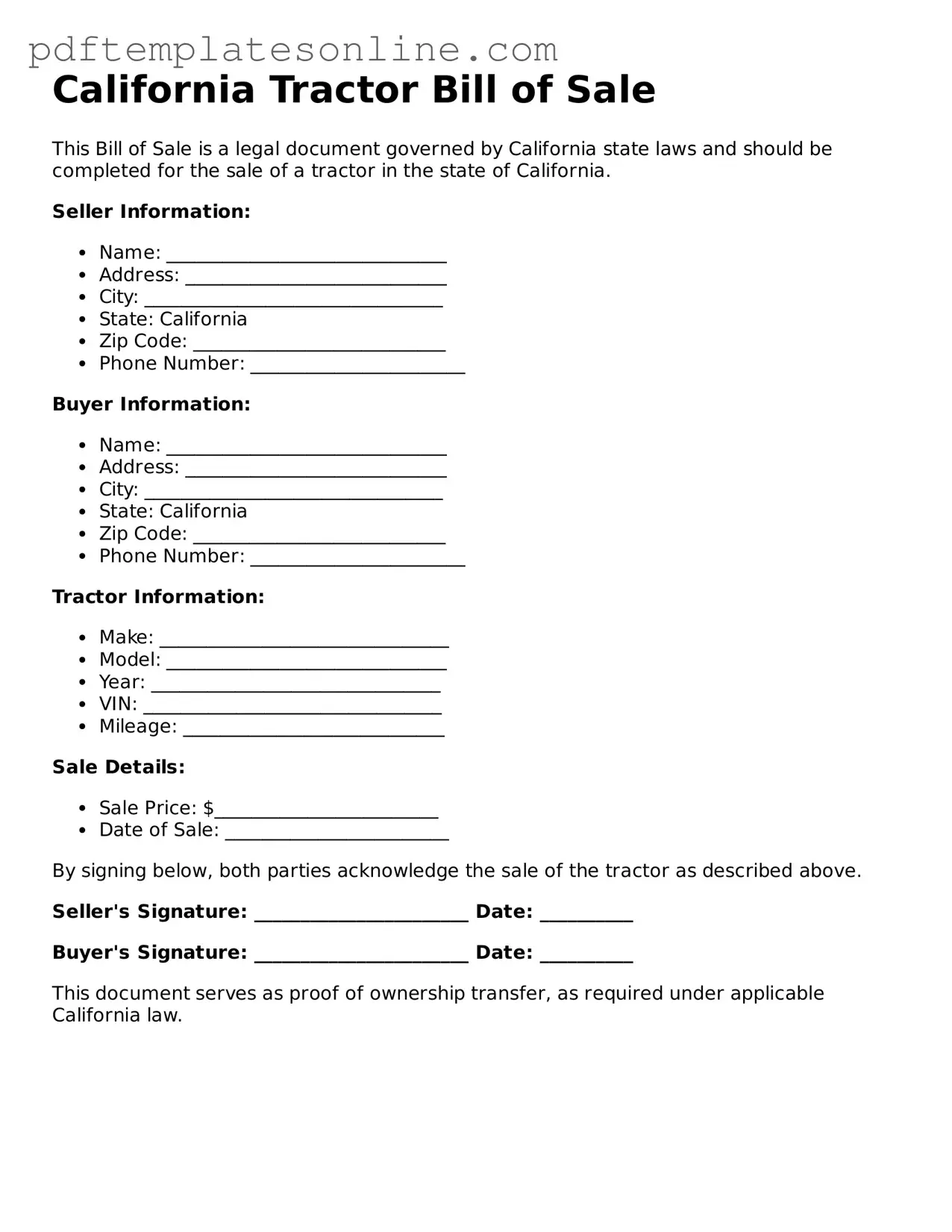

Official California Tractor Bill of Sale Document

Key takeaways

When filling out and using the California Tractor Bill of Sale form, there are several important points to keep in mind. This document serves as a critical record of the transaction between the buyer and the seller. Here are five key takeaways:

- Accurate Information: Ensure that all details, such as the names of both the buyer and seller, are correctly filled out. This includes addresses and contact information to avoid any future disputes.

- Vehicle Identification: Provide the tractor's Vehicle Identification Number (VIN) and other relevant details. This helps confirm the identity of the tractor being sold and is essential for registration purposes.

- Sale Price: Clearly state the sale price of the tractor. This amount is important for both parties, as it reflects the agreed-upon value of the transaction.

- Signatures Required: Both the buyer and seller must sign the document. Their signatures indicate agreement to the terms of the sale and validate the transaction.

- Keep Copies: After the form is completed and signed, both parties should retain a copy for their records. This documentation can be useful for future reference or in case of any disputes.

By following these guidelines, individuals can ensure a smooth transaction when buying or selling a tractor in California.

Common mistakes

Filling out the California Tractor Bill of Sale form can seem straightforward, but many individuals make common mistakes that can lead to complications. One frequent error is not providing complete information about the tractor. Essential details such as the make, model, year, and Vehicle Identification Number (VIN) must be included. Omitting any of these can create confusion and may hinder the registration process.

Another mistake often seen is failing to accurately report the sale price. The form requires a clear statement of the transaction amount. If this information is incorrect or missing, it can raise questions during tax assessments or future transactions.

People sometimes overlook the necessity of both the buyer's and seller's signatures. This step is crucial for validating the sale. Without the appropriate signatures, the document may not be recognized as a legal transfer of ownership, which can lead to disputes later on.

Inaccurate dates can also pose a problem. The date of sale should be clearly indicated. If the date is left blank or filled out incorrectly, it can create confusion regarding the timeline of ownership and responsibilities associated with the tractor.

Many individuals forget to include their contact information. Providing a phone number or email address is essential for any follow-up communication. This oversight can lead to difficulties if further clarification is needed after the sale.

Another common issue is neglecting to check for any liens or outstanding loans on the tractor. If the seller does not disclose this information, the buyer may face unexpected financial obligations. It is vital to ensure that the tractor is free of any encumbrances before completing the sale.

Additionally, people often fail to keep a copy of the completed Bill of Sale for their records. This document serves as proof of the transaction and can be important for both parties in case of future disputes or inquiries.

Lastly, individuals may not familiarize themselves with the specific requirements of their local Department of Motor Vehicles (DMV). Each county may have unique regulations or additional paperwork needed. It is wise to consult local guidelines to ensure compliance and a smooth transaction.

Misconceptions

Understanding the California Tractor Bill of Sale form can be challenging due to several misconceptions. Here are nine common misunderstandings, along with clarifications.

-

It is not necessary to have a bill of sale for a tractor sale.

Many people believe that a bill of sale is optional. However, having a written bill of sale is crucial for documenting the transaction and protecting both the buyer and seller.

-

The bill of sale must be notarized.

Some think that notarization is required for the bill of sale to be valid. In California, notarization is not mandatory, although it can add an extra layer of security.

-

Only the seller needs to sign the bill of sale.

It is a common belief that only the seller's signature is necessary. In reality, both the buyer and seller should sign the document to ensure that both parties agree to the terms of the sale.

-

The bill of sale needs to be filed with the state.

Some individuals assume that they must submit the bill of sale to a state agency. This is not true; the bill of sale is primarily for the parties involved and does not need to be filed.

-

A bill of sale is only for new tractors.

People often think that bills of sale are only necessary for new purchases. However, they are equally important for used tractors, as they provide proof of ownership and transaction details.

-

All details of the tractor must be included in the bill of sale.

Some believe that every minor detail about the tractor must be listed. While important information should be included, not every single feature is necessary; focus on key details like make, model, and VIN.

-

Only cash transactions require a bill of sale.

There is a misconception that bills of sale are only needed for cash transactions. Regardless of the payment method, having a bill of sale is beneficial for record-keeping.

-

The bill of sale protects only the seller.

Many think that the bill of sale serves only the seller's interests. In fact, it provides protection for both parties by documenting the terms of the sale.

-

A bill of sale is not legally binding.

Some individuals believe that a bill of sale holds no legal weight. However, it is a legally binding document that can be used in court if disputes arise.

By addressing these misconceptions, individuals can better understand the importance and function of the California Tractor Bill of Sale form.

Dos and Don'ts

When filling out the California Tractor Bill of Sale form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do:

- Do provide accurate information about the tractor, including the make, model, and year.

- Do include the Vehicle Identification Number (VIN) to uniquely identify the tractor.

- Do specify the sale price clearly to avoid any misunderstandings.

- Do ensure that both the buyer and seller sign the form to validate the transaction.

- Don't leave any fields blank; all sections should be completed to prevent delays.

- Don't use abbreviations or unclear terms that may confuse the information provided.

- Don't forget to keep a copy of the completed form for your records.

- Don't submit the form without verifying all details for accuracy.

Browse Popular Tractor Bill of Sale Forms for US States

Do Tractors Need to Be Registered - Essential for legally recording the sale of a tractor.

When dealing with legal documents, the California Notary Acknowledgment form plays a crucial role in validating the identity of signers and their signatures, ensuring that transactions are conducted with integrity. For those seeking to create or manage such documents, online resources like California PDF Forms can be invaluable tools, offering convenient and reliable templates that adhere to legal standards.

Tractor Bill of Sale Word Template - The Tractor Bill of Sale captures all necessary transaction details.

Tractor Bill of Sale Word Template - Can include payment methods accepted by the seller.

Detailed Guide for Writing California Tractor Bill of Sale

Completing the California Tractor Bill of Sale form is a straightforward process that requires attention to detail. After filling out the form, it is essential to ensure that both the buyer and seller retain a copy for their records. This document serves as proof of the transaction and may be needed for future reference, such as registration or tax purposes.

- Begin by obtaining the California Tractor Bill of Sale form. This can be found online or at local DMV offices.

- In the first section, enter the date of the sale. This is crucial for record-keeping.

- Next, provide the full name and address of the seller. Ensure that this information is accurate to avoid any issues later.

- Following that, fill in the buyer's full name and address. Like the seller's information, accuracy is key.

- Indicate the make, model, year, and Vehicle Identification Number (VIN) of the tractor being sold. This helps to clearly identify the vehicle.

- State the sale price of the tractor. This amount should reflect the agreed-upon price between the buyer and seller.

- Both parties should sign and date the form at the bottom. Signatures confirm the agreement and finalize the transaction.

- Finally, ensure that each party receives a copy of the completed form for their records.