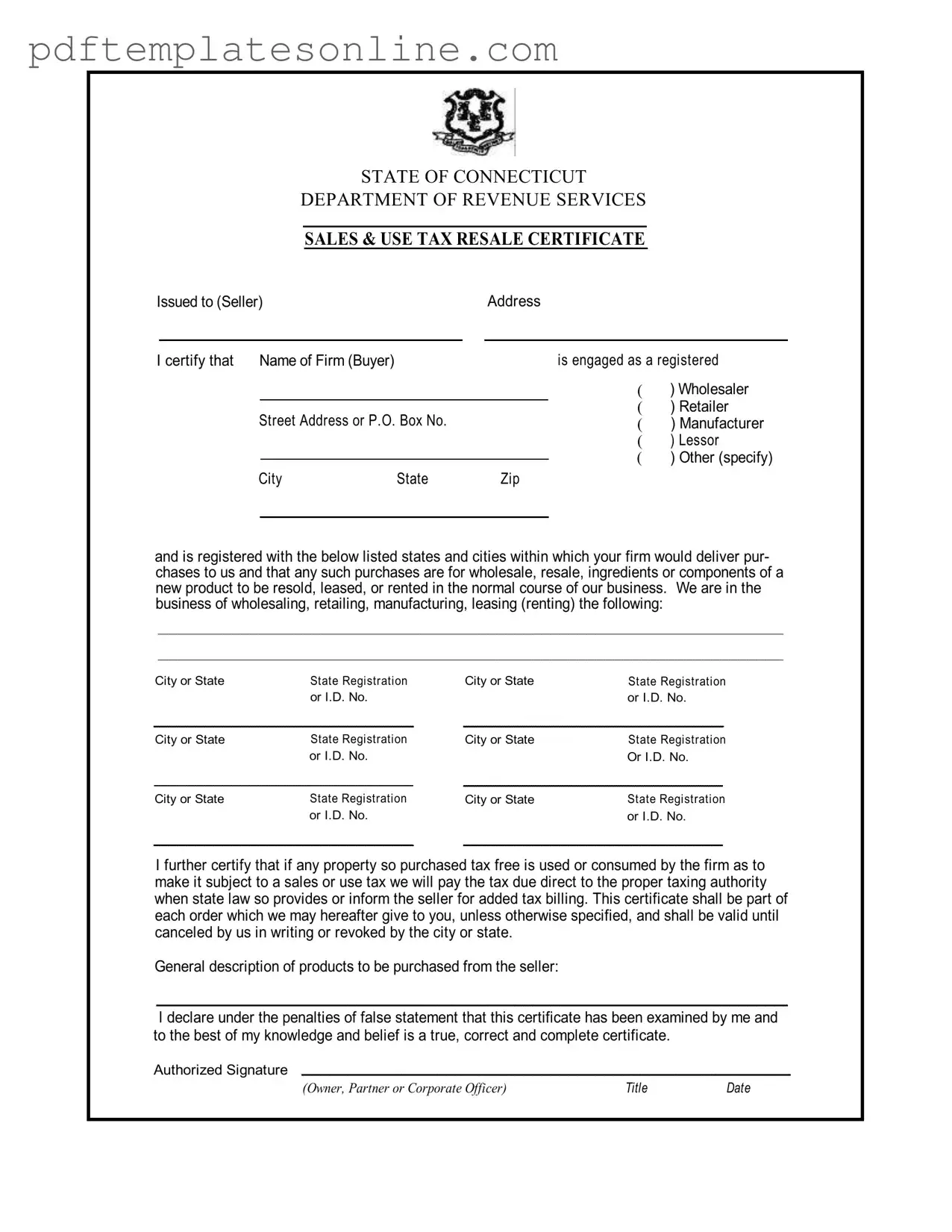

Blank Ct Resale Certificate Form

Key takeaways

When using the Connecticut Resale Certificate form, it is essential to understand its purpose and requirements. Here are key takeaways to keep in mind:

- Purpose: The form is used to certify that purchases are for resale, allowing buyers to avoid paying sales tax at the time of purchase.

- Eligibility: Only registered wholesalers, retailers, manufacturers, lessors, or other specified businesses can use this certificate.

- Information Required: The form requires details about both the seller and buyer, including names, addresses, and state registration or ID numbers.

- General Description: A description of the products to be purchased must be included, ensuring clarity on what is being bought tax-free.

- Responsibility for Tax: If the purchased items are used in a way that incurs tax, the buyer is responsible for paying that tax directly to the taxing authority.

- Validity: The certificate remains valid until it is canceled in writing by the buyer or revoked by the city or state.

- Signature Requirement: An authorized signature is necessary, confirming that the information provided is accurate and complete.

- Part of Each Order: This certificate should accompany each order made to the seller, unless specified otherwise.

Understanding these points will help ensure compliance and facilitate smoother transactions between buyers and sellers in Connecticut.

Common mistakes

Filling out the Connecticut Resale Certificate form can be straightforward, but several common mistakes can lead to complications. One frequent error is failing to provide complete information about the buyer. It's essential to fill in the name of the firm and the address accurately. Incomplete details can result in the certificate being rejected, which could lead to unexpected tax liabilities.

Another mistake involves not selecting the correct business type. The form requires the buyer to specify whether they are a wholesaler, retailer, manufacturer, or another type of business. Choosing the wrong category can cause confusion and may invalidate the certificate. Always double-check the selection to ensure it aligns with the nature of your business.

Many people overlook the requirement to list state registration or identification numbers. Each state where the buyer is registered should be noted clearly. Failing to include these numbers can lead to issues during audits or when the seller tries to validate the certificate. It’s crucial to provide all relevant registration details to avoid complications.

Inadequate descriptions of the products being purchased is another common pitfall. The form includes a section for a general description of products. Leaving this section blank or providing vague information can raise red flags. Be specific about the types of products to ensure clarity and compliance.

Some individuals forget to include the authorized signature. The certificate must be signed by an owner, partner, or corporate officer. Without a signature, the document is not valid. Always ensure that the appropriate person signs the certificate before submission.

Additionally, the date on the form is often neglected. An unsigned or undated certificate can create problems for both the buyer and seller. Make sure to include the date when the certificate is completed to maintain its validity.

Finally, failing to understand the implications of using the certificate can lead to significant issues. If property purchased tax-free is used for personal or non-business purposes, the buyer is responsible for paying the tax. It’s vital to comprehend the responsibilities that come with using the resale certificate to avoid potential penalties.

Misconceptions

Misconceptions about the Connecticut Resale Certificate form can lead to confusion and potential legal issues. Here are five common misconceptions clarified:

- It can be used for personal purchases. The Connecticut Resale Certificate is strictly for business transactions. It is intended for items that will be resold, leased, or rented in the normal course of business, not for personal use.

- All businesses can use it without registration. Only registered wholesalers, retailers, manufacturers, and lessors can utilize the certificate. Businesses must be properly registered with the state to qualify for tax-exempt purchases.

- Once issued, it never expires. This certificate remains valid until it is canceled in writing by the buyer or revoked by the state. Businesses must keep track of their certificates and ensure they are up to date.

- It covers all types of purchases. The certificate only applies to items intended for resale or as components of a new product. If the purchased items will be used or consumed, the buyer is responsible for paying the appropriate sales tax.

- It can be used in any state. The Connecticut Resale Certificate is valid only within Connecticut. If a business operates in multiple states, it must obtain the appropriate resale certificates for each state where it conducts business.

Dos and Don'ts

When filling out the Connecticut Resale Certificate form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do:

- Do provide complete and accurate information about your business, including the name and address.

- Do specify the type of business you operate, such as wholesaler, retailer, or manufacturer.

- Do include your state registration or identification numbers for all relevant states.

- Do clearly describe the products you intend to purchase from the seller.

- Don't leave any sections blank; incomplete forms can lead to processing delays.

- Don't use the certificate for personal purchases or items not intended for resale.

- Don't forget to sign and date the form; an unsigned form is invalid.

- Don't assume the certificate is valid indefinitely; keep track of any changes or cancellations.

Other PDF Forms

Ca Divorce Forms - Verification of residency may be a requirement included within this form.

In situations where vehicle owners are unable to manage their motor vehicle affairs, the California Motor Vehicle Power of Attorney form becomes an indispensable resource. By enabling a trusted individual to act on their behalf, owners can ensure that the registration and ownership processes are maintained without disruption. For those looking for convenient options regarding this important document, they can explore resources such as California PDF Forms.

Physical Exam Form for Healthcare Workers - The general physical examination section evaluates vital signs like blood pressure, pulse, and temperature.

Detailed Guide for Writing Ct Resale Certificate

Completing the Connecticut Resale Certificate form is a straightforward process, but it requires careful attention to detail. This certificate is essential for businesses looking to make tax-exempt purchases for resale. Follow these steps to ensure that the form is filled out correctly and efficiently.

- Obtain the Form: Download the Connecticut Resale Certificate form from the Connecticut Department of Revenue Services website or acquire a physical copy.

- Fill in the Seller Information: In the first section, enter the name and address of the seller from whom you are purchasing goods.

- Complete Buyer Information: Next, provide your firm’s name and address. Be sure to include the street address or P.O. Box, city, and zip code.

- Select Your Business Type: Check the appropriate box that describes your business: Wholesaler, Retailer, Manufacturer, Lessor, or Other. If you select "Other," specify the type of business.

- List State Registrations: For each state or city where your firm is registered, fill in the name of the city or state and the corresponding registration or ID number. Repeat this for all applicable locations.

- Describe Your Business: Provide a brief description of the products you will be purchasing from the seller. This helps clarify the nature of your business transactions.

- Sign and Date the Form: The form must be signed by an authorized individual, such as an owner, partner, or corporate officer. Include their title and the date of signing.

Once the form is completed, it should be submitted to the seller. Keep a copy for your records, as it may be needed for future transactions or tax-related inquiries. Ensure that you understand the responsibilities that come with using this certificate, particularly regarding tax obligations.