Official California Quitclaim Deed Document

Key takeaways

When dealing with a California Quitclaim Deed, understanding the essentials can simplify the process. Here are some key takeaways:

- Purpose: A Quitclaim Deed transfers ownership interest in a property without guaranteeing that the title is clear. It is often used between family members or in divorce settlements.

- Form Requirements: Ensure that the form is filled out completely. Missing information can lead to delays or issues with the transfer.

- Signatures: All parties involved must sign the deed. The signatures must be notarized to validate the document.

- Recording the Deed: After completion, the Quitclaim Deed must be recorded at the county recorder’s office where the property is located. This step is crucial for public notice.

- Tax Implications: Be aware of potential tax consequences. Transferring property can have implications for property taxes and capital gains taxes.

- Legal Advice: Consider seeking legal advice, especially if the property has complications. A professional can help navigate any challenges that may arise.

Common mistakes

Filling out a California Quitclaim Deed form can seem straightforward, but many individuals make common mistakes that can complicate the process. One frequent error involves incorrect names. It is essential to ensure that the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property) are spelled correctly and match the names on their respective identification documents. A simple typo can lead to significant issues later on.

Another mistake often encountered is neglecting to include a legal description of the property. This description should be precise and detailed, including the parcel number and any relevant boundaries. Without this information, the deed may not be valid, and the transfer of property rights could be questioned.

People sometimes forget to sign the deed. A Quitclaim Deed must be signed by the grantor to be legally effective. If the grantor fails to sign, the deed holds no value, and the transfer of property does not occur. Additionally, the signature must be notarized. Failing to have the deed notarized can lead to challenges in the future, particularly if the document needs to be presented in court.

Many individuals also overlook the importance of recording the Quitclaim Deed with the county recorder's office. While the deed becomes effective upon signing, recording it provides public notice of the transfer and protects the grantee's rights. Without this step, future claims on the property may arise, leading to potential disputes.

Another common error is not understanding the implications of a Quitclaim Deed. This type of deed transfers whatever interest the grantor has in the property without guaranteeing that the title is clear. Many people mistakenly believe they are receiving a warranty deed, which provides more protection. It is crucial to understand the nature of the deed being used to avoid unexpected consequences.

In some cases, individuals fail to check for existing liens or encumbrances on the property before completing the deed. If there are outstanding debts or claims against the property, the grantee may inherit these issues. Conducting a title search can help identify any potential problems that need to be addressed before the transfer.

Another mistake involves not providing adequate consideration. While a Quitclaim Deed can be used for transfers without monetary exchange, it is still advisable to state some form of consideration, even if it is a nominal amount. This practice can help clarify the intent of the transfer and may prevent future legal complications.

People sometimes misinterpret the relationship between the grantor and grantee. If the parties involved have a familial or business relationship, it may be beneficial to include this information in the deed. This context can help clarify the nature of the transaction and may be relevant in the event of future disputes.

Lastly, failing to consult with a professional can lead to a host of problems. While it is possible to fill out a Quitclaim Deed independently, seeking guidance from a real estate attorney or a qualified legal document preparer can help avoid mistakes. Professional assistance can provide clarity and ensure that all necessary steps are taken to complete the transfer smoothly.

Misconceptions

When it comes to the California Quitclaim Deed form, several misconceptions can lead to confusion. Understanding these can help ensure proper use of the form and avoid potential legal issues.

- Misconception 1: A Quitclaim Deed transfers ownership of property.

- Misconception 2: Quitclaim Deeds are only used in divorce or estate settlements.

- Misconception 3: A Quitclaim Deed eliminates all liabilities associated with the property.

- Misconception 4: A Quitclaim Deed does not require notarization.

While a Quitclaim Deed does transfer any interest the grantor has in the property, it does not guarantee that the grantor has full ownership. The deed merely conveys whatever rights the grantor possesses, which could be partial or even nonexistent.

Although they are commonly used in these contexts, Quitclaim Deeds can also serve various purposes, such as transferring property between family members or clearing up title issues. Their flexibility makes them useful in many situations.

This is not true. A Quitclaim Deed does not absolve the grantor of any debts or liens attached to the property. Buyers should conduct thorough due diligence to uncover any existing obligations.

In California, a Quitclaim Deed must be notarized to be legally valid. This step is crucial to ensure the transfer is recognized by the county recorder's office, which is necessary for the deed to be enforceable.

Dos and Don'ts

Filling out a California Quitclaim Deed form requires attention to detail. Here are some essential dos and don'ts to consider:

- Do ensure that the property description is accurate and complete.

- Do include the names of all parties involved clearly.

- Do sign the document in front of a notary public.

- Do check for any specific county requirements regarding the form.

- Do file the completed deed with the appropriate county recorder's office.

- Don't leave any required fields blank.

- Don't use outdated forms; always use the most current version.

- Don't forget to keep a copy for your records.

- Don't assume that all counties have the same rules; verify local regulations.

Browse Popular Quitclaim Deed Forms for US States

Quit Claim Deed Instructions - The deed reflects the transfer of interest but not the property's marketability.

The Employment Application PDF form is a standardized document used by employers to collect essential information from job applicants. This form typically includes sections for personal details, work history, education, and references. Candidates can find a blank version of this form at https://mypdfform.com/blank-employment-application-pdf, and completing it accurately is vital for those seeking employment, as it serves as a primary tool for assessing qualifications and suitability for available positions.

Quick Claim Deeds Ohio - This form can prevent misunderstandings about property rights and ownership.

Quit Claim Deed Form Georgia - This form is helpful in ensuring clear title before proceeding with further transactions.

Detailed Guide for Writing California Quitclaim Deed

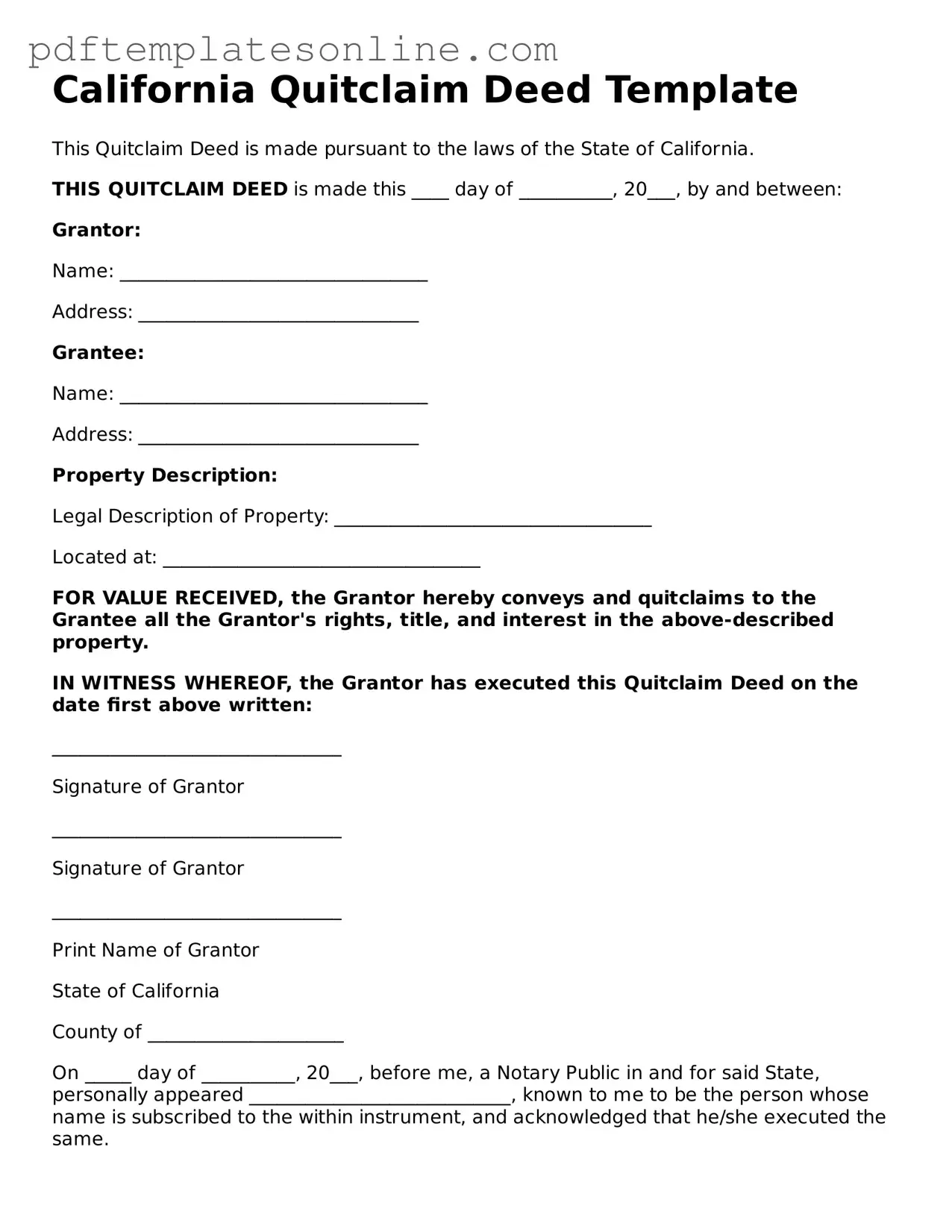

After obtaining the California Quitclaim Deed form, it's important to complete it accurately to ensure the transfer of property rights is legally recognized. Follow these steps carefully to fill out the form correctly.

- Identify the Grantor: In the first section, write the name of the person or entity transferring the property. Include their address and any additional identifying information.

- Identify the Grantee: Next, enter the name of the person or entity receiving the property. Again, provide their address and any relevant details.

- Describe the Property: Clearly describe the property being transferred. Include the address, parcel number, and any other identifying information that helps to locate it.

- State the Consideration: Indicate the amount of money or value exchanged for the property, if applicable. If the transfer is a gift, you can note that as well.

- Sign the Form: The grantor must sign the deed in the presence of a notary public. Ensure the signature matches the name written in the grantor section.

- Notarization: Have the notary public complete their section, verifying the identity of the grantor and witnessing the signature.

- Record the Deed: Finally, take the completed and notarized deed to the county recorder's office where the property is located. Pay any applicable recording fees to have the deed officially recorded.