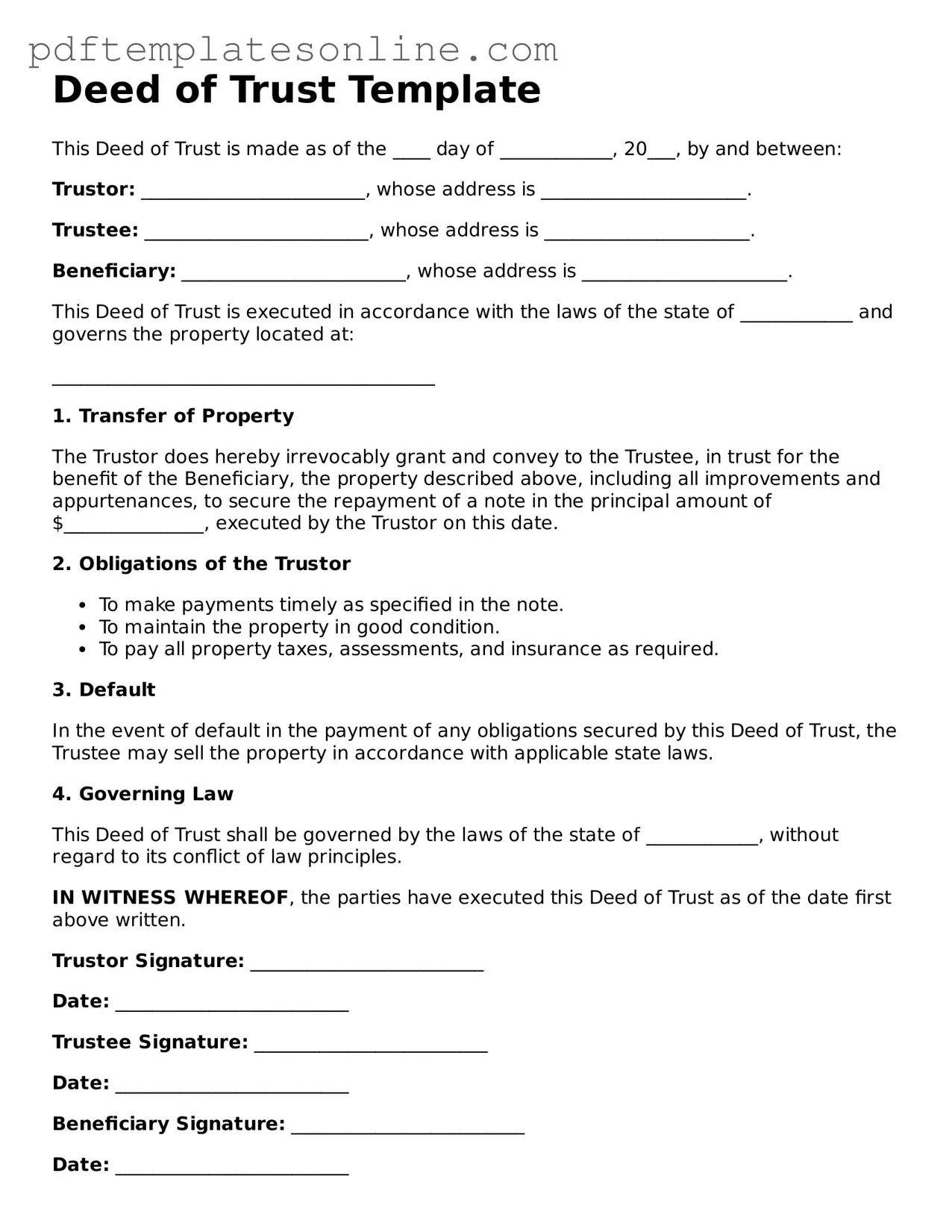

Fillable Deed of Trust Document

Key takeaways

When filling out and using a Deed of Trust form, it is important to keep several key points in mind. The following takeaways provide guidance on the process and implications of this legal document.

- Understand the purpose: A Deed of Trust serves as a security instrument for a loan, allowing the lender to take possession of the property if the borrower defaults.

- Identify the parties: Clearly specify the borrower, lender, and trustee in the document. Each party plays a crucial role in the transaction.

- Property description: Include a detailed description of the property being secured. This should encompass the address and any relevant identifiers, such as parcel numbers.

- Loan amount: State the exact amount of the loan being secured by the Deed of Trust. This figure is critical for both parties.

- Terms of repayment: Outline the repayment terms, including interest rates, payment schedule, and any penalties for late payments.

- Signatures required: Ensure that all parties sign the document. The signatures must be notarized to validate the Deed of Trust.

- Record the document: After execution, file the Deed of Trust with the appropriate local government office. This step is essential for public notice and to protect the lender's interest.

By keeping these points in mind, individuals can navigate the process of completing and utilizing a Deed of Trust more effectively.

Common mistakes

Filling out a Deed of Trust form is a crucial step in securing a loan against real property. However, many individuals make common mistakes that can lead to complications down the line. One frequent error is not accurately identifying the parties involved. The borrower, lender, and trustee must all be clearly stated. Omitting or incorrectly naming any party can render the document invalid.

Another mistake often seen is the failure to provide a complete legal description of the property. The legal description is essential as it specifies the exact boundaries of the property being secured. Using vague or incomplete descriptions can cause confusion and disputes in the future. It is vital to reference the property’s deed or tax records to ensure accuracy.

People also frequently overlook the requirement for signatures. All parties involved must sign the Deed of Trust for it to be legally binding. Some individuals assume that a single signature suffices, but this is not the case. Each party's consent is necessary to enforce the terms of the agreement.

Additionally, neglecting to have the document notarized is a significant oversight. Many states require notarization to validate the Deed of Trust. Without a notary's acknowledgment, the document may not be enforceable, which could lead to legal challenges regarding the loan.

Lastly, individuals often fail to understand the implications of the terms outlined in the Deed of Trust. This can include the interest rate, payment schedule, and any clauses related to default or foreclosure. Misunderstanding these terms can result in financial difficulties or unintentional breaches of the agreement. It is essential to read and comprehend every section of the form before signing.

Misconceptions

Understanding the Deed of Trust can be tricky, and there are several misconceptions that often lead to confusion. Here are seven common misunderstandings:

-

A Deed of Trust is the same as a mortgage.

While both are used in real estate transactions to secure a loan, they are not identical. A Deed of Trust involves three parties: the borrower, the lender, and a third-party trustee, whereas a mortgage typically involves just two parties: the borrower and the lender.

-

Signing a Deed of Trust means you own the property.

This is not accurate. Signing a Deed of Trust means you are securing a loan with the property as collateral. Ownership remains with the borrower until the loan is paid off.

-

Once a Deed of Trust is signed, it cannot be changed.

This misconception is misleading. While the terms are generally set at signing, modifications can occur through refinancing or renegotiating the loan terms.

-

A Deed of Trust guarantees that you won’t lose your home.

Unfortunately, this is not true. If loan payments are not made, the lender can initiate foreclosure proceedings, which can lead to the loss of the property.

-

Deeds of Trust are only used for residential properties.

This is a common belief, but Deeds of Trust can also be used for commercial properties. They serve the same purpose of securing a loan, regardless of the property type.

-

You can’t sell your property if there’s a Deed of Trust on it.

This is incorrect. You can sell the property, but the Deed of Trust must be satisfied, typically by paying off the existing loan with the proceeds from the sale.

-

A Deed of Trust is a one-time agreement.

Many believe this, but it’s not the case. A Deed of Trust can be modified or replaced if refinancing occurs, or if the borrower and lender agree to new terms.

By clearing up these misconceptions, you can better understand the role of a Deed of Trust in real estate transactions and make informed decisions.

Dos and Don'ts

When filling out the Deed of Trust form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid during this process.

- Do: Read the instructions carefully before starting.

- Do: Provide accurate information about all parties involved.

- Do: Sign and date the form where required.

- Do: Keep a copy of the completed form for your records.

- Do: Seek assistance if you have questions about the form.

- Don't: Leave any sections blank unless instructed.

- Don't: Use correction fluid or tape on the form.

- Don't: Provide false or misleading information.

- Don't: Forget to check for any required signatures.

- Don't: Submit the form without reviewing it for errors.

Browse Common Types of Deed of Trust Templates

Lady Bird Deed Form - Heirs benefit from a stepped-up basis on the property, which can lead to tax savings when sold later.

To ensure a smooth and legally compliant property transfer, individuals can utilize resources such as NY PDF Forms, which offer conveniently prepared templates and guidance for completing the deed form accurately in New York.

Iowa Quit Claim Deed - This deed does not transfer any obligation related to mortgages or liens on the property.

Title Companies and Transfer on Death Deeds - In many states, beneficiaries can use the Transfer-on-Death Deed to quickly and easily transfer property ownership, reducing complications.

Detailed Guide for Writing Deed of Trust

Once you have the Deed of Trust form in hand, the next steps involve carefully filling it out to ensure that all necessary information is accurately provided. This document will require specific details about the parties involved, the property in question, and the terms of the agreement. Take your time to review each section and ensure everything is clear and correct before submission.

- Identify the parties: Begin by entering the names and addresses of the borrower (trustor) and the lender (beneficiary). Make sure to use full legal names as they appear on official documents.

- Describe the property: Provide a complete description of the property being secured. This includes the address, legal description, and any relevant parcel numbers.

- Specify the loan amount: Clearly state the total amount of the loan that the borrower is receiving. This should match the amount agreed upon in the loan agreement.

- Outline the terms: Fill in the terms of the loan, including the interest rate, payment schedule, and any late fees. Be precise to avoid confusion later on.

- Include the maturity date: Indicate when the loan will be fully paid off. This is typically the date when the last payment is due.

- Signatures: Ensure that both the borrower and lender sign the document. Depending on your state, you may also need a witness or notary public to validate the signatures.

- Review for accuracy: Before submitting, double-check all entries for accuracy and completeness. Any mistakes could lead to complications down the road.

- File the document: Once everything is in order, file the Deed of Trust with the appropriate county office to ensure it is officially recorded.