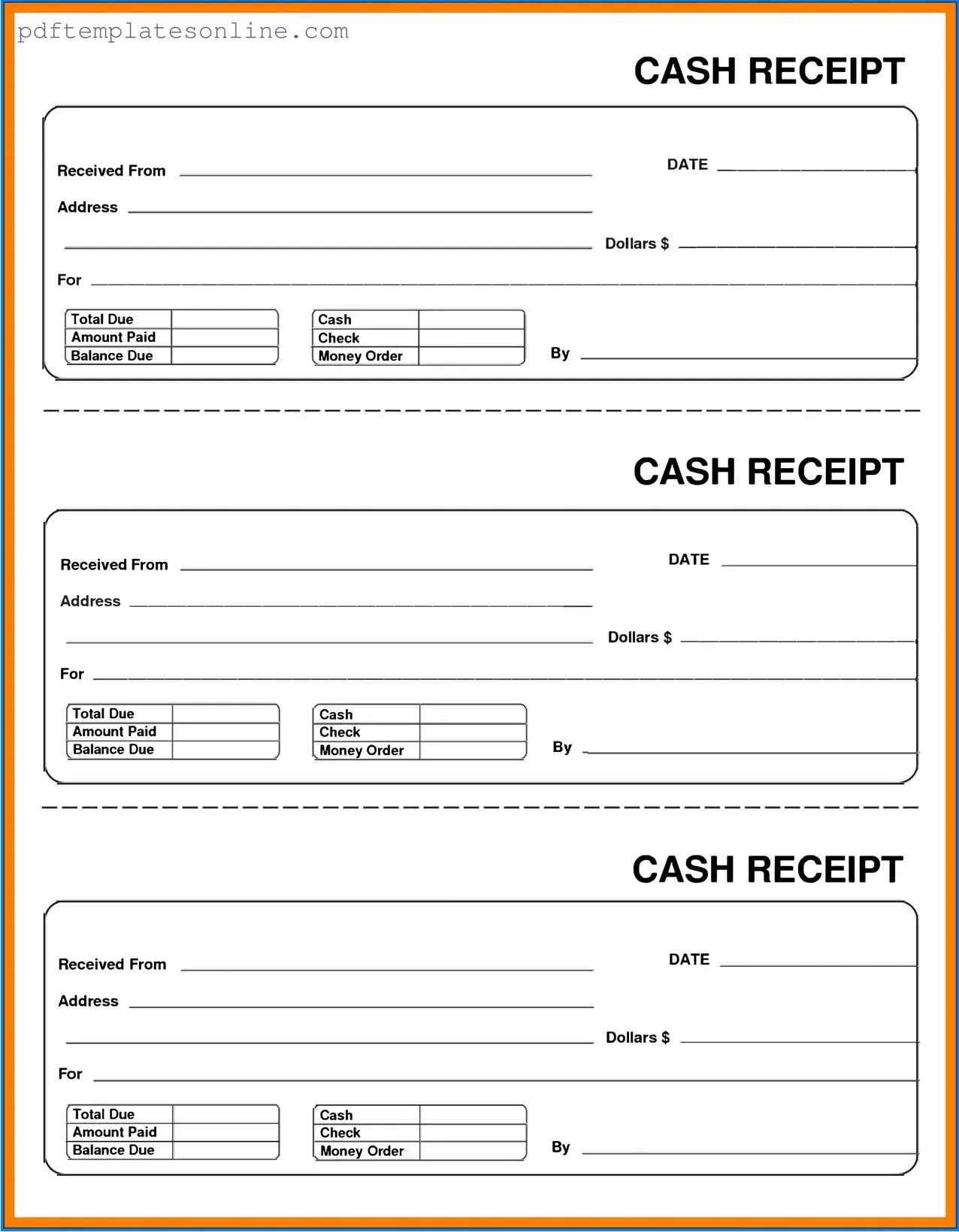

Blank Cash Receipt Form

Key takeaways

When filling out and using the Cash Receipt form, there are several important considerations to keep in mind. These key takeaways can help ensure accuracy and compliance.

- Accurate Information: Always provide accurate details, including the date, amount received, and the purpose of the payment. This ensures clarity and helps prevent misunderstandings.

- Signature Requirement: A signature from the person receiving the cash is crucial. This serves as a confirmation that the funds were indeed received.

- Record Keeping: Maintain a copy of the Cash Receipt form for your records. This is essential for tracking transactions and for future reference.

- Timely Submission: Submit the completed form promptly to the appropriate department. Delays can lead to discrepancies in financial records.

- Use of Clear Language: Avoid jargon and use clear language when describing the purpose of the payment. This makes it easier for anyone reviewing the form to understand the context.

- Compliance with Policies: Ensure that you are familiar with and adhere to any organizational policies regarding cash handling and receipt documentation.

By keeping these points in mind, you can effectively manage cash transactions and maintain accurate financial records.

Common mistakes

Filling out the Cash Receipt form accurately is crucial for maintaining proper financial records. However, many individuals make common mistakes that can lead to confusion and errors. One frequent mistake is failing to include all necessary information. Each section of the form must be completed, including the date, amount received, and the payer's details. Omitting any of these elements can delay processing and cause discrepancies in accounting.

Another common error is miscalculating the total amount received. Double-checking calculations is essential. An incorrect total can lead to significant issues in financial reporting. It is advisable to verify the math before submitting the form. This simple step can save time and prevent potential audits.

People often overlook the importance of clear handwriting. Illegible writing can create misunderstandings regarding the details provided. It is vital to ensure that all information is written clearly and legibly. If typing is an option, it is preferable to avoid any ambiguity.

Additionally, some individuals forget to sign and date the form. This oversight can render the document invalid. A signature confirms the authenticity of the transaction, while the date indicates when the payment was received. Both elements are essential for proper record-keeping.

Another mistake involves using outdated forms. Financial procedures may change, and using the correct version of the Cash Receipt form is important. Always check for the latest version to ensure compliance with current policies and practices.

Finally, failing to keep a copy of the completed form is a significant oversight. Retaining a copy provides a record of the transaction for future reference. This practice can be invaluable in case of disputes or audits. Always make sure to keep a duplicate for personal records.

Misconceptions

Understanding the Cash Receipt form is essential for both businesses and individuals who engage in financial transactions. However, several misconceptions can lead to confusion. Here are ten common misunderstandings about the Cash Receipt form:

-

All cash transactions require a Cash Receipt form.

This is not true. While it is advisable to document cash transactions for accountability, not every cash exchange necessitates a formal Cash Receipt form.

-

The Cash Receipt form is only for businesses.

Individuals can also use Cash Receipt forms for personal transactions, such as selling items or providing services.

-

Cash Receipt forms are only needed for large transactions.

Even small cash transactions benefit from documentation. Keeping a record helps in tracking finances, regardless of the amount.

-

A Cash Receipt form must be printed.

While many prefer printed forms for record-keeping, digital versions are equally valid as long as they contain the necessary information.

-

Once a Cash Receipt form is filled out, it cannot be changed.

Corrections can be made if necessary, but it’s important to document any changes clearly to maintain transparency.

-

Cash Receipt forms are only for cash payments.

These forms can also be used for other payment methods, such as checks or electronic transfers, as long as cash is involved in the transaction.

-

Only the seller needs to keep a copy of the Cash Receipt form.

Both parties should retain a copy for their records. This practice ensures clarity and accountability in the transaction.

-

Cash Receipt forms are not necessary for tax purposes.

In fact, having these forms can be beneficial during tax season, as they provide proof of income and expenses.

-

All Cash Receipt forms look the same.

Forms can vary significantly based on the organization or individual’s preferences. However, they generally include similar essential information.

-

Cash Receipt forms are outdated and no longer used.

Despite advancements in technology, Cash Receipt forms remain relevant. Many businesses still rely on them for accurate financial tracking.

Addressing these misconceptions can help individuals and businesses utilize Cash Receipt forms more effectively, ensuring better financial management and accountability.

Dos and Don'ts

When filling out the Cash Receipt form, attention to detail is crucial. Here are seven guidelines to follow and avoid for a smooth process.

- Do: Ensure all required fields are completed accurately.

- Do: Double-check the amount received for accuracy.

- Do: Use clear and legible handwriting or type the information.

- Do: Include the date of the transaction.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank.

- Don't: Use correction fluid on the form; instead, cross out errors neatly.

Following these guidelines can help prevent errors and ensure proper documentation of cash transactions.

Other PDF Forms

Better Business Bureau Website - Flag breaches of warranty terms by a seller.

Futa Chart - Employers can consult IRS publications for additional guidance on Form 940 reporting.

The California Transfer-on-Death Deed form allows homeowners to pass on their property to a beneficiary without the complexities of going through probate court. This legal document offers a straightforward way for property owners to ensure their real estate transitions smoothly after they pass away. It's a valuable tool, designed to simplify the process of transferring property ownership in California. For those interested in this form, more information can be found on California PDF Forms.

Salary Amount and Frequency I983 - The I-983 serves as a formal agreement before proceeding with training activities.

Detailed Guide for Writing Cash Receipt

After obtaining the Cash Receipt form, you will need to complete it accurately to ensure proper record-keeping. Follow the steps below to fill out the form correctly.

- Start by entering the date of the transaction in the designated field.

- Write the name of the individual or organization making the payment.

- Fill in the amount received in the appropriate box.

- Specify the payment method, such as cash, check, or credit card.

- If applicable, include any reference number associated with the payment.

- Provide a brief description of the purpose of the payment.

- Sign the form to confirm that the information is accurate.