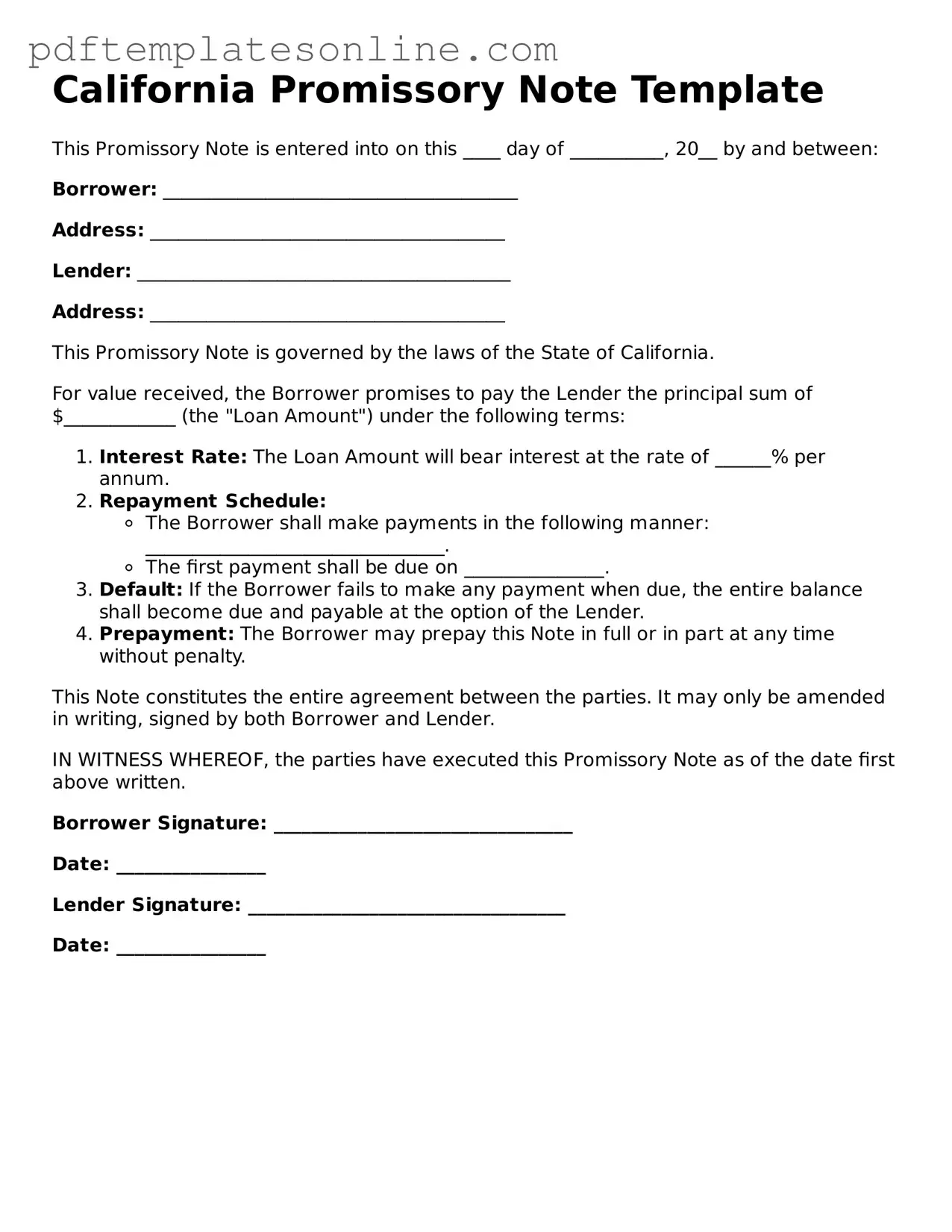

Official California Promissory Note Document

Key takeaways

When filling out and using the California Promissory Note form, it's essential to understand several key aspects to ensure clarity and legality.

- Identify the parties: Clearly state the names and addresses of both the borrower and the lender.

- Specify the loan amount: Indicate the exact amount being borrowed to avoid any confusion later.

- Detail the interest rate: Include the interest rate, whether it is fixed or variable, and how it will be calculated.

- Outline repayment terms: Specify the repayment schedule, including the frequency of payments and the due date for the final payment.

- Include late fees: State any penalties for late payments to encourage timely repayment.

- Address prepayment options: Clarify whether the borrower can pay off the loan early without penalties.

- Signatures are crucial: Ensure that both parties sign and date the document to validate the agreement.

- Keep copies: Each party should retain a signed copy of the Promissory Note for their records.

- Consult a professional: If unsure about any terms, seek advice from a legal or financial professional.

Understanding these points can help streamline the borrowing process and protect the interests of both parties involved.

Common mistakes

When individuals fill out the California Promissory Note form, several common mistakes can lead to complications down the line. One frequent error is the omission of essential details. Borrowers often forget to include their full names and addresses, which are crucial for identifying the parties involved. Without this information, the note may lack legal validity.

Another common mistake is failing to clearly state the loan amount. Some people write the amount in words but neglect to include the numerical figure, or vice versa. This inconsistency can create confusion and disputes regarding the actual amount owed. Always ensure that both forms of the amount are included and match perfectly.

Many individuals also overlook the importance of specifying the interest rate. While some may assume that a standard rate applies, this is not always the case. Not stating an interest rate can lead to misunderstandings and may even result in legal issues. Always clarify whether the rate is fixed or variable, and include it explicitly.

In addition, borrowers often fail to define the repayment terms clearly. Some may write vague statements about repayment without specifying due dates or installment amounts. This lack of clarity can lead to disagreements later on. Clearly outlining the repayment schedule helps both parties understand their obligations.

Another mistake is neglecting to include a late payment penalty. Without this provision, borrowers may not feel the urgency to pay on time. Including a penalty can encourage timely payments and provide a clear course of action if payments are missed.

Additionally, many people forget to sign the document. While it may seem obvious, a lack of signatures can render the note unenforceable. Both the borrower and the lender should sign the document to confirm their agreement to the terms.

Some individuals also fail to date the note. The date is crucial for establishing the timeline of the loan and can impact the calculation of interest and repayment deadlines. Always ensure that the date of signing is included.

Another common oversight is not providing a clear description of the collateral, if any, backing the loan. If the loan is secured, it is vital to specify what asset is at stake. This information protects the lender's interests and provides clarity to both parties.

Furthermore, people sometimes ignore the legal requirements for witnesses or notarization. Depending on the situation, having a witness or notarizing the document may be necessary for it to be legally binding. Failing to follow these requirements can lead to complications in enforcing the note.

Lastly, individuals often neglect to keep copies of the signed note. After completing the form, it is essential for both parties to retain copies for their records. This ensures that both borrower and lender have access to the agreed-upon terms in the future.

Misconceptions

Understanding the California Promissory Note form can be challenging due to various misconceptions. Here are ten common misunderstandings about this document:

-

All Promissory Notes are the Same:

Many people believe that all promissory notes are identical. In reality, the terms and conditions can vary significantly based on the agreement between the parties involved.

-

A Promissory Note Must Be Notarized:

Some assume that notarization is required for a promissory note to be valid. However, while notarization can provide additional legal protection, it is not a strict requirement in California.

-

Only Loans Require a Promissory Note:

It is a common belief that promissory notes are only used for loans. In fact, they can also be used for other types of agreements where one party promises to pay another party.

-

Promissory Notes Are Unenforceable:

Some individuals think that promissory notes are not legally enforceable. This is incorrect; they are binding contracts that can be enforced in a court of law if properly executed.

-

Interest Rates Are Always Required:

Many assume that a promissory note must include an interest rate. While it is common to include interest, it is not mandatory; a note can be interest-free.

-

They Are Only for Personal Loans:

Some believe promissory notes are limited to personal loans. In fact, businesses often use them for various financial transactions, including sales and services.

-

There Is No Standard Format:

While there is flexibility in drafting a promissory note, many people think there is no standard format. In California, certain elements must be included to ensure the note's validity.

-

Verbal Agreements Are Sufficient:

Some people believe that a verbal promise to pay is enough. However, having a written promissory note provides clear evidence of the agreement and its terms.

-

Only Individuals Can Issue Promissory Notes:

It is a misconception that only individuals can issue promissory notes. Businesses and organizations can also create and sign these documents.

-

They Are Only for Short-Term Loans:

Many think promissory notes are limited to short-term loans. However, they can be used for both short and long-term financing arrangements.

Being aware of these misconceptions can help individuals better understand the purpose and function of the California Promissory Note form.

Dos and Don'ts

When filling out the California Promissory Note form, it's important to follow some guidelines to ensure accuracy and legality. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide clear and accurate information about the borrower and lender.

- Do specify the loan amount in both numbers and words.

- Do include the interest rate, if applicable, and state whether it’s fixed or variable.

- Do outline the repayment terms, including the schedule and due dates.

- Don’t leave any sections blank; fill in all required fields.

- Don’t use vague language; be specific about all terms and conditions.

- Don’t forget to sign and date the document.

- Don’t overlook the need for witnesses or notarization, if required.

- Don’t assume that verbal agreements are sufficient; everything should be in writing.

Browse Popular Promissory Note Forms for US States

Georgia Promissory Note - It encapsulates the key details of the financial agreement in one document.

In addition to its crucial role in simplifying the probate process, individuals seeking to complete a Self-Proving Affidavit can find essential resources and templates through California PDF Forms, ensuring compliance with state regulations and ease of use.

Ohio Promissory Note Requirements - Documentation can prevent future legal complications related to loans.

Texas Promissory Note Form - The note's format can vary, but essential elements must always be included.

Detailed Guide for Writing California Promissory Note

After gathering all necessary information, you are ready to fill out the California Promissory Note form. This document will require specific details about the loan agreement between the borrower and the lender. Follow these steps carefully to ensure accuracy and completeness.

- Identify the parties: Clearly write the names and addresses of both the borrower and the lender at the top of the form.

- Specify the loan amount: Indicate the total amount of money being borrowed. This should be a precise figure.

- Set the interest rate: If applicable, include the interest rate that will be charged on the loan. Make sure to specify whether it is fixed or variable.

- Define the repayment terms: Outline how and when the borrower will repay the loan. Include payment frequency (e.g., monthly, quarterly) and the final due date.

- Include any late fees: If there are penalties for late payments, detail these fees clearly in the appropriate section.

- State any prepayment options: If the borrower can pay off the loan early without penalties, mention this here.

- Sign and date: Both the borrower and the lender must sign and date the form at the bottom to validate the agreement.

Once you have completed the form, review it for any errors or omissions. It is crucial that both parties understand and agree to the terms outlined before proceeding with the agreement.