Blank Dhs 38 Form

Key takeaways

Here are some key takeaways about filling out and using the DHS 38 form:

- Understand the Purpose: The DHS 38 form is used to verify employment and income information for individuals applying for assistance.

- Provide Accurate Information: Employers must fill out the form completely and accurately to avoid potential penalties.

- Deadline Awareness: The form must be returned by a specified date to the DHS specialist listed on the form.

- Legal Compliance: Failure to complete the form can lead to legal actions, including the issuance of a subpoena.

- Confidentiality Matters: The Family Educational Rights and Privacy Act (FERPA) protects student employment information. Written authorization is necessary for its release.

- Insurance and Retirement Details: Employers must disclose any health plans, retirement plans, and other benefits available to employees.

- Income Reporting: Employers need to report all income received by the employee during the specified period, including tips and bonuses.

- Disability and Workers' Compensation: Any medical or disability benefits paid, as well as workers' compensation, must be documented in the appropriate sections.

- Signature Requirement: The form must be signed by the employer or the person completing it, confirming the information is accurate.

Common mistakes

When filling out the Dhs 38 form, many individuals make common mistakes that can lead to delays or complications. One frequent error is failing to provide complete information. Each section of the form requires specific details, and missing even one item can result in the form being returned for corrections.

Another mistake is incorrect dates. Applicants often enter the wrong dates for employment or benefits, which can create confusion. It is essential to double-check all dates to ensure accuracy. Similarly, people sometimes misreport their employment status. Selecting the wrong option, such as "employed" instead of "previously employed," can lead to significant misunderstandings.

Inaccurate income reporting is also a common issue. Individuals frequently underestimate or overestimate their earnings, which can impact eligibility for assistance. Providing the correct gross income is critical. Additionally, some applicants neglect to include tips or bonuses in their income calculations. These amounts can be significant and should always be accounted for.

Another area of concern is the failure to sign the form. Without a signature, the form is not valid. It’s also important to ensure that the signature matches the name provided on the form. Incomplete sections, especially regarding insurance or retirement plans, are often overlooked. Providing all requested information in these areas is crucial for a complete application.

Additionally, individuals sometimes fail to read the instructions thoroughly. Misunderstanding what is required can lead to errors. It’s essential to follow the directions carefully. Lastly, some applicants submit the form without checking for clarity and legibility. Illegible handwriting can cause processing delays and misunderstandings.

Taking the time to review the Dhs 38 form before submission can prevent these common mistakes. Accuracy and completeness are key to ensuring a smooth application process.

Misconceptions

Misconceptions about the DHS 38 form can lead to confusion and errors in the application process. Understanding these misconceptions can help individuals navigate the form more effectively. Below is a list of common misunderstandings:

- The DHS 38 form is only for students. This form is applicable to all individuals seeking assistance, not just students. It gathers employment and income information from various applicants.

- Employers do not have to respond to the DHS 38 form. Employers are legally required to provide the necessary information requested on this form. Failure to do so may result in penalties.

- The form can be filled out by anyone. Only authorized personnel, typically the employer, should complete the employment sections of the form to ensure accuracy and compliance.

- The DHS 38 form guarantees assistance. Completing the form does not guarantee that assistance will be granted. Eligibility is determined based on various factors, including income and employment status.

- Providing false information is harmless. Submitting false information on the DHS 38 form can lead to serious legal consequences, including felony charges if the assistance involved exceeds $500.

- There is no deadline for submitting the form. The form must be submitted by a specified return date. Delays can impact the processing of assistance requests.

- Only one copy of the form is needed. It is advisable to keep a copy of the completed form for personal records. This can be useful for future reference or in case of disputes.

- Assistance is based solely on income. While income is a significant factor, other elements such as family size and specific needs also play a crucial role in determining eligibility.

- The DHS 38 form is complicated and not user-friendly. While it may seem daunting, the form is designed to collect necessary information in a structured manner. Help is available from DHS offices if needed.

By addressing these misconceptions, individuals can better understand the DHS 38 form and its implications. Seeking assistance when needed is encouraged, and it is important to ensure that all information provided is accurate and complete.

Dos and Don'ts

When filling out the DHS 38 form, there are essential guidelines to follow. Here’s a list of things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do sign and date the form where required.

- Do return the form by the specified deadline.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless instructed.

- Don't provide false information or omit details.

- Don't forget to check for any additional documentation needed.

- Don't hesitate to ask for help if you don’t understand something.

- Don't submit the form late, as this may result in penalties.

Other PDF Forms

Cadet Command - Details about transferred credits are recorded here.

The process of creating a Marital Separation Agreement can be daunting, but resources like California PDF Forms can help simplify the necessary documentation, ensuring that both parties can address their individual needs and concerns effectively. It's essential for couples to understand the implications of their agreement, as it lays the groundwork for their separation while still allowing them to retain their legal marriage status.

School Function Assessment Pdf - Teachers and staff use the form to track student progress over time.

Detailed Guide for Writing Dhs 38

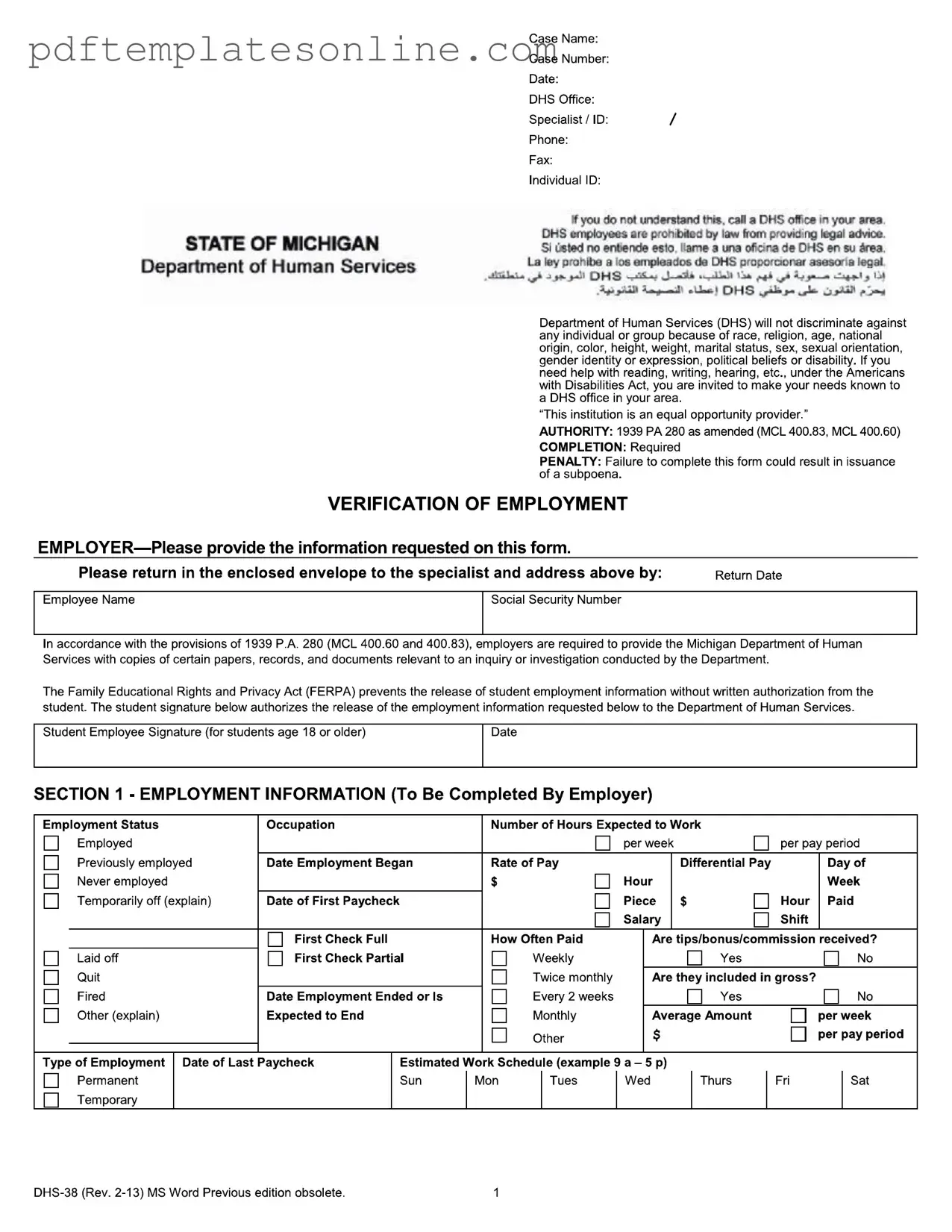

After gathering the necessary information, you can begin filling out the DHS 38 form. This form requires specific details about employment, insurance, and income, which are crucial for processing your request. Make sure to have all relevant documents on hand to ensure accuracy.

- Start by entering the Case Name and Case Number at the top of the form.

- Fill in the Date and the DHS Office you are submitting the form to.

- Provide the Specialist/ID along with their Phone and Fax numbers.

- Enter the Individual ID if applicable.

- For the Employee Name, write the full name of the employee.

- Input the Social Security Number of the employee.

- Indicate the Employment Status by checking the appropriate box: Employed, Previously employed, Never employed, or Temporarily off.

- Fill in the Occupation and the Date Employment Began.

- Record the Date of First Paycheck and whether it was a full or partial check.

- Specify the Date Employment Ended or when it is expected to end.

- Indicate the Number of Hours Expected to Work per week and per pay period.

- Enter the Rate of Pay and whether it is hourly, piece, or salary.

- Complete the Differential Pay section if applicable.

- Specify the Shift and the Day of Week Paid.

- Indicate how often the employee is paid: Weekly, Twice monthly, Every 2 weeks, or Monthly.

- Answer whether tips, bonuses, or commissions are received and if they are included in gross income.

- Complete the Type of Employment section, indicating if it is Permanent.

- Fill in the Average Amount per week or pay period.

- Provide the Date of Last Paycheck and an Estimated Work Schedule.

- In SECTION 2, indicate whether the employer offers a health plan and if the employee is enrolled.

- Fill in the Health Plan Premium and whether a cafeteria-style benefit plan is available.

- Specify if anyone other than the employee is covered under any plan and provide the names and types of coverage.

- Indicate if the employee has a 401K or other retirement plan.

- Complete SECTION 3 with income information for each pay received during the specified period.

- In SECTION 4, indicate if medical or disability benefits were paid and provide details for any worker’s compensation.

- Fill out SECTION 5 for any additional information or comments.

- Complete SECTION 6 with the business name, address, and the name and signature of the person completing the form.

- Ensure to include the Employer Federal ID (FEIN) and contact information.