Official Georgia Operating Agreement Document

Key takeaways

Filling out and utilizing the Georgia Operating Agreement form is essential for any business entity operating in the state. Here are some key takeaways to consider:

- Understand the Purpose: The Operating Agreement outlines the management structure and operating procedures of your business. It serves as a foundational document that guides the organization.

- Include Essential Information: Ensure that the agreement contains critical details such as the name of the business, the address, and the names of the members or managers.

- Define Roles and Responsibilities: Clearly delineate the roles of each member or manager. This helps prevent misunderstandings and ensures that everyone knows their duties.

- Address Profit and Loss Distribution: Specify how profits and losses will be shared among members. This can be based on ownership percentages or other agreed-upon methods.

- Include Procedures for Adding or Removing Members: Outline the process for admitting new members or removing existing ones. This can protect the interests of current members and maintain stability.

- Consider Dispute Resolution: Incorporate methods for resolving disputes, such as mediation or arbitration. This can save time and resources in the event of disagreements.

- Review and Update Regularly: The Operating Agreement should be a living document. Regular reviews and updates ensure that it remains relevant as the business evolves.

By following these guidelines, businesses can create a robust Operating Agreement that supports their goals and fosters a cooperative environment among members.

Common mistakes

Filling out the Georgia Operating Agreement form can be a straightforward process, but many people still make common mistakes that can lead to complications later. One frequent error is failing to include all members of the LLC. It’s crucial to list every member involved in the business. Omitting a member can create confusion and potential disputes down the line.

Another mistake often seen is not specifying the percentage of ownership for each member. Each member should have a clearly defined ownership interest. If these percentages are left blank or incorrectly stated, it can lead to misunderstandings about profit distribution and decision-making authority.

Additionally, people sometimes neglect to outline the management structure of the LLC. Whether the company will be managed by members or appointed managers should be clearly stated. This clarity helps in establishing roles and responsibilities, preventing conflicts among members.

Some individuals also forget to include provisions for adding or removing members. This oversight can create significant hurdles if changes in membership occur. Including a process for these changes ensures smooth transitions and maintains the integrity of the agreement.

Another common error is not having the agreement signed by all members. An unsigned agreement may not hold up in legal situations. It’s essential for every member to sign and date the document to validate the agreement and protect everyone’s interests.

Lastly, people often overlook the importance of keeping the Operating Agreement updated. As the business evolves, changes in membership, management, or ownership percentages may occur. Regularly reviewing and updating the agreement is vital to reflect the current state of the business and avoid potential disputes.

Misconceptions

The Georgia Operating Agreement form is a crucial document for any limited liability company (LLC) operating in the state. However, several misconceptions surround this form, which can lead to confusion among business owners. Below is a list of nine common misconceptions, along with explanations to clarify the truth.

- It is not necessary for all LLCs. Some people believe that an Operating Agreement is optional for LLCs in Georgia. In reality, while it is not required by law, having one is highly recommended as it outlines the management structure and operational procedures.

- All Operating Agreements must be filed with the state. There is a misconception that the Operating Agreement needs to be submitted to the Georgia Secretary of State. This is false; the agreement is an internal document and does not need to be filed.

- Only multi-member LLCs need an Operating Agreement. Many assume that only LLCs with multiple members require an Operating Agreement. However, even single-member LLCs benefit from having one, as it helps establish the business as a separate legal entity.

- The Operating Agreement cannot be changed. Some individuals think that once an Operating Agreement is signed, it cannot be modified. In fact, members can amend the agreement as needed, provided they follow the procedures outlined within the document.

- It covers only financial aspects. There is a belief that the Operating Agreement only addresses financial matters, such as profit distribution. In truth, it encompasses a wide range of topics, including management roles, voting rights, and procedures for adding or removing members.

- All Operating Agreements are the same. Some people assume that a standard template will suffice for any LLC. However, each business has unique needs, and the Operating Agreement should be tailored to reflect those specific circumstances.

- Verbal agreements are sufficient. It is a common misconception that a verbal agreement among members can replace a written Operating Agreement. A written document is essential for clarity and legal protection, as verbal agreements can lead to misunderstandings.

- The Operating Agreement is only for legal disputes. Some believe that the document is only necessary when conflicts arise. In reality, it serves as a proactive tool to prevent disputes by clearly defining roles and responsibilities from the outset.

- Once created, the Operating Agreement is no longer relevant. There is a misconception that the Operating Agreement can be ignored after it is created. However, it should be reviewed and updated regularly to ensure it remains aligned with the company’s operations and any changes in the law.

Understanding these misconceptions can help business owners make informed decisions regarding their LLC and the importance of a well-drafted Operating Agreement. By addressing these misunderstandings, individuals can better appreciate the value of this document in facilitating smooth operations and protecting their interests.

Dos and Don'ts

When filling out the Georgia Operating Agreement form, it's essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of dos and don’ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate and up-to-date information.

- Do include all members' names and addresses.

- Do specify the management structure clearly.

- Do review the agreement with all members before submission.

- Don't leave any required fields blank.

- Don't use vague language; be specific in your descriptions.

- Don't forget to date and sign the document.

- Don't submit the form without a final review.

- Don't ignore state-specific requirements or guidelines.

Browse Popular Operating Agreement Forms for US States

What Is an Llc Business - The Operating Agreement serves as a binding contract among members of a limited liability company (LLC).

The creation of an LLC often necessitates a thorough understanding of its operational framework; this is where a solid understanding of a single-member operating agreement template becomes essential. This document acts as a cornerstone for defining how the business operates while ensuring compliance with regulations.

How to Make an Operating Agreement - This document may include indemnification clauses for protection.

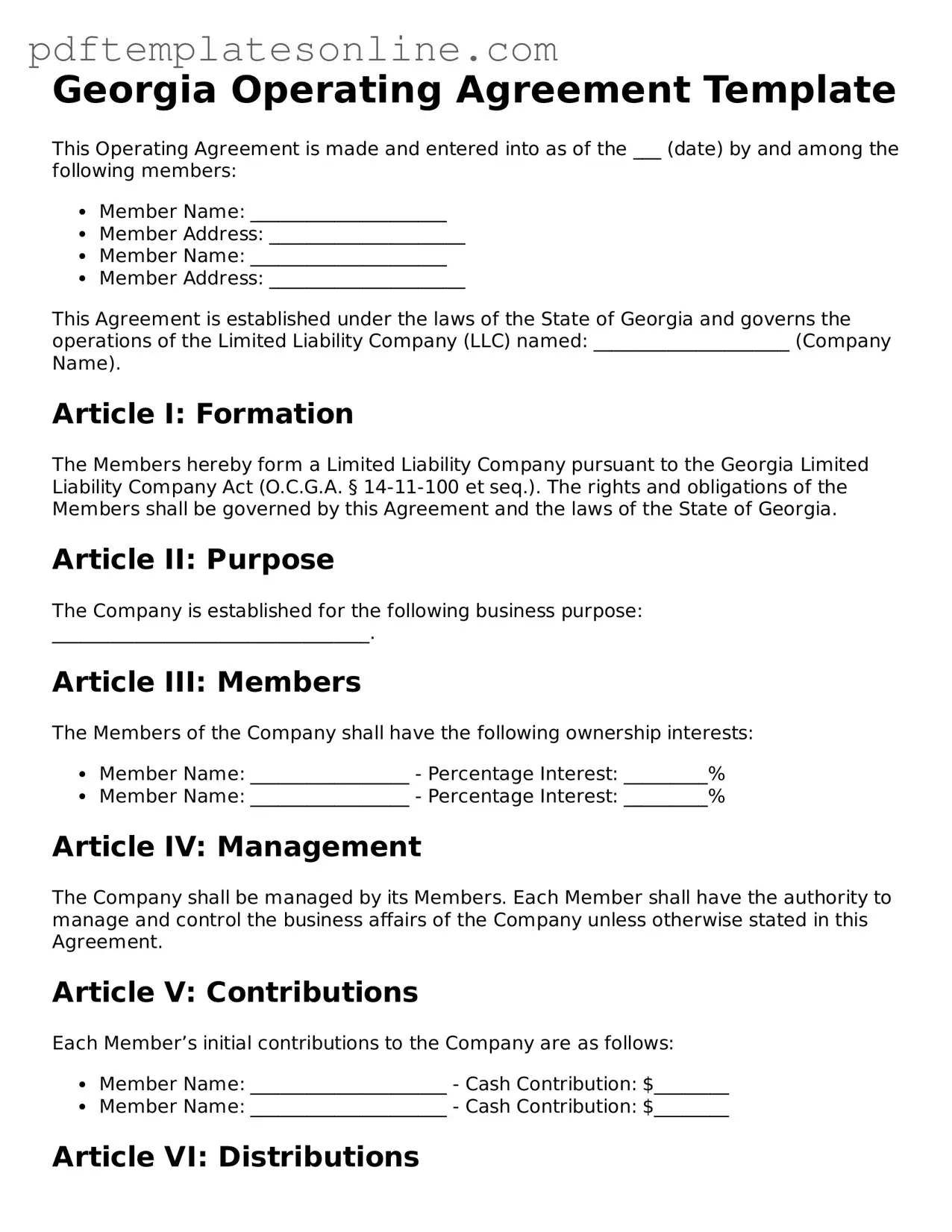

Detailed Guide for Writing Georgia Operating Agreement

After gathering the necessary information, you are ready to fill out the Georgia Operating Agreement form. This document will outline the structure and management of your business. Ensure that all details are accurate and reflect your intentions for the company.

- Begin by entering the name of your LLC at the top of the form. Make sure it matches the name registered with the state.

- Provide the principal office address of the LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members of the LLC. Include their ownership percentages if applicable.

- Outline the purpose of the LLC. Describe what the business will do in clear, simple terms.

- Specify the management structure. Indicate whether the LLC will be member-managed or manager-managed.

- Include details about how profits and losses will be distributed among members. Be clear about the percentages or amounts.

- State the duration of the LLC. Indicate whether it will be perpetual or for a specified period.

- Sign and date the document. Ensure that all members sign as well, if required.

Once you have completed the form, review it carefully to check for any errors or omissions. After confirming that everything is correct, you can proceed with the next steps for filing your Operating Agreement with the appropriate authorities.