Official Georgia Motorcycle Bill of Sale Document

Key takeaways

When completing the Georgia Motorcycle Bill of Sale form, keep these key points in mind:

- Accurate Information: Ensure all details about the motorcycle, including make, model, year, and Vehicle Identification Number (VIN), are correct.

- Seller and Buyer Details: Include full names and addresses for both the seller and buyer to avoid any future disputes.

- Sale Price: Clearly state the sale price of the motorcycle. This helps establish the value for tax purposes.

- Date of Sale: Record the exact date when the transaction takes place. This is important for legal and registration purposes.

- Signatures: Both the seller and buyer must sign the form. This shows agreement on the sale terms.

- Notarization: While not required, having the bill of sale notarized can add an extra layer of security and legitimacy.

- Keep Copies: Both parties should keep a copy of the signed bill of sale for their records. This can be useful for future reference.

- Registration: The bill of sale is often needed when registering the motorcycle with the Georgia Department of Revenue.

Common mistakes

Filling out the Georgia Motorcycle Bill of Sale form can be straightforward, but many individuals make common mistakes that can lead to complications later. One frequent error is failing to include all required information. The form typically asks for details such as the motorcycle's make, model, year, and Vehicle Identification Number (VIN). Omitting any of this information can result in delays or issues when transferring ownership.

Another mistake involves incorrect VIN entry. The VIN is a unique identifier for the motorcycle. If a buyer or seller misreads or mistypes this number, it could create confusion or legal problems. Always double-check the VIN on the motorcycle against what is written on the form.

People often forget to sign the form. Both the buyer and seller must provide their signatures for the Bill of Sale to be valid. Without signatures, the document lacks authenticity and may not hold up in future transactions or disputes.

Not dating the form is another common oversight. The date of the sale is crucial for record-keeping and legal purposes. Leaving this field blank can lead to ambiguity regarding when the ownership transfer occurred.

Some individuals neglect to include the sale price. This information is important for tax purposes and for establishing the value of the transaction. Failing to list the sale price can complicate future dealings or tax assessments.

Inaccurate descriptions of the motorcycle can also be a significant error. The Bill of Sale should clearly describe the motorcycle, including its condition. Vague descriptions can lead to misunderstandings between the buyer and seller.

Another mistake is not providing the correct contact information. Both parties should ensure their names, addresses, and phone numbers are clearly stated. This information is vital for any follow-up communication or potential disputes.

Some people use outdated forms or templates. Laws and requirements can change, so it's essential to use the most current version of the Georgia Motorcycle Bill of Sale form. Using an outdated form may result in non-compliance with state regulations.

Additionally, failing to keep a copy of the completed Bill of Sale is a mistake that can have consequences. Both parties should retain a copy for their records. This document serves as proof of the transaction and can be necessary for future reference.

Lastly, individuals sometimes overlook the importance of having witnesses or notarization. While not always required, having a witness or notarizing the Bill of Sale can provide an extra layer of protection and validation for both parties involved in the transaction.

Misconceptions

The Georgia Motorcycle Bill of Sale form is an important document for anyone buying or selling a motorcycle in the state. However, several misconceptions can lead to confusion. Here are nine common misunderstandings about this form:

- It’s not necessary for private sales. Many believe that a bill of sale is only required for dealership transactions. In reality, having a bill of sale protects both the buyer and the seller, regardless of whether the sale is private or through a dealer.

- Any form will do. Some think that any generic bill of sale can suffice. However, using the specific Georgia Motorcycle Bill of Sale ensures compliance with state requirements and includes all necessary details.

- The form doesn’t need to be notarized. While notarization is not always required, having the bill of sale notarized can add an extra layer of protection and legitimacy to the transaction.

- It’s only for the seller’s records. Many assume that the bill of sale is solely for the seller. In fact, both parties should keep a copy for their records, as it serves as proof of ownership transfer.

- It’s irrelevant for title transfers. Some people believe that the bill of sale has no impact on the title transfer process. However, it is often required when registering the motorcycle in the new owner's name.

- It doesn’t need to include vehicle details. There is a misconception that the bill of sale can be vague. On the contrary, it should include specific details such as the make, model, year, and Vehicle Identification Number (VIN) to avoid future disputes.

- Once signed, it can’t be changed. Some think that once the bill of sale is signed, it is set in stone. If both parties agree, they can amend the document to correct any errors or add additional information.

- It’s only important for the buyer. Many believe that only the buyer needs the bill of sale. However, it is equally important for the seller as it provides proof that the motorcycle has been sold.

- It can be ignored if the motorcycle is a gift. Some individuals think that if the motorcycle is given as a gift, a bill of sale is unnecessary. However, having a bill of sale is still advisable for documentation purposes, even for gifted vehicles.

Understanding these misconceptions can help ensure a smoother transaction when buying or selling a motorcycle in Georgia. Always prioritize clarity and transparency in any sale, as it protects all parties involved.

Dos and Don'ts

When filling out the Georgia Motorcycle Bill of Sale form, it’s important to ensure accuracy and completeness. Here are five things you should do and five things you should avoid.

Things You Should Do:

- Double-check all information before submission to avoid mistakes.

- Include the motorcycle's Vehicle Identification Number (VIN) to ensure proper identification.

- Clearly state the sale price to avoid any future disputes.

- Have both the buyer and seller sign the document to validate the transaction.

- Keep a copy of the completed Bill of Sale for your records.

Things You Shouldn't Do:

- Do not leave any fields blank; incomplete forms can lead to issues later.

- Avoid using nicknames or informal names; use legal names as they appear on identification.

- Do not forget to date the document; an undated Bill of Sale may cause confusion.

- Refrain from making alterations or corrections without initialing them; this can raise questions about the validity.

- Do not rush through the process; take your time to ensure everything is accurate.

Browse Popular Motorcycle Bill of Sale Forms for US States

Sample Auto Bill of Sale - The form can empower both buyer and seller with necessary information.

Bill of Sale Sample - Sets the stage for smooth vehicle registration processes afterward.

Bill of Sale Paper for Car - Both parties should complete this form to ensure a smooth transaction.

California Vehicle Bill of Sale - Includes information about the motorcycle, such as make and model.

Detailed Guide for Writing Georgia Motorcycle Bill of Sale

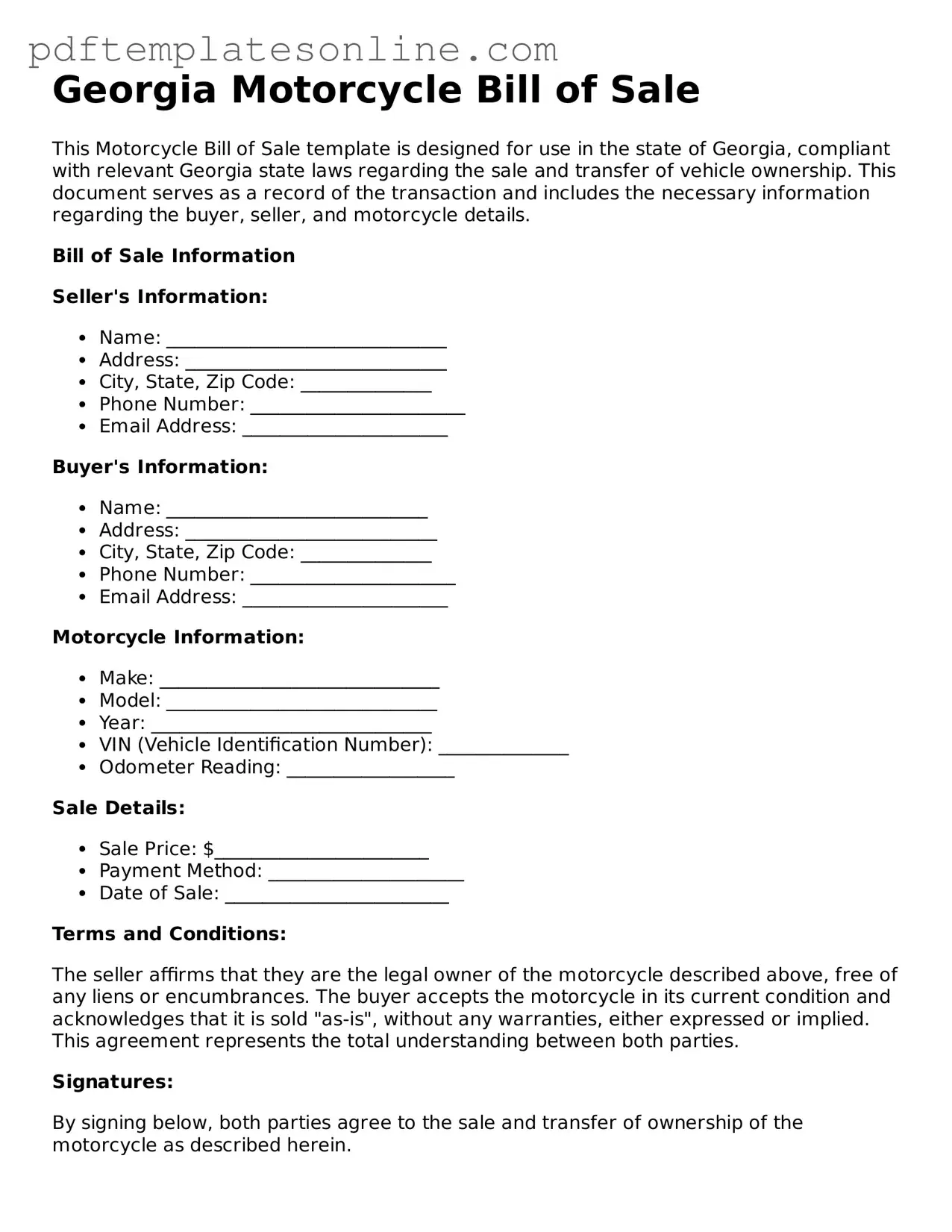

Once you have the Georgia Motorcycle Bill of Sale form in hand, it’s time to fill it out accurately. This document will serve as a record of the sale and is important for both the buyer and the seller. Follow these steps to ensure all necessary information is included and correctly documented.

- Obtain the form: Download or print the Georgia Motorcycle Bill of Sale form from a reliable source.

- Fill in the date: Write the date of the transaction at the top of the form.

- Seller information: Enter the seller's full name, address, and contact information in the designated sections.

- Buyer information: Provide the buyer's full name, address, and contact information in the appropriate fields.

- Motorcycle details: Fill in the motorcycle's make, model, year, VIN (Vehicle Identification Number), and odometer reading.

- Sale price: Clearly state the sale price of the motorcycle in the designated area.

- Signatures: Both the seller and buyer must sign and date the form to validate the transaction.

- Witness or notary (if required): Depending on local regulations, you may need a witness or notary to sign the document.

After completing the form, both parties should keep a copy for their records. This ensures that each party has proof of the sale and the details involved in the transaction.