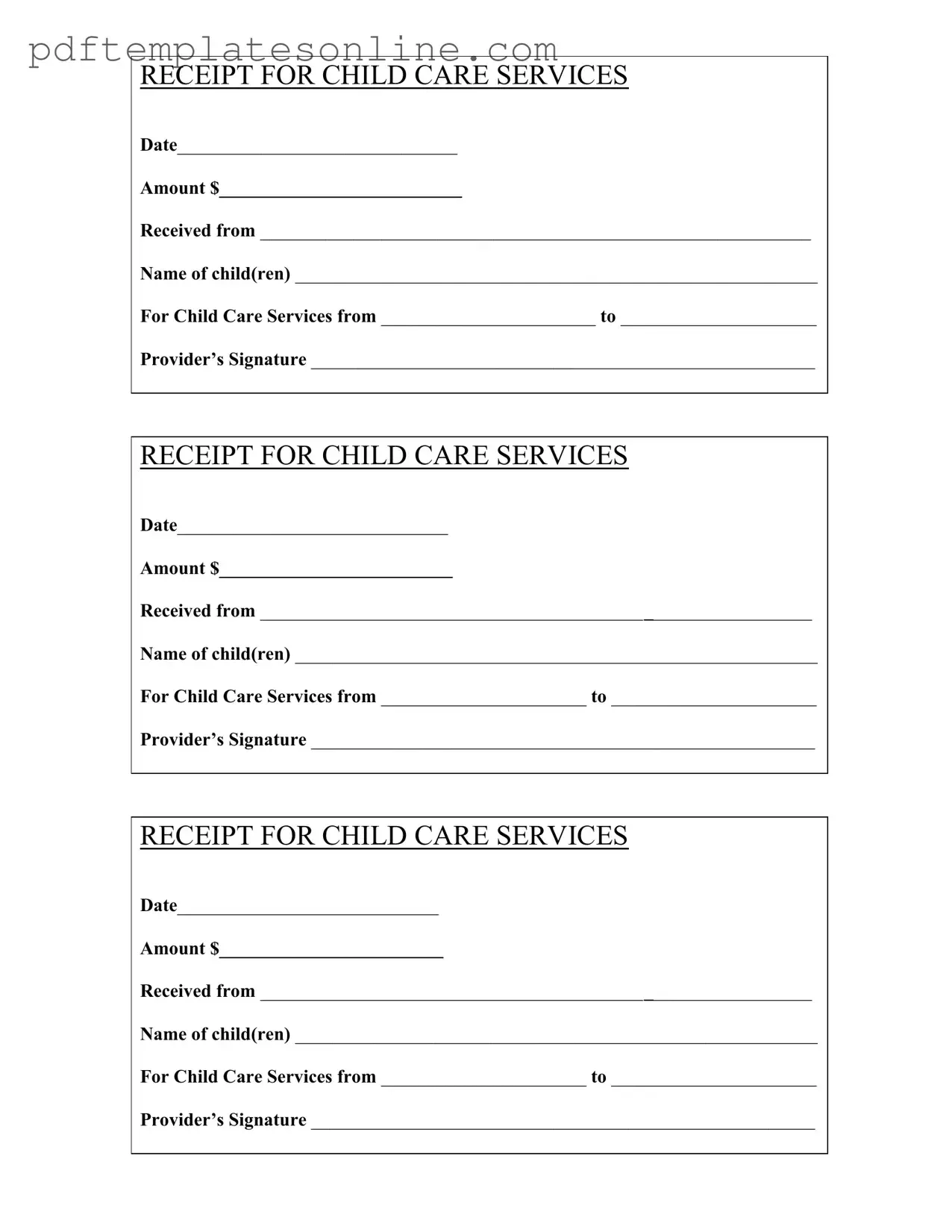

Blank Childcare Receipt Form

Key takeaways

Filling out and using the Childcare Receipt form is essential for keeping accurate records. Here are some key takeaways to consider:

- Complete All Fields: Ensure that every section of the form is filled out completely. This includes the date, amount, names of the children, and the care period.

- Provider's Signature: The form must be signed by the childcare provider. This signature verifies that the services were rendered.

- Keep Copies: Always keep a copy of the completed receipt for your records. This is important for tax purposes and any future disputes.

- Use Clear Dates: Clearly indicate the start and end dates of the childcare services. This helps avoid confusion later.

- Accurate Amounts: Double-check the amount received. An accurate figure is crucial for both your records and the provider's.

- Organize Receipts: Store your receipts in a designated folder. This makes it easier to find them when needed.

Common mistakes

Filling out the Childcare Receipt form can seem straightforward, but many people make common mistakes that can lead to confusion or issues later on. One frequent error is leaving the date section blank. This information is crucial, as it provides a timeline for when the childcare services were provided. Without a date, it can be difficult to verify the period of care, which may affect reimbursement or tax claims.

Another mistake often made is not including the amount paid for services. This figure is essential for both the provider and the parent. If the amount is missing, it can complicate financial records and hinder any potential claims for tax deductions. Always ensure this section is filled out completely and accurately.

People sometimes forget to write down the name of the child(ren) receiving care. This oversight can create problems if there are multiple children in the family or if the provider offers services to several families. Clearly indicating the names helps to avoid any mix-ups and ensures that the receipt is specific to the right child.

Another common error is neglecting to fill in the service dates. This section should clearly state the start and end dates of the childcare services. Without these dates, it becomes challenging to establish the duration of care, which can be important for both payment records and tax purposes.

Lastly, many people forget to obtain the provider's signature. This signature serves as proof that the childcare services were rendered and that the receipt is valid. Without it, the receipt may not hold up if questioned by tax authorities or financial institutions. Always ensure that the provider signs the form before considering it complete.

Misconceptions

There are several misconceptions regarding the Childcare Receipt form that can lead to confusion. Understanding these misconceptions can help parents and guardians navigate the process more effectively.

- All childcare providers must use the same form. In reality, providers may have different formats for their receipts. However, the essential information should remain consistent.

- The receipt is only necessary for tax purposes. While it is useful for tax deductions, the receipt also serves as proof of payment for parents and guardians.

- The receipt does not need to include specific dates. It is crucial to include the start and end dates of the childcare services to clarify the period covered by the payment.

- Only licensed providers can issue receipts. Even unlicensed caregivers can provide receipts, but the documentation should still contain all necessary details.

- Parents do not need to keep receipts if they pay in cash. Keeping receipts, regardless of payment method, is important for record-keeping and potential disputes.

- Receipts can be handwritten or typed without any issues. While both formats are acceptable, typed receipts are generally preferred for clarity and professionalism.

- Providers can alter receipts after they have been issued. Once a receipt is given, it should not be altered. Any changes should be documented with a new receipt.

- Only the provider’s signature is needed on the receipt. The receipt should also include the name of the parent or guardian for proper identification.

- Parents can ignore the amount section if they pay a flat fee. It is essential to specify the amount paid, even if it is a flat fee, to maintain accurate records.

Dos and Don'ts

When filling out the Childcare Receipt form, there are several important dos and don'ts to keep in mind. Following these guidelines can help ensure that your form is completed correctly and efficiently.

- Do fill in all required fields completely.

- Do double-check the dates for accuracy.

- Do clearly print the names of the child(ren) to avoid any confusion.

- Do keep a copy of the receipt for your records.

- Don't leave any sections blank unless specified.

- Don't use nicknames; always use the full legal names of the child(ren).

- Don't forget to obtain the provider’s signature before submitting the form.

Other PDF Forms

Usps Vacation Hold - Submit the form in advance to ensure your mail is held as requested.

In addition to the inherent structure and purpose of the Employment Application PDF form, candidates can find a convenient resource to obtain this essential document at https://mypdfform.com/blank-employment-application-pdf/, which can help streamline the application process and ensure that all necessary information is accurately provided.

How Do You Know You Had a Miscarriage - Overall, this form represents a critical intersection of medical care and personal experience.

Detailed Guide for Writing Childcare Receipt

After gathering the necessary information, you are ready to fill out the Childcare Receipt form. This form requires specific details about the childcare services provided. Follow these steps to ensure accurate completion.

- Write the current date in the designated space labeled "Date."

- Enter the total amount paid for the childcare services in the "Amount" section.

- Fill in the name of the person making the payment in the "Received from" line.

- List the names of the child(ren) receiving care in the "Name of child(ren)" field.

- Indicate the start date of the childcare services in the "For Child Care Services from" section.

- Specify the end date of the childcare services in the "to" section.

- Sign the form in the "Provider’s Signature" area to validate the receipt.