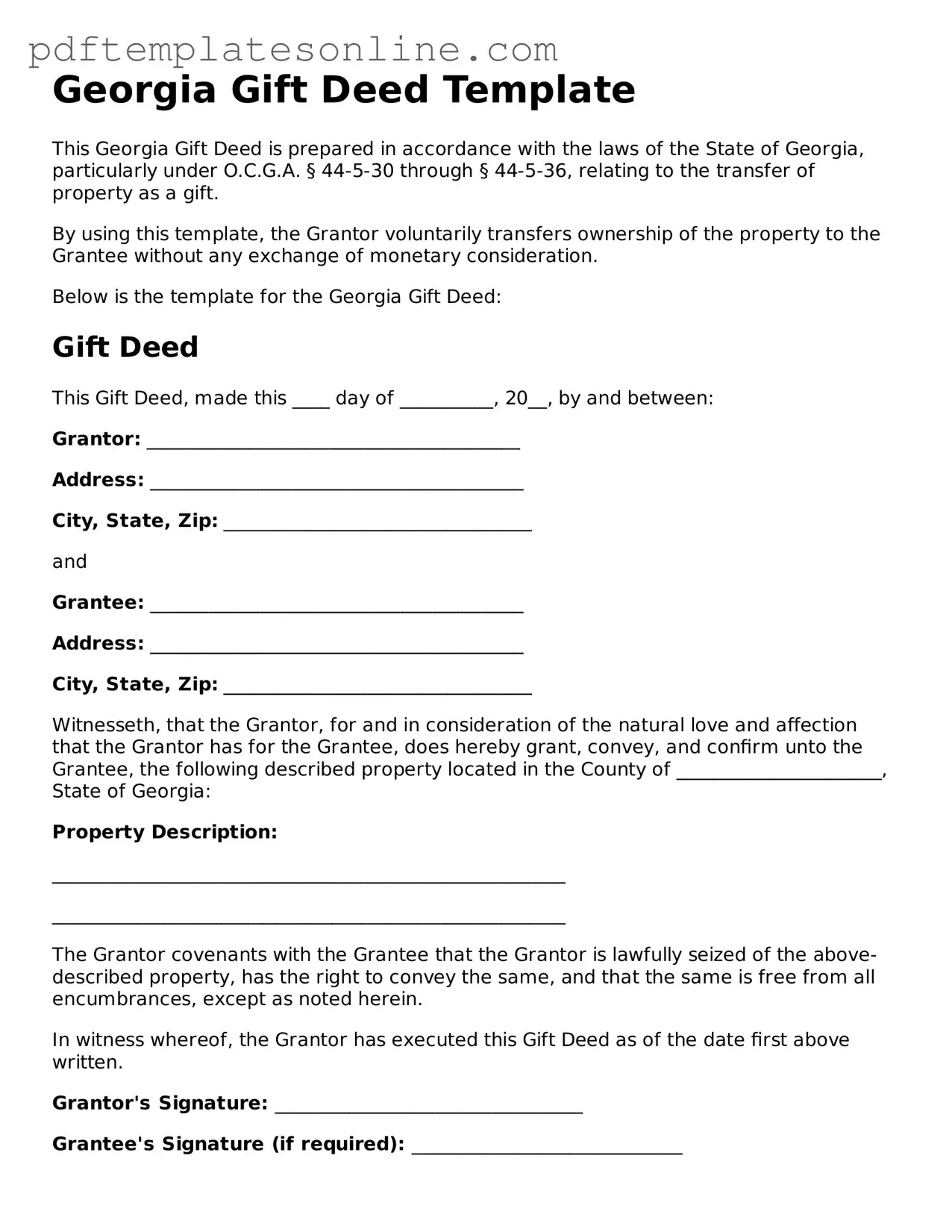

Official Georgia Gift Deed Document

Key takeaways

When filling out and using the Georgia Gift Deed form, there are several important points to keep in mind. These key takeaways can help ensure that the process is smooth and legally sound.

- Understand the Purpose: A Gift Deed is used to transfer property ownership without any exchange of money. It is essential to know that this is a voluntary transfer.

- Complete the Form Accurately: Ensure all required fields are filled out correctly. This includes the names of the donor and recipient, property description, and any necessary signatures.

- Consider Tax Implications: Gifting property may have tax consequences for both the giver and receiver. Consulting with a tax professional can provide clarity on potential gift taxes.

- File the Deed Appropriately: After completing the Gift Deed, it must be filed with the county clerk's office where the property is located. This step is crucial for the transfer to be legally recognized.

Common mistakes

Filling out the Georgia Gift Deed form can be a straightforward process, but there are common mistakes that individuals often make. One frequent error is not providing complete and accurate information about the property being gifted. It is essential to include the correct legal description of the property, which typically can be found on the property deed. Omitting this information can lead to confusion and potential legal complications down the line.

Another mistake involves the identification of the parties involved. The form requires the full names of both the donor (the person giving the gift) and the recipient (the person receiving the gift). Failing to use the correct names or including nicknames can create issues regarding the validity of the deed. Ensuring that the names match those on official identification documents is crucial.

People often overlook the importance of signatures. The Gift Deed must be signed by the donor, and in some cases, it may also require the signature of a witness. Neglecting to sign the document or not having the necessary witnesses present can invalidate the deed. It is advisable to review the signature requirements carefully before submitting the form.

Additionally, individuals may not properly understand the implications of the gift. Some may assume that a verbal agreement is sufficient, but a Gift Deed must be executed in writing to be legally binding. Not recognizing this can lead to disputes or misunderstandings between the parties involved. It is important to have a clear understanding of the transaction and its consequences.

Finally, failing to record the Gift Deed with the appropriate county office is a common oversight. Recording the deed is essential to ensure that the gift is recognized legally and to protect the recipient's ownership rights. Without proper recording, the gift may not be enforceable against third parties. Taking the time to file the deed correctly can prevent future complications.

Misconceptions

Understanding the Georgia Gift Deed form is essential for anyone considering transferring property as a gift. However, several misconceptions can lead to confusion. Here are five common misunderstandings about the Georgia Gift Deed:

- Gift Deeds Are Only for Family Members: Many believe that gift deeds can only be used to transfer property to family members. In reality, a gift deed can be executed between any two parties, regardless of their relationship.

- Gift Deeds Are Not Legally Binding: Some people think that a gift deed lacks legal weight. However, when properly executed and recorded, a gift deed is a legally binding document that transfers ownership of the property.

- Tax Implications Do Not Exist: A common misconception is that transferring property as a gift incurs no tax consequences. In fact, the IRS may impose gift taxes if the value of the gift exceeds a certain threshold.

- Only Real Estate Can Be Transferred: Many assume that gift deeds apply solely to real estate. While they are commonly used for real property, gift deeds can also be used for other types of assets, such as vehicles or personal property.

- A Gift Deed Cannot Be Revoked: Some believe that once a gift deed is executed, it cannot be undone. In truth, a donor may revoke a gift deed before the transfer is completed, provided they follow the appropriate legal procedures.

Clarifying these misconceptions can help individuals make informed decisions about property transfers in Georgia.

Dos and Don'ts

When filling out the Georgia Gift Deed form, it's essential to follow certain guidelines to ensure the process goes smoothly. Here are five things you should and shouldn't do:

- Do: Double-check all names and addresses for accuracy.

- Do: Clearly describe the property being gifted, including its legal description.

- Do: Sign the form in the presence of a notary public.

- Do: Keep a copy of the completed form for your records.

- Do: Consult with a legal professional if you have questions about the process.

- Don't: Leave any sections of the form blank; incomplete forms can cause delays.

- Don't: Use vague language when describing the property.

- Don't: Forget to date the form at the time of signing.

- Don't: Attempt to fill out the form under duress or without the donor's consent.

- Don't: Ignore local regulations that may affect the gift deed process.

Browse Popular Gift Deed Forms for US States

How to Add Name to House Title in California - This form is essential for gifting real estate to another individual.

The California firearm bill of sale document is necessary for individuals looking to formally establish the ownership transfer of a firearm in California. This official form facilitates compliance with local regulations while providing both parties with essential evidence of the transaction.

Detailed Guide for Writing Georgia Gift Deed

Completing the Georgia Gift Deed form is an important step in transferring property ownership without a sale. After filling out the form, you will need to ensure that it is properly signed, notarized, and filed with the appropriate county office to make the transfer official.

- Obtain the Form: Download the Georgia Gift Deed form from a reliable source or acquire a physical copy from a legal office.

- Identify the Grantor: Enter the full name and address of the person giving the gift (the grantor).

- Identify the Grantee: Fill in the full name and address of the person receiving the gift (the grantee).

- Describe the Property: Provide a clear description of the property being gifted, including the address and any relevant legal descriptions.

- Include Consideration: Indicate the amount of consideration, if any, being exchanged for the property. In a gift deed, this is typically a nominal amount.

- Sign the Document: The grantor must sign the form in the presence of a notary public. Ensure that the notary public also signs and stamps the document.

- File the Deed: Submit the completed and notarized Gift Deed form to the county clerk’s office where the property is located. Pay any applicable recording fees.