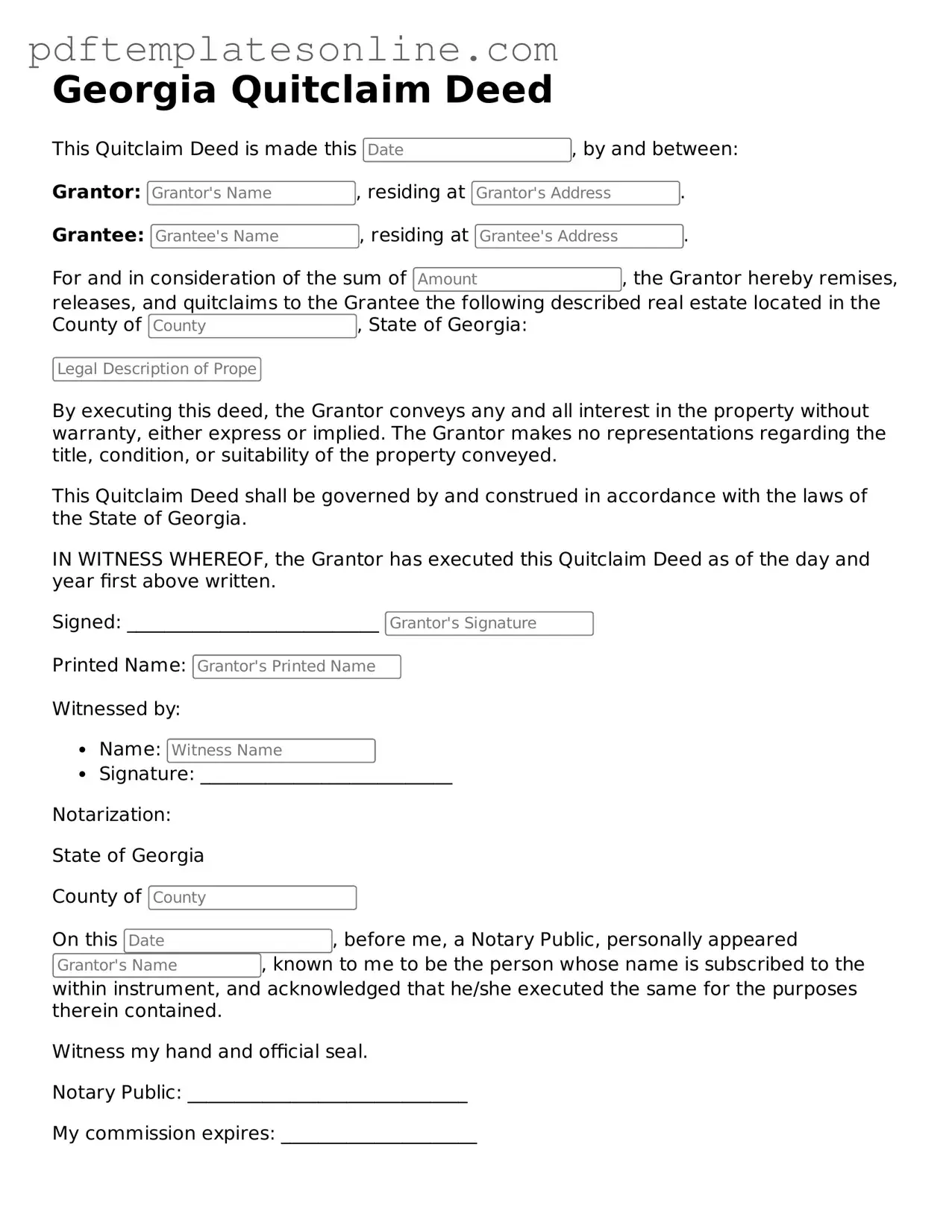

Official Georgia Quitclaim Deed Document

Key takeaways

Here are key takeaways about filling out and using the Georgia Quitclaim Deed form:

- Understand the Purpose: A Quitclaim Deed transfers ownership of property from one person to another without guaranteeing the title's validity.

- Identify the Parties: Clearly list the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide Accurate Property Description: Include a complete legal description of the property. This can typically be found in the property’s current deed.

- Signatures Required: The grantor must sign the deed in front of a notary public. This is crucial for the deed to be legally valid.

- Consider Witnesses: While not required, having witnesses can provide additional verification of the transaction.

- File with the County: After completing the deed, it must be filed with the county clerk’s office where the property is located.

- Check for Fees: Be aware that there may be filing fees associated with recording the Quitclaim Deed.

- Consult a Professional: If unsure about any part of the process, consider seeking legal advice to ensure everything is done correctly.

Common mistakes

Filling out a Georgia Quitclaim Deed form can be straightforward, but many people make common mistakes that can lead to complications. One major error is failing to include the correct legal description of the property. This description must be precise, as it identifies the property being transferred. Without it, the deed may be deemed invalid.

Another frequent mistake is not including the names of all parties involved. Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly listed. Omitting a name can create confusion and may delay the transfer process.

People often forget to sign the Quitclaim Deed. A signature is essential for the document to be legally binding. If the grantor does not sign, the deed will not hold up in court. Additionally, the deed must be notarized. Some individuals overlook this step, thinking a signature alone suffices.

Another common error is misdating the document. The date of signing should be accurate and reflect when the transfer is intended to take effect. An incorrect date can lead to disputes or questions about the validity of the deed.

Many individuals fail to check the property tax records before completing the deed. It's important to ensure that there are no liens or other claims against the property. If there are, the grantee may inherit these issues, complicating their ownership.

People sometimes use vague language in the deed. The Quitclaim Deed should clearly state the intent of the transfer. Ambiguities can lead to misunderstandings and legal challenges down the line.

Another mistake involves not including the consideration amount. While a Quitclaim Deed can be used for a nominal fee or even as a gift, it’s important to note any consideration exchanged. This helps clarify the nature of the transaction.

Forgetting to file the Quitclaim Deed with the appropriate county office is another error. Once completed, the deed must be recorded to be effective. If it’s not filed, the transfer may not be recognized legally.

Some individuals neglect to review the form for errors before submission. Typos or incorrect information can lead to delays or rejections. A thorough review can save time and prevent issues.

Lastly, people may not seek legal advice when needed. While a Quitclaim Deed is relatively simple, consulting with a legal expert can help ensure that all aspects of the transfer are handled correctly. This can provide peace of mind and protect all parties involved.

Misconceptions

The Georgia Quitclaim Deed is a common legal document used for transferring property rights. However, several misconceptions surround its use and implications. Here are eight of those misconceptions, along with clarifications to help you understand the true nature of this form.

-

It transfers ownership of the property.

A quitclaim deed does not guarantee that the person transferring the property actually owns it. It merely transfers whatever interest the grantor has, if any.

-

It provides a warranty of title.

Unlike warranty deeds, quitclaim deeds come with no guarantees regarding the title. The grantee accepts the property "as is," with no assurances about its legal status.

-

It is only used between family members.

While quitclaim deeds are often used among family members, they can be used in various situations, including sales and transfers between unrelated parties.

-

It is a complicated legal document.

In reality, a quitclaim deed is relatively straightforward. It typically includes the names of the parties involved, a description of the property, and the signatures of the grantors.

-

It is valid without notarization.

A quitclaim deed must be signed in the presence of a notary public to be legally effective in Georgia. Without notarization, the deed may not be enforceable.

-

It is the same as a warranty deed.

These two types of deeds serve different purposes. A warranty deed provides protection against claims on the property, while a quitclaim deed does not offer such protection.

-

Using a quitclaim deed avoids taxes.

While quitclaim deeds can simplify property transfers, they do not exempt the transaction from tax implications. Tax obligations may still apply based on the property's value.

-

It cannot be revoked once signed.

A quitclaim deed can be revoked by the grantor, provided the revocation is executed correctly. However, this typically requires a formal process to be legally binding.

Understanding these misconceptions can help individuals make informed decisions when considering the use of a Georgia Quitclaim Deed. Always consult a legal expert for personalized advice tailored to specific situations.

Dos and Don'ts

When filling out the Georgia Quitclaim Deed form, there are certain practices that can help ensure the process goes smoothly. Here’s a list of what you should and shouldn’t do:

- Do ensure that all names are spelled correctly. This includes both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Do provide a complete and accurate description of the property. This typically includes the address and legal description, which can be found in previous deeds or tax records.

- Do sign the form in the presence of a notary public. This step is crucial for validating the document.

- Do check for any local requirements. Some counties may have specific regulations regarding the filing of a Quitclaim Deed.

- Don't leave any fields blank. Incomplete information can lead to delays or rejection of the deed.

- Don't forget to include the date of the transfer. This date is important for legal records.

- Don't use outdated forms. Always ensure you have the most current version of the Quitclaim Deed form.

- Don't overlook the filing process. After completing the form, it must be filed with the appropriate county office to be legally effective.

Browse Popular Quitclaim Deed Forms for US States

Printable Quit Claim Deed Form - A Quitclaim Deed can help streamline ownership transfers in complex estates.

Quick Claim Deeds Ohio - Signing a Quitclaim Deed means giving up any claim to the property.

Quitclaim Deed Pa - It is crucial for both parties to understand the implications of the transfer when using this deed.

Detailed Guide for Writing Georgia Quitclaim Deed

After completing the Georgia Quitclaim Deed form, the next step involves ensuring that the document is properly signed, notarized, and recorded with the appropriate county office. This process is essential for the transfer of property ownership to be legally recognized.

- Obtain the Georgia Quitclaim Deed form. You can find it online or at your local county clerk's office.

- Fill in the names of the Grantor (the person transferring the property) and Grantee (the person receiving the property). Ensure that the names are spelled correctly.

- Provide the address of the property being transferred. Include the complete legal description of the property, which can often be found on the current deed or tax records.

- Indicate the consideration amount, which is the value exchanged for the property. This can be a nominal amount or the actual sale price.

- Include the date of the transfer. This is the date when the Grantor signs the deed.

- Sign the document in the presence of a notary public. Both the Grantor and any witnesses (if required) must sign.

- Have the deed notarized. The notary will verify the identities of the signers and affix their seal.

- Record the completed Quitclaim Deed with the county clerk or recorder's office in the county where the property is located. Pay any applicable recording fees.