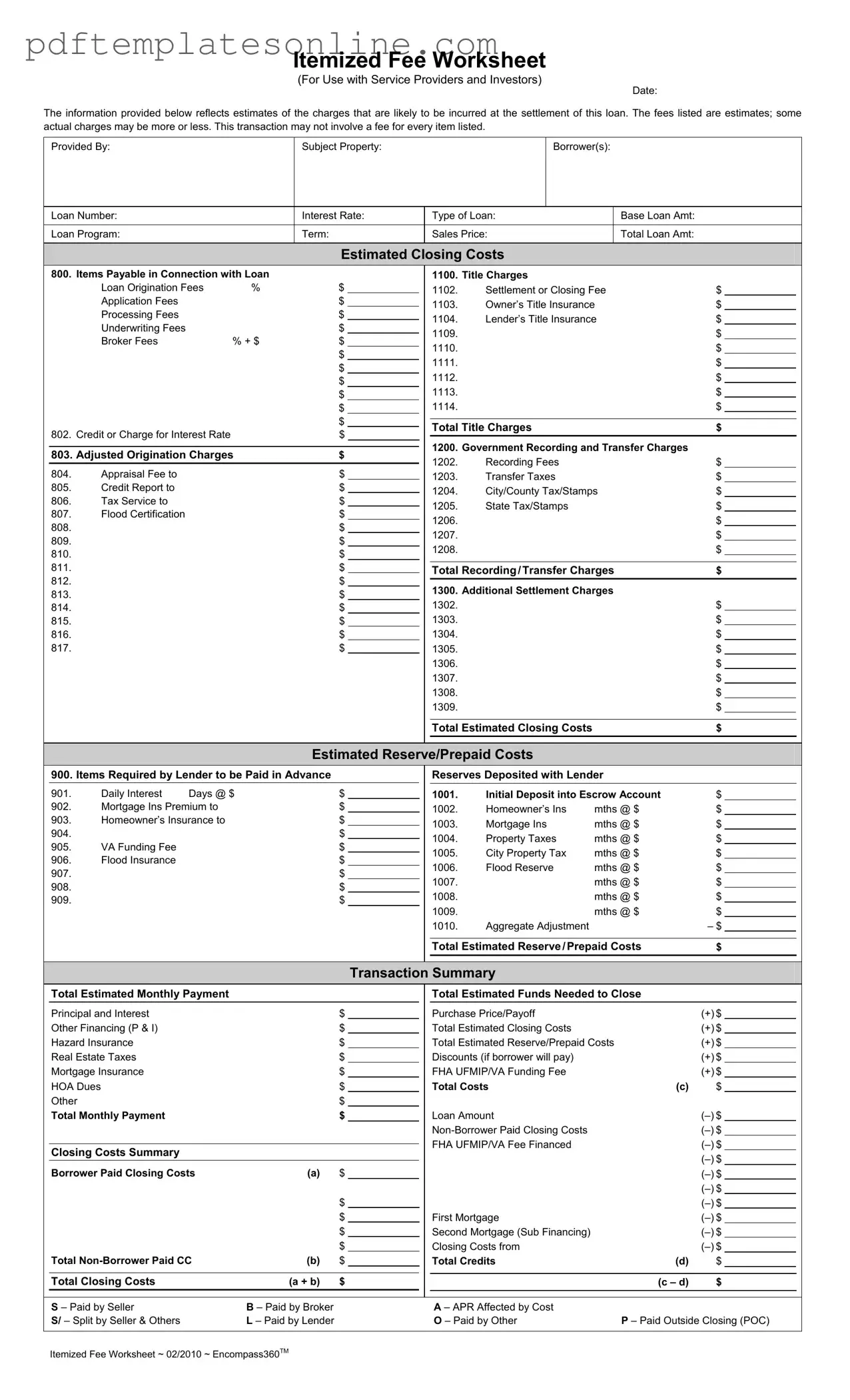

Blank Fee Worksheet Form

Key takeaways

When using the Fee Worksheet form, keep these key takeaways in mind to ensure a smooth process:

- Understand the Estimates: The fees listed on the worksheet are estimates. Actual charges may vary, so it's important to prepare for potential differences at closing.

- Identify Key Charges: Familiarize yourself with the various categories of fees, such as title charges, recording fees, and additional settlement charges. This will help you anticipate costs associated with the loan.

- Document Specifics: Fill out the form with accurate information regarding the property, borrower, and loan details. This ensures clarity and helps avoid confusion during the settlement process.

- Review Closing Costs: Pay close attention to the total estimated closing costs. Understanding this figure will aid in financial planning and readiness for the transaction.

- Consider Prepaid Costs: Be aware of any items required by the lender to be paid in advance, such as insurance premiums and property taxes. These can significantly impact your overall financial commitment.

Common mistakes

Filling out the Fee Worksheet form can be a straightforward process, but there are common mistakes that can lead to confusion or delays. One frequent error is failing to provide accurate property information. The Subject Property section must clearly identify the property involved in the transaction. Missing or incorrect details can result in significant issues later in the process.

Another common mistake is not specifying the Borrower(s) correctly. It's essential to include all parties involved in the loan. Omitting a borrower or using incorrect names can lead to complications in loan approval and closing. Similarly, neglecting to enter the Loan Number can create difficulties in tracking the loan throughout its lifecycle.

Individuals often miscalculate the Total Loan Amount or the Sales Price. These figures should align with the purchase agreement and the loan offer. Inaccurate amounts can affect the overall calculations of closing costs and may lead to funding issues.

In the section for Estimated Closing Costs, people sometimes forget to list all applicable fees. Each fee, such as the Settlement or Closing Fee and Title Insurance, should be included. Missing fees can lead to unexpected expenses at closing, which may cause frustration for all parties involved.

Another mistake is failing to review the Estimated Reserve/Prepaid Costs. This section includes critical items like Homeowner’s Insurance and Property Taxes. Omitting these costs can result in a lack of funds at closing, which can delay or derail the transaction.

People often overlook the Transaction Summary section. This summary provides a clear picture of the total estimated monthly payment and the funds needed to close. Not double-checking this summary can lead to misunderstandings about the total costs associated with the loan.

Lastly, individuals sometimes neglect to verify their calculations. Errors in addition or subtraction can lead to discrepancies that may complicate the closing process. It's advisable to carefully review all entries and totals before submission to ensure accuracy.

By being mindful of these common mistakes, individuals can help facilitate a smoother loan process and avoid potential setbacks during closing.

Misconceptions

-

Misconception 1: The Fee Worksheet form lists final fees.

Many people believe that the fees listed on the Fee Worksheet form are final and fixed. In reality, these fees are estimates. Actual charges may vary, and some items may not even incur a fee at all.

-

Misconception 2: All fees apply to every transaction.

Some assume that every fee listed will apply to their specific loan transaction. However, the form indicates that not all items may be relevant. It’s essential to review the specifics of each transaction to determine applicable fees.

-

Misconception 3: The form guarantees a specific interest rate.

Many borrowers mistakenly think that the interest rate noted on the Fee Worksheet is guaranteed. The form provides an estimate, and the actual interest rate can fluctuate based on various factors.

-

Misconception 4: The Fee Worksheet includes all potential costs.

Some individuals believe that the Fee Worksheet captures every possible cost associated with closing a loan. However, it is essential to understand that additional costs may arise that are not listed on the form.

-

Misconception 5: The worksheet is only for buyers.

There’s a common belief that the Fee Worksheet is exclusively for homebuyers. In truth, it can also be useful for service providers and investors involved in real estate transactions, providing a clear breakdown of expected fees.

Dos and Don'ts

When filling out the Fee Worksheet form, it is essential to follow certain guidelines to ensure accuracy and completeness. Here is a list of what to do and what to avoid:

- Do provide accurate information for each section, including the subject property and borrower details.

- Do double-check the estimated charges to ensure they reflect the current market conditions.

- Do include all applicable fees, such as title charges and government recording fees.

- Do use clear and legible handwriting or type the information to avoid misunderstandings.

- Don't leave any sections blank; if a fee does not apply, indicate that clearly.

- Don't estimate fees without proper research or confirmation from service providers.

- Don't forget to include any additional settlement charges that may apply.

- Don't rush through the form; take your time to ensure all information is correct.

Other PDF Forms

Well Agreement - The form can be customized with specific property descriptions for each parcel.

Leap Program - Accessible to all users, the IML-4 supports diverse input options for flexibility.

For those interested in understanding the intricacies of legal documentation, the importance of a thorough Notary Acknowledgement process cannot be overstated. To learn more about this essential procedure, visit the Notary Acknowledgement form overview for valuable insights.

Blank 1750 - The form also includes a space for counting and registering total quantities.

Detailed Guide for Writing Fee Worksheet

Completing the Fee Worksheet form is an essential step in preparing for the settlement of a loan. The information you provide will help outline the estimated charges associated with the transaction. Following the steps below will ensure that all necessary details are accurately captured.

- Begin by entering the Date at the top of the form.

- Fill in the Provided By section with your name or the name of the service provider.

- Input the Subject Property address where the loan is applicable.

- List the Borrower(s) name(s) who are applying for the loan.

- Enter the Loan Number assigned to this transaction.

- Specify the Interest Rate for the loan.

- Indicate the Type of Loan being applied for.

- Fill in the Base Loan Amount that the borrower is seeking.

- Identify the Loan Program being utilized.

- Provide the Term of the loan in years.

- Enter the Sales Price of the property.

- Complete the Total Loan Amount field.

- Proceed to estimate the Estimated Closing Costs by filling in the relevant sections for items payable in connection with the loan.

- Continue to the Government Recording and Transfer Charges section and fill in the necessary fees.

- Next, complete the Additional Settlement Charges section with any additional costs that may apply.

- Calculate and enter the Total Estimated Closing Costs at the end of this section.

- Move on to the Estimated Reserve/Prepaid Costs section and fill in the required information.

- Finally, summarize the Transaction Summary by entering the total estimated monthly payment and funds needed to close.