Official Georgia Real Estate Purchase Agreement Document

Key takeaways

When filling out and using the Georgia Real Estate Purchase Agreement form, keep these key takeaways in mind:

- Ensure all parties' names are accurately listed. This includes buyers and sellers.

- Clearly define the property being sold. Include the address and any legal descriptions.

- Specify the purchase price. Be clear about the total amount and any deposits required.

- Outline the closing date. This is crucial for both parties to understand the timeline.

- Include any contingencies. Common contingencies involve financing, inspections, and appraisal results.

- Review the terms for earnest money. This shows the buyer's commitment and should be defined in the agreement.

- Discuss any repairs or improvements. If the seller agrees to make changes, detail these in the agreement.

- Understand the implications of default. Both parties should know the consequences of failing to meet the agreement's terms.

- Consult with a real estate attorney if needed. Legal advice can clarify complex terms and protect your interests.

- Keep a copy of the signed agreement. This document is essential for future reference and any potential disputes.

Common mistakes

Filling out the Georgia Real Estate Purchase Agreement can be straightforward, but mistakes often occur. One common error is not including all parties involved in the transaction. Buyers and sellers must be clearly identified. Omitting a co-signer or co-owner can lead to complications later.

Another frequent mistake is failing to specify the purchase price accurately. This amount should reflect the agreed-upon price between the buyer and seller. If the price is incorrect, it can create confusion and disputes during the closing process.

Many people also overlook the importance of including contingencies. These are conditions that must be met for the sale to proceed. Not addressing issues such as financing or home inspections can lead to problems if unexpected situations arise.

Another area where errors occur is in the description of the property. It's essential to provide a detailed description, including the address and any specific features. A vague description can lead to misunderstandings about what is being sold.

Buyers and sellers sometimes forget to check the closing date. This date is crucial for both parties. If it’s left blank or incorrectly filled out, it can delay the transaction and cause frustration.

Not including earnest money is another common mistake. This deposit shows the buyer's commitment to the purchase. If it’s not mentioned, the seller may question the buyer's seriousness.

People often neglect to read the entire agreement thoroughly. Skimming through the document can lead to missing important clauses or terms. Understanding every part of the agreement is vital to avoid future disputes.

Finally, failing to sign and date the agreement is a simple yet critical mistake. An unsigned contract is not legally binding. Both parties must provide their signatures to make the agreement valid.

Misconceptions

-

Misconception 1: The form is only for residential properties.

Many believe the Georgia Real Estate Purchase Agreement is limited to residential transactions. In reality, it can be used for both residential and commercial properties.

-

Misconception 2: The agreement is not legally binding.

Some people think the purchase agreement is just a casual document. However, once signed, it is legally binding and enforceable in a court of law.

-

Misconception 3: All terms are negotiable.

While many terms can be negotiated, certain aspects, such as state laws and regulations, must be adhered to. Buyers and sellers should understand which terms are flexible.

-

Misconception 4: The agreement does not require a real estate agent.

Some assume they can complete the agreement without professional help. Although it is possible, having a real estate agent can provide valuable guidance and ensure compliance with legal requirements.

-

Misconception 5: There are no contingencies in the agreement.

Many think that the purchase agreement is a straightforward transaction without contingencies. In fact, buyers can include contingencies for inspections, financing, and other factors.

-

Misconception 6: Once signed, the agreement cannot be changed.

Some believe that after signing, the terms are set in stone. Modifications can be made, but both parties must agree to any changes in writing.

Dos and Don'ts

When filling out the Georgia Real Estate Purchase Agreement form, it’s important to be careful and thorough. Here are six essential tips to keep in mind:

- Do: Read the entire form carefully before filling it out.

- Do: Provide accurate information about the property and the parties involved.

- Do: Include all necessary contingencies to protect your interests.

- Do: Sign and date the agreement to make it legally binding.

- Don't: Rush through the form; mistakes can lead to complications.

- Don't: Leave any sections blank; this can create confusion later.

By following these guidelines, you can help ensure a smoother transaction process.

Browse Popular Real Estate Purchase Agreement Forms for US States

How to Make a Purchase Agreement - It addresses the transfer of property title at closing.

When applying for state disability insurance benefits in California, it is important to correctly complete the EDD DE 2501 form, as it includes vital information regarding your medical condition and work history. For more detailed guidance on the application process, you can visit mypdfform.com/blank-edd-de-2501, which offers resources to help you navigate through the requirements effectively.

Simple Real Estate Sales Contract - It generally requires full disclosure of the property's history and status.

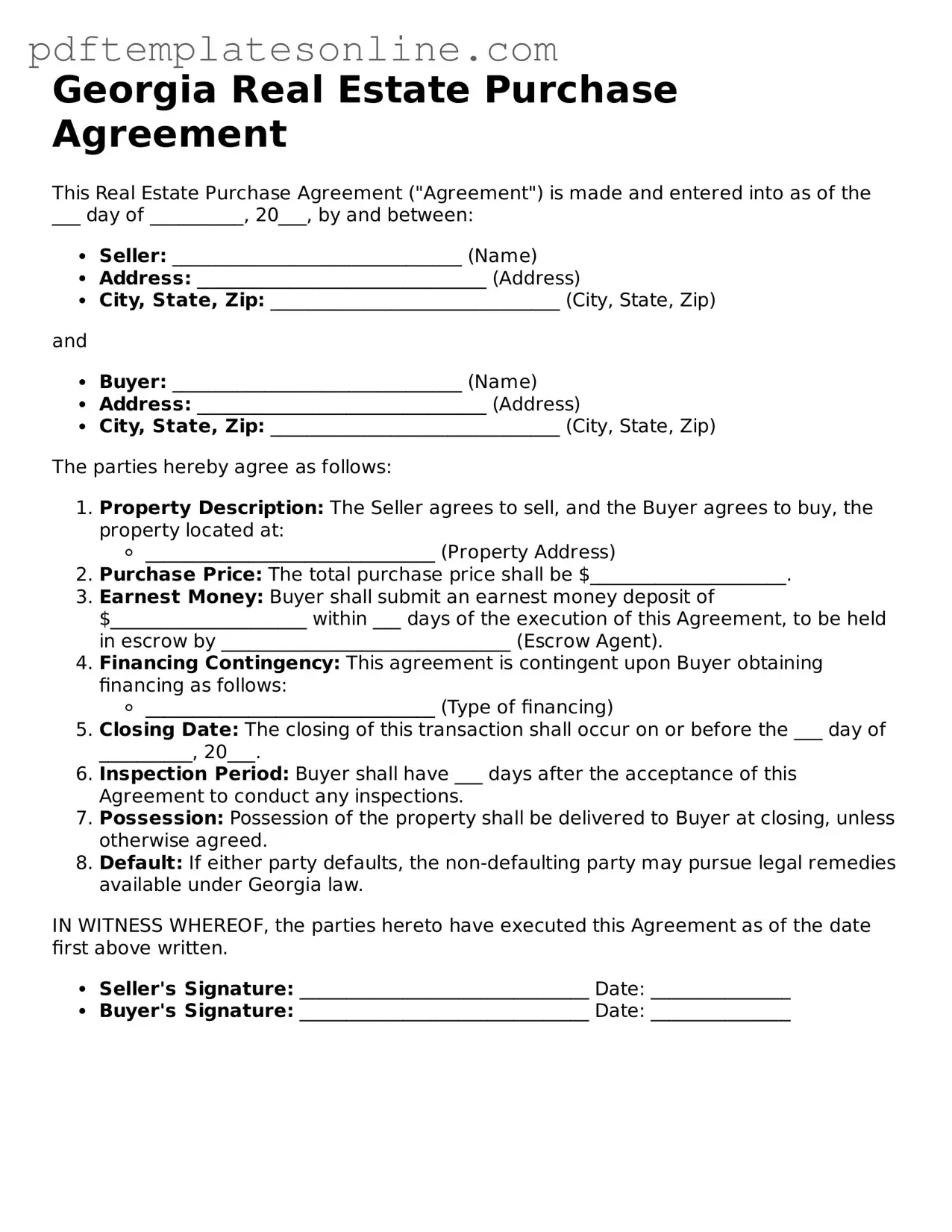

Detailed Guide for Writing Georgia Real Estate Purchase Agreement

After obtaining the Georgia Real Estate Purchase Agreement form, you will need to complete it with accurate and relevant information. This process is crucial for ensuring that all parties are on the same page regarding the terms of the real estate transaction.

- Identify the Parties: Fill in the names and contact information of the buyer(s) and seller(s). Ensure that all names are spelled correctly and match the legal documents.

- Property Description: Provide a detailed description of the property being sold. Include the address, parcel number, and any relevant details that define the property.

- Purchase Price: Clearly state the total purchase price of the property. Specify any deposit amount that is required.

- Financing Terms: Indicate how the buyer plans to finance the purchase. Include details about any loans or cash payments.

- Closing Date: Choose a closing date for the transaction. This date should be agreed upon by both parties.

- Contingencies: List any contingencies that must be met before the sale can proceed. This may include inspections, financing, or other conditions.

- Signatures: Ensure that both the buyer and seller sign and date the agreement. If there are multiple buyers or sellers, all must sign.

Once you have completed the form, review it carefully for accuracy. It is advisable to keep a copy for your records and provide copies to all parties involved in the transaction.