Fillable General Bill of Sale Document

Key takeaways

Filling out and using a General Bill of Sale form is a straightforward process, but it is essential to understand its key components and implications. Here are ten important takeaways:

- Purpose: A General Bill of Sale serves as a legal document that records the transfer of ownership of personal property from one individual to another.

- Details Matter: Ensure that all relevant details, such as the names of the buyer and seller, the date of the transaction, and a description of the item being sold, are included.

- Item Description: Provide a clear and accurate description of the item, including any serial numbers or unique identifiers, to avoid disputes later.

- Payment Information: Specify the payment amount and method. This can include cash, check, or other forms of payment.

- As-Is Condition: State whether the item is sold "as-is," meaning the buyer accepts the item in its current condition without warranties.

- Signatures Required: Both the buyer and seller must sign the document to validate the transaction. This signature confirms agreement to the terms outlined in the Bill of Sale.

- Witness or Notary: Depending on state laws, having a witness or notary public can add an extra layer of authenticity to the document.

- Record Keeping: Keep a copy of the Bill of Sale for personal records. This serves as proof of the transaction and can be useful for future reference.

- State Laws: Be aware that different states may have specific requirements for a Bill of Sale, so check local regulations to ensure compliance.

- Tax Implications: Consider any tax obligations that may arise from the sale. This may include sales tax or reporting the sale on income tax returns.

Common mistakes

When completing a General Bill of Sale form, individuals often overlook important details that can lead to complications. One common mistake is failing to provide accurate information about the buyer and seller. Each party's full name, address, and contact information should be clearly stated. Missing or incorrect details can create confusion and potential disputes later on.

Another frequent error is neglecting to describe the item being sold in sufficient detail. A vague description can lead to misunderstandings about the condition and specifications of the item. It's essential to include information such as the make, model, year, and any identifying numbers, like a Vehicle Identification Number (VIN) for vehicles. This clarity helps both parties understand exactly what is being transferred.

Some individuals forget to include the sale price. This is a crucial element of the General Bill of Sale, as it establishes the financial terms of the transaction. Without a stated price, it may be challenging to prove the value of the item for tax purposes or in the event of a dispute.

Additionally, people often overlook the importance of signatures. Both the buyer and seller must sign the document for it to be legally binding. Failing to obtain signatures can invalidate the sale, leaving both parties without legal recourse if issues arise later.

Another mistake involves not keeping a copy of the completed Bill of Sale. After the form is filled out and signed, it is vital for both parties to retain a copy for their records. This document serves as proof of the transaction and can be necessary for future reference, especially if questions about ownership or condition arise.

Finally, individuals sometimes forget to check local laws regarding the Bill of Sale. Requirements can vary by state or municipality, and some areas may have specific rules about what must be included or how the document should be formatted. Ignoring these regulations can lead to issues with the validity of the sale.

Misconceptions

Many people have misconceptions about the General Bill of Sale form. Understanding these misconceptions can help individuals navigate transactions more effectively. Here are eight common misunderstandings:

-

Misconception: A Bill of Sale is only for vehicles. Many believe that a Bill of Sale is exclusively used for cars or motorcycles. In reality, it can be used for various personal property transactions, including furniture, electronics, and even livestock.

-

Misconception: A Bill of Sale is not legally binding. Some think that a Bill of Sale holds no legal weight. However, when properly completed and signed, it serves as a legally binding document that can protect both the buyer and seller.

-

Misconception: You don’t need a Bill of Sale for private sales. Many assume that private sales do not require documentation. In fact, having a Bill of Sale is advisable to provide proof of the transaction and to clarify the terms agreed upon.

-

Misconception: A verbal agreement is enough. Some believe that a verbal agreement suffices in a sale. This is risky. A Bill of Sale documents the agreement and can prevent disputes later on.

-

Misconception: A Bill of Sale is only necessary for expensive items. People often think that only high-value transactions require a Bill of Sale. However, it is wise to use one for any transaction to ensure clarity and protection, regardless of the item's value.

-

Misconception: You can create a Bill of Sale without any specific details. Some think that a simple statement of sale suffices. In truth, a Bill of Sale should include detailed information about the item, the parties involved, and the terms of the sale.

-

Misconception: A Bill of Sale is only needed at the time of sale. Many believe that the document is only necessary during the transaction. However, retaining a copy for future reference is important, as it can be useful for tax purposes or in case of disputes.

-

Misconception: You can use any template found online. While templates are available, not all are suitable for every situation. It's crucial to ensure that the template complies with state laws and covers all necessary details specific to the transaction.

By addressing these misconceptions, individuals can approach their transactions with greater confidence and clarity.

Dos and Don'ts

When filling out a General Bill of Sale form, it’s important to follow certain guidelines to ensure that the document is accurate and legally binding. Below is a list of things you should and shouldn't do during this process.

- Do provide complete and accurate information about the buyer and seller.

- Do describe the item being sold in detail, including any identifying information such as serial numbers.

- Do include the date of the transaction to establish a clear timeline.

- Do ensure that both parties sign the document to validate the agreement.

- Do keep a copy of the signed Bill of Sale for your records.

- Don't leave any fields blank; incomplete forms can lead to confusion or disputes later.

- Don't use vague language; be specific about the terms of the sale.

- Don't forget to include payment details, such as the amount paid and the payment method.

- Don't rush through the process; take your time to ensure all information is correct.

Browse Common Types of General Bill of Sale Templates

Heavy Equipment Bill of Sale - Acceptance of the Equipment Bill of Sale confirms both parties agree on the terms of the sale.

Business Sale Agreement Template - This document allows sellers to transfer existing contracts with clients or suppliers to the new owner.

Detailed Guide for Writing General Bill of Sale

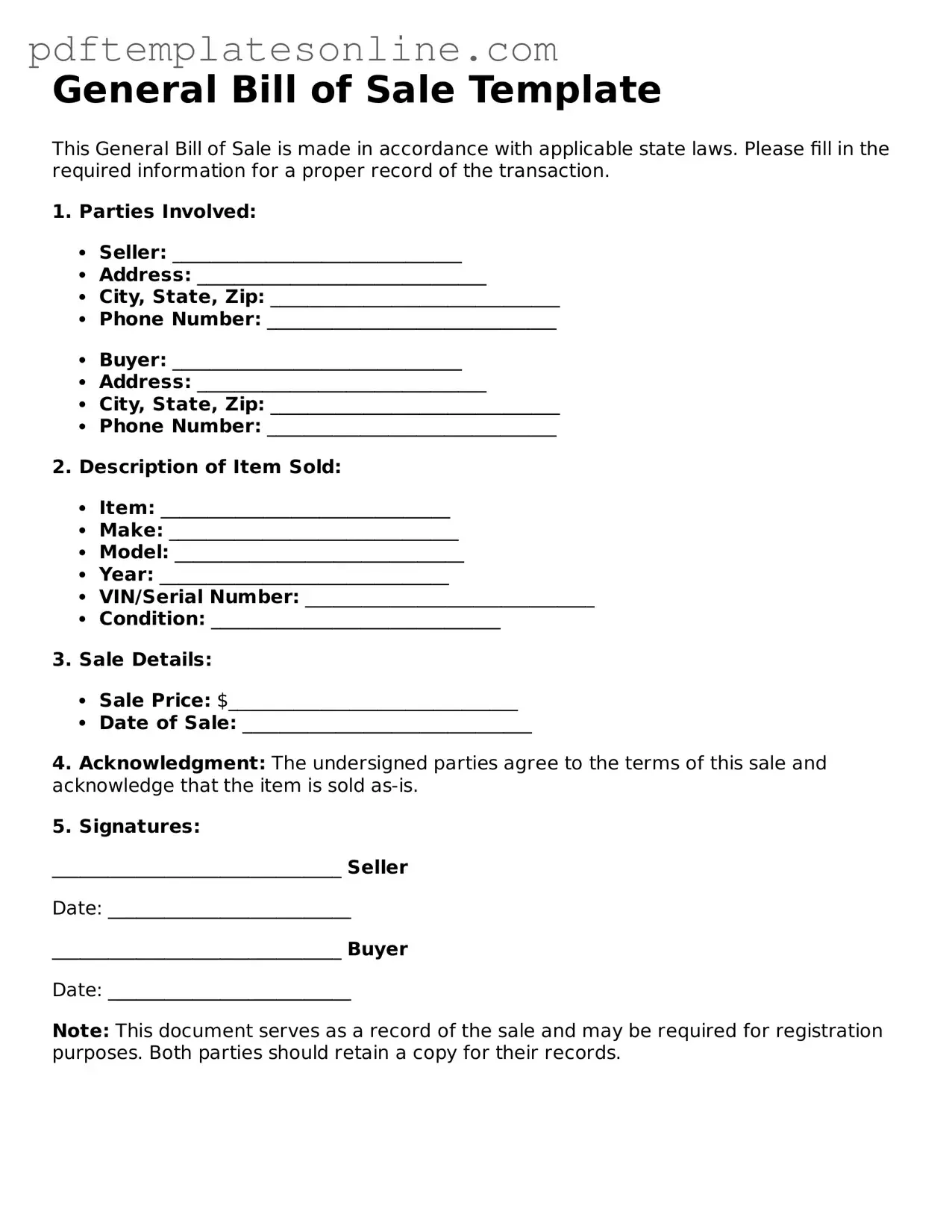

Filling out a General Bill of Sale form is a straightforward process that helps document the sale of an item between a buyer and a seller. Once completed, this form serves as a record of the transaction, ensuring that both parties have a clear understanding of the agreement. Here’s how to fill it out step by step.

- Obtain the form: You can find a General Bill of Sale form online or at local offices that deal with vehicle or property transactions.

- Enter the date: Write the date of the transaction at the top of the form.

- Provide seller information: Fill in the seller's name, address, and contact information. Ensure all details are accurate.

- Provide buyer information: Similarly, enter the buyer's name, address, and contact information.

- Describe the item: Clearly describe the item being sold. Include details like make, model, year, and any identification numbers, such as a VIN for vehicles.

- State the purchase price: Write down the agreed-upon price for the item. Make sure this amount is clear and accurate.

- Sign the form: Both the seller and the buyer should sign the form. This signifies that both parties agree to the terms outlined.

- Make copies: After signing, make copies of the completed form for both the seller and the buyer. Keeping a record is important for future reference.