Fillable Deed in Lieu of Foreclosure Document

Key takeaways

Filling out and using the Deed in Lieu of Foreclosure form can be a crucial step for homeowners facing financial difficulties. Here are five key takeaways to consider:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to transfer property ownership to the lender to avoid foreclosure. This can help mitigate damage to credit scores.

- Eligibility Requirements: Not all homeowners qualify. Lenders typically require that the property is unencumbered by other liens and that the homeowner is in financial distress.

- Impact on Credit: While a Deed in Lieu of Foreclosure is less damaging than a foreclosure, it can still negatively affect credit scores. Understanding this impact is essential before proceeding.

- Consult with Professionals: It is advisable to consult with a real estate attorney or financial advisor. They can provide guidance and ensure that the process is handled correctly.

- Document Everything: Keep detailed records of all communications with the lender and copies of all documents submitted. This can be important for future reference or disputes.

Deed in Lieu of Foreclosure Forms for Particular States

Common mistakes

Filling out a Deed in Lieu of Foreclosure form can be a daunting task, and many people make common mistakes that can complicate the process. One frequent error is failing to provide accurate property information. This includes the address, legal description, and other identifying details. Inaccuracies can lead to delays or even rejection of the deed.

Another common mistake involves not fully understanding the implications of signing the deed. Many individuals do not realize that by signing this document, they are voluntarily giving up their rights to the property. This can lead to regret if they later wish to contest the decision or reclaim the property.

People often overlook the importance of obtaining the lender's approval before submitting the deed. Not securing this approval can result in the lender refusing to accept the deed, thereby prolonging the foreclosure process. It is crucial to communicate with the lender and ensure all necessary steps are taken beforehand.

In addition, some individuals neglect to consult with a legal professional. While the form may seem straightforward, legal nuances can significantly impact the outcome. Seeking advice from an attorney can help avoid pitfalls and ensure that all aspects of the deed are properly addressed.

Another mistake involves not considering tax implications. Individuals may not realize that a Deed in Lieu of Foreclosure can have tax consequences, such as potential liability for canceled debt income. Understanding these implications can help in making informed decisions.

Lastly, failing to keep copies of all submitted documents is a common oversight. Having a record of what was submitted can be invaluable in case any disputes arise later. Documentation serves as proof of the transaction and can help clarify any misunderstandings with the lender.

Misconceptions

There are several misconceptions about the Deed in Lieu of Foreclosure form. Understanding these can help homeowners make informed decisions. Here are eight common misconceptions:

- It eliminates all debt. Many believe that signing a Deed in Lieu of Foreclosure wipes out all mortgage debt. However, this is not always the case. Depending on state laws, homeowners may still owe money after the deed transfer.

- It’s a quick process. Some think that a Deed in Lieu is a fast way to resolve mortgage issues. In reality, the process can take time. Lenders must review the request and may require additional documentation.

- It affects credit less than foreclosure. A Deed in Lieu may still negatively impact credit scores. While it might be less damaging than a foreclosure, the effects can still be significant.

- It’s available to anyone. Not all homeowners qualify for a Deed in Lieu. Lenders typically have specific criteria, and homeowners must demonstrate financial hardship.

- It’s the same as a short sale. A Deed in Lieu of Foreclosure is different from a short sale. In a short sale, the property is sold for less than the mortgage balance, while a Deed in Lieu involves transferring ownership back to the lender.

- It releases all liability. Homeowners often think that a Deed in Lieu releases them from all liabilities associated with the property. However, lenders may still pursue deficiency judgments in certain situations.

- It doesn’t require a negotiation. Many assume that a Deed in Lieu is straightforward and requires no negotiation. In fact, homeowners often need to negotiate terms with their lender.

- It’s a guaranteed solution. Some believe that a Deed in Lieu is a guaranteed way to avoid foreclosure. However, lenders may reject the request for various reasons, including insufficient financial hardship.

Dos and Don'ts

When filling out a Deed in Lieu of Foreclosure form, it’s crucial to approach the process with care. Here’s a list of things you should and shouldn’t do to ensure a smoother experience.

- Do read the entire form thoroughly before filling it out.

- Do provide accurate information to avoid delays or complications.

- Do seek legal advice if you have questions about the process.

- Do ensure that all parties involved in the property are included in the deed.

- Don't rush through the form; take your time to understand each section.

- Don't omit any required signatures or dates.

- Don't ignore any outstanding obligations related to the property.

- Don't submit the form without making copies for your records.

Browse Common Types of Deed in Lieu of Foreclosure Templates

California Correction Deed - This form ensures that the public record accurately reflects true property ownership.

When utilizing a Promissory Note form, it's essential to ensure that all terms are clearly defined to avoid disputes. For those looking for a reliable template, California PDF Forms provides various options that can be customized to fit the specific needs of both borrowers and lenders, maintaining the legal integrity of the agreement.

Deed of Gift Property - Recordkeeping is important; lose the Gift Deed, and the gift may be contested.

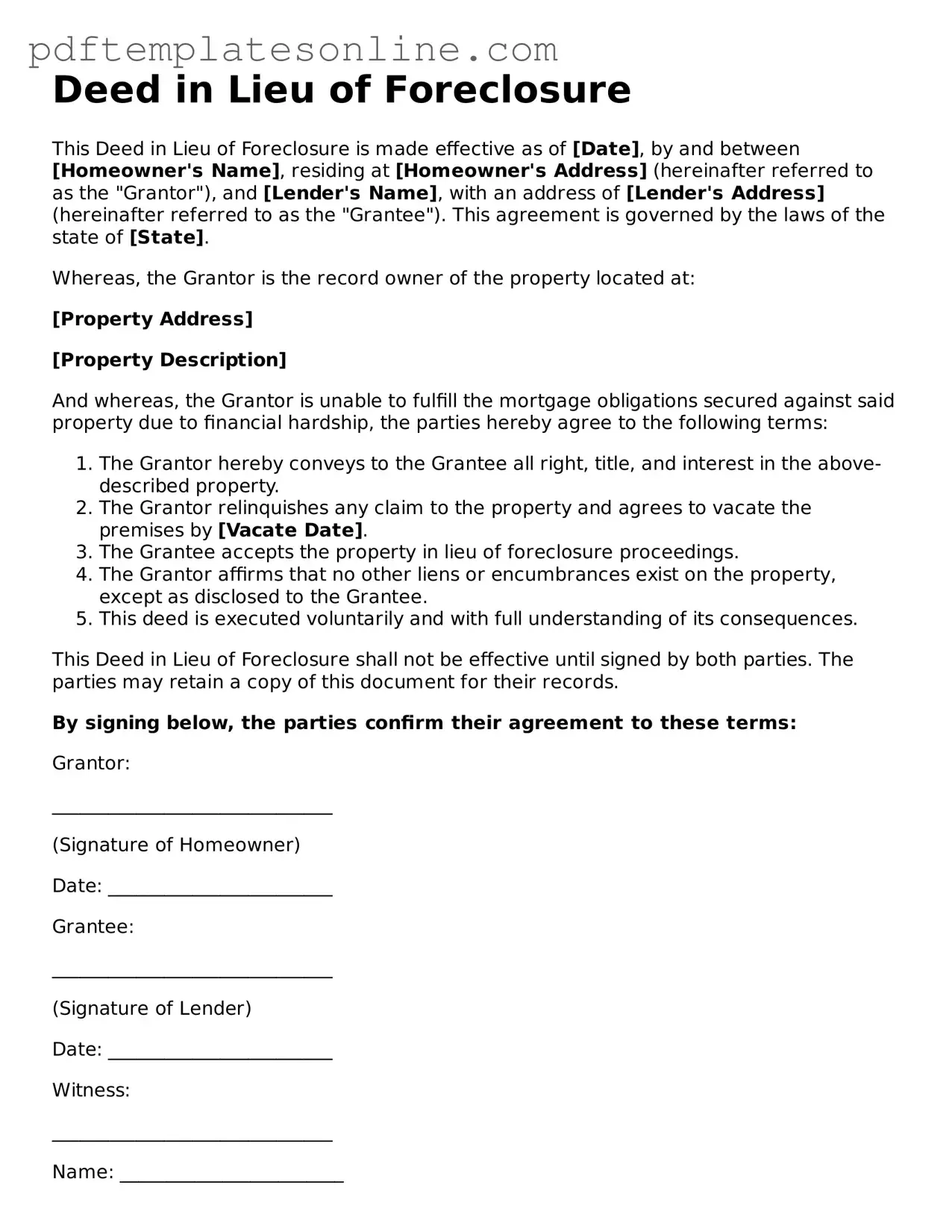

Detailed Guide for Writing Deed in Lieu of Foreclosure

After completing the Deed in Lieu of Foreclosure form, the next steps involve submitting the document to your lender and ensuring that all necessary parties are informed. It is essential to keep a copy for your records and follow up with your lender to confirm receipt and discuss any further actions required.

- Gather all necessary information, including your property details, loan information, and personal identification.

- Obtain the Deed in Lieu of Foreclosure form from your lender or a reliable legal resource.

- Fill in the property address accurately in the designated field.

- Provide the names of all parties involved, including the borrower(s) and lender.

- Include the legal description of the property, which can usually be found on the property deed or tax documents.

- State the reason for the transfer in the appropriate section of the form.

- Sign and date the form in the presence of a notary public, if required.

- Make copies of the completed form for your records.

- Submit the original form to your lender and retain proof of submission.