Fillable Durable Power of Attorney Document

Key takeaways

Filling out and using a Durable Power of Attorney (DPOA) form is an important step in ensuring that your financial and medical decisions are handled according to your wishes. Here are five key takeaways to consider:

- Understand the Purpose: A Durable Power of Attorney allows you to appoint someone to make decisions on your behalf if you become unable to do so. This can include financial matters and healthcare decisions.

- Choose Your Agent Wisely: Select a trustworthy individual who understands your values and will act in your best interest. This person should be reliable and willing to take on this responsibility.

- Specify Powers Clearly: Clearly outline the powers you are granting to your agent. This can include managing bank accounts, making medical decisions, and handling real estate transactions.

- Consider Legal Requirements: Each state has specific laws regarding Durable Power of Attorney forms. Ensure that you follow your state’s requirements for signing and witnessing the document.

- Review Regularly: Your needs and circumstances may change over time. Regularly review and update your DPOA to reflect any changes in your life or preferences.

By keeping these key points in mind, you can create a Durable Power of Attorney that effectively serves your needs and protects your interests.

Durable Power of Attorney Forms for Particular States

Common mistakes

Filling out a Durable Power of Attorney (DPOA) form is a significant step in planning for the future. However, many individuals make common mistakes that can lead to complications down the line. Understanding these pitfalls can help ensure that your wishes are honored and that the document serves its intended purpose.

One frequent error is failing to specify the powers granted to the agent. A DPOA can cover a wide range of financial and legal decisions, but if the document is vague, it may create confusion. Clearly outlining the specific powers you wish to grant can prevent misunderstandings and ensure that your agent knows exactly what actions they can take on your behalf.

Another mistake is neglecting to choose a reliable and trustworthy agent. This person will have significant authority over your affairs, so selecting someone who you believe will act in your best interest is crucial. Friends or family members may seem like a good choice, but it’s essential to consider their ability to handle the responsibilities that come with this role.

Some individuals overlook the importance of discussing their intentions with the chosen agent. It’s not enough to simply name someone; open communication about your wishes and expectations is vital. This conversation can help ensure that your agent understands your values and priorities, which can guide their decisions if the time comes for them to act on your behalf.

Additionally, many people forget to sign and date the DPOA form correctly. A missing signature or an incorrect date can render the document invalid. Always review the form carefully to ensure that all required signatures are present and that they are dated properly, as this can be critical in legal situations.

Another common oversight is failing to have the document notarized or witnessed when required. While not all states require notarization, having a notary or witnesses can add an extra layer of authenticity and help prevent challenges to the document’s validity. Checking your state’s requirements is essential to ensure compliance.

Finally, individuals often neglect to update their DPOA as circumstances change. Life events such as marriage, divorce, or the death of a chosen agent can necessitate changes to the document. Regularly reviewing and updating your DPOA ensures that it remains relevant and reflects your current wishes.

By being aware of these common mistakes, individuals can take proactive steps to create a Durable Power of Attorney that truly reflects their intentions and protects their interests. Thoughtful consideration and careful planning can help ensure that your wishes are respected, even when you are unable to communicate them yourself.

Misconceptions

Understanding the Durable Power of Attorney (DPOA) is essential for anyone considering this important legal document. However, several misconceptions can lead to confusion. Here are nine common misconceptions about the Durable Power of Attorney form:

- A Durable Power of Attorney is only for financial matters. Many people believe that a DPOA can only be used for financial decisions. In reality, it can also cover healthcare decisions, depending on how it is drafted.

- Once I sign a DPOA, I lose all control over my affairs. This is not true. You can continue to manage your own affairs as long as you are capable. The DPOA only comes into effect when you are unable to make decisions for yourself.

- A DPOA is the same as a living will. A DPOA and a living will serve different purposes. A living will outlines your wishes regarding medical treatment, while a DPOA appoints someone to make decisions on your behalf.

- I can’t change or revoke a DPOA once it’s signed. You can revoke or change a DPOA at any time, as long as you are mentally competent. It’s important to communicate any changes to your appointed agent and any relevant institutions.

- My agent can do anything they want with my DPOA. While your agent has significant authority, they are required to act in your best interest and follow your wishes as outlined in the document.

- A DPOA is only necessary for older adults. This is a misconception. Anyone, regardless of age, can benefit from having a DPOA in place to prepare for unexpected situations.

- All states have the same DPOA laws. DPOA laws can vary significantly from state to state. It’s crucial to understand the specific laws in your state when creating a DPOA.

- My spouse automatically has power of attorney over me. While spouses often have rights to make decisions for each other, a formal DPOA must be established to grant that authority legally.

- I don’t need a DPOA if I have a trust. A trust and a DPOA serve different functions. A trust manages your assets while you are alive and after your death, whereas a DPOA allows someone to make decisions on your behalf during your lifetime.

By addressing these misconceptions, individuals can make more informed decisions about establishing a Durable Power of Attorney and ensure their wishes are respected in the future.

Dos and Don'ts

When filling out a Durable Power of Attorney form, it's important to be careful and thorough. Here are five things you should do and five things you should avoid.

Things You Should Do:

- Read the entire form carefully before filling it out.

- Clearly identify the person you are appointing as your agent.

- Specify the powers you are granting to your agent.

- Sign the form in the presence of a notary public, if required by your state.

- Keep a copy of the signed document for your records.

Things You Shouldn't Do:

- Do not leave any sections of the form blank.

- Do not appoint someone who may have conflicting interests.

- Do not forget to date the document when you sign it.

- Do not assume that a verbal agreement is sufficient.

- Do not ignore state-specific requirements that may apply.

Browse Common Types of Durable Power of Attorney Templates

Continuing Power of Attorney - The General Power of Attorney can facilitate care for minor children.

Dmv Power of Attorney - This form is essential for transferring authority regarding vehicle registration and title matters.

Detailed Guide for Writing Durable Power of Attorney

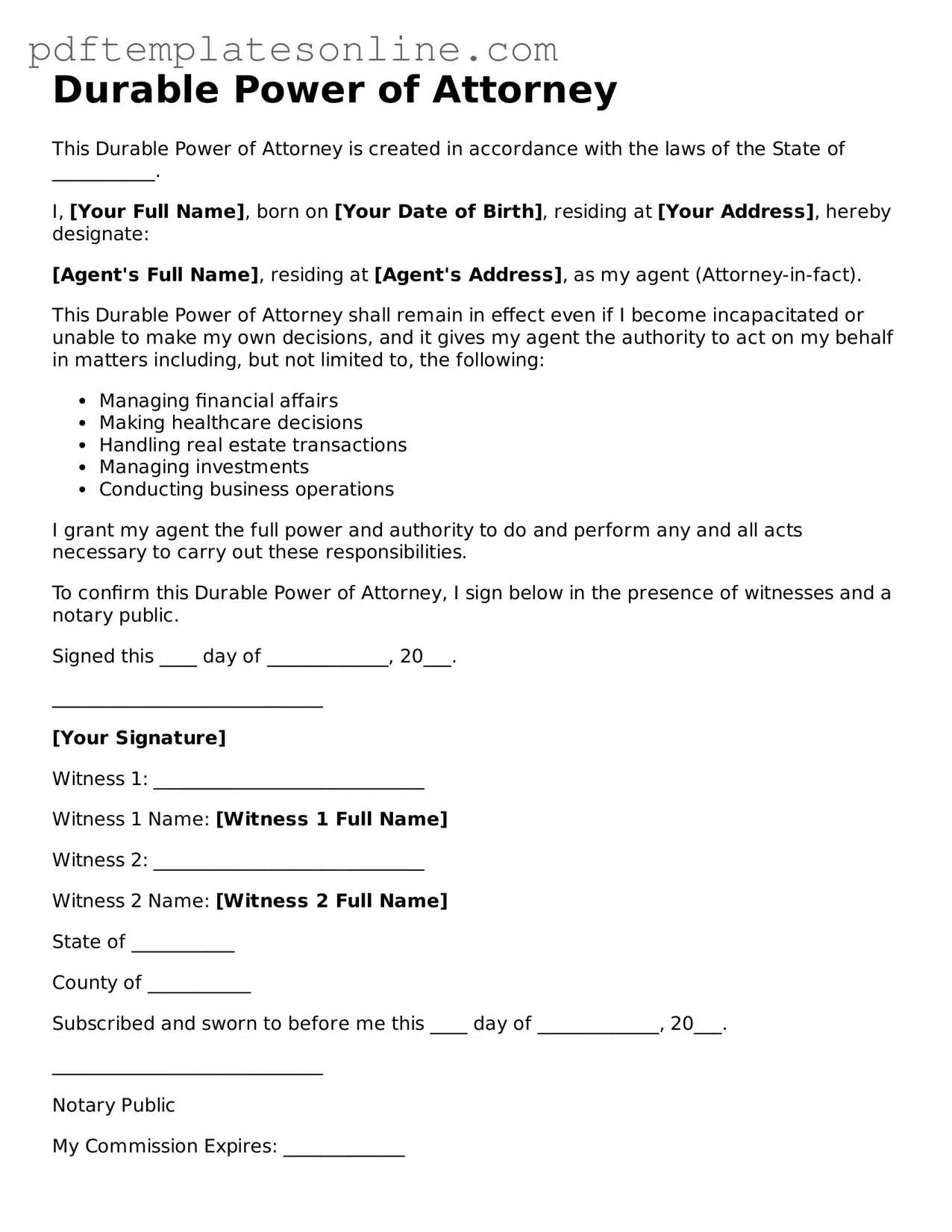

Once you have the Durable Power of Attorney form, you can begin filling it out. This process requires careful attention to detail to ensure that all necessary information is accurately provided. Follow these steps to complete the form correctly.

- Read the Instructions: Before filling out the form, read any accompanying instructions carefully to understand what information is needed.

- Identify Yourself: Fill in your full name, address, and contact information at the top of the form.

- Choose Your Agent: Specify the person you want to designate as your agent. Include their full name, address, and relationship to you.

- Specify Powers: Clearly outline the powers you wish to grant your agent. You can choose general powers or specific ones, depending on your needs.

- Include Successor Agents: If desired, name one or more successor agents who can act if your primary agent is unavailable.

- Set Effective Date: Indicate when the powers granted to your agent will begin. This can be immediately or at a future date.

- Sign the Form: Sign and date the form in the designated area. Your signature must match the name provided at the top of the form.

- Notarization: Depending on your state’s requirements, have the form notarized to ensure its validity.

- Distribute Copies: Provide copies of the completed form to your agent, any successor agents, and relevant financial institutions or healthcare providers.