Official Georgia Loan Agreement Document

Key takeaways

When filling out and using the Georgia Loan Agreement form, consider the following key takeaways:

- Understand the Purpose: The loan agreement serves as a legal document outlining the terms between the lender and borrower.

- Identify the Parties: Clearly state the names and addresses of both the lender and borrower to avoid confusion.

- Specify Loan Amount: Clearly indicate the total amount of money being borrowed, as this is crucial for both parties.

- Outline Interest Rates: Include the interest rate, whether it is fixed or variable, to clarify repayment expectations.

- Detail Repayment Terms: Specify how and when the borrower will repay the loan. Include payment frequency and due dates.

- Include Default Terms: Clearly outline what happens if the borrower defaults on the loan, including potential penalties.

- Signatures Required: Ensure both parties sign the agreement to make it legally binding.

- Keep Copies: Each party should retain a signed copy of the agreement for their records.

Common mistakes

Filling out the Georgia Loan Agreement form can be straightforward, but many individuals make common mistakes that can lead to complications. One frequent error is failing to provide accurate personal information. This includes names, addresses, and contact details. Even a small typo can create significant issues down the line, such as delays in processing or problems with communication.

Another mistake often made is neglecting to read the terms and conditions thoroughly. Borrowers may sign the agreement without fully understanding their obligations and rights. This oversight can result in unexpected fees or unfavorable loan terms. It's crucial to take the time to understand what you are agreeing to before signing.

Inadequate documentation is also a common issue. Many people forget to attach necessary documents, such as proof of income or identification. Without these documents, the loan application may be incomplete, leading to rejection or prolonged processing times.

Additionally, individuals sometimes miscalculate the loan amount they need. Borrowers may either underestimate or overestimate their requirements. This mistake can affect repayment plans and financial stability. It's advisable to carefully assess your financial needs before specifying the loan amount.

Another frequent error is not disclosing all existing debts. Borrowers might think that omitting certain debts will improve their chances of approval. However, lenders typically conduct thorough background checks. Failing to disclose all financial obligations can lead to trust issues and potential denial of the loan.

People also often forget to date the form correctly. An incorrect or missing date can lead to confusion about when the agreement was made. This detail is essential for establishing the timeline of the loan and ensuring that both parties are on the same page.

Lastly, many individuals overlook the importance of reviewing the completed form before submission. Rushing through the process can lead to errors that might have been easily caught with a final review. Taking a moment to double-check the information can save time and prevent headaches later on.

Misconceptions

When it comes to the Georgia Loan Agreement form, several misconceptions can lead to confusion and misunderstandings. Here are nine common myths, along with clarifications to help set the record straight.

-

All loan agreements are the same.

Many people assume that all loan agreements follow a standard template. In reality, each agreement can be tailored to fit the specific needs of the borrower and lender, reflecting the unique terms of their arrangement.

-

A loan agreement must be notarized.

While notarization can add an extra layer of security, it is not a legal requirement for a loan agreement in Georgia. What matters most is that both parties understand and agree to the terms.

-

Only banks can issue loan agreements.

This misconception overlooks the fact that individuals and private lenders can also create valid loan agreements. Anyone can lend money and establish terms, as long as both parties consent.

-

Loan agreements are only for large sums of money.

Loan agreements can be used for any amount, big or small. Whether it’s a few hundred dollars or a substantial investment, having a written agreement helps clarify expectations.

-

Verbal agreements are just as binding as written ones.

While verbal agreements can be legally binding, they are much harder to enforce. A written loan agreement provides clear evidence of the terms, making it easier to resolve disputes.

-

Once signed, a loan agreement cannot be changed.

This is not true. If both parties agree, modifications can be made to the loan agreement. It’s important to document any changes in writing to avoid future misunderstandings.

-

Loan agreements are only necessary for personal loans.

Loan agreements are beneficial for any type of loan, including business loans, student loans, and even informal loans between friends or family members. They help ensure everyone is on the same page.

-

Interest rates are fixed and cannot be negotiated.

Interest rates are often negotiable. Borrowers should feel empowered to discuss and potentially lower the rate, depending on their creditworthiness and the lender’s policies.

-

Loan agreements are only for the lender's protection.

While these agreements do protect the lender, they also safeguard the borrower. By outlining terms clearly, both parties can avoid misunderstandings and ensure fair treatment.

Understanding these misconceptions can empower individuals to navigate the loan process more confidently. A well-informed borrower is better equipped to make decisions that align with their financial goals.

Dos and Don'ts

When filling out the Georgia Loan Agreement form, attention to detail is crucial. Here are seven essential tips to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information.

- Do double-check all figures and calculations for accuracy.

- Do sign and date the form where required.

- Don’t leave any sections blank unless instructed to do so.

- Don’t use abbreviations or shorthand that may cause confusion.

- Don’t submit the form without reviewing it for errors.

Following these guidelines can help ensure a smooth process when submitting your loan agreement. Accuracy and thoroughness are key.

Browse Popular Loan Agreement Forms for US States

California Promissory Note Template - Define the loan purpose to clarify how the funds will be used.

The California Cease and Desist Letter is an important tool for anyone looking to halt unwarranted actions, providing a formal request for cessation that can lead to further legal measures if necessary. You can find a useful resource for this process in the California cease and desist letter preparation guide.

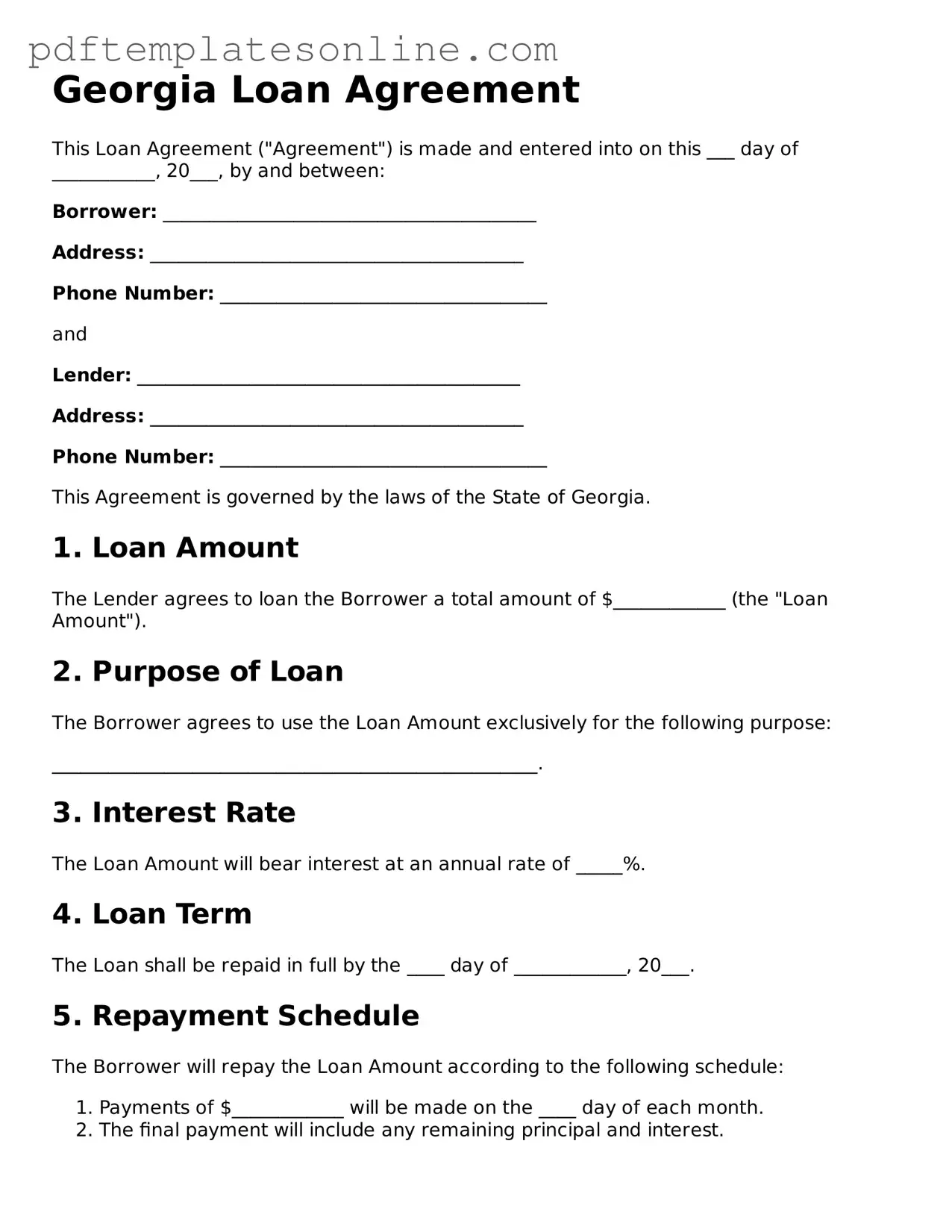

Detailed Guide for Writing Georgia Loan Agreement

Once you have the Georgia Loan Agreement form in front of you, it’s time to fill it out carefully. Each section requires specific information to ensure the agreement is valid and meets all necessary requirements. Follow the steps below to complete the form accurately.

- Read the instructions: Before starting, take a moment to read any instructions provided with the form. This will give you a clear understanding of what information is needed.

- Enter the date: At the top of the form, write the date on which you are completing the agreement.

- Fill in the borrower’s information: Provide the full name, address, and contact information of the borrower. Ensure all details are accurate.

- Provide the lender’s information: Similarly, fill in the full name, address, and contact information of the lender.

- Detail the loan amount: Clearly state the total amount of the loan being agreed upon. Make sure to write the number and the amount in words for clarity.

- Specify the interest rate: Indicate the interest rate applicable to the loan. This can be a fixed or variable rate, so specify accordingly.

- Outline repayment terms: Describe how and when the borrower will repay the loan. Include details about the payment schedule and any grace periods.

- Include any additional terms: If there are any other conditions or agreements, such as collateral or penalties for late payments, include them in this section.

- Sign the agreement: Both the borrower and lender must sign and date the form. Ensure that signatures are clear and legible.

- Make copies: After completing the form, make copies for both the borrower and lender to keep for their records.

After filling out the form, review it to ensure all information is complete and accurate. This step is crucial to avoid any potential issues later on. Once you are satisfied, proceed with the next steps as instructed by the lender or relevant parties.