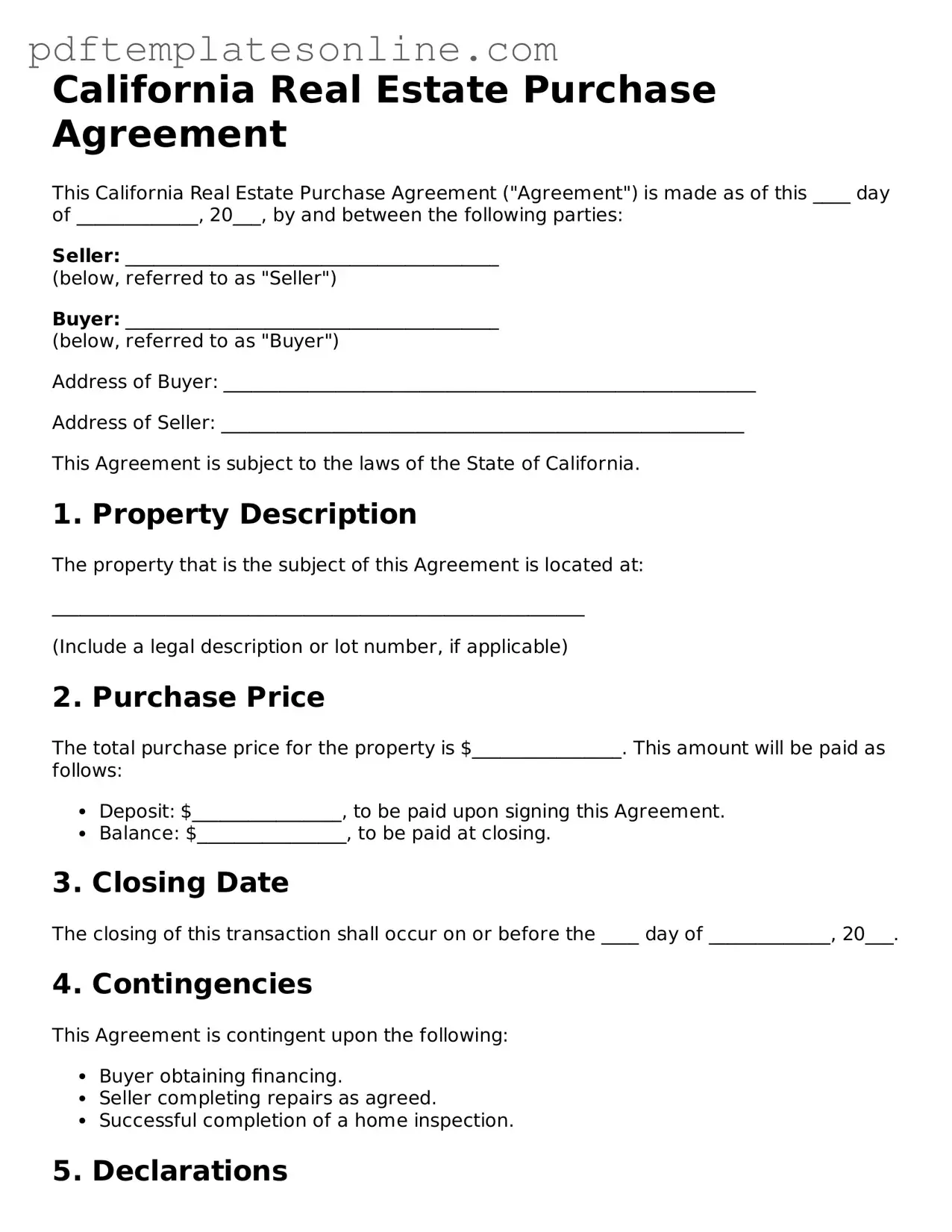

Official California Real Estate Purchase Agreement Document

Key takeaways

When filling out and using the California Real Estate Purchase Agreement form, it is important to consider several key points to ensure a smooth transaction. Here are nine essential takeaways:

- Understand the Purpose: The Real Estate Purchase Agreement outlines the terms and conditions under which a property is bought and sold.

- Identify the Parties: Clearly state the names and contact information of both the buyer and the seller to avoid confusion.

- Property Description: Provide a detailed description of the property, including the address and any relevant parcel numbers.

- Purchase Price: Specify the agreed-upon purchase price and any deposit amount that will be made.

- Contingencies: Include any contingencies, such as inspections or financing, that must be met for the sale to proceed.

- Closing Date: Set a timeline for the closing date, which is the day ownership is officially transferred.

- Disclosures: Ensure that all necessary disclosures about the property are provided, as required by California law.

- Signatures: Both parties must sign the agreement to make it legally binding. Ensure all signatures are dated.

- Consult Professionals: It is advisable to seek guidance from a real estate agent or attorney to navigate the complexities of the agreement.

Common mistakes

Filling out the California Real Estate Purchase Agreement can be a daunting task, especially for first-time buyers or sellers. It is crucial to pay attention to detail and avoid common mistakes that can lead to complications down the road. One frequent error is neglecting to specify the property address clearly. The legal description should be accurate, as it defines the property being sold. Without this clarity, disputes may arise regarding the exact location or boundaries of the property.

Another mistake often made is failing to include the correct purchase price. This figure should reflect the agreed-upon amount between the buyer and seller. If it is not stated correctly, it can lead to misunderstandings or even legal disputes. Additionally, buyers sometimes forget to account for contingencies. These are conditions that must be met for the sale to proceed, such as obtaining financing or passing a home inspection. Omitting these can leave buyers vulnerable to unexpected issues.

Moreover, many individuals overlook the importance of signatures and dates. Each party involved in the agreement must sign and date the document. Missing signatures can render the agreement void, leading to wasted time and effort. It's essential to ensure that all parties have reviewed the agreement and have signed it in the appropriate places.

Buyers and sellers also often fail to include necessary disclosures. California law requires certain disclosures about the property, such as known defects or environmental hazards. Not providing this information can lead to legal repercussions. Transparency is vital in real estate transactions, and both parties should be aware of any potential issues before proceeding.

Lastly, individuals sometimes rush through the completion of the form without seeking professional advice. While it may seem straightforward, real estate transactions can be complex. Consulting with a real estate agent or legal professional can provide valuable insights and help avoid costly mistakes. Taking the time to understand each section of the agreement can lead to a smoother transaction and peace of mind for everyone involved.

Misconceptions

When it comes to the California Real Estate Purchase Agreement (RPA), several misconceptions can lead to confusion among buyers and sellers. Understanding these myths is crucial for making informed decisions. Here are seven common misconceptions:

- The RPA is a legally binding contract from the moment it is signed. Many people believe that simply signing the RPA makes it enforceable. In reality, it becomes legally binding only after all parties have signed and any contingencies are met.

- All real estate transactions require an RPA. While the RPA is standard for most residential transactions, some sales, like those involving certain types of properties or unique situations, may not require this specific form.

- The RPA covers all aspects of the sale. Some think that the RPA includes every detail of the transaction. However, it primarily addresses the terms of the sale, and additional agreements may be necessary for specific issues like financing or repairs.

- Once the RPA is signed, there is no room for negotiation. Many assume that signing the RPA finalizes all terms. In fact, negotiations can continue even after signing, especially if contingencies are included in the agreement.

- The RPA is the same for every transaction. Some believe that the RPA is a one-size-fits-all document. In reality, it can be customized to fit the unique needs of each transaction, allowing for specific clauses or terms to be added.

- The RPA protects both the buyer and seller equally. It is a common misconception that the RPA is designed to benefit both parties equally. While it aims to provide a fair framework, the interests of buyers and sellers can differ significantly, and the agreement may favor one party over the other depending on the terms negotiated.

- Using the RPA guarantees a successful transaction. Many believe that simply using the RPA will ensure a smooth sale. However, successful transactions depend on various factors, including market conditions, financing, and communication between parties.

Understanding these misconceptions can help buyers and sellers navigate the complexities of real estate transactions in California more effectively.

Dos and Don'ts

When filling out the California Real Estate Purchase Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do read the entire agreement carefully before filling it out. Understanding each section is crucial.

- Do provide accurate information regarding the property, including the address and legal description.

- Do consult with a real estate agent or legal advisor if you have questions about any terms or conditions.

- Don't leave any sections blank. If a section does not apply, indicate that clearly.

- Don't rush through the process. Take your time to ensure all details are correct.

Browse Popular Real Estate Purchase Agreement Forms for US States

Standard Agreement for the Sale of Real Estate Pennsylvania Pdf - The document may outline procedures for communicating changes to the agreement.

The use of a Self-Proving Affidavit form is not only beneficial for ensuring the validity of a will but also significantly eases the process of estate administration. For those looking to create or modify such documents, resources like California PDF Forms can provide valuable templates and information to facilitate this important legal step.

Real Estate Contract Georgia - Keeping a copy of the signed agreement is essential for both parties as a reference for the transaction.

How to Make a Purchase Agreement - Amendments to terms can be clearly established within it.

Simple Real Estate Sales Contract - It may address the allocation of closing costs between parties.

Detailed Guide for Writing California Real Estate Purchase Agreement

Completing the California Real Estate Purchase Agreement form is an important step in the home buying process. This document outlines the terms of the sale and ensures that both the buyer and seller are clear on their obligations. After filling out the form, it will be necessary to review it carefully and ensure all parties involved are in agreement before proceeding.

- Obtain the Form: Start by downloading the California Real Estate Purchase Agreement form from a reliable source or obtain it from a real estate professional.

- Fill in the Date: Write the date on which the agreement is being signed at the top of the form.

- Identify the Parties: Clearly state the names and addresses of the buyer(s) and seller(s). Make sure the names are spelled correctly.

- Property Description: Provide a detailed description of the property being sold, including the address and any relevant legal descriptions.

- Purchase Price: Enter the total purchase price agreed upon by both parties. Be precise in this figure.

- Deposit Information: Indicate the amount of the deposit and the method of payment. Specify where the deposit will be held.

- Financing Contingency: If applicable, outline any financing contingencies that need to be met for the sale to proceed.

- Closing Date: Specify the anticipated closing date for the transaction. This is when the ownership will officially transfer.

- Additional Terms: Include any additional terms or conditions that have been agreed upon by both parties. This can cover repairs, inclusions, or other stipulations.

- Signatures: Ensure that both the buyer(s) and seller(s) sign and date the agreement. All signatures should be in ink.

Once the form is completed and signed, it is important to keep a copy for your records. This document will serve as the foundation for the transaction and should be treated with care. Make sure to communicate with all parties involved to ensure a smooth process moving forward.