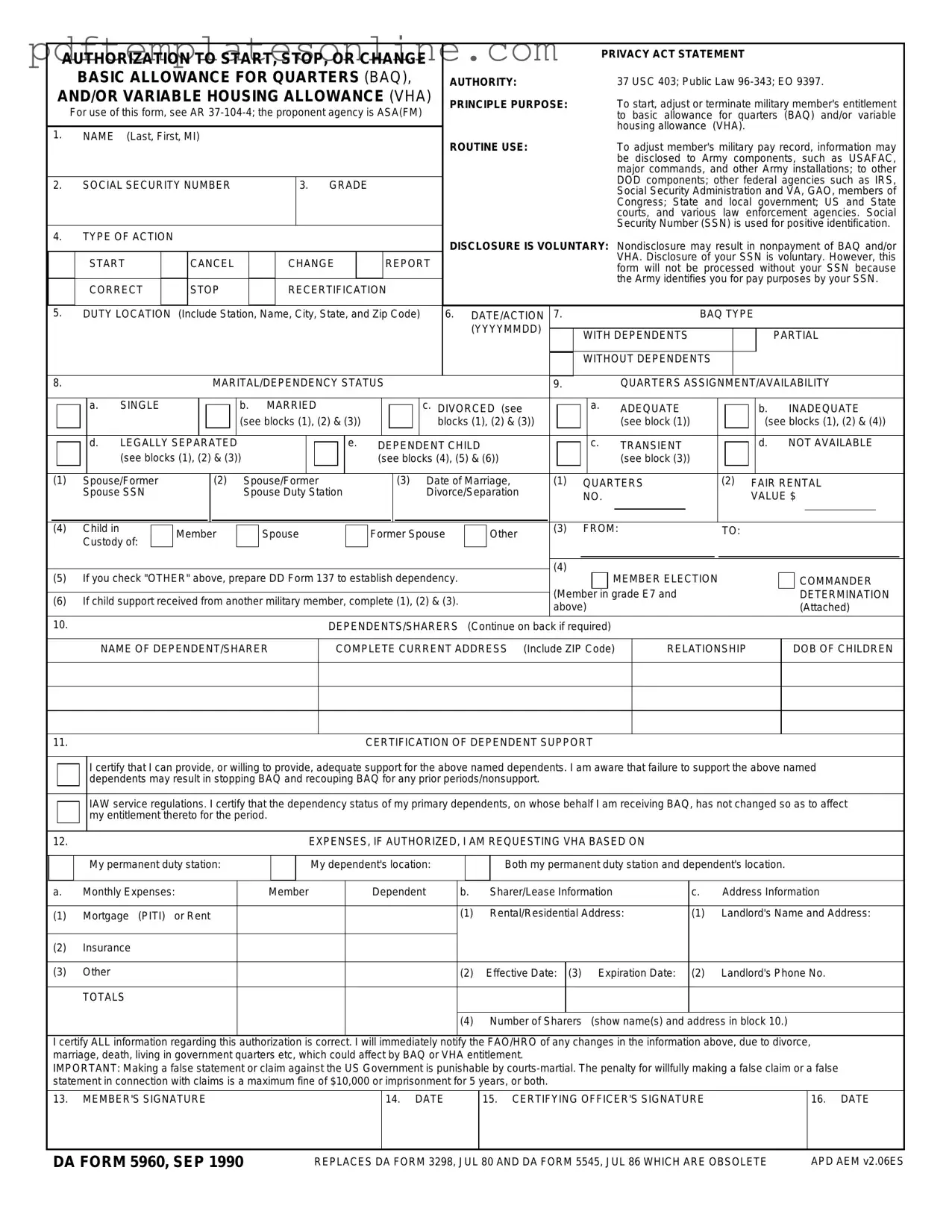

Blank DA 5960 Form

Key takeaways

When filling out the DA 5960 form, keep these key points in mind:

- Ensure all personal information is accurate. This includes your name, Social Security number, and contact details.

- Double-check the date of the application. It should be current and reflect the day you submit the form.

- Provide clear and complete details about your dependents. This is crucial for benefits eligibility.

- Use black or blue ink when filling out the form. This helps ensure legibility.

- Sign and date the form at the bottom. An unsigned form may delay processing.

- Keep a copy of the completed form for your records. This can be helpful for future reference.

- Submit the form to the appropriate office. Check where to send it based on your specific situation.

- Follow up after submission. Confirm that your form has been received and is being processed.

Common mistakes

Filling out the DA 5960 form can be a straightforward process, but many people make mistakes that can delay their benefits. One common error is failing to provide accurate personal information. This includes your name, Social Security number, and other identifying details. Even a small typo can lead to significant issues in processing your request.

Another frequent mistake is not signing the form. Many individuals complete the form but forget to include their signature. Without a signature, the form is incomplete and cannot be processed. Always double-check to ensure that you have signed the document before submitting it.

Some people overlook the importance of including all required documentation. The DA 5960 form may require additional paperwork to support your request. Failing to attach these documents can result in delays or denials. Review the instructions carefully to ensure you include everything needed.

Inaccurate financial information is another common pitfall. When reporting your financial situation, it’s essential to provide truthful and complete details. Misrepresenting your income or expenses can lead to complications and may even result in legal consequences.

Many applicants also forget to keep a copy of the completed form for their records. This can be a problem if there are questions or issues later on. Keeping a copy allows you to reference your submission and provides proof of what you submitted.

Lastly, submitting the form to the wrong address can cause significant delays. It’s crucial to ensure that you send the DA 5960 form to the correct office. Check the submission guidelines carefully to avoid this mistake. Taking these steps will help ensure a smoother process and reduce the likelihood of errors.

Misconceptions

The DA 5960 form, used for requesting basic allowance for housing (BAH) for military personnel, is often surrounded by misconceptions. Here are nine common misunderstandings about this important document:

- It is only for active-duty service members. Many believe that only active-duty members can use the DA 5960 form. In reality, eligible reservists and National Guard members may also utilize this form under certain conditions.

- Submission is optional. Some think that submitting the DA 5960 form is not mandatory. However, to receive BAH, it is crucial to complete and submit the form accurately.

- All housing allowances are the same. A common misconception is that all service members receive the same housing allowance. BAH rates vary based on location, rank, and dependency status.

- It can be submitted at any time. Many assume that the DA 5960 can be submitted whenever convenient. In fact, there are specific timelines and deadlines that must be adhered to for timely processing.

- Only one form is needed for multiple dependents. Some believe that one DA 5960 form covers all dependents. Each dependent situation may require separate documentation or additional information.

- Changes to housing status do not require a new form. There is a misconception that if a service member’s housing situation changes, they do not need to submit a new DA 5960 form. In truth, any changes in status must be reported to ensure accurate BAH payments.

- It is a straightforward process without complications. Many think that filling out the DA 5960 is simple and without issues. However, inaccuracies or missing information can lead to delays in processing and payments.

- Once submitted, the form cannot be modified. Some individuals believe that after submitting the DA 5960, it is final and cannot be changed. In reality, modifications can be made if necessary, but timely communication is essential.

- All supporting documents are optional. A frequent misunderstanding is that supporting documents are not needed. In fact, providing accurate and complete supporting documents is vital for the approval of the form.

Understanding these misconceptions can help ensure that service members and their families receive the housing benefits they are entitled to without unnecessary delays or complications.

Dos and Don'ts

When filling out the DA 5960 form, it’s important to follow certain guidelines to ensure accuracy and efficiency. Here are five things you should do and five things you shouldn't do.

Things You Should Do:

- Read the instructions carefully before starting.

- Provide accurate and complete information.

- Double-check all entries for spelling and numerical accuracy.

- Sign and date the form where required.

- Submit the form to the appropriate authority in a timely manner.

Things You Shouldn't Do:

- Do not leave any required fields blank.

- Avoid using abbreviations unless specified in the instructions.

- Do not submit the form without a review for errors.

- Refrain from providing false or misleading information.

- Don’t forget to keep a copy of the completed form for your records.

Other PDF Forms

Paystubs for Independent Contractor - This form is important for contractors to track their working income over time.

In California, utilizing a Self-Proving Affidavit form not only simplifies the probate process but also provides peace of mind to the testator and heirs alike. This document affirms the authenticity of the will through the signatures of both the author and the witnesses, thereby eliminating the need for them to testify in court about the will's validity. For those looking to create such essential documents, resources like California PDF Forms can be invaluable in ensuring proper completion and filing.

What Is a Writ of Certiorari - Preparing a petition takes careful attention to detail and a clear understanding of the issues.

Detailed Guide for Writing DA 5960

Filling out the DA 5960 form is an important step in ensuring that your financial information is accurately recorded. Completing this form correctly will help facilitate the necessary processes related to your military benefits. Follow these steps to fill out the form efficiently.

- Begin by downloading the DA 5960 form from the appropriate military website or obtaining a hard copy from your administrative office.

- Carefully read the instructions provided with the form to understand the requirements.

- In the top section, fill in your personal information, including your name, rank, and Social Security number.

- Provide your unit information, including the unit name and address.

- Next, indicate the type of request you are making by checking the appropriate box.

- Fill out the financial information section, detailing your current allowances and deductions.

- Review your entries for accuracy and completeness.

- Sign and date the form at the bottom to certify that the information provided is true and correct.

- Submit the completed form to your administrative office or the designated authority.

After submitting the DA 5960 form, you may want to follow up to ensure that it has been processed. Keeping a copy for your records can also be beneficial. Stay informed about any additional steps or documentation that may be required as your request is reviewed.