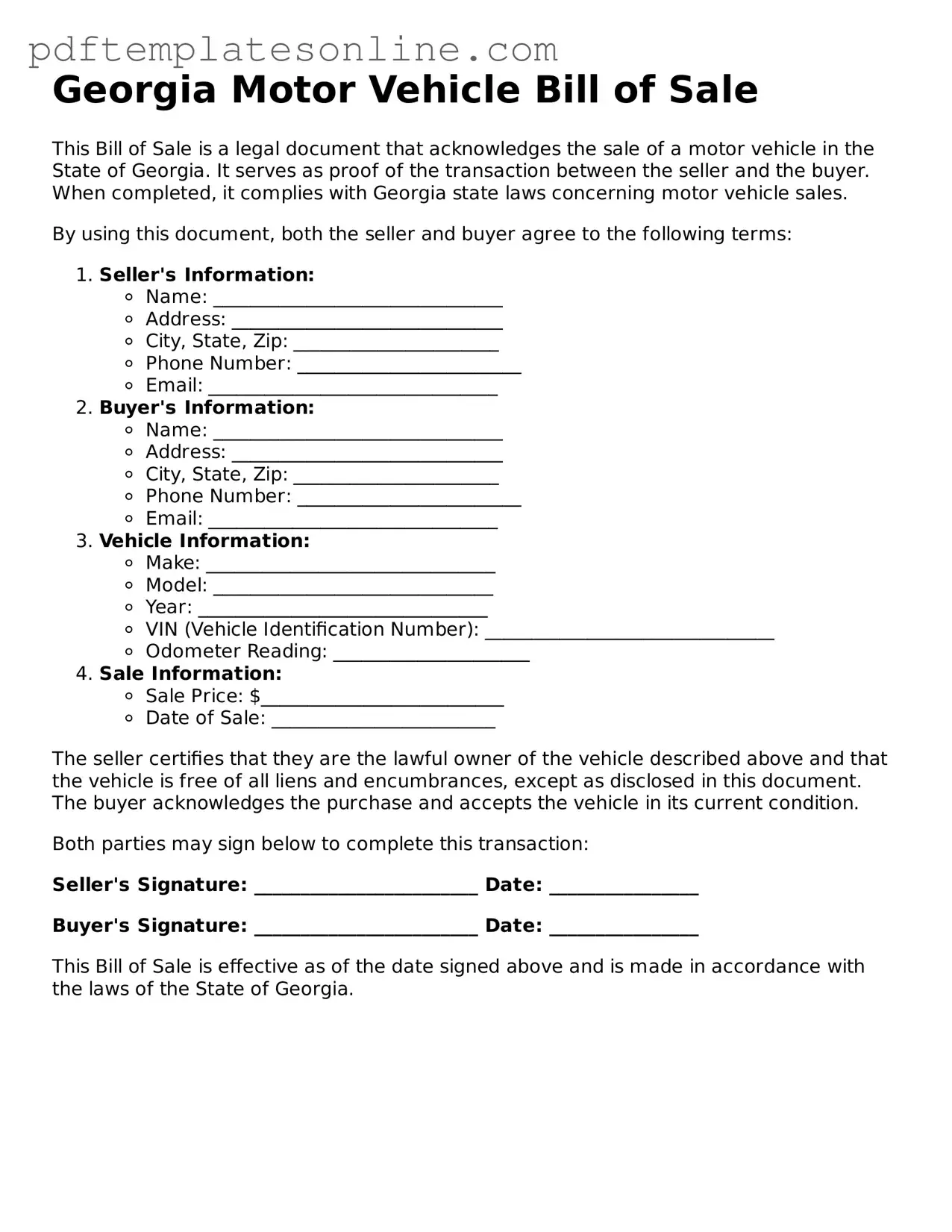

Official Georgia Motor Vehicle Bill of Sale Document

Key takeaways

When filling out and using the Georgia Motor Vehicle Bill of Sale form, keep these key takeaways in mind:

- Complete Information: Ensure that all sections of the form are filled out accurately. This includes the names of both the buyer and seller, vehicle details, and sale price.

- Vehicle Identification Number (VIN): Always include the VIN. This unique number identifies the vehicle and is essential for registration purposes.

- Signatures Required: Both the buyer and seller must sign the document. Without signatures, the bill of sale is not valid.

- Consider Notarization: While notarization is not required in Georgia, having the document notarized can add an extra layer of authenticity.

- Keep Copies: After completing the bill of sale, make copies for both the buyer and seller. This provides proof of the transaction for future reference.

- Sales Tax: Be aware that the buyer may need to pay sales tax when registering the vehicle. The bill of sale can help determine the taxable amount.

- Use for Title Transfer: The bill of sale is often used to facilitate the transfer of the vehicle title. It serves as proof of ownership change.

Common mistakes

When completing the Georgia Motor Vehicle Bill of Sale form, individuals often make several common mistakes that can lead to complications. One frequent error is failing to include the correct vehicle identification number (VIN). The VIN is essential for identifying the vehicle and ensuring that all details match the official records.

Another mistake is not accurately recording the sale price. The sale price must reflect the actual amount exchanged for the vehicle. If the price is misrepresented, it can cause issues with tax assessments or registration.

Many people overlook the importance of both the buyer's and seller's signatures. The form requires signatures from both parties to validate the transaction. Without these signatures, the document may not be considered legally binding.

Inaccurate dates can also create problems. The date of sale must be clearly indicated. If this date is missing or incorrect, it may lead to disputes regarding ownership or liability.

Some individuals fail to provide complete contact information for both the buyer and seller. This includes names, addresses, and phone numbers. Incomplete contact details can complicate future communications or legal matters.

Not providing a clear description of the vehicle is another common oversight. The form should include details such as the make, model, year, and color. A vague description can lead to confusion or disputes over the vehicle sold.

People often forget to check for any liens on the vehicle. If a lien exists, it should be disclosed in the bill of sale. Failure to do so can result in legal issues for the buyer.

Some individuals neglect to include any warranties or guarantees associated with the vehicle. If the seller offers any assurances, these should be clearly stated in the bill of sale to avoid misunderstandings.

Another mistake is not keeping a copy of the completed bill of sale. Both the buyer and seller should retain a copy for their records. This document serves as proof of the transaction and can be important for future reference.

Finally, individuals may fail to submit the bill of sale to the appropriate authorities. In Georgia, it is necessary to file the bill of sale with the Department of Revenue for proper registration. Not doing so can lead to issues with ownership verification.

Misconceptions

Understanding the Georgia Motor Vehicle Bill of Sale can help simplify the process of buying or selling a vehicle. However, there are several misconceptions that often lead to confusion. Here are ten common myths surrounding this important document:

- A Bill of Sale is only needed for new vehicles. Many people believe that this form is only necessary for new cars, but it is actually essential for both new and used vehicles to document the sale.

- Verbal agreements are sufficient. Some think that a handshake or verbal agreement is enough to finalize a vehicle sale. However, having a written Bill of Sale protects both parties and provides legal proof of the transaction.

- Only the seller needs to sign the Bill of Sale. It's a common misconception that only the seller's signature is required. In reality, both the buyer and seller should sign the document to validate the sale.

- The Bill of Sale is the same as the title. Many confuse the Bill of Sale with the vehicle title. While the title transfers ownership, the Bill of Sale serves as a record of the transaction and may include additional details.

- It's not necessary if the vehicle is a gift. Some believe that gifting a vehicle doesn't require a Bill of Sale. However, documenting the gift can help avoid potential tax issues and clarify ownership.

- All states have the same Bill of Sale requirements. People often assume that Bill of Sale requirements are uniform across the country. Each state, including Georgia, has its own specific rules and forms.

- Once signed, the Bill of Sale cannot be changed. Many think that once the Bill of Sale is signed, it is set in stone. In fact, both parties can agree to amend the document if necessary, as long as both sign the changes.

- It's only for private sales. Some individuals think that a Bill of Sale is only needed for private transactions. However, dealerships and businesses also use this document to record sales.

- There is a specific format that must be followed. While certain information is required, there is no one-size-fits-all format for a Bill of Sale. As long as it includes the necessary details, it can be customized.

- The Bill of Sale is not legally binding. Some people believe that a Bill of Sale holds no legal weight. On the contrary, it is a legally binding document that can be used in court if disputes arise.

By clearing up these misconceptions, you can navigate the process of buying or selling a vehicle in Georgia with greater confidence and ease. Always ensure that you have the proper documentation to protect your interests.

Dos and Don'ts

When filling out the Georgia Motor Vehicle Bill of Sale form, it is important to follow certain guidelines to ensure the document is completed accurately. Here are five things you should and shouldn't do:

- Do provide accurate vehicle information, including the make, model, year, and VIN.

- Do include the full names and addresses of both the buyer and the seller.

- Do specify the sale price clearly to avoid any confusion.

- Don't leave any required fields blank; this can lead to issues during the registration process.

- Don't forget to sign and date the form; both parties must acknowledge the transaction.

Browse Popular Motor Vehicle Bill of Sale Forms for US States

Auto Bill of Sale Template - This type of Bill of Sale can be customized to fit specific sale circumstances.

Dmv Statement of Facts - The form is sometimes required by banks for financing or loans related to the vehicle.

Texas Auto Bill of Sale - Outlines any warranties or disclaimers associated with the sale.

Ohio Vehicle Bill of Sale - Provides a clear record of sale for personal and tax purposes.

Detailed Guide for Writing Georgia Motor Vehicle Bill of Sale

After obtaining the Georgia Motor Vehicle Bill of Sale form, it is essential to complete it accurately to ensure a smooth transaction. The following steps will guide you through the process of filling out the form.

- Obtain the form: Download or print the Georgia Motor Vehicle Bill of Sale form from a reliable source.

- Fill in the date: Write the date of the sale at the top of the form.

- Provide seller information: Enter the full name and address of the seller in the designated section.

- Provide buyer information: Enter the full name and address of the buyer in the appropriate section.

- Describe the vehicle: Fill in the vehicle's make, model, year, and Vehicle Identification Number (VIN).

- Indicate the sale price: Clearly state the agreed-upon sale price for the vehicle.

- Sign the form: Both the seller and buyer must sign and date the form to validate the transaction.

Once the form is completed and signed, ensure that both parties retain a copy for their records. This document serves as proof of the transaction and may be needed for future reference.