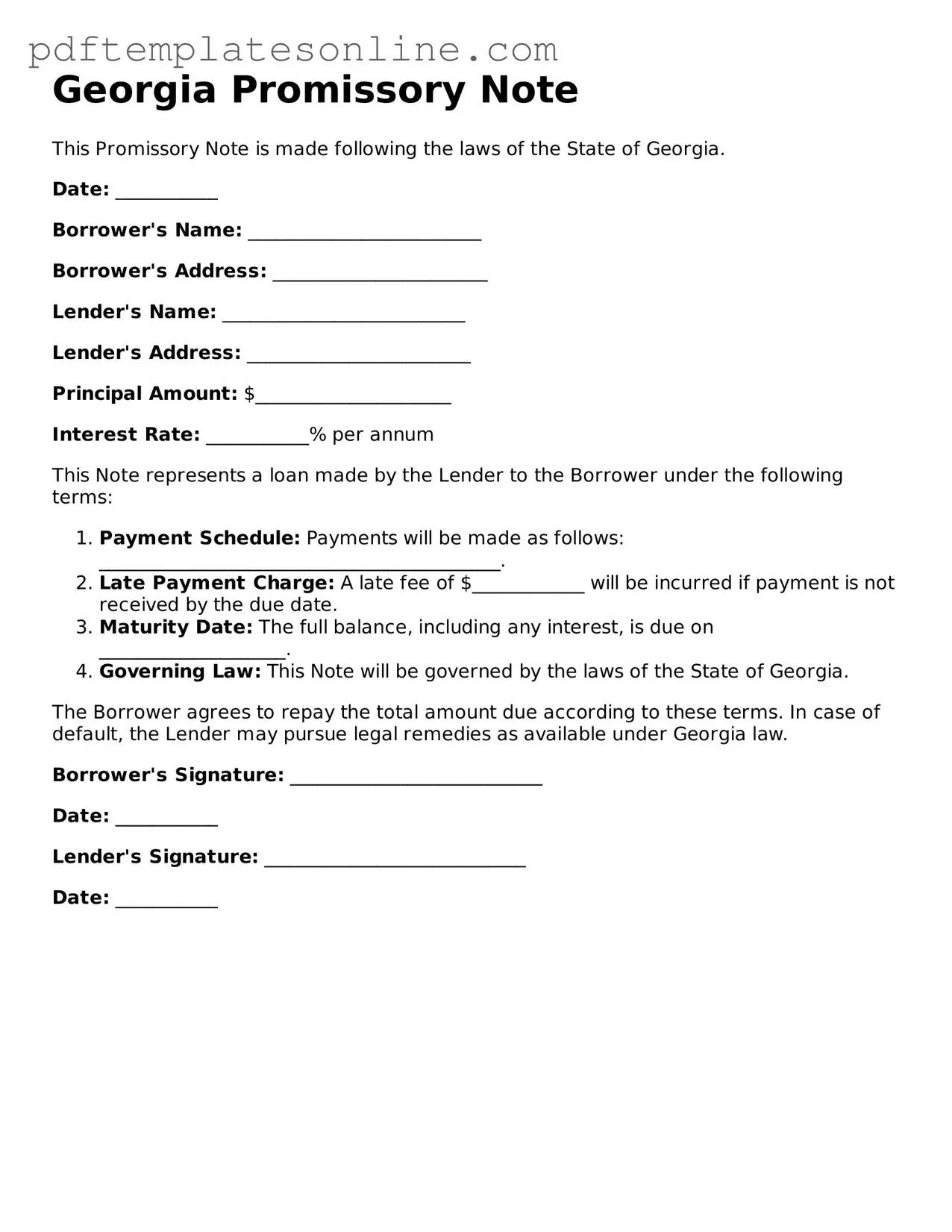

Official Georgia Promissory Note Document

Key takeaways

Understand the purpose of a promissory note. It serves as a written promise to pay back a loan under specified terms.

Clearly state the loan amount. This figure must be accurate to avoid confusion later.

Include the interest rate, if applicable. This informs the borrower how much extra they will pay over time.

Specify the repayment terms. Detail when payments are due and the method of payment to ensure clarity.

Both parties should sign the document. Signatures validate the agreement and protect the interests of both lender and borrower.

Keep a copy of the signed note. This record is important for future reference and any potential disputes.

Common mistakes

Filling out a Georgia Promissory Note form can seem straightforward, but many individuals make common mistakes that can lead to complications down the line. One frequent error is neglecting to include all necessary details about the borrower and lender. It's essential to provide full names, addresses, and contact information. Omitting even a small piece of this information can create confusion and complicate enforcement of the note.

Another mistake often made is failing to specify the interest rate clearly. The interest rate should be stated explicitly, including whether it is fixed or variable. If this detail is left vague, it may lead to disputes later regarding how much interest is actually owed. Clarity is key; both parties should know exactly what they are agreeing to.

Some individuals also overlook the importance of defining the repayment terms. This includes not only the amount due but also the schedule for payments. Is it monthly, quarterly, or a lump sum? Without clear terms, misunderstandings can arise, potentially leading to late payments or defaults. A well-defined repayment schedule is vital for maintaining a positive lender-borrower relationship.

Additionally, many people forget to include a late fee clause. Life can be unpredictable, and sometimes payments are missed. Including a clause that outlines the consequences of late payments can protect both parties and encourage timely repayment. Without this clause, the lender may find it difficult to enforce any penalties or fees for late payments.

Lastly, failing to sign and date the document is a common oversight. Even the most meticulously filled-out Promissory Note is invalid without the signatures of both parties. Ensure that both the borrower and lender sign and date the form to make it legally binding. This final step is crucial, as it confirms that both parties agree to the terms laid out in the document.

Misconceptions

-

Misconception 1: A promissory note must be notarized to be valid.

Many people believe that notarization is a requirement for a promissory note to be legally binding. In Georgia, while having a notary can add an extra layer of authenticity, it is not a strict necessity. A promissory note can be valid and enforceable even without a notary's signature, as long as it meets the essential elements of a contract.

-

Misconception 2: Promissory notes are only for large loans.

Another common myth is that promissory notes are only used for significant amounts of money. In reality, they can be used for any loan amount, big or small. Whether it's a friend lending you $100 or a business transaction involving thousands, a promissory note serves as a clear record of the agreement.

-

Misconception 3: All promissory notes are the same.

Some people think that all promissory notes are identical in structure and content. However, this is not true. Promissory notes can vary significantly based on the terms of the loan, interest rates, repayment schedules, and other specific conditions. Tailoring the note to fit the particular agreement is essential for clarity and enforceability.

-

Misconception 4: Once signed, a promissory note cannot be changed.

Many individuals assume that a promissory note is set in stone once it is signed. While it is true that changes to the terms can be complicated, it is possible to amend a promissory note if both parties agree. Documenting any modifications in writing ensures that all parties are on the same page and helps prevent misunderstandings in the future.

Dos and Don'ts

When filling out the Georgia Promissory Note form, it’s important to ensure that you complete it accurately and clearly. Here are some dos and don'ts to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate information regarding the borrower and lender.

- Do specify the loan amount clearly and in both numbers and words.

- Do include the interest rate, if applicable, and ensure it complies with Georgia laws.

- Don't leave any required fields blank; this could lead to delays or issues later.

- Don't use vague language; be specific about the terms of repayment.

- Don't forget to sign and date the document; an unsigned note may not be enforceable.

- Don't overlook the importance of keeping a copy for your records.

Browse Popular Promissory Note Forms for US States

Notarized Promissory Note - Failure to repay as outlined in the note could lead to legal consequences.

Texas Promissory Note Form - This document can help both individuals and organizations manage their financial commitments.

When engaging in the sale or purchase of a mobile home, it is essential to utilize the proper documentation, such as the California Mobile Home Bill of Sale. This form is not only a legal requirement but also provides clarity in the transaction. For those looking for reliable resources, you can find useful templates and guidance through California PDF Forms.

Ohio Promissory Note Requirements - It establishes legal rights for the lender in case of default.

Promissory Note Template California Word - The note creates a legal obligation for the borrower, making it enforceable in court.

Detailed Guide for Writing Georgia Promissory Note

After you have gathered the necessary information, you are ready to fill out the Georgia Promissory Note form. This document will require specific details about the loan agreement between the lender and the borrower. Follow these steps carefully to ensure that all information is accurate and complete.

- Title the Document: At the top of the form, write "Promissory Note." This clearly identifies the purpose of the document.

- Enter the Date: Write the date on which the note is being executed. This is important for record-keeping.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. Make sure to include any relevant titles or designations.

- Specify the Loan Amount: Write the total amount of money being borrowed. This should be a precise figure.

- Outline the Interest Rate: Indicate the interest rate applicable to the loan. Specify whether it is fixed or variable.

- Detail the Payment Terms: Clearly describe how and when payments will be made. Include the frequency of payments (e.g., monthly, quarterly) and the due date for the first payment.

- Include Late Fees: If applicable, state any penalties for late payments. Specify the amount or percentage that will be charged.

- Signatures: Both the borrower and the lender must sign the document. Include the date of each signature.

- Witness or Notary: Depending on requirements, consider having the document witnessed or notarized for added legal protection.

Once the form is filled out, review it carefully for any errors or omissions. This ensures that both parties are clear on the terms of the agreement and helps prevent disputes in the future.