Fillable Credit Check Authorization Document

Key takeaways

When filling out and using the Credit Check Authorization form, it is important to keep the following key takeaways in mind:

- Understand the Purpose: This form allows a lender or service provider to check your credit history, which is often a requirement for loans or rental applications.

- Provide Accurate Information: Ensure that all personal details, such as your name, address, and Social Security number, are correct to avoid delays.

- Read the Fine Print: Familiarize yourself with the terms and conditions associated with the credit check to know your rights and obligations.

- Know Your Rights: Under the Fair Credit Reporting Act, you have the right to know why your credit was checked and to dispute any inaccuracies.

- Limit the Number of Checks: Frequent credit checks can negatively impact your credit score, so only authorize checks when necessary.

- Check for Expiration: Some forms may have an expiration date; ensure that your authorization is still valid when the check is conducted.

- Keep a Copy: Always retain a copy of the signed form for your records, as it can be useful for future reference.

- Communicate with the Lender: If you have concerns or questions about the credit check, reach out to the lender or service provider for clarification.

- Be Aware of Fees: Some lenders may charge fees for conducting credit checks; confirm any costs upfront.

- Monitor Your Credit Report: Regularly review your credit report to ensure that all information is accurate and that no unauthorized checks have occurred.

Common mistakes

Filling out a Credit Check Authorization form can seem straightforward, but many people make common mistakes that can delay the process or lead to complications. One frequent error is providing incorrect personal information. Names, addresses, and Social Security numbers must be accurate. Even a small typo can result in significant issues.

Another mistake is neglecting to read the entire form. Some individuals rush through the process and miss important details or requirements. Taking the time to understand each section can prevent misunderstandings later on.

In addition, people often forget to sign and date the form. A signature is a crucial part of the authorization process. Without it, the request for a credit check cannot proceed, and this can cause unnecessary delays.

Some applicants also overlook the need to provide supporting documentation. Depending on the lender or agency, additional paperwork may be required to complete the authorization. Failing to include these documents can lead to rejection of the application.

Another common issue is not checking for completeness. After filling out the form, it’s essential to review it for any missing information. An incomplete form can result in automatic disqualification from the credit check process.

People sometimes misinterpret the purpose of the form. It is meant to authorize a credit check, not to apply for credit itself. Misunderstanding this can lead to confusion about the next steps in the process.

Additionally, individuals may not be aware of the importance of providing accurate contact information. If the credit agency needs to reach out for clarification or additional information, they must have the correct phone number or email address.

Lastly, some forget to follow up after submitting the form. It’s advisable to check in with the lender or agency to confirm that the authorization was received and is being processed. This proactive approach can help ensure that everything proceeds smoothly.

Misconceptions

Understanding the Credit Check Authorization form is essential for consumers and businesses alike. However, several misconceptions can cloud the true purpose and implications of this document. Here are four common misunderstandings:

-

Credit checks only affect your credit score negatively.

This is a prevalent myth. While it's true that certain types of credit inquiries can impact your score, not all checks are created equal. For example, a "soft inquiry," such as a pre-approval check, does not affect your credit score at all. Only "hard inquiries," typically associated with loan applications, can have a temporary negative effect.

-

You must authorize a credit check every time.

Many people believe that a new authorization is required for every single credit check. In reality, once you provide authorization, businesses may retain that permission for future checks, depending on their policies and the terms of the authorization. Always review the terms to understand how long your consent remains valid.

-

Credit checks are only for loans and credit cards.

This misconception overlooks the broader use of credit checks. Landlords, insurance companies, and employers may also conduct credit checks as part of their decision-making processes. Understanding this can help individuals be better prepared for various applications.

-

Signing the form means you will definitely be denied credit.

Many consumers fear that simply signing the authorization form guarantees a denial of credit. This is not the case. The form allows the lender to assess your creditworthiness, but it does not predetermine the outcome. Each application is evaluated on its own merits.

By addressing these misconceptions, individuals can approach the credit check process with greater confidence and clarity.

Dos and Don'ts

When filling out a Credit Check Authorization form, it's essential to approach the task with care. Here’s a helpful list of things you should and shouldn’t do:

- Do read the entire form thoroughly before signing.

- Do provide accurate and up-to-date personal information.

- Do double-check for any required signatures or initials.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; mistakes can lead to delays.

- Don't leave any fields blank unless instructed.

- Don't provide false information, as it can have serious consequences.

- Don't forget to verify the legitimacy of the request before sharing your information.

Check out Popular Documents

Md State Inspection - The parking brake functionality is verified during inspection.

When dealing with vehicle ownership and registration, it's often necessary to have a reliable process in place, especially when the owner cannot attend to these matters directly. The California Motor Vehicle Power of Attorney form serves as an essential tool in such situations, allowing a trusted individual to manage these responsibilities. For those looking for convenient resources, you might consider utilizing California PDF Forms to streamline the completion of this important document.

Texas Temporary Tag - Every Texas vehicular transaction can benefit from the utility of a temporary tag.

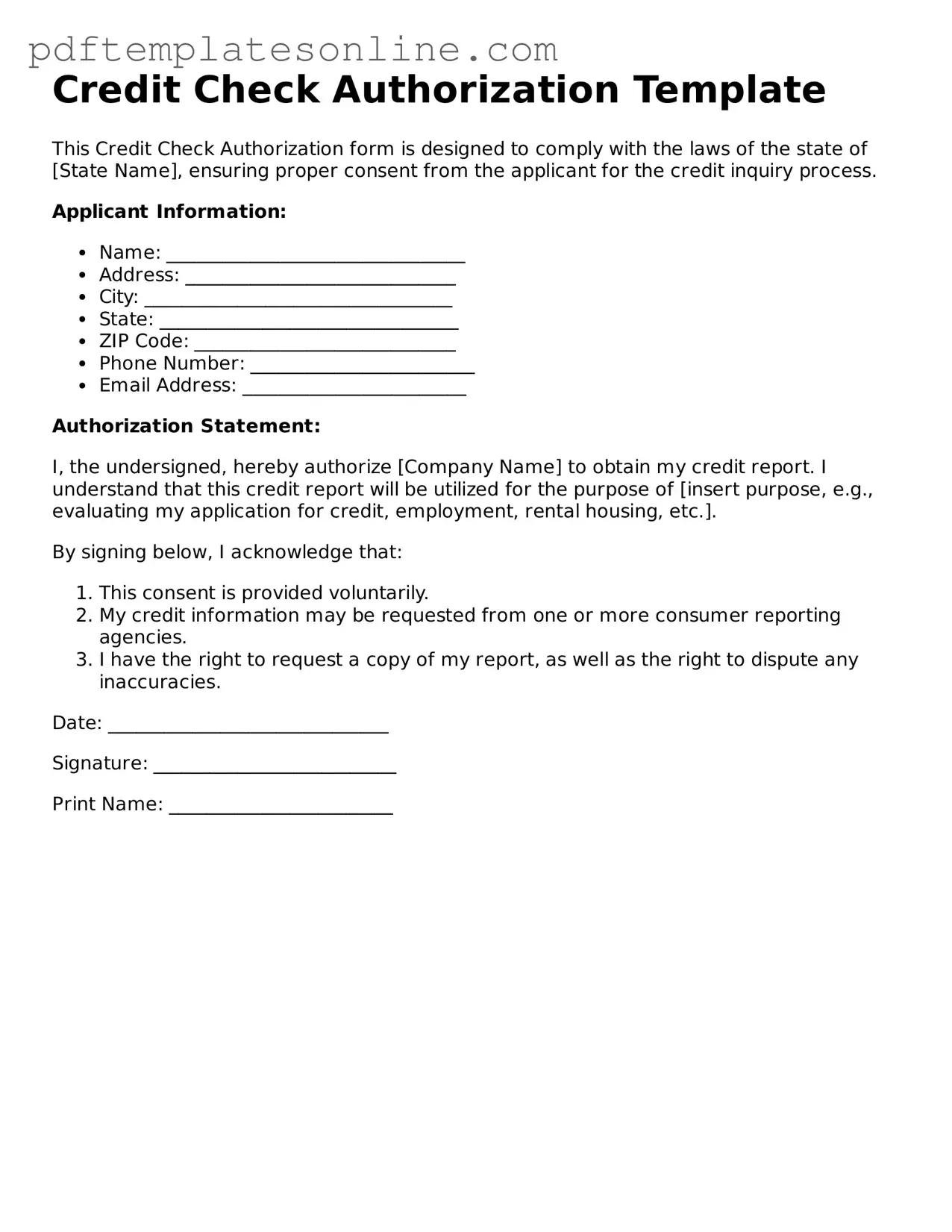

Detailed Guide for Writing Credit Check Authorization

After completing the Credit Check Authorization form, it will be submitted to the relevant department for processing. This will help in verifying your credit history as part of the application process. Follow the steps below to fill out the form accurately.

- Begin by entering your full name in the designated field.

- Provide your current address, including city, state, and zip code.

- Fill in your Social Security Number. Ensure that you double-check for accuracy.

- Input your date of birth in the specified format.

- Enter your phone number, making sure to include the area code.

- If applicable, provide your email address for further communication.

- Read the authorization statement carefully before signing.

- Sign and date the form at the bottom.