Blank Fl Dr 312 Form

Key takeaways

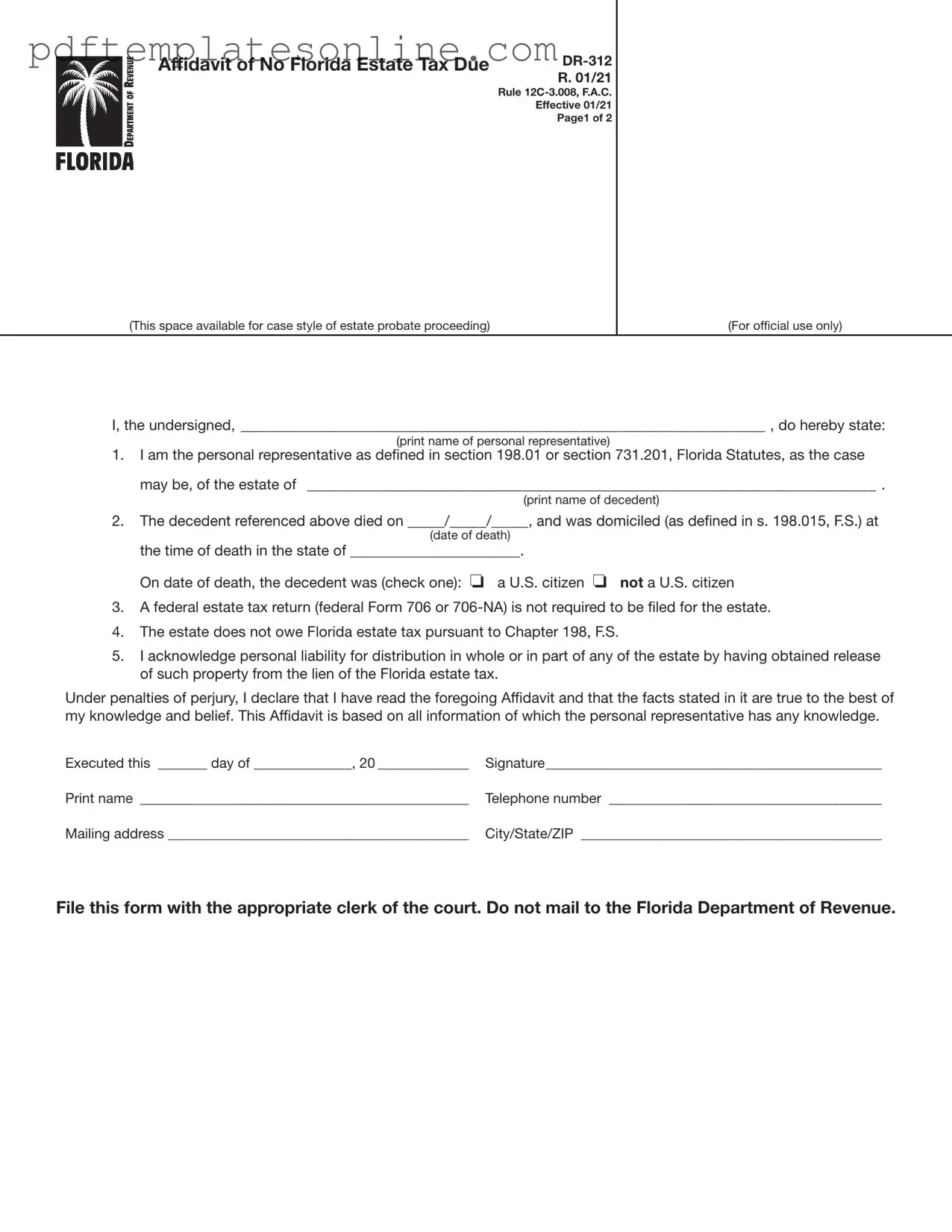

- The Fl Dr 312 form is officially titled the Affidavit of No Florida Estate Tax Due.

- This form must be filed with the clerk of the circuit court in the county where the decedent owned property.

- It is essential to confirm that a federal estate tax return (Form 706 or 706-NA) is not required before using this form.

- The personal representative must accurately state their relationship to the estate and provide the decedent's details.

- The form acknowledges personal liability for distributing estate property after obtaining a release from the Florida estate tax lien.

- It is not permissible to send this form to the Florida Department of Revenue.

- The upper right corner of the form is reserved for the clerk's use; do not mark or write in this space.

- Form DR-312 serves as evidence of nonliability for Florida estate tax, effectively removing any existing tax lien.

- Filing this form will eliminate the need for a Nontaxable Certificate from the Florida Department of Revenue.

Common mistakes

Filling out the FL DR-312 form can be straightforward, but many people make mistakes that can lead to delays or complications. One common error is failing to include the correct name of the decedent. This name must match official documents exactly. Any discrepancies can cause issues when the form is processed.

Another frequent mistake is neglecting to provide the date of death. This date is crucial for establishing the estate's tax status. Without it, the form cannot be validated. Additionally, some individuals forget to check the box indicating whether the decedent was a U.S. citizen. This detail is essential for determining the estate's tax obligations.

Many people also overlook the requirement to sign the affidavit. A missing signature renders the form invalid. Furthermore, not providing accurate contact information can lead to communication issues with the court or tax authorities. It’s vital to ensure that the telephone number and mailing address are correct.

Another pitfall is failing to file the form with the appropriate clerk of the court. Submitting it to the Florida Department of Revenue instead will result in rejection. It’s important to know where to file the form to avoid unnecessary complications.

Some filers mistakenly assume that the DR-312 can be used for estates that are required to file federal Form 706 or 706-NA. This is incorrect. The DR-312 is only for estates that do not need to file these federal forms. Misunderstanding this requirement can lead to significant issues.

Additionally, individuals sometimes forget to include the case style of the estate probate proceeding in the designated space. This omission can delay processing. It's crucial to fill out every part of the form accurately and completely.

Another common error is not double-checking the information before submission. Simple typographical errors can lead to significant delays. Always review the form for accuracy before filing.

Lastly, some filers do not keep a copy of the submitted form for their records. This oversight can create problems later if questions arise regarding the estate's tax status. Maintaining a copy ensures that you have documentation if needed.

By being aware of these common mistakes, you can ensure that your FL DR-312 form is completed accurately and submitted without issues. Take the time to review your submission carefully, and consult with a professional if you have any doubts.

Misconceptions

Here are some common misconceptions about the Florida Form DR-312, also known as the Affidavit of No Florida Estate Tax Due. Understanding these can help clarify the purpose and requirements of the form.

- Misconception 1: The DR-312 form is only for wealthy estates.

- Misconception 2: Filing the DR-312 means you don’t need to worry about taxes at all.

- Misconception 3: The form can be mailed to the Florida Department of Revenue.

- Misconception 4: You can use the DR-312 if a federal estate tax return is required.

- Misconception 5: The DR-312 is only for personal representatives.

- Misconception 6: Once the DR-312 is filed, the estate is free from any future tax issues.

This form can be used by any estate that does not owe Florida estate tax, regardless of its size. If no federal estate tax return is required, this form may apply.

While the form indicates no Florida estate tax is due, it does not exempt the estate from other potential taxes or obligations. Always consider other tax requirements that may apply.

This is incorrect. The DR-312 must be filed directly with the clerk of the circuit court in the county where the decedent owned property. Do not send it to the Department of Revenue.

This form is specifically for estates that do not require a federal estate tax return. If a federal Form 706 or 706-NA is needed, the DR-312 cannot be used.

While personal representatives typically file this form, anyone in actual or constructive possession of the decedent’s property can use it. This broadens the potential users of the form.

Filing the form removes the Florida estate tax lien, but it does not guarantee that the estate will not face tax issues in the future. Ongoing compliance with tax laws is still necessary.

Dos and Don'ts

When filling out the FL DR 312 form, here are eight important dos and don'ts to keep in mind:

- Do ensure that all required fields are completed accurately, including the names and dates.

- Do confirm that you are the personal representative of the estate before signing the affidavit.

- Do file the form directly with the clerk of the circuit court in the appropriate county.

- Do double-check the date of death and decedent's domicile information for accuracy.

- Don't write or mark in the 3-inch by 3-inch space designated for the clerk of the court.

- Don't mail the form to the Florida Department of Revenue; it must be filed in person.

- Don't use this form if a federal estate tax return is required (Form 706 or 706-NA).

- Don't overlook the personal liability acknowledgment; it is a crucial part of the affidavit.

Other PDF Forms

How to Create a Family Crest - A unique symbol embodying a family's aspirations and values.

For those looking to complete their transactions smoothly, a vital resource is the comprehensive Tractor Bill of Sale form that ensures all necessary details are captured effectively. This official document aids in the secure transfer of ownership and is crucial for both buyers and sellers in California. For more information, you can refer to the well-structured Tractor Bill of Sale guidelines.

Durable Power of Attorney Florida - The Vehicle POA form includes spaces for vital details like the owner's information and the agent's identity.

Detailed Guide for Writing Fl Dr 312

After you have gathered all necessary information, you can begin filling out the Fl Dr 312 form. This form is essential for confirming that no Florida estate tax is due for the estate in question. Make sure to provide accurate details as you proceed, as this will ensure a smooth process when submitting the form to the appropriate court.

- Begin by printing your name in the designated space for the personal representative at the top of the form.

- In the next section, write the name of the decedent whose estate you are representing.

- Enter the date of death in the format of month/day/year.

- Indicate the state where the decedent was domiciled at the time of death.

- Check the appropriate box to indicate whether the decedent was a U.S. citizen or not.

- Confirm that a federal estate tax return (Form 706 or 706-NA) is not required for the estate by leaving the statement as is.

- Affirm that the estate does not owe Florida estate tax according to Chapter 198, F.S.

- Sign and date the affidavit on the line provided, ensuring to include the day and month.

- Print your name below your signature.

- Provide your telephone number and mailing address, including city, state, and ZIP code.

Once you have completed the form, file it with the appropriate clerk of the court in the county where the decedent owned property. Ensure that you do not send the form to the Florida Department of Revenue, as it is not required.