Blank Employee Advance Form

Key takeaways

Filling out and using the Employee Advance form is an important process for ensuring employees receive the funds they need in a timely manner. Here are some key takeaways to keep in mind:

- Always provide accurate and complete information on the form. This helps prevent delays in processing your request.

- Ensure you understand the company's policy regarding advances. Familiarize yourself with any limits or restrictions that may apply.

- Submit the form well in advance of when you need the funds. This allows for adequate processing time and reduces the risk of complications.

- Keep a copy of the completed form for your records. This can be helpful for tracking your request and for future reference.

- Communicate with your supervisor or HR department if you have questions or need assistance with the form. They can provide guidance and support.

Common mistakes

When completing the Employee Advance form, many individuals inadvertently make mistakes that can delay processing or lead to misunderstandings. One common error is failing to provide accurate personal information. This includes not double-checking your name, employee ID, or department. Inaccurate details can cause confusion and may result in your request being denied.

Another frequent mistake involves not specifying the purpose of the advance clearly. A vague description can lead to questions or a lack of approval. It's essential to be specific about why you are requesting the advance, whether it’s for travel expenses, medical bills, or other legitimate needs. Providing a clear purpose helps the reviewing party understand your request better.

Additionally, some employees overlook the importance of attaching supporting documentation. If your company requires proof of expenses or justification for the advance, failing to include these documents can result in delays. Always check the requirements before submission to ensure you have all necessary paperwork included.

Lastly, many individuals forget to review the company’s policy regarding advances. Each organization may have different rules, limits, and repayment terms. Ignoring these guidelines can lead to submitting a request that does not comply with company standards. Understanding these policies is crucial for a smooth process.

Misconceptions

Misconceptions about the Employee Advance form can lead to confusion among employees. Understanding the facts is essential for proper use of this form. Below are nine common misconceptions along with clarifications.

- Employee Advances are always granted. Not all requests for advances are approved. The company evaluates each request based on its policies and the employee's circumstances.

- Only full-time employees can request an advance. Part-time employees may also be eligible to request an advance, depending on company policy.

- Advances are considered bonuses. Advances are loans that must be repaid, while bonuses are additional compensation that does not require repayment.

- There is no limit to the amount of an advance. Companies often set limits on the amount that can be requested to ensure financial responsibility.

- All advances are paid out immediately. Processing times may vary. Some requests may require additional approval, which can delay payment.

- Repayment is flexible and can be postponed. Repayment terms are typically outlined in the advance agreement and must be adhered to unless otherwise negotiated.

- Only certain expenses qualify for an advance. While some companies have specific guidelines, many allow advances for a variety of business-related expenses.

- Filling out the form is optional. Completing the Employee Advance form is mandatory for any employee seeking an advance.

- The form does not require managerial approval. Most companies require managerial or supervisory approval before an advance can be granted.

Clarifying these misconceptions can help employees better navigate the process of requesting an advance, ensuring that they follow the necessary steps and understand their obligations.

Dos and Don'ts

When filling out the Employee Advance form, it is important to follow certain guidelines to ensure accuracy and compliance. Below are some do's and don'ts to keep in mind:

- Do provide accurate personal information, including your name and employee ID.

- Do specify the amount requested clearly and concisely.

- Do include a detailed description of the purpose for the advance.

- Do ensure that all required signatures are obtained before submission.

- Don't leave any sections of the form blank unless specified as optional.

- Don't submit the form without double-checking for errors or omissions.

Other PDF Forms

Alabama Sports Physical Form 2022 - A physician must complete the physical examination section.

The Emotional Support Animal Letter is a document that certifies an individual's need for an emotional support animal (ESA). This letter typically comes from a licensed mental health professional and serves to help individuals manage their mental health challenges. By clarifying the importance of ESAs, this letter enables individuals to live more comfortably while receiving the support they require. For more information, you can visit https://mypdfform.com/blank-emotional-support-animal-letter.

Texas Law Help FM-DivC-100 Original Petition for Divorce Set C - Changes in the form may reflect changes in marital circumstances.

Detailed Guide for Writing Employee Advance

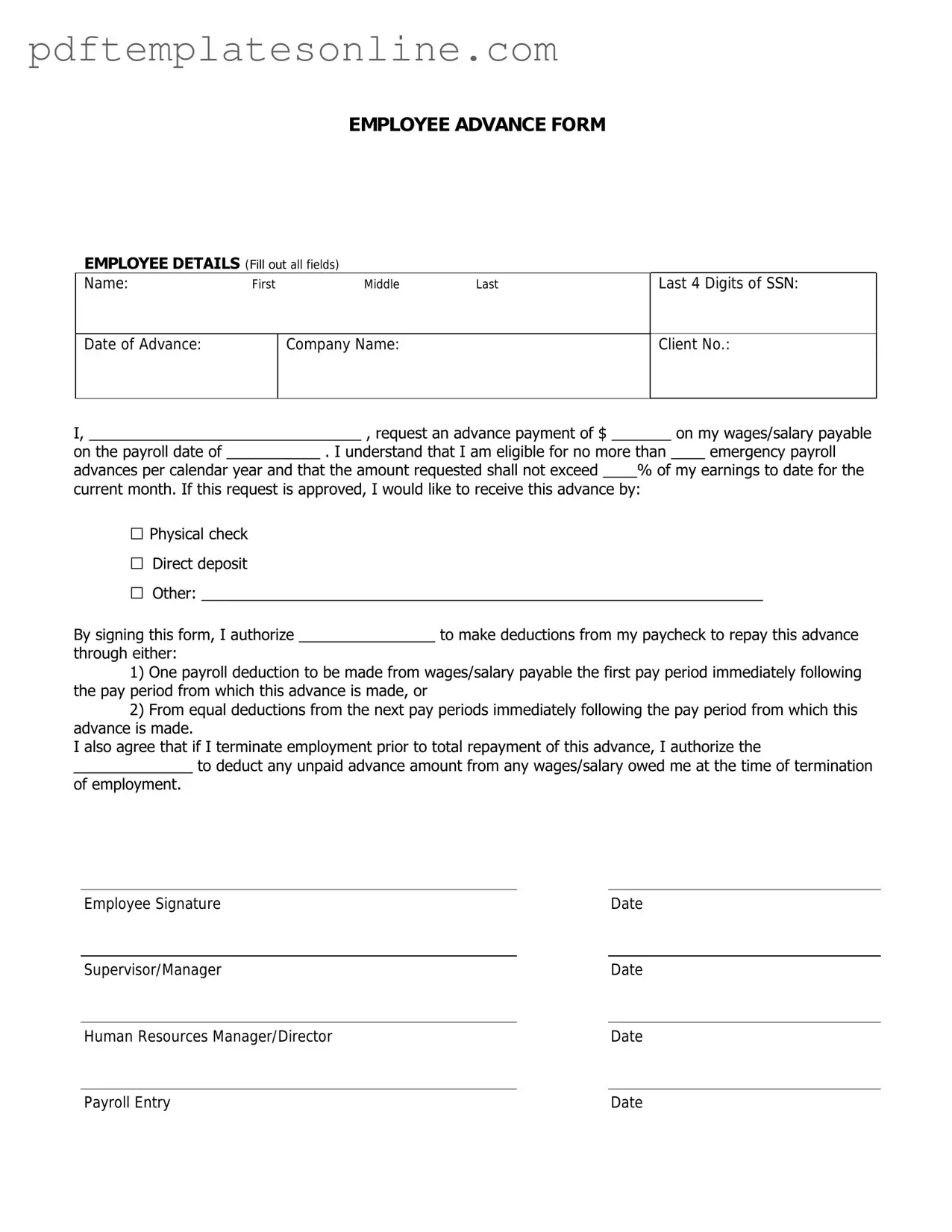

Once you have the Employee Advance form in front of you, it’s time to start filling it out. Completing this form accurately is essential for ensuring that your request is processed smoothly. Follow the steps outlined below to provide all necessary information clearly and concisely.

- Begin by entering your full name at the top of the form.

- Next, fill in your employee ID number or any identification number assigned to you by the company.

- In the designated section, indicate your department or team name.

- Provide the date on which you are submitting the form.

- Clearly state the amount requested for the advance.

- In the next section, briefly describe the reason for the advance. Be specific but concise.

- Sign and date the form at the bottom to confirm that all information is accurate and complete.

After you have filled out the form, ensure that you keep a copy for your records before submitting it to the appropriate department for processing. This will help you track your request and provide a reference if needed.