Blank Cg 20 10 07 04 Liability Endorsement Form

Key takeaways

Here are key takeaways for filling out and using the CG 20 10 07 04 Liability Endorsement form:

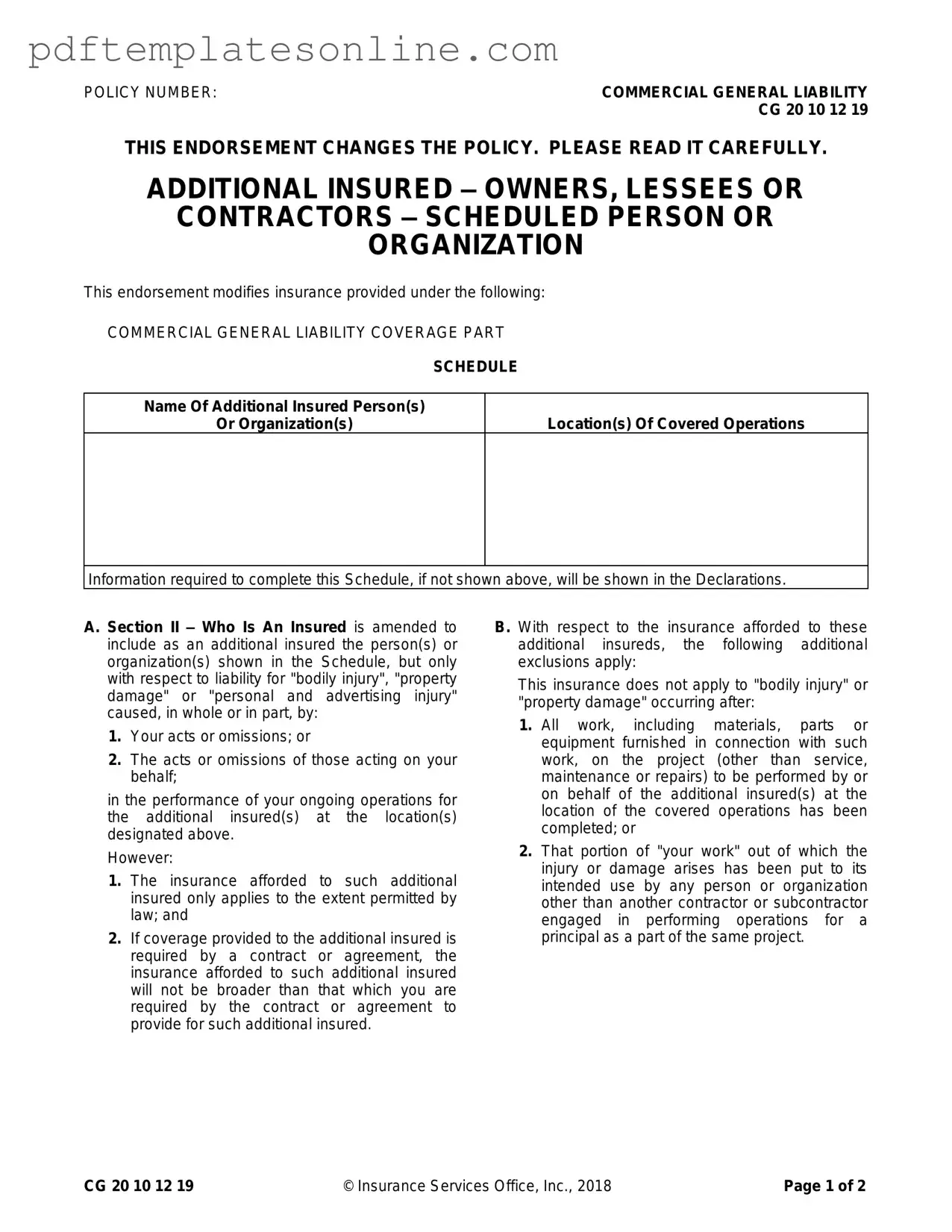

- Understand the Purpose: This endorsement adds additional insured parties to your commercial general liability policy. It is crucial for protecting those parties from liability related to your operations.

- Complete the Schedule: Ensure you accurately list the names of additional insured persons or organizations and the locations of covered operations. This information is essential for the endorsement to be valid.

- Review Coverage Limits: The coverage for additional insureds is limited to what is required by contract or the policy's existing limits. Familiarize yourself with these limits to avoid surprises.

- Know the Exclusions: Coverage does not apply to injuries or damages that occur after your work is completed or after the project has been put to its intended use. Be aware of these exclusions to manage risks effectively.

- Legal Compliance: The insurance provided will only apply to the extent permitted by law. Ensure that your endorsements comply with relevant legal requirements.

- Contractual Obligations: If a contract requires additional insured status, the coverage provided cannot exceed what the contract stipulates. Always refer to your agreements when filling out the form.

Common mistakes

Filling out the CG 20 10 07 04 Liability Endorsement form can be a straightforward process, but there are common mistakes that individuals often make. These errors can lead to complications in coverage and potential disputes down the line. Understanding these pitfalls can help ensure that the form is completed accurately and effectively.

One significant mistake is failing to provide complete and accurate information in the Name of Additional Insured Person(s) or Organization(s) section. It is crucial to list the correct names as they appear in official documents. Omitting a middle initial or misspelling a name may result in coverage issues. Always double-check the spelling and ensure that the names match the legal entities you intend to cover.

Another common error involves neglecting to specify the Location(s) of Covered Operations. This section is vital, as it defines where the coverage applies. If this information is missing or unclear, it could lead to confusion about the scope of the insurance. Providing precise addresses or descriptions of the locations where work will be performed helps to avoid misunderstandings later.

Additionally, individuals often overlook the importance of understanding the limitations of the coverage. The form explicitly states that the insurance for additional insureds only applies to the extent permitted by law. Ignoring this can lead to unrealistic expectations about the extent of coverage. It is essential to read the terms carefully and understand that the coverage may not be as broad as one might hope.

People sometimes also fail to consider the implications of contractual obligations when filling out the form. If coverage is required by a contract or agreement, the insurance provided cannot exceed what is stipulated in that document. Misunderstanding this can lead to inadequate coverage, leaving parties exposed to risks they thought were covered. Always refer back to any existing contracts to ensure compliance.

Finally, a frequent oversight is not reviewing the entire form before submission. Even minor errors can have significant consequences. Taking the time to review each section can help catch mistakes, ensuring that the information is complete and accurate. A thorough review can save time and prevent potential issues in the future.

Misconceptions

Here are ten common misconceptions about the CG 20 10 07 04 Liability Endorsement form, along with clarifications for each:

- All entities are automatically covered as additional insureds. Many believe that any party involved in a contract is automatically included. In reality, only those specifically listed in the endorsement are covered.

- This endorsement covers all types of liability. Some think it provides blanket coverage. However, it only covers liability related to bodily injury, property damage, or personal and advertising injury caused by your actions or those acting on your behalf.

- Once added, the coverage lasts indefinitely. It's a common assumption that coverage continues forever. In fact, it only applies while ongoing operations are being performed for the additional insured at the designated locations.

- Coverage is the same as the primary policy. Many assume the coverage for additional insureds is identical to that of the primary insured. This is not true; the coverage can be limited based on contract requirements.

- All work is covered until the project is finished. Some believe that coverage lasts until project completion. However, coverage ends once all work related to the project is completed, except for service or maintenance.

- The endorsement increases the policy limits. There’s a misconception that adding additional insureds raises the overall limits. In reality, the endorsement does not increase the applicable limits of insurance.

- Coverage applies regardless of contractual obligations. Some think that the endorsement provides coverage without regard to any contracts. However, if a contract requires specific coverage, the insurance provided cannot exceed what the contract stipulates.

- Coverage applies to any location. Many believe that any location is covered. The endorsement only applies to locations specified in the schedule.

- All injuries and damages are covered. There’s a belief that all incidents are covered. However, the endorsement specifically excludes injuries or damages that arise after the work has been put to its intended use.

- Additional insureds have the same rights as the primary insured. Some think additional insureds can make claims like the primary insured. In fact, their rights are limited to the terms outlined in the endorsement.

Dos and Don'ts

When filling out the CG 20 10 07 04 Liability Endorsement form, it’s essential to approach the task with care. Here are ten important things to keep in mind:

- Do read the entire endorsement carefully before starting.

- Don’t leave any required fields blank; provide all necessary information.

- Do ensure the policy number is correct and matches your documents.

- Don’t use abbreviations or shorthand that might confuse the reviewer.

- Do specify the names of additional insured persons or organizations clearly.

- Don’t forget to include the location of covered operations.

- Do double-check for typos or errors before submitting the form.

- Don’t assume that your previous endorsements are still valid; verify each time.

- Do understand the limitations of coverage as outlined in the endorsement.

- Don’t overlook the exclusions; they can significantly impact coverage.

Following these guidelines will help ensure that your form is completed accurately and efficiently.

Other PDF Forms

Alabama Public Title Portal - Notifications regarding security interests can be noted on the form, ensuring all parties are aware of existing liens.

Bdsm Kink Checklist - Consider how body language might signal comfort or discomfort during play.

The Employment Application PDF form is an essential resource for aspiring candidates, as it aids in gathering critical information required by employers. By accurately filling out this document, applicants can present their personal details, work history, education, and references effectively. To access a convenient version of this form, you can visit mypdfform.com/blank-employment-application-pdf, making the application process smoother for job seekers.

Durable Power of Attorney Florida - In emergencies, having a POA can expedite necessary vehicle procedures.

Detailed Guide for Writing Cg 20 10 07 04 Liability Endorsement

Completing the CG 20 10 07 04 Liability Endorsement form is essential for ensuring that the necessary parties are covered under your commercial general liability policy. This process requires careful attention to detail, as the information provided will determine the extent of coverage for additional insureds. Follow these steps closely to fill out the form accurately.

- Obtain the Form: Start by downloading or printing the CG 20 10 07 04 Liability Endorsement form from a reliable source.

- Fill in the Policy Number: Locate the section labeled "POLICY NUMBER" and enter your commercial general liability policy number.

- Identify Additional Insureds: In the section titled "Name Of Additional Insured Person(s) Or Organization(s)," list the names of the individuals or organizations that need to be added as additional insureds.

- Specify Locations: Next, fill in the "Location(s) Of Covered Operations" section with the addresses where the operations related to the additional insureds will take place.

- Review the Declarations: If any required information is not displayed in the form, check the Declarations page of your policy for the necessary details.

- Double-Check Your Entries: Ensure all names and addresses are spelled correctly and that no fields are left blank.

- Sign and Date: Finally, sign and date the form to certify that the information provided is accurate and complete.

Once the form is filled out, submit it to your insurance provider as directed. They will process the endorsement and update your policy accordingly. Make sure to keep a copy for your records, as it may be needed for future reference.