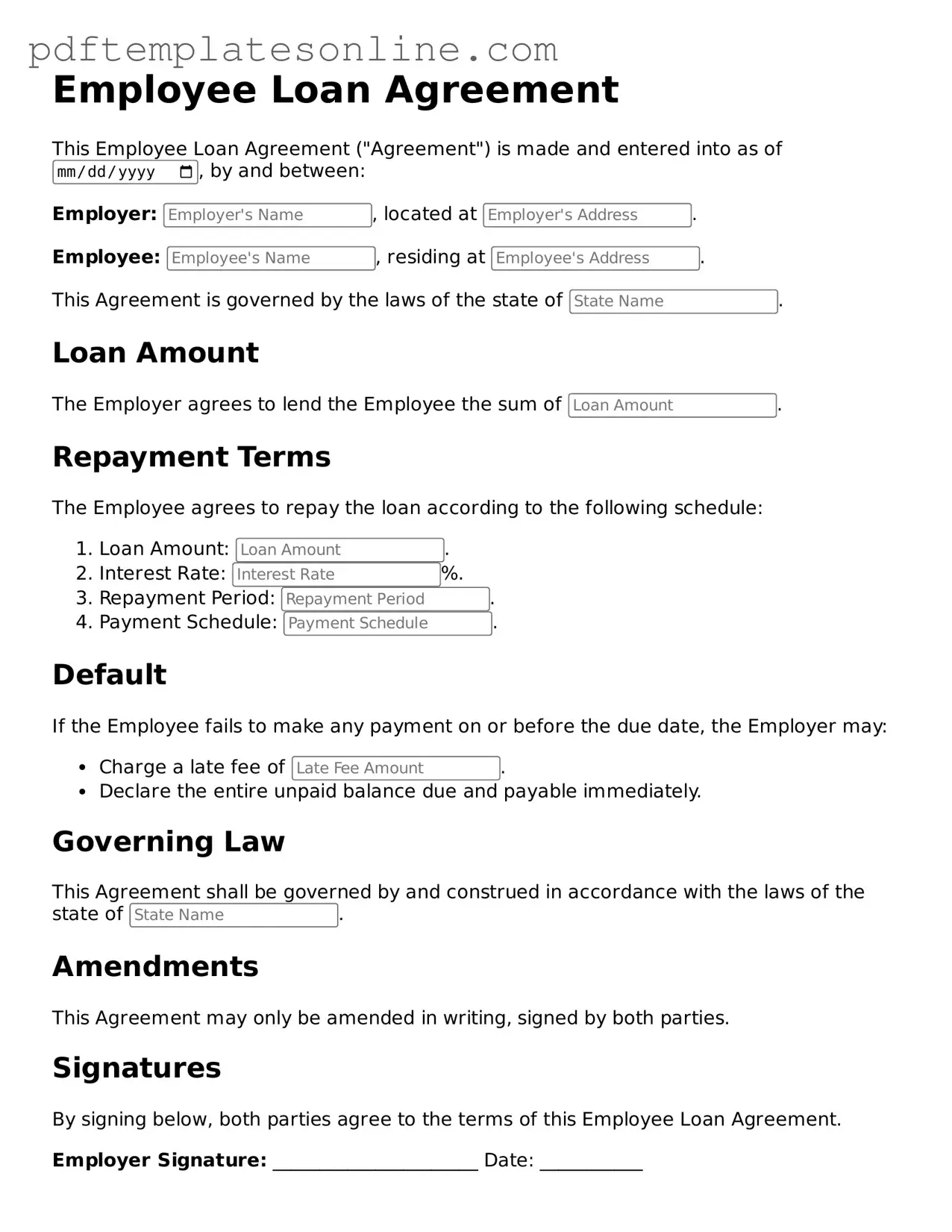

Fillable Employee Loan Agreement Document

Key takeaways

When filling out and using the Employee Loan Agreement form, there are several important points to keep in mind. Here are eight key takeaways:

- Understand the Purpose: The Employee Loan Agreement is designed to outline the terms of a loan provided by the employer to the employee. Clarity on the purpose helps in avoiding misunderstandings.

- Complete All Sections: Ensure that every section of the form is filled out completely. Missing information can lead to delays or complications later on.

- Specify Loan Amount: Clearly state the amount being loaned. This is crucial for both parties to understand the financial commitment involved.

- Define Repayment Terms: Outline the repayment schedule, including the duration and frequency of payments. This helps set expectations and accountability.

- Include Interest Rates: If applicable, specify the interest rate on the loan. This should be clearly defined to avoid confusion over the total repayment amount.

- Signature Requirement: Both the employer and the employee must sign the agreement. This step is essential for the document to be legally binding.

- Keep Copies: Make sure to retain copies of the signed agreement for both parties. This provides a reference point in case any issues arise.

- Review Regularly: Regularly review the terms of the agreement, especially if there are changes in employment status or financial circumstances.

By following these key takeaways, both employers and employees can navigate the Employee Loan Agreement process more effectively.

Common mistakes

Completing the Employee Loan Agreement form can be straightforward, yet many individuals make common mistakes that can lead to complications. One frequent error is failing to provide accurate personal information. It is essential to ensure that your name, address, and contact details are correct. Any discrepancies can delay processing and may even result in the loan being denied.

Another common mistake is neglecting to read the terms and conditions thoroughly. Many individuals may sign the agreement without fully understanding the repayment terms or interest rates. This oversight can lead to unexpected financial burdens down the line. Take the time to review all sections carefully, and do not hesitate to ask for clarification if needed.

Inaccurate financial information is also a significant issue. When filling out the form, it is crucial to provide truthful and complete details about your income and expenses. Misrepresenting your financial situation can result in serious consequences, including potential legal action. Always double-check your figures before submitting the form.

Lastly, many people forget to sign and date the form. This may seem like a minor oversight, but without a signature, the agreement is not valid. Ensure that you have signed and dated the document before submission. Taking these steps will help facilitate a smoother loan process and foster a positive relationship with your employer.

Misconceptions

Understanding the Employee Loan Agreement form is crucial for both employers and employees. However, several misconceptions can lead to confusion. Here are seven common misunderstandings:

- It is a legally binding contract. Many believe that simply signing the Employee Loan Agreement makes it enforceable. In reality, both parties must understand the terms and conditions for it to be legally binding.

- All loans are interest-free. Some employees assume that any loan provided by an employer is interest-free. This is not always the case; the agreement should clearly state whether interest applies.

- Only full-time employees can apply. There is a misconception that only full-time employees are eligible for loans. Part-time employees may also qualify, depending on the company's policy.

- Loan repayment is optional. Some individuals think that repayment of the loan is optional. In fact, the agreement typically outlines specific repayment terms that must be followed.

- Employee Loan Agreements are the same across all companies. Each company may have different terms and conditions. It is essential to review the specific agreement for your employer.

- Loans can be used for any purpose. Employees often believe they can use the loan for any expense. However, some agreements may restrict the use of funds to specific purposes.

- Signing the agreement guarantees approval. Lastly, many assume that signing the Employee Loan Agreement guarantees loan approval. Approval is typically contingent on other factors, including credit checks and company policy.

Being aware of these misconceptions can help ensure a smoother process for both employers and employees when dealing with Employee Loan Agreements.

Dos and Don'ts

When filling out the Employee Loan Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate personal information, including your full name and address.

- Do clearly state the loan amount you are requesting.

- Do understand the terms of repayment before signing.

- Don't leave any sections blank; fill in all required fields.

- Don't use unclear or ambiguous language in your explanations.

- Don't forget to sign and date the form.

- Don't submit the form without making a copy for your records.

Detailed Guide for Writing Employee Loan Agreement

After obtaining the Employee Loan Agreement form, it is essential to fill it out accurately to ensure all necessary information is provided. This will help facilitate the loan process smoothly.

- Begin by entering the employee's full name in the designated field.

- Provide the employee's identification number or Social Security number as required.

- Fill in the employee's current address, including street, city, state, and zip code.

- Indicate the loan amount requested in the appropriate section.

- Specify the purpose of the loan in the provided space.

- Enter the repayment terms, including the repayment period and frequency of payments.

- Include the employee's signature and date at the bottom of the form.

- Have the supervisor or HR representative sign and date the form where indicated.