Official Georgia Deed in Lieu of Foreclosure Document

Key takeaways

Filling out and using the Georgia Deed in Lieu of Foreclosure form can be a critical step for homeowners facing foreclosure. Here are key takeaways to keep in mind:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to transfer property ownership to the lender to avoid foreclosure proceedings.

- Eligibility Requirements: Not all homeowners qualify. Ensure you meet the lender's criteria before proceeding.

- Consult with Professionals: It's advisable to seek guidance from a real estate attorney or a housing counselor to navigate the process smoothly.

- Document Preparation: Gather all necessary documents, including the mortgage agreement and any correspondence with the lender.

- Complete the Form Accurately: Fill out the Deed in Lieu of Foreclosure form carefully. Mistakes can delay the process or lead to rejection.

- Negotiate Terms: Before signing, discuss any potential deficiencies or obligations with your lender to avoid future liabilities.

- Consider Tax Implications: Transferring your property may have tax consequences. Consult a tax advisor to understand your obligations.

- Submit the Form Promptly: Time is of the essence. Submit the completed form to your lender as soon as possible to expedite the process.

- Keep Copies: Retain copies of all documents submitted and received. This is crucial for your records and any future disputes.

Taking these steps can help ensure a smoother transition and mitigate some of the stress associated with foreclosure. Act quickly and stay informed throughout the process.

Common mistakes

When filling out the Georgia Deed in Lieu of Foreclosure form, many individuals make critical errors that can complicate the process. One common mistake is failing to provide accurate property descriptions. The legal description must match what is recorded in the county records. If it doesn't, the deed may be deemed invalid.

Another frequent error is neglecting to include all necessary signatures. Both the borrower and the lender must sign the document for it to be legally binding. Missing a signature can lead to delays or even the rejection of the deed.

People often overlook the need for notarization. The deed must be notarized to ensure its authenticity. Without a notary's seal, the document may not hold up in court, potentially leaving the borrower still liable for the mortgage.

Many individuals also fail to understand the implications of the deed. They might assume it absolves them of all debt, but this is not always the case. It’s crucial to clarify whether any deficiency judgments can still be pursued by the lender after the deed is executed.

Another mistake is not providing a full financial disclosure. Lenders typically require a complete picture of the borrower's financial situation. Omitting details can lead to misunderstandings and may affect the lender's decision.

People sometimes rush through the form, leading to typographical errors. Simple mistakes, like misspelled names or incorrect dates, can cause significant issues. Take the time to review the document thoroughly before submission.

Additionally, failing to communicate with the lender can be detrimental. Some borrowers submit the deed without confirming that the lender is willing to accept it. Open communication can prevent unnecessary complications.

Individuals may also ignore the tax implications of a deed in lieu of foreclosure. It's essential to consult with a tax advisor to understand how this action may affect tax liability, as it could result in taxable income.

Lastly, not keeping copies of all submitted documents is a common oversight. Always retain copies for personal records. This documentation can be crucial if any disputes arise in the future.

By avoiding these mistakes, individuals can navigate the Deed in Lieu of Foreclosure process more effectively. Careful attention to detail and open communication with all parties involved are key to a smoother transition.

Misconceptions

The Georgia Deed in Lieu of Foreclosure form is often misunderstood. Here are six common misconceptions that need clarification:

-

It eliminates all debt associated with the property.

Many believe that signing a deed in lieu means they will no longer owe any money. However, this is not always the case. If there are other liens or obligations tied to the property, those may still remain even after the deed is transferred.

-

It is the same as a foreclosure.

While both processes involve relinquishing ownership, they are not identical. A deed in lieu is a voluntary agreement between the borrower and lender, whereas foreclosure is a legal process initiated by the lender.

-

It can be completed without lender approval.

This is a significant misconception. Lenders must agree to the deed in lieu process. They will review the borrower’s financial situation and the property’s value before granting approval.

-

It will not affect credit scores.

Contrary to popular belief, a deed in lieu of foreclosure can impact credit scores. It is typically reported to credit bureaus and may be viewed negatively by future lenders.

-

It is a quick solution to avoid foreclosure.

While it may seem like a faster option, the process can take time. Negotiating with the lender and completing necessary paperwork can delay resolution.

-

It absolves the borrower from all legal responsibilities.

Even after a deed in lieu is executed, borrowers may still be held accountable for certain obligations, such as property taxes or homeowner association fees that accrued before the transfer.

Dos and Don'ts

When filling out the Georgia Deed in Lieu of Foreclosure form, it’s important to be careful and thorough. Here are ten things to keep in mind:

- Do ensure that all information is accurate and complete.

- Don't rush through the form; take your time to review each section.

- Do provide clear and legible signatures where required.

- Don't leave any fields blank unless instructed to do so.

- Do consult with a legal expert if you have questions about the process.

- Don't ignore any deadlines related to submitting the form.

- Do keep copies of the completed form for your records.

- Don't submit the form without double-checking for errors.

- Do make sure all parties involved understand the implications of signing.

- Don't sign the form under pressure; ensure you are making an informed decision.

Browse Popular Deed in Lieu of Foreclosure Forms for US States

Deed in Lieu Vs Foreclosure - This solution might be quicker than going through a lengthy short sale process.

Deed in Lieu of Mortgage - Homeowners must disclose any relevant financial information to their lender to facilitate the process.

California Pre-foreclosure Property Transfer - This option can provide a clean way out of homeownership for those who can no longer afford their mortgage payments.

In California, having the proper documentation in place is crucial for healthcare decision-making, which is why utilizing resources such as California PDF Forms can help individuals effectively navigate the process of creating a Medical Power of Attorney. This ensures that their preferences are honored and that they have designated a trusted person to act on their behalf when they are unable to communicate their healthcare wishes.

Deed in Lieu of Foreclosure Pa - Homeowners need to ensure all terms of the deed are clearly defined before finalizing the transfer.

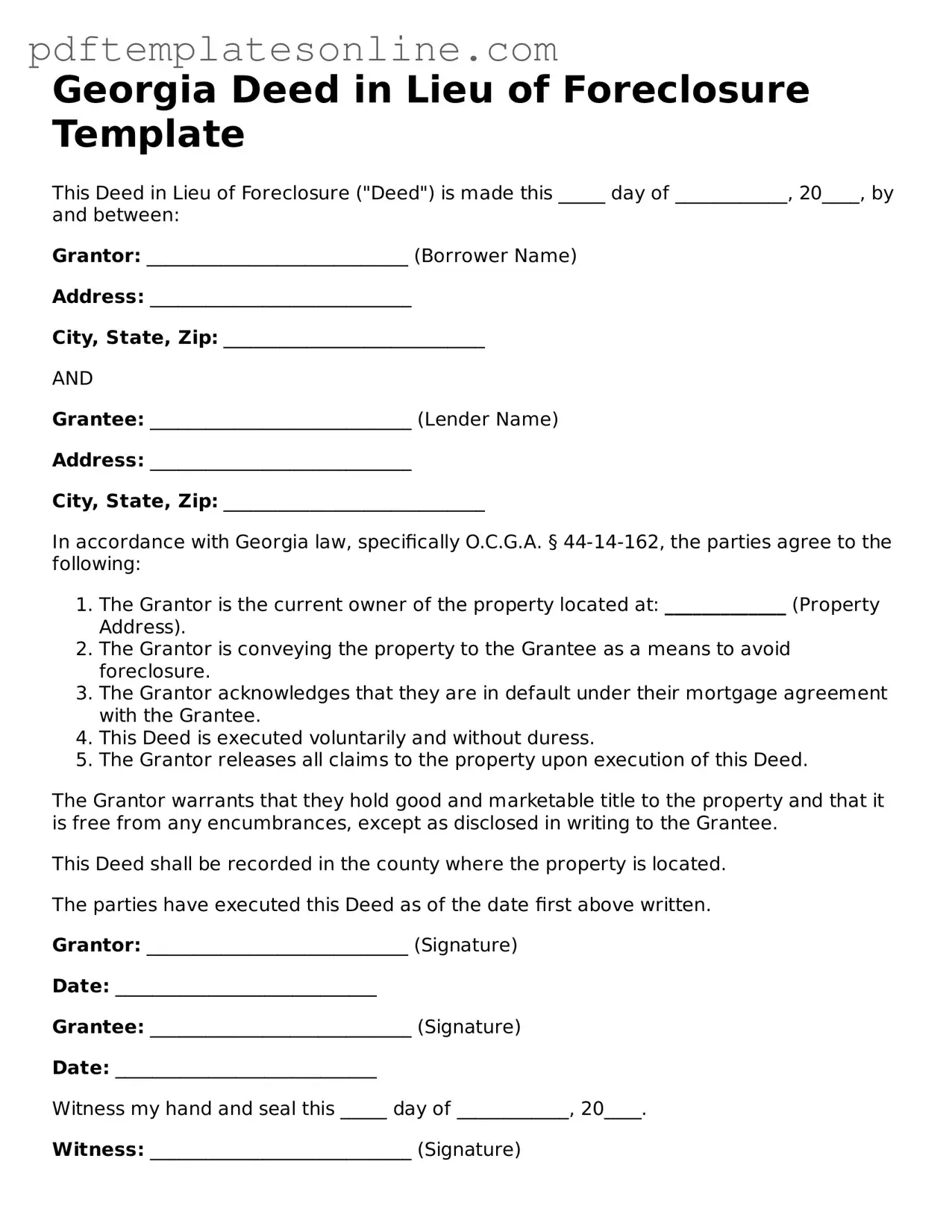

Detailed Guide for Writing Georgia Deed in Lieu of Foreclosure

After completing the Georgia Deed in Lieu of Foreclosure form, the next step involves submitting it to the appropriate parties, which may include the lender and local government office. Ensure that all necessary copies are made for your records. Follow the steps below to accurately fill out the form.

- Obtain the Georgia Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the date at the top of the form.

- Enter the name of the borrower as it appears on the mortgage documents.

- Provide the borrower's address, including city, state, and zip code.

- List the lender's name and address in the designated section.

- Include a description of the property, including the street address and legal description.

- State the reason for the deed in lieu of foreclosure in the specified area.

- Sign the form in the designated area, ensuring that the signature matches the name provided earlier.

- Have the signature notarized by a licensed notary public.

- Make copies of the completed form for personal records and any required parties.