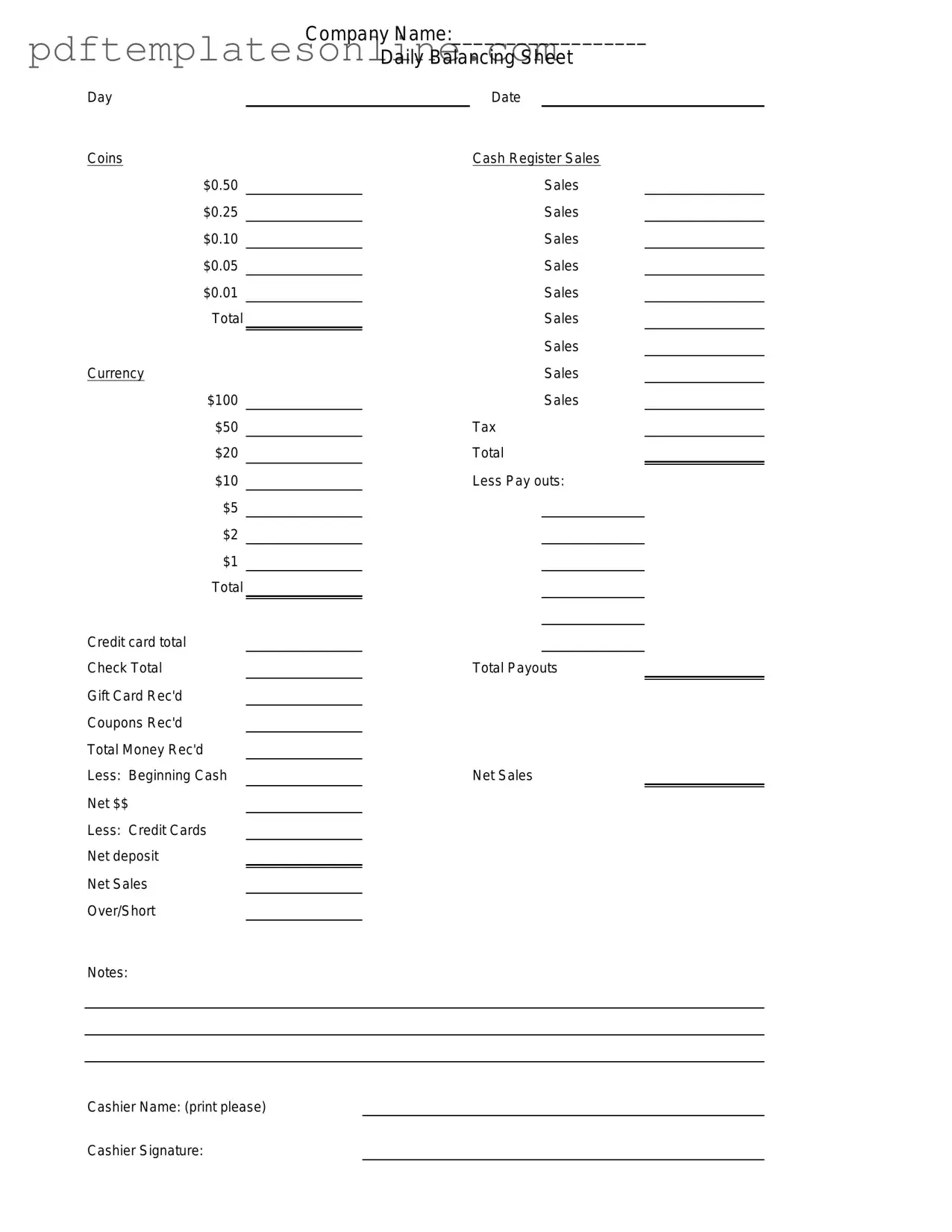

Blank Cash Drawer Count Sheet Form

Key takeaways

When using the Cash Drawer Count Sheet form, several key points can enhance your understanding and efficiency. Here are some essential takeaways:

- Ensure you fill out the form at the beginning and end of each shift to maintain accurate records.

- Double-check your cash totals to avoid discrepancies; errors can lead to bigger issues later.

- Include all denominations of cash, including coins, to provide a complete picture of your drawer's contents.

- Use clear and legible handwriting to prevent misinterpretation of your entries.

- Keep the form in a secure location to protect sensitive financial information.

- Review the completed form with a supervisor if required, fostering accountability and transparency.

- Store the form for future reference; it can be useful for audits or financial reviews.

- Regularly train staff on how to accurately complete the form to ensure consistency across shifts.

By following these guidelines, you can effectively manage cash drawer counts and contribute to a smoother operational process.

Common mistakes

When filling out the Cash Drawer Count Sheet form, accuracy is crucial. One common mistake is failing to double-check the cash amounts. Individuals may miscount bills or overlook coins, leading to discrepancies. A simple verification process can prevent these errors.

Another frequent error is neglecting to record all forms of payment. Cash, checks, and credit card transactions should all be documented. Omitting any of these can result in an incomplete financial picture.

Inconsistent notation is also a prevalent issue. Using different formats for writing amounts can create confusion. For example, writing "$100" in one instance and "100" in another may lead to misunderstandings during reconciliation.

People often forget to sign and date the Cash Drawer Count Sheet. This step is essential for accountability. Without a signature, it may be unclear who completed the form, which can complicate audits.

Another mistake is not using the correct version of the form. Sometimes, outdated forms circulate, which can lead to missing information or incorrect calculations. Always ensure the latest version is being used.

Inadequate training can also contribute to errors. If individuals are not familiar with the form or its purpose, they may fill it out incorrectly. Providing clear instructions and training can help mitigate this issue.

Some people overlook the importance of clear handwriting. Illegible writing can cause misunderstandings or errors in data entry. Taking the time to write clearly can save time and effort later on.

Failing to keep a copy of the completed form is another mistake. Retaining a record can be beneficial for future reference or audits. Individuals should consider making a photocopy or scanning the document.

Inconsistent cash handling practices can lead to errors on the form. If individuals do not follow the same procedures for cash management, discrepancies may arise. Establishing standardized practices can help maintain accuracy.

Lastly, not reviewing the completed form before submission can lead to overlooked mistakes. A final check can catch errors that may have been missed during the initial filling out process. Taking a moment to review can enhance overall accuracy.

Misconceptions

- Misconception 1: The Cash Drawer Count Sheet is only for cash transactions.

- Misconception 2: The form is only necessary at the end of the day.

- Misconception 3: It is only needed in retail environments.

- Misconception 4: Completing the form is a complicated process.

This form can track all types of transactions, not just cash. It helps in keeping an accurate record of all sales, including credit and debit card payments.

While it is often used for end-of-day reconciliation, the Cash Drawer Count Sheet can also be useful throughout the day. Regular updates can help identify discrepancies early.

Many businesses, including restaurants and service providers, can benefit from using this form. It aids in tracking cash flow and ensuring accurate financial records.

The Cash Drawer Count Sheet is designed to be straightforward. With clear instructions, anyone can fill it out without extensive training.

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, it’s important to be meticulous and organized. Here are some key dos and don'ts to keep in mind:

- Do double-check your cash totals before recording them.

- Do ensure that all denominations are accurately counted and listed.

- Do keep the form clean and free from smudges or stray marks.

- Do submit the form promptly after completing the count.

- Don't rush through the counting process; accuracy is crucial.

- Don't use correction fluid or erase any entries on the form.

- Don't leave any sections of the form blank; fill in all required information.

- Don't forget to sign and date the form before submission.

Other PDF Forms

Hunter Permission - Respect for property boundaries is a key requirement.

The California Transfer-on-Death Deed form allows homeowners to pass on their property to a beneficiary without the complexities of going through probate court. This legal document offers a straightforward way for property owners to ensure their real estate transitions smoothly after they pass away. It's a valuable tool, designed to simplify the process of transferring property ownership in California, and you can find more resources, including forms and details, at California PDF Forms.

Custody Affidavit - This document may be a necessary step before seeking other legal arrangements for the child.

Ucc 308 - The affidavit stands as a testimony of rights preserved from birth onward.

Detailed Guide for Writing Cash Drawer Count Sheet

After gathering the necessary cash and preparing your workspace, you’re ready to fill out the Cash Drawer Count Sheet. This form will help you accurately record the amount of cash in your drawer, ensuring accountability and transparency. Follow the steps below to complete the form correctly.

- Start with the date at the top of the form. Write the current date clearly.

- Next, enter your name or the name of the person responsible for the cash drawer.

- In the designated section, list the denominations of cash you have. This includes bills and coins.

- Count each denomination carefully. Write down the number of each type of bill and coin in the appropriate columns.

- Calculate the total amount for each denomination. Multiply the number of bills or coins by their respective values.

- Sum the totals of all denominations to find the overall cash total. Write this amount in the designated area.

- Finally, sign and date the form to confirm that the count is accurate.

Once the form is complete, it should be submitted to the appropriate supervisor or manager for review. Ensure that it is stored securely for future reference.