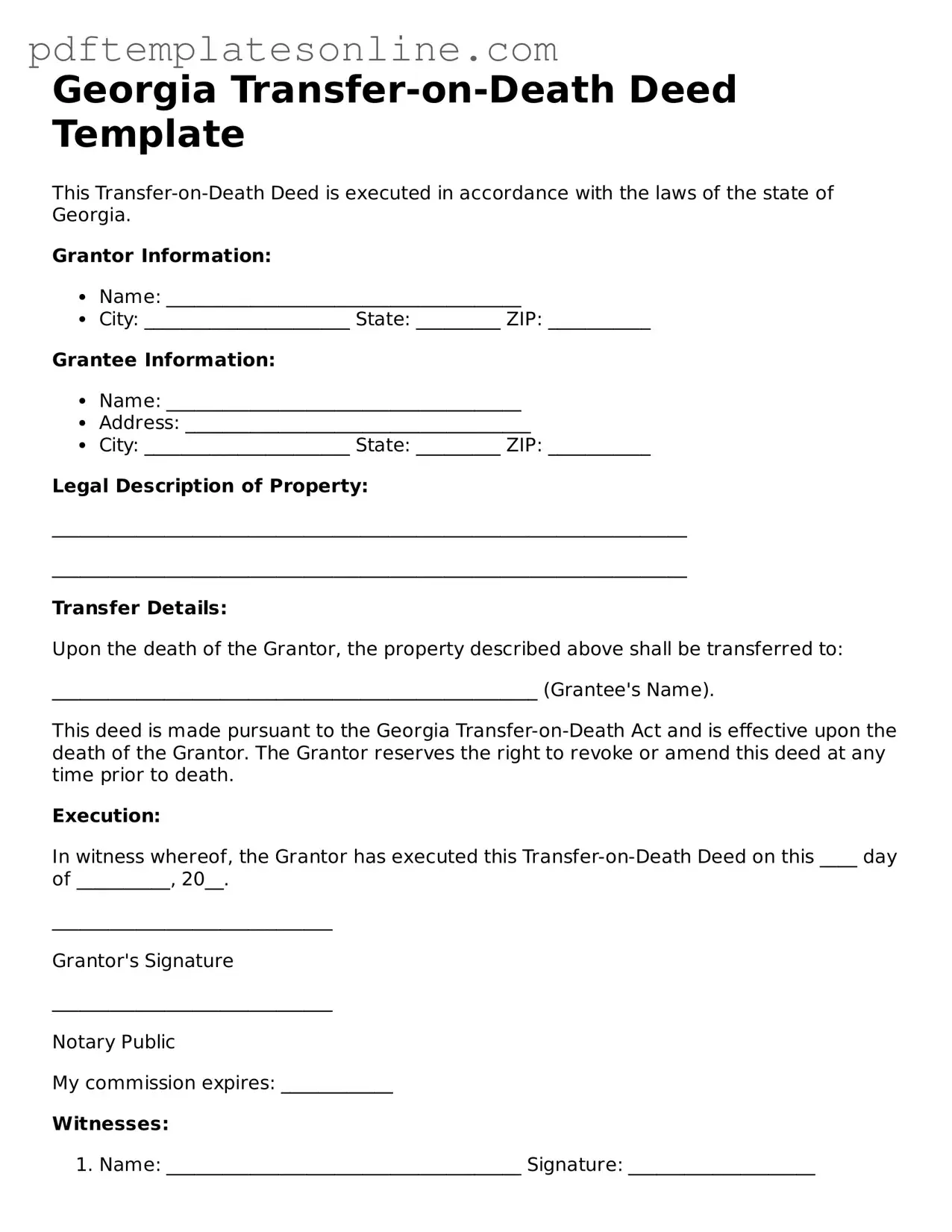

Official Georgia Transfer-on-Death Deed Document

Key takeaways

When filling out and using the Georgia Transfer-on-Death Deed form, it is essential to understand the following key points:

- The Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive the property upon the owner's death.

- This deed must be executed while the owner is alive and must comply with Georgia law to be valid.

- To be effective, the deed must be recorded with the county clerk's office where the property is located.

- Beneficiaries do not have any rights to the property until the owner passes away.

- It is advisable to include the full legal description of the property to avoid any confusion.

- The form must be signed in the presence of a notary public to ensure its legality.

- Revocation of the deed can occur at any time by filing a new deed or a written revocation with the county clerk.

- Consulting with a legal professional can provide guidance tailored to individual circumstances.

Common mistakes

Filling out a Georgia Transfer-on-Death Deed form can seem straightforward, but many individuals make common mistakes that can lead to complications down the line. One prevalent error is failing to include the correct legal description of the property. This description must be precise, as it identifies the property being transferred. Without it, the deed may be deemed invalid, leaving your intentions unfulfilled.

Another frequent mistake involves not properly identifying the beneficiary. It’s essential to clearly state the full name of the person receiving the property. Omitting a middle name or using an incorrect spelling can create confusion and potentially lead to disputes among heirs.

Some individuals neglect to sign the deed in the presence of a notary public. In Georgia, a Transfer-on-Death Deed must be notarized to be valid. Failing to do this step can invalidate the entire document, meaning your property will not transfer as intended.

Additionally, many people overlook the requirement to record the deed with the county clerk's office. Even if the deed is filled out correctly, it must be filed to be effective. Without recording, the deed has no legal effect, and the property may not pass to the intended beneficiary.

Another common oversight is not considering the implications of multiple beneficiaries. If more than one person is named, the deed should specify how the property will be divided. Without clear instructions, conflicts may arise among beneficiaries, complicating the transfer process.

Some individuals forget to update the deed after significant life events, such as marriage or divorce. Changes in marital status can affect property rights, and failing to revise the deed accordingly can lead to unintended consequences.

Moreover, people often misinterpret the nature of a Transfer-on-Death Deed. It does not transfer ownership during the grantor's lifetime. Understanding this distinction is crucial, as some may mistakenly believe they can use the deed to avoid probate while still retaining control of the property.

Another mistake involves using outdated or incorrect forms. Legal documents can change, and using an old version of the Transfer-on-Death Deed may not comply with current laws. Always ensure you are using the most recent form available.

Furthermore, individuals may fail to communicate their intentions with beneficiaries. While the deed itself is a legal document, discussing your plans with your loved ones can prevent misunderstandings and ensure everyone is on the same page.

Lastly, neglecting to seek professional advice can be a significant error. While it’s possible to complete the deed independently, consulting with a legal expert can help clarify any uncertainties and ensure that all aspects of the deed are correctly addressed. Taking this step can save time and reduce stress for both the grantor and the beneficiaries.

Misconceptions

The Georgia Transfer-on-Death Deed (TOD) form is a useful estate planning tool, but several misconceptions surround its use. Understanding these can help individuals make informed decisions about their property and estate. Below are six common misconceptions about the Georgia TOD deed.

- It automatically transfers property upon death. Many believe that the TOD deed transfers property immediately upon the owner's death. In reality, the transfer occurs only after the owner passes away, and the deed must be recorded properly to be effective.

- It replaces a will. Some think that a TOD deed serves as a substitute for a will. However, a TOD deed only applies to specific real estate and does not address other assets or personal wishes that a will would cover.

- All property can be transferred via a TOD deed. There is a misconception that any type of property can be transferred using a TOD deed. In Georgia, this deed only applies to real estate, such as land or buildings, not personal property like vehicles or bank accounts.

- It is irrevocable once signed. Some individuals believe that a TOD deed cannot be changed after it is signed. In fact, the owner can revoke or modify the deed at any time before their death, as long as the changes are properly documented and recorded.

- Beneficiaries have immediate rights to the property. There is a belief that beneficiaries can access the property immediately after the owner's death. However, beneficiaries must go through the probate process to establish their rights and ensure the transfer is legally recognized.

- Using a TOD deed is complicated. Many people think that creating a TOD deed is a complicated process. In reality, the form is straightforward, and with proper guidance, individuals can complete it without extensive legal knowledge.

By dispelling these misconceptions, individuals can better understand the benefits and limitations of the Georgia Transfer-on-Death Deed and make informed choices about their estate planning needs.

Dos and Don'ts

Filling out a Transfer-on-Death Deed form in Georgia is an important task that requires attention to detail. Here are some essential do's and don'ts to keep in mind:

- Do ensure that you understand the purpose of the Transfer-on-Death Deed. This form allows you to transfer property to a beneficiary upon your death without going through probate.

- Don't forget to check the eligibility requirements. Not all properties can be transferred using this deed.

- Do provide accurate information about the property. This includes the legal description and the address.

- Don't leave any fields blank. Incomplete forms may lead to delays or rejection.

- Do include the names and contact information of the beneficiaries clearly.

- Don't use vague terms when naming beneficiaries. Be specific to avoid confusion.

- Do have the form notarized. This step is crucial for the deed to be legally binding.

- Don't forget to file the completed deed with the appropriate county office. This ensures that the transfer is recorded.

- Do keep a copy of the filed deed for your records. This can be useful for future reference.

Browse Popular Transfer-on-Death Deed Forms for US States

Transfer on Death Affidavit Ohio - Beneficiaries named in a Transfer-on-Death Deed acquire no rights until the property owner passes away.

Understanding the importance of risk management is crucial for anyone involved in potentially hazardous activities. By utilizing a legal safeguard such as the Hold Harmless Agreement form, individuals can clarify responsibilities and protect their interests, ensuring that they are covered in the event of unforeseen circumstances.

Texas Deed Transfer Form - The deed allows for a smooth transition of property between generations, thereby preserving family assets.

How to Avoid Probate in Pa - The Transfer-on-Death Deed is not valid if the property is sold or mortgaged before the owner's death.

Transfer on Death Deed California Common Questions - Gives your beneficiaries immediate rights to the property after death.

Detailed Guide for Writing Georgia Transfer-on-Death Deed

Once you have your Georgia Transfer-on-Death Deed form, it’s time to fill it out carefully. This process involves providing specific information about the property and the beneficiaries. Make sure to have all necessary details at hand to ensure accuracy.

- Obtain the form: Find a blank Georgia Transfer-on-Death Deed form online or through a legal stationery store.

- Property description: Clearly describe the property you wish to transfer. Include the full address and any relevant legal descriptions.

- Owner's information: Fill in your name as the current owner of the property. Include any other names if the property is jointly owned.

- Beneficiary details: List the full names and addresses of the beneficiaries who will receive the property upon your passing.

- Sign the form: Sign the deed in the presence of a notary public. Ensure that the notary acknowledges your signature.

- File the deed: Submit the completed and notarized deed to the county clerk's office in the county where the property is located. There may be a filing fee.

After submitting the deed, keep a copy for your records. It’s essential to inform your beneficiaries about the deed and its contents to avoid confusion in the future.