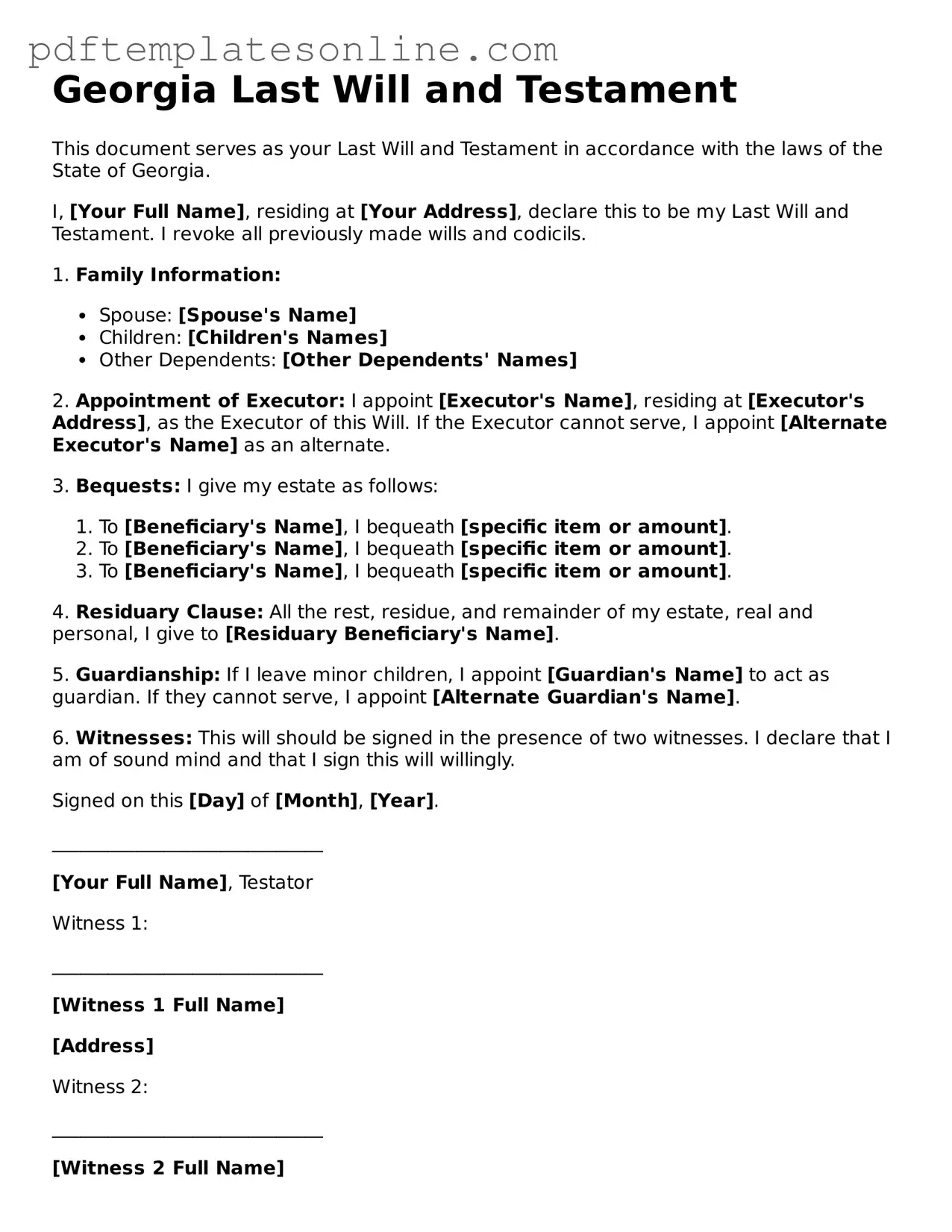

Official Georgia Last Will and Testament Document

Key takeaways

Filling out a Last Will and Testament in Georgia is a significant step in ensuring your wishes are honored after your passing. Here are some key takeaways to consider:

- Understand the Purpose: A will outlines how your assets will be distributed, names guardians for minor children, and specifies your wishes regarding funeral arrangements.

- Eligibility: To create a valid will in Georgia, you must be at least 14 years old and of sound mind.

- Written Document: The will must be in writing. Oral wills are generally not recognized in Georgia.

- Signature Requirement: You must sign the will at the end. If you are unable to sign, you may direct someone else to sign on your behalf in your presence.

- Witnesses: At least two witnesses must sign the will. They should be present at the same time and should not be beneficiaries of the will to avoid conflicts of interest.

- Revocation: You can revoke a will at any time by creating a new one or by destroying the original document.

- Storing the Will: Keep the will in a safe place and inform your executor of its location. This ensures that your wishes can be easily accessed when needed.

Taking the time to understand these aspects can help ensure that your Last Will and Testament accurately reflects your intentions and provides peace of mind for you and your loved ones.

Common mistakes

Filling out a Last Will and Testament form in Georgia can be a straightforward process, but there are common mistakes that individuals often make. One significant error is not being specific about the distribution of assets. It is crucial to clearly outline who will receive what. Vague language can lead to confusion and disputes among heirs, potentially resulting in legal challenges.

Another common mistake is failing to properly witness the will. In Georgia, two witnesses must sign the will in the presence of the testator. If this step is overlooked, the will may be deemed invalid. It is essential to ensure that the witnesses are not beneficiaries of the will to avoid any conflicts of interest.

Many people also neglect to update their will after major life changes, such as marriage, divorce, or the birth of children. A will that does not reflect current circumstances may not serve its intended purpose. Regularly reviewing and revising the will is vital to ensure it aligns with one’s current wishes and family dynamics.

Additionally, some individuals may forget to include a self-proving affidavit. This document can simplify the probate process by affirming the validity of the will without requiring the witnesses to testify. Including this affidavit can save time and reduce complications during probate.

Lastly, individuals sometimes overlook the importance of selecting an appropriate executor. The executor is responsible for managing the estate and ensuring that the will is executed according to the testator’s wishes. Choosing someone who is trustworthy and capable is essential. Failing to do so can lead to mismanagement and disputes among beneficiaries.

Misconceptions

Understanding the Georgia Last Will and Testament form is crucial for anyone looking to prepare their estate plan. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

- A handwritten will is not valid in Georgia. Many believe that a will must be typed and formally executed. In fact, Georgia recognizes handwritten wills, also known as holographic wills, as valid if they are signed by the testator and the material provisions are in their handwriting.

- Only lawyers can create a valid will. While having legal assistance can be beneficial, it is not a requirement. Individuals can create their own will, provided it meets Georgia’s legal standards, including proper signing and witnessing.

- Wills can only be changed through a new will. Some think that once a will is created, it cannot be altered without drafting an entirely new document. However, Georgia allows for changes through a codicil, which is an amendment to the original will.

- All assets must be mentioned in the will. It is a common belief that every single asset must be listed in the will. In reality, any property not specifically mentioned will still be distributed according to Georgia’s intestacy laws, unless it is explicitly excluded.

- Witnesses must be family members. There is a misconception that witnesses to a will must be related to the testator. In Georgia, witnesses can be anyone who is at least 14 years old and of sound mind, as long as they are not beneficiaries of the will.

Addressing these misconceptions can help individuals navigate the process of creating a Last Will and Testament more effectively. It is essential to be informed and prepared to ensure that your wishes are honored.

Dos and Don'ts

When filling out the Georgia Last Will and Testament form, it is crucial to approach the task with care and attention. Here are some important dos and don'ts to keep in mind:

- Do ensure that you are of sound mind and at least 14 years old when creating your will.

- Do clearly state your full name and address at the beginning of the document.

- Do specify how you want your assets distributed among your beneficiaries.

- Do sign the will in the presence of at least two witnesses, who should also sign it.

- Don't use ambiguous language that could lead to confusion about your intentions.

- Don't forget to update your will after significant life changes, such as marriage or the birth of a child.

Browse Popular Last Will and Testament Forms for US States

Is It Legal to Write Your Own Will - Is designed to reflect unique family dynamics, accommodating various relationships and traditions.

To effectively handle disputes and protect one's rights, it is often necessary to utilize formal documents, and a vital resource for such legal needs is the Florida PDF Forms, which offers comprehensive templates for creating a Florida Cease and Desist Letter. This document enables individuals or organizations to demand that unwanted actions cease, serving as a pivotal first step in resolving potential conflicts without immediate legal escalation.

California Holographic Will - Can include a living will that outlines healthcare preferences in case of incapacity.

Detailed Guide for Writing Georgia Last Will and Testament

After completing the Georgia Last Will and Testament form, you will need to ensure that it is properly signed and witnessed. This step is crucial for the validity of your will. Follow these steps to fill out the form accurately.

- Begin by writing your full name at the top of the form.

- Provide your address, including city, state, and zip code.

- State your intention to create a last will and testament clearly.

- List your beneficiaries. Include their full names and relationships to you.

- Designate an executor. This person will carry out your wishes. Include their full name and contact information.

- Specify any guardians for your minor children. Include their names and addresses.

- Detail how your assets should be distributed among your beneficiaries.

- Include any specific bequests, such as personal items or amounts of money.

- Sign and date the form at the designated area.

- Have at least two witnesses sign the form. They should also print their names and addresses.