Official Georgia Deed Document

Key takeaways

When filling out and using the Georgia Deed form, keep the following key points in mind:

- Accurate Information: Ensure all names, addresses, and property details are correct. Errors can lead to legal complications.

- Signatures Required: All parties involved in the transaction must sign the deed. Notarization is also necessary to validate the document.

- Recording the Deed: After completion, the deed must be recorded with the county clerk's office. This step protects ownership rights.

- Consult Legal Advice: Consider seeking legal guidance to navigate any complexities and ensure compliance with state laws.

Common mistakes

Filling out a Georgia Deed form can seem straightforward, yet many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to include the correct legal description of the property. This description should not only identify the property but also be precise enough to avoid any ambiguity. Without an accurate legal description, the deed may not be enforceable, leading to potential disputes over ownership.

Another mistake often encountered is neglecting to properly sign the deed. In Georgia, the signatures of both the grantor (the person transferring the property) and the grantee (the person receiving the property) are required. Additionally, if the grantor is a corporation or other entity, the deed must be signed by an authorized representative. Missing a signature can render the deed invalid, complicating the transfer process.

People also frequently overlook the necessity of having the deed notarized. A deed must be signed in the presence of a notary public to be legally binding. This step serves as a safeguard against fraud and ensures that the identities of the parties involved are verified. Without notarization, the deed may not hold up in court, which can create significant issues for both the buyer and the seller.

Incorrectly identifying the type of deed being used is another common pitfall. There are various types of deeds, such as warranty deeds and quitclaim deeds, each serving different purposes. Choosing the wrong type can lead to misunderstandings about the rights and responsibilities being transferred. For example, a warranty deed provides guarantees about the title, while a quitclaim deed does not. This distinction is crucial and should not be overlooked.

Finally, many individuals fail to consider the implications of tax assessments and recording fees associated with the deed. After filling out the deed form, it is essential to understand the local requirements for recording the deed with the county. Ignoring these fees can result in delays or even the inability to complete the property transfer. Being aware of all associated costs and procedures is vital for a smooth transaction.

Misconceptions

Understanding the Georgia Deed form can be challenging due to various misconceptions. Here’s a list of common misunderstandings about the form:

- All deeds are the same. Many people think that all deeds are interchangeable. In reality, different types of deeds serve different purposes, such as warranty deeds and quitclaim deeds.

- A deed must be notarized to be valid. While notarization is important for many legal documents, not all deeds require notarization in Georgia to be valid. However, it is highly recommended.

- You can use a deed without legal advice. Some believe they can fill out a deed without any legal guidance. However, it’s wise to consult with a legal expert to avoid errors that could cause issues later.

- All property transfers require a new deed. Some think that every transfer of property ownership necessitates a new deed. In certain cases, existing deeds can be amended or updated instead.

- Deeds are only needed for selling property. Many assume that deeds are only necessary when selling property. However, they are also required for gifting property or transferring ownership for other reasons.

- The Georgia Deed form is the same for all counties. Some people believe that the deed form is uniform across Georgia. In fact, different counties may have specific requirements or variations.

- Once a deed is signed, it cannot be changed. A common misconception is that signed deeds are set in stone. In reality, deeds can be modified or revoked under certain conditions.

- Only a lawyer can prepare a deed. While lawyers can certainly prepare deeds, individuals can also create them, provided they understand the necessary elements and requirements.

- Property taxes are not affected by the deed. Some believe that changing the deed has no impact on property taxes. However, changes in ownership can trigger reassessments and adjustments in tax obligations.

- Deeds do not need to be recorded. Many think that recording a deed is optional. In Georgia, recording is crucial for protecting ownership rights and providing public notice of the transfer.

Being aware of these misconceptions can help individuals navigate the process of property transfer in Georgia more effectively.

Dos and Don'ts

When filling out the Georgia Deed form, it's essential to be careful and precise. Here are some important dos and don'ts to keep in mind:

- Do double-check all names and addresses for accuracy.

- Do ensure the legal description of the property is complete and correct.

- Do have the form notarized to validate the deed.

- Do keep a copy of the completed deed for your records.

- Do consult with a legal professional if you have questions.

- Don't leave any blank spaces on the form; fill in all required fields.

- Don't use white-out or erase any mistakes; instead, cross them out and initial.

- Don't sign the form until you are in front of a notary.

- Don't rush through the process; take your time to ensure everything is correct.

- Don't forget to pay any applicable recording fees when submitting the deed.

Browse Popular Deed Forms for US States

House Deed Template - Document for formalizing changes in property ownership structure.

How Do I Get a Copy of My House Title in California - A deed can detail the sale price of the property being transferred.

Release of Dower Rights Ohio Form - Might include a warranty or guarantee of title validity.

House Deed Sample - Must be signed and notarized to be legally binding.

Detailed Guide for Writing Georgia Deed

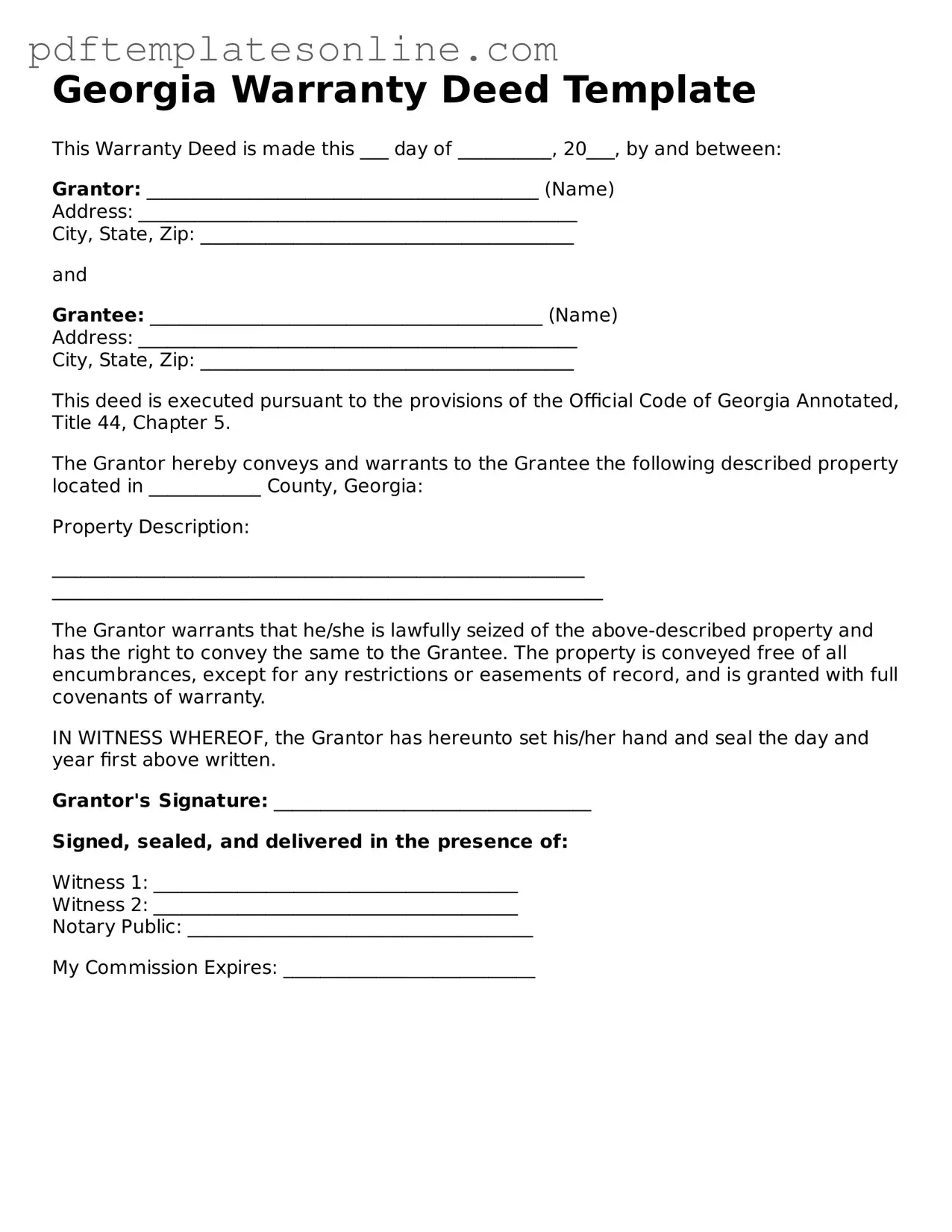

After obtaining the Georgia Deed form, you will need to complete it accurately to ensure the transfer of property is legally recognized. Follow these steps to fill out the form correctly.

- Identify the Grantor: Write the full name of the person or entity transferring the property. Ensure the name matches official documents.

- Identify the Grantee: Enter the full name of the person or entity receiving the property. Again, use the exact name as it appears on legal documents.

- Provide Property Description: Clearly describe the property being transferred. Include the address and any legal description if available.

- State the Consideration: Indicate the amount paid for the property, or state if the transfer is a gift.

- Sign the Document: The grantor must sign the deed in the presence of a notary public. Ensure the signature is clear and legible.

- Notarization: Have the notary public complete their section, confirming the identity of the grantor and witnessing the signature.

- File the Deed: Submit the completed deed to the appropriate county office for recording. Check for any filing fees that may apply.