Blank Citibank Direct Deposit Form

Key takeaways

When filling out and using the Citibank Direct Deposit form, consider the following key takeaways:

- Ensure that all personal information is accurate. This includes your name, address, and Social Security number.

- Clearly indicate the type of account you wish to deposit funds into, whether it is a checking or savings account.

- Provide your Citibank account number. Double-check this number for accuracy to avoid delays in processing.

- Include the Citibank routing number. This is essential for directing funds to your account correctly.

- Sign and date the form. An unsigned form may lead to processing issues.

- Submit the completed form to your employer or the organization responsible for your payments.

- Keep a copy of the submitted form for your records. This can be helpful for future reference or in case of discrepancies.

Common mistakes

Filling out the Citibank Direct Deposit form can seem straightforward, but many people make common mistakes that can delay their payments. One major error is providing incorrect account numbers. Each bank account has a unique number, and even a single digit off can lead to funds being deposited into the wrong account. Always double-check your account number against your bank statements.

Another frequent mistake is neglecting to sign the form. Without a signature, the bank cannot process the request. It's a simple step, but it's often overlooked. Make sure to sign the form in the designated area before submitting it.

People also sometimes forget to include their routing number. The routing number is essential for directing funds to the correct bank. This number can usually be found on your checks or by contacting your bank. Ensure that you enter it correctly to avoid any issues.

In some cases, individuals fail to specify the type of account they are using. Whether it’s a checking or savings account, this detail is crucial. If you don’t indicate the account type, it may lead to confusion and delays in processing your deposit.

Another common error is submitting the form without verifying the information. It’s easy to rush through the process, but taking a moment to review your entries can save a lot of hassle. Look for typos or missing information before sending it off.

Finally, some people forget to keep a copy of the completed form for their records. Having a copy can be helpful if there are any issues later on. It serves as proof of what you submitted and can assist in resolving any discrepancies that may arise.

Misconceptions

Understanding the Citibank Direct Deposit form is important for anyone looking to set up direct deposit for their paycheck or benefits. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- Direct deposit is only for employees. Many people think that only employees can use direct deposit. In reality, anyone receiving regular payments, such as government benefits or pensions, can set up direct deposit.

- Setting up direct deposit is complicated. Some believe the process is overly complex. In fact, filling out the form is straightforward and usually requires just a few pieces of information.

- You need a Citibank account to use the form. While the form is designed for Citibank accounts, it can be used to deposit funds into accounts at other banks as well.

- Direct deposit is not secure. Many worry about the security of direct deposit. However, it is generally considered safer than receiving paper checks, which can be lost or stolen.

- Once set up, direct deposit cannot be changed. Some people think that once they set up direct deposit, they cannot make changes. In reality, you can update your information or switch accounts at any time.

- Direct deposit means you won't receive a pay stub. Many assume that opting for direct deposit eliminates the need for a pay stub. However, employers typically provide pay stubs regardless of how employees are paid.

- Direct deposit is only for full-time employees. There is a belief that only full-time employees can take advantage of direct deposit. Part-time workers and freelancers can also benefit from this service.

- You will receive your funds immediately. Some expect that direct deposits are available instantly. However, there may be a processing time, and funds may not be available until the next business day.

By addressing these misconceptions, individuals can better understand the Citibank Direct Deposit form and make informed decisions about their payment options.

Dos and Don'ts

When filling out the Citibank Direct Deposit form, it's important to be careful and precise. Here are some things you should and shouldn't do:

- Do double-check your account number for accuracy.

- Don't use a temporary account number.

- Do ensure your name matches the name on your bank account.

- Don't forget to sign the form where required.

- Do provide a valid routing number.

- Don't leave any required fields blank.

- Do keep a copy of the completed form for your records.

Following these guidelines can help ensure your direct deposit is set up correctly and without delays.

Other PDF Forms

Dos 1246 - Include proof of name change if applicable, such as a marriage certificate.

Megger Test Form - Provides a visual summary of electrical performance metrics.

Detailed Guide for Writing Citibank Direct Deposit

Filling out the Citibank Direct Deposit form is a straightforward process that ensures your funds are deposited directly into your bank account. Once you complete the form, you’ll need to submit it to your employer or the organization that will be processing your payments. This helps streamline your payment process and can provide peace of mind knowing your money is securely deposited.

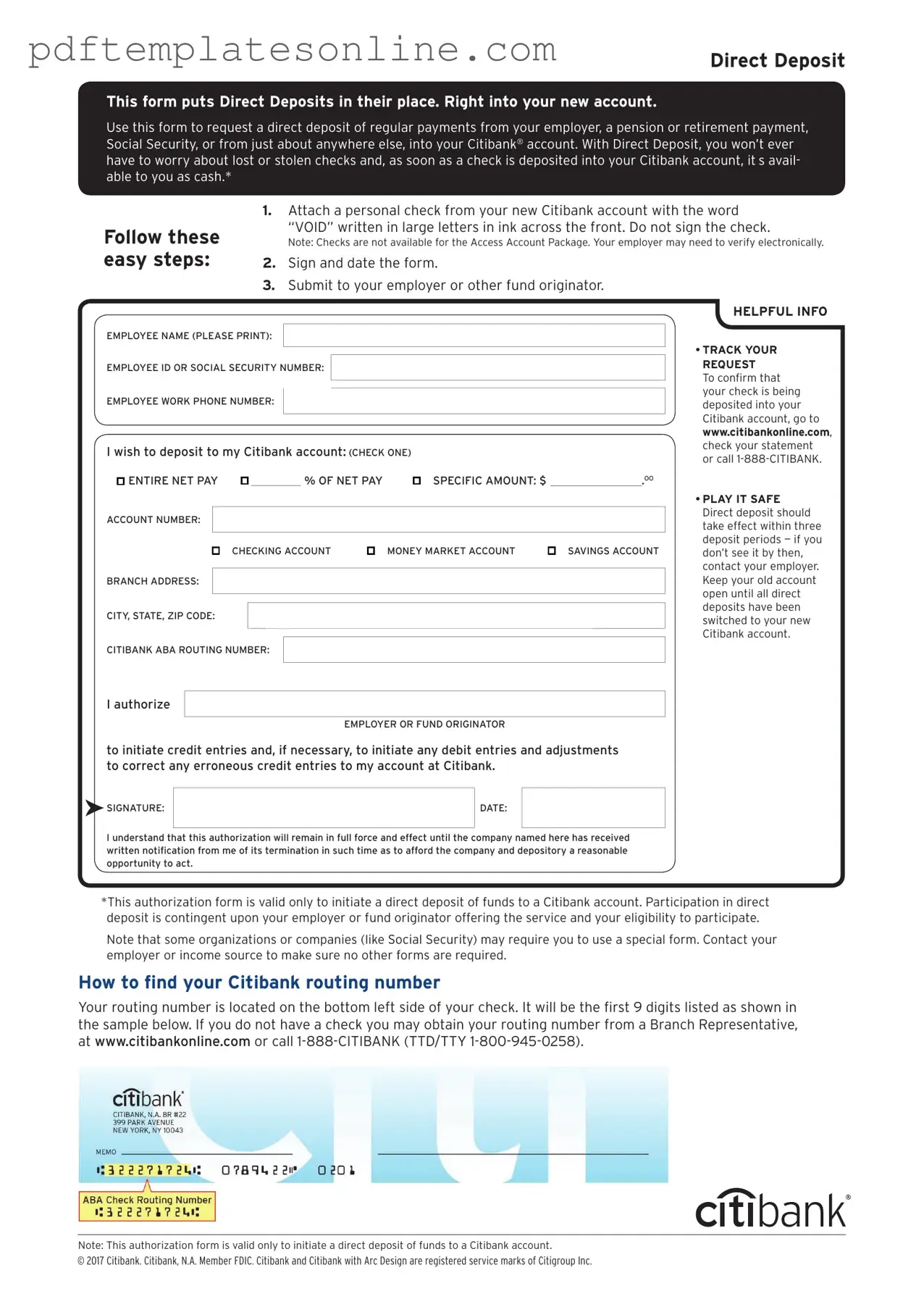

- Begin by locating the Citibank Direct Deposit form. Ensure you have the most current version.

- Fill in your personal information at the top of the form. This typically includes your name, address, and contact information.

- Provide your Social Security number. This is important for identification and processing purposes.

- Enter your bank account information. This includes the account number and the routing number for your Citibank account. You can find these numbers on your checks or by logging into your online banking account.

- Indicate the type of account you are using, either checking or savings. Make sure to check the appropriate box.

- Review all the information you have entered for accuracy. Double-check your account and routing numbers to avoid any issues.

- Sign and date the form at the designated area. This signature authorizes the direct deposit.

- Submit the completed form to your employer or the relevant organization handling your payments.