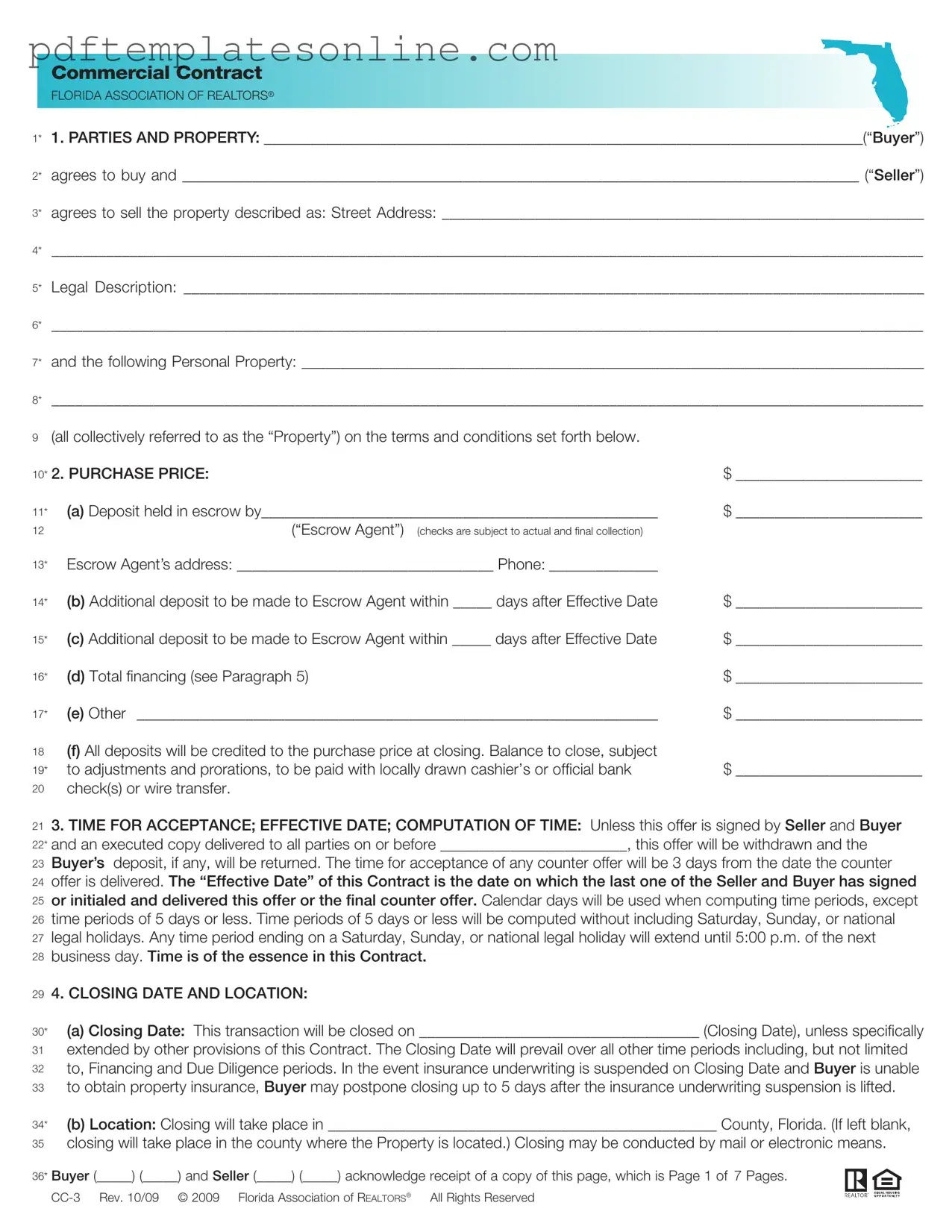

Blank Florida Commercial Contract Form

Key takeaways

Clearly identify the parties involved in the contract. Specify the Buyer and Seller's names, along with the property description, including the street address and legal description.

Outline the purchase price and any deposits required. Include details about the escrow agent and any additional deposits that need to be made after the effective date.

Understand the timeframes for acceptance and counteroffers. Ensure that all parties sign and deliver the contract by the specified deadline to avoid withdrawal of the offer.

Be aware of the closing date and location. The closing date is crucial and may override other time periods. Specify the county for closing and whether it will occur in person or electronically.

Review the financing obligations and conditions. The Buyer must apply for financing within a specified timeframe and notify the Seller of any approval or rejection.

Common mistakes

Filling out the Florida Commercial Contract form can be a complex task. Many people make common mistakes that can lead to misunderstandings or even legal issues down the line. Here are nine mistakes to watch out for when completing this important document.

One frequent error is failing to accurately identify the parties involved. It’s crucial to clearly state the names of both the Buyer and Seller. Leaving out any party’s name or using incorrect names can create confusion and may lead to disputes later. Always double-check that all names are spelled correctly and match the legal documents.

Another common mistake is neglecting to provide a complete property description. The contract requires a detailed legal description of the property being sold. This includes the street address and any additional identifiers. If this section is incomplete or vague, it can complicate the transaction and lead to legal challenges.

Many people also overlook the purchase price section. It’s essential to specify not only the total price but also any deposits and payment schedules. Incomplete or unclear financial terms can create misunderstandings about the obligations of each party, which can lead to disputes over payment expectations.

Timeframes are another area where errors commonly occur. The contract specifies deadlines for acceptance and financing. Missing these deadlines or failing to provide the correct number of days can result in the contract being voided. It’s important to be precise about all timeframes and to remember that time is often of the essence in real estate transactions.

Buyers often forget to include necessary financing details. The contract requires specific information about financing, including loan amounts and interest rates. If this information is missing or incorrect, it could jeopardize the buyer’s ability to secure financing and complete the purchase.

Another mistake is not addressing the condition of the property properly. The contract allows for either an "as is" condition or a due diligence period for inspections. Failing to select one of these options can lead to confusion regarding the buyer's rights and responsibilities concerning property condition.

People also sometimes neglect to consider the closing date and location. It’s vital to specify when and where the closing will take place. Leaving this section blank or vague can lead to logistical issues that delay the transaction.

Additionally, many overlook the importance of notices. The contract requires that all notices be in writing and sent to specified addresses. Failing to follow this requirement can lead to misunderstandings and missed communications between parties.

Finally, it’s important to remember that the contract is a legally binding document. Many individuals fail to read the entire contract carefully before signing. Ignoring any part of the contract can lead to unintended consequences. Always take the time to review the document thoroughly and consult with a legal professional if needed.

Misconceptions

- Misconception 1: The Florida Commercial Contract form is only for large businesses.

- Misconception 2: Once signed, the contract cannot be changed.

- Misconception 3: The contract guarantees financing.

- Misconception 4: The seller is responsible for all repairs before closing.

- Misconception 5: The buyer can back out of the contract without consequences.

- Misconception 6: The closing date is flexible and can be changed easily.

- Misconception 7: All deposits are non-refundable.

- Misconception 8: The contract does not require any disclosures.

This form is designed for any commercial real estate transaction, regardless of the size of the business involved. Small businesses can also use it effectively.

While the contract is binding once signed, modifications can be made. Any changes must be documented in writing and signed by both parties to be enforceable.

The form includes a provision for financing, but it does not guarantee that financing will be obtained. Buyers must still apply for and secure financing independently.

The contract typically allows for the property to be sold "as is." This means the buyer accepts the property in its current condition, with limited obligations for the seller to make repairs.

If a buyer wishes to cancel the contract after signing, there may be financial penalties, including the loss of deposits. Buyers should understand their obligations before proceeding.

The contract specifies a closing date, which is important for both parties. Changes to this date require mutual agreement and must be documented in writing.

Deposits can be refundable under certain conditions, especially if financing is not obtained or if the contract is canceled according to its terms.

The form includes sections for necessary disclosures, such as property condition and any liens. Both parties must be aware of these to avoid future disputes.

Dos and Don'ts

- Do read the entire contract thoroughly before filling it out. Understanding each section is crucial.

- Don't leave any required fields blank. Missing information can lead to delays or complications.

- Do ensure all parties involved sign and date the contract. This confirms agreement and intent.

- Don't use vague language. Be specific about terms, conditions, and property details to avoid misunderstandings.

- Do keep copies of all documents for your records. This will help in case of disputes or questions later.

- Don't ignore deadlines. Pay attention to dates for deposits, inspections, and other time-sensitive actions.

Other PDF Forms

Driver License Renewal Form Texas - The DL-43 form collects demographic data pertinent to license issuance.

In the realm of property improvement, understanding the nuances of a Mechanics Lien California form is essential for contractors and suppliers alike. This form not only secures payment for services rendered but also serves as a crucial safeguard against financial disputes. For those looking to navigate this process efficiently, resources such as California PDF Forms can provide valuable assistance in drafting and filing the necessary documentation.

Florida Real Estate Forms - The form defines how notices should be sent between the landlord and tenant to ensure communication.

Detailed Guide for Writing Florida Commercial Contract

Completing the Florida Commercial Contract form involves several important steps to ensure accuracy and compliance. The information entered will form the basis of the agreement between the buyer and seller regarding the property transaction. Follow these steps carefully to fill out the form correctly.

- Identify the Parties: Fill in the names of the Buyer and Seller in the designated spaces.

- Property Description: Enter the street address and legal description of the property being sold.

- Personal Property: List any personal property included in the sale, if applicable.

- Purchase Price: Specify the total purchase price, including any deposits and financing details.

- Acceptance and Effective Date: Indicate the deadline for acceptance of the offer and the effective date of the contract.

- Closing Date and Location: Provide the closing date and location where the transaction will take place.

- Financing Information: Detail the terms of any third-party financing, including interest rates and loan amounts.

- Title Information: State how the title will be conveyed and any requirements for title evidence.

- Property Condition: Indicate whether the property is being sold "as is" or if there will be a due diligence period for inspections.

- Closing Procedures: Outline the responsibilities of each party regarding possession, costs, and required documents at closing.

- Escrow Agent: Designate the escrow agent who will hold the deposits and manage the transaction funds.

- Signatures: Ensure that both Buyer and Seller sign and date the contract at the end of the form.

After completing the form, review all entries for accuracy. Both parties should retain copies for their records. It is advisable to consult with a real estate professional or attorney if any questions arise during the process.