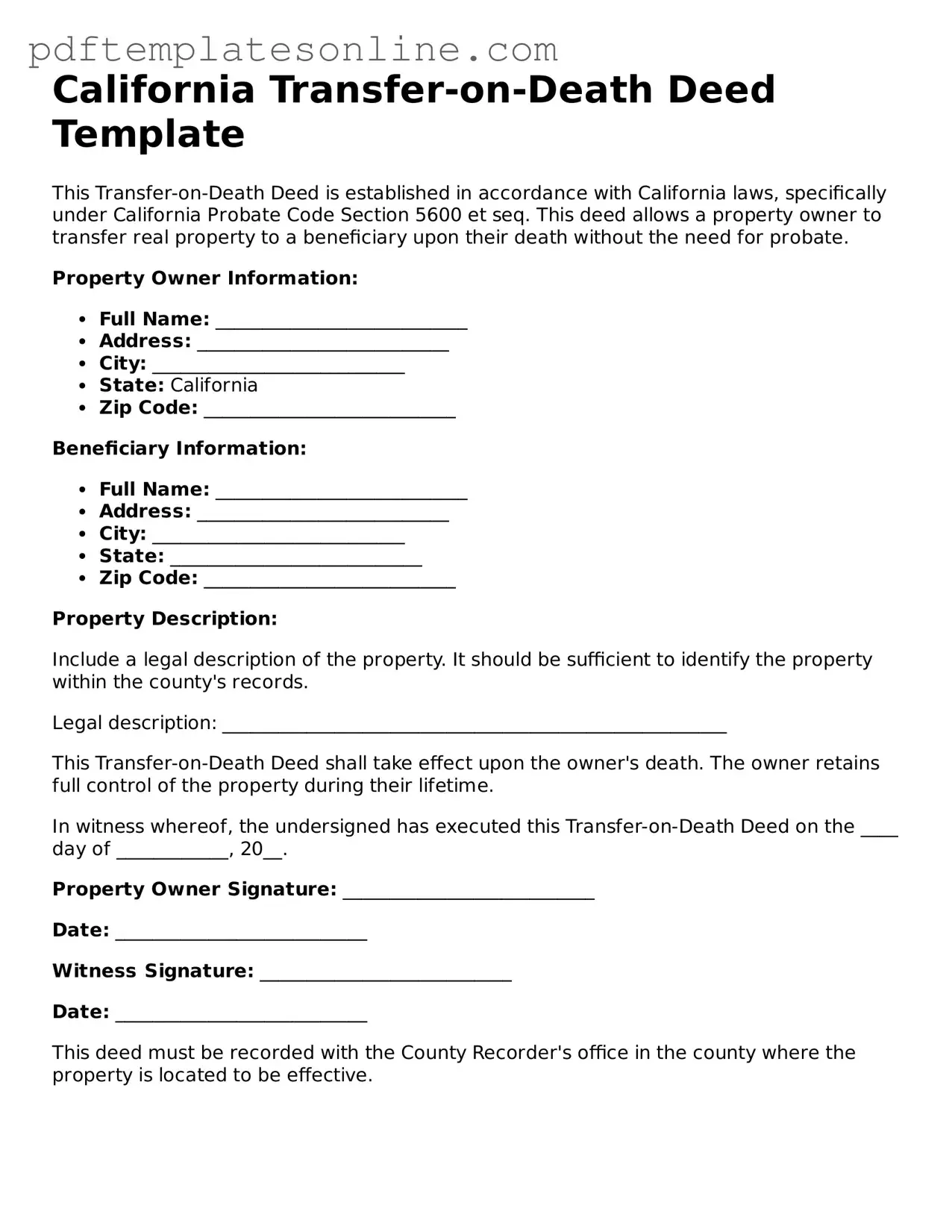

Official California Transfer-on-Death Deed Document

Key takeaways

When considering the California Transfer-on-Death Deed form, there are several important points to keep in mind. This deed allows property owners to transfer their property upon death without going through probate.

- Eligibility: Only individuals can use this deed. Joint tenants and community property owners cannot transfer property using this method.

- Filling Out the Form: Ensure that all required information, such as the property description and the names of the beneficiaries, is accurately provided.

- Signature Requirement: The deed must be signed by the property owner(s) in front of a notary public to be valid.

- Recording the Deed: After signing, the deed must be recorded with the county recorder’s office where the property is located to take effect.

- Revocation: Property owners can revoke the deed at any time before their death by filing a revocation form with the county recorder.

- Tax Implications: Beneficiaries should be aware that property taxes may reassess upon transfer, which could lead to increased costs.

Understanding these key points can help ensure that the Transfer-on-Death Deed is filled out correctly and serves its intended purpose.

Common mistakes

Filling out the California Transfer-on-Death Deed form can be a straightforward process, but several common mistakes can complicate matters. One frequent error occurs when individuals fail to properly identify the property. It is crucial to provide a complete and accurate legal description of the property being transferred. Omitting details such as the parcel number or street address can lead to confusion and potential legal disputes in the future.

Another mistake involves the designation of beneficiaries. Many people overlook the importance of naming the beneficiaries clearly and correctly. If a beneficiary's name is misspelled or if the relationship to the property owner is not specified, it may create issues during the transfer process. Ensuring that the names match official documents is essential to avoid complications.

Additionally, individuals often neglect to sign the deed in the presence of a notary public. A Transfer-on-Death Deed must be notarized to be legally valid in California. Failing to complete this step can render the deed ineffective, leaving the property in limbo and potentially leading to disputes among heirs.

Finally, some people mistakenly believe that simply filling out the form is enough. They may not realize the importance of recording the deed with the county recorder's office. Until the deed is recorded, it does not take effect. Without this crucial step, the intended transfer may not be recognized, leading to unintended consequences for the property owner and their beneficiaries.

Misconceptions

The California Transfer-on-Death Deed (TOD) is a useful tool for estate planning, but several misconceptions surround its use. Understanding these misconceptions can help individuals make informed decisions about their property and estate.

- Misconception 1: The TOD Deed is the same as a will.

- Misconception 2: You cannot change or revoke a TOD Deed once it is created.

- Misconception 3: A TOD Deed only works for single individuals.

- Misconception 4: The property is immediately transferred to the beneficiary upon signing the TOD Deed.

- Misconception 5: A TOD Deed can be used for all types of property.

- Misconception 6: There are no tax implications when using a TOD Deed.

A TOD Deed transfers property outside of probate upon the owner’s death. Unlike a will, which requires probate, a TOD Deed allows for a more straightforward transfer process.

This is not true. A TOD Deed can be revoked or changed at any time before the property owner’s death, as long as the owner follows the proper procedures.

In fact, a TOD Deed can be executed by individuals who are married or in domestic partnerships. Co-owners can also create a TOD Deed for their share of the property.

This is incorrect. The transfer only occurs upon the death of the property owner. Until that time, the owner retains full rights to the property.

While a TOD Deed is effective for real estate, it cannot be used for personal property, bank accounts, or other assets. It is specifically designed for real property in California.

While a TOD Deed can avoid probate, it does not eliminate potential tax liabilities. Beneficiaries may still be subject to property taxes or capital gains taxes depending on the situation.

Dos and Don'ts

When completing the California Transfer-on-Death Deed form, it is important to follow specific guidelines to ensure accuracy and compliance with state laws. Below is a list of things to do and avoid.

- Do ensure you are the legal owner of the property before filling out the form.

- Do provide accurate property descriptions to avoid any confusion or disputes.

- Do include the full names of the beneficiaries you wish to designate.

- Do sign the deed in the presence of a notary public to validate it.

- Don't forget to check for any local requirements that may apply to the deed.

- Don't leave any fields blank; incomplete forms may be rejected.

- Don't use vague language when describing the property or beneficiaries.

- Don't assume that verbal agreements are sufficient; all terms must be documented in writing.

Browse Popular Transfer-on-Death Deed Forms for US States

Transfer on Death Deed Form Georgia - It can serve as a cost-effective solution for individuals seeking to pass down real estate without hassle.

Using a Straight Bill of Lading can significantly streamline your shipping process, as it functions not only as a receipt for goods but also as a binding contract between the shipper and the carrier. This essential document provides crucial information about the shipment, and to facilitate your shipping needs, you can access the necessary documentation through the Straight Bill Of Lading form.

Where Can I Get a Tod Form - The deed takes effect only upon the death of the property owner, making it an effective estate planning tool.

Detailed Guide for Writing California Transfer-on-Death Deed

After obtaining the California Transfer-on-Death Deed form, it's important to complete it accurately to ensure your wishes are honored. This process involves providing specific information about the property and the beneficiaries. Once the form is filled out, you will need to have it notarized and recorded with the county recorder's office where the property is located.

- Start by entering the name of the property owner(s) at the top of the form. Make sure to include all owners if the property is jointly held.

- Next, provide the address of the property. This should include the street address, city, and zip code.

- Identify the legal description of the property. This can often be found on the property's deed or tax records. It may include details such as lot number, block number, and subdivision name.

- List the name(s) of the beneficiary or beneficiaries. These are the individuals who will receive the property upon the owner's death.

- Include the address of each beneficiary. This ensures that the county can reach them if necessary.

- Sign and date the form. If there are multiple owners, all must sign.

- Have the form notarized. This step is crucial for the document to be legally valid.

- Finally, take the completed and notarized form to the county recorder's office where the property is located. Pay any applicable recording fees.