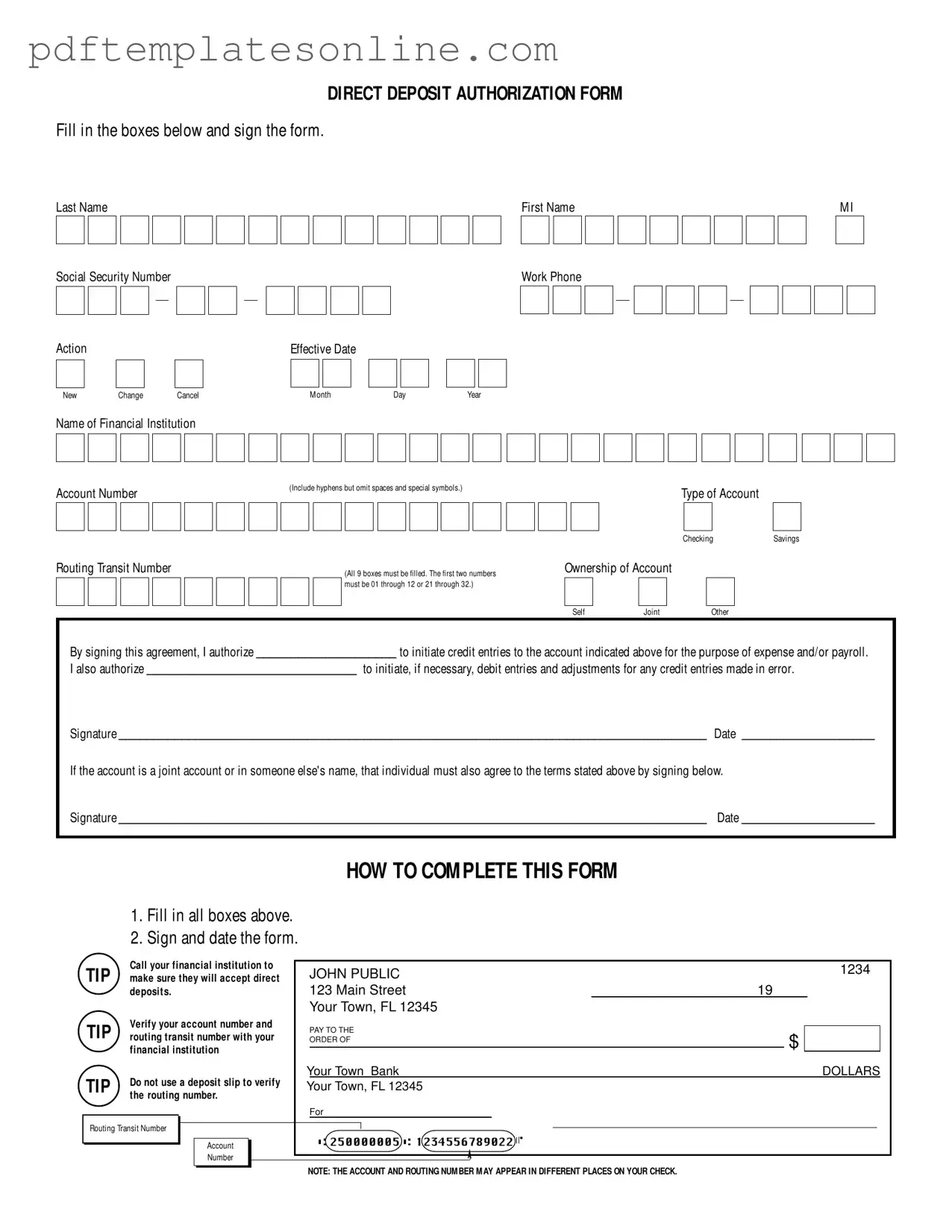

Blank Generic Direct Deposit Form

Key takeaways

When filling out the Generic Direct Deposit form, keep these key points in mind:

- Complete All Sections: Ensure that every box is filled out accurately. Missing information can delay the processing of your direct deposit.

- Verify Your Information: Double-check your account number and routing transit number with your financial institution. This step is crucial to avoid errors.

- Sign and Date: Don’t forget to sign and date the form. Your signature is necessary to authorize the direct deposit.

- Contact Your Bank: Before submitting, call your financial institution to confirm that they accept direct deposits. This can save you time and frustration.

- Joint Accounts: If the account is joint or in someone else's name, that person must also sign the form. Both signatures are required for authorization.

Following these steps will help ensure a smooth process for setting up your direct deposit.

Common mistakes

Filling out a Generic Direct Deposit form may seem straightforward, but many people make mistakes that can delay payments or cause other issues. One common error is failing to fill in all required fields. Each box on the form must be completed, including the last name, first name, Social Security number, and account details. Missing even a single box can lead to processing delays.

Another frequent mistake involves providing incorrect account numbers. It’s essential to double-check the account number and the routing transit number with the financial institution. Misplacing a digit or omitting a hyphen can result in funds being deposited into the wrong account. Always verify these numbers before submitting the form.

People often neglect to sign and date the form. A signature is a critical component that authorizes the financial institution to process the direct deposit. Without it, the form is incomplete, and the request cannot be processed. Ensure that both the employee and, if necessary, the joint account holder sign the form.

Some individuals use deposit slips to verify their account and routing numbers, which is not advisable. The routing number may not be correctly represented on a deposit slip. Instead, it is better to contact the financial institution directly to confirm these details.

Another mistake occurs when individuals do not indicate the type of account correctly. The form requires you to specify whether the account is a checking or savings account. Failing to do so can lead to confusion and misdirected deposits.

People sometimes overlook the effective date of the change or new deposit. Not specifying when the direct deposit should start can result in payments being delayed. It is crucial to clearly indicate the desired effective date to avoid interruptions in payroll or other payments.

Additionally, individuals may forget to include information about the ownership of the account. If the account is joint or in someone else's name, the other account holder must also sign the form. Neglecting to do this can lead to complications in processing the deposit.

Another common error is not following the instructions provided on the form. The form includes specific tips and instructions that can help avoid mistakes. Ignoring these can result in unnecessary errors that could have been easily prevented.

Finally, some individuals fail to communicate with their employer or payroll department about the changes. It’s important to notify the relevant parties that a new direct deposit form has been submitted. This ensures that everyone is aware of the change and can update their records accordingly.

Misconceptions

- Misconception 1: The form is only for payroll deposits.

- Misconception 2: You can skip filling out some boxes.

- Misconception 3: Only one signature is needed.

- Misconception 4: The routing number is not important.

- Misconception 5: You can use a deposit slip to verify your account information.

- Misconception 6: The form does not need to be signed in person.

Many people believe that the Generic Direct Deposit form is only used for payroll deposits. In reality, it can also be used for expense reimbursements and other types of payments.

Some individuals think they can leave certain boxes blank. However, it is crucial to fill in all boxes to avoid delays or errors in processing your deposit.

People often assume that only the primary account holder's signature is required. If the account is a joint account, the other account holder must also sign the form.

Many underestimate the importance of the routing number. This number is essential for directing funds to the correct bank and must be accurate to ensure timely deposits.

Some believe that a deposit slip is an acceptable way to confirm their routing number. However, it is recommended to contact your financial institution directly for the most accurate information.

There is a common belief that the form can be submitted without a physical signature. To ensure validity, the form must be signed by the account holder(s) in person.

Dos and Don'ts

When filling out the Generic Direct Deposit form, follow these guidelines to ensure accuracy and efficiency.

- Do fill in all boxes completely. Missing information can delay processing.

- Do sign and date the form to validate your authorization.

- Do verify your account number and routing transit number with your financial institution.

- Do confirm that your financial institution accepts direct deposits.

- Don't use a deposit slip to verify the routing number; this can lead to errors.

- Don't omit any details, especially on the routing transit number, as it must be complete.

- Don't forget to include hyphens in your account number where required.

- Don't assume that a joint account does not require both parties' signatures; both must agree.

Other PDF Forms

Blank 1750 - This form helps document the contents of shipped boxes for better tracking and accountability.

Hunting Liability Waiver Template - This document is designed to ensure all parties understand their rights and responsibilities on the leased land.

Employee Corrective Action Form - The date of the warning decision is also included.

Detailed Guide for Writing Generic Direct Deposit

Filling out the Generic Direct Deposit form is a straightforward process. Once completed, this form will allow your employer or other entities to deposit funds directly into your bank account. Ensure that you have all necessary information on hand before you start. Here are the steps to guide you through the process.

- Write your last name, first name, and middle initial in the designated boxes.

- Enter your Social Security Number in the specified format (###-##-####).

- Select the action you are taking: New, Change, or Cancel.

- Fill in the effective date using the format Month/Day/Year.

- Provide your work phone number in the format (###-###-####).

- Write the name of your financial institution in the appropriate box.

- Fill in your account number, including hyphens, and omit any spaces or special symbols.

- Indicate the type of account by checking either Savings or Checking.

- Enter your routing transit number, ensuring all 9 boxes are filled correctly.

- Select your ownership of the account by checking Self, Joint, or Other.

- Sign and date the form to authorize the direct deposit.

- If applicable, have the other account holder sign and date the form as well.

Once you have completed these steps, double-check all entries for accuracy. It’s advisable to contact your financial institution to confirm that they accept direct deposits and to verify your account and routing numbers. This ensures a smooth process for receiving your funds.